TLDR

- Decentralized Autonomous Organizations, also known as DAOs, provide greater accessibility to individuals for decision-making powers within an organization as compared to traditional centralized organizations.

- There are many types of DAOs - ranging from protocol, investment, NFT, incubation to service DAOs whereby individuals can join based on their interests or by being a token/NFT holder.

- The current form of token-based governance used in most DAOs favors “whales” who can easily overturn votes to be in line with their interests due to their voting power; hence, many argue that DAOs are not that decentralized after all.

- The number of DAO proposals created has remained relatively constant YTD, while the number of voters has been increasing in recent months.

- Top token holders of DeFi protocols such as Lido, Aave and Uniswap are often top token holders of other Top 20 DAOs as well, with UNI and AAVE holders having the most overlap among them.

- Future forms of governance will vary from the current token-based governance to include credential-based or limited governance.

- DAOs are still rather new in terms of development; hence, greater infrastructure and tooling innovation can be expected in the near future.

Introduction

Decentralized Autonomous Organizations, also known as DAOs, have become one of the flagship use cases for blockchain. Traditional organizations are mostly top-down with power centralized in the hands of a few. With DAOs, every individual who holds a stake in the organization (i.e. holding a token) gets to participate in making decisions about the organization's wellbeing. As such, it incentivizes better decision making, as individuals (i.e. token holders) would want the best for the DAO so that everyone can benefit. DAOs also provide greater accessibility for individuals worldwide, as anyone with a working internet connection can join.

There are many types of DAOs, ranging from protocol, investment, NFT, and incubation to service DAOs. Protocol DAOs are more well-known as they are often products that have a steady amount of users and sufficient funds to run. These include DeFI protocols such as Uniswap, Aave and Synthetix. DAO members get to make decisions related to the protocol's operations, which could affect the protocol’s revenue and sustainability, equivalent to leaders running an organization in the real world.

Other types of DAOs are often smaller in size and treasury, with a specific purpose to serve. Some prominent non-protocol DAOs include The LAO and PleasrDAO. The LAO is an investment DAO that has been around since 2020, focused on backing projects across the Ethereum ecosystem. It has contributed over 18,378 ETH to date and backed notable projects such as Fei Protocol, APY.Finance and Maple Finance. PleasrDAO is an NFT collector DAO for influential people in the space who are interested in unique NFT pieces. The DAO buys these unique pieces and aims to give back to the community by fractionalizing them - like what they did with the original doge meme NFT. These DAOs provide more access and bring like-minded people together with aligned interests, allowing the organization to be much more efficient in carrying out its goals. Many other prominent DAOs serve specific purposes, which are covered in this article here.

Even though DAOs are meant to tackle centralization, it seems that current mechanisms are insufficient. A recent example of what happened with Tribe DAO has garnered attention regarding the topic of whether DAOs are decentralized once again.

In December 2021, Fei and Rari Capital merged following a successful governance vote, with both protocols being governed by Tribe DAO. In April 2022, Rari Capital’s Fuse pools were exploited for $80 million.

Following the exploit, proposals were created to decide on the response to the victims affected by the hack:

- May 13: FIP-106 was created as a proposal on using DAO funds to repay the Fuse hack victims. The vote passed with a 75% majority.

- June 8: TIP-112 was then proposed to go through the steps for repayment proposal since it was not outlined in the initial FIP-106 proposal.

- June 9: The proposal was then veto-ed by NopeDAO, in which the Veto for TIP-112 proposal passed with 85% majority.

- June 18: Since the TIP-112 was veto-ed, the proposal to repay the Fuse hack victims had to go through a full DAO re-vote. The proposal eventually failed to pass.

NopeDAO has the power to veto pod proposals, which serves as a check and balance in the governance process. Pod proposals are proposals enacted by the Tribal Council which is composed of community members and protocol experts that were elected by DAO members through a vote. The list of members in the Tribal Council can be viewed here. In the case of TIP-112, it was enacted by Tribal Council member Jack Longarzo and subsequently veto-ed by NopeDAO. There are no minimum requirements for creating a veto proposal and the quorum to pass a vote is significantly lower than a normal DAO vote - 10m vs 25m. The veto proposal was created by a wallet labeled as "Multisig Owner" on Nansen and is a counterparty of tomwaite.eth.

This was a significant event as the veto proposal was passed with just four individuals making up the 10m required to pass the vote, which showed a high degree of centralization. The same individuals also voted against repaying the debt in the re-vote proposal on repaying Fuse hack victims, with their votes making up more than 20% of the total “against” votes. Even though TribeDAO’s governance model is rather unique to the protocol, it was one of the first cases whereby an initial vote (FIP-106) that passed was reversed, which drew in a lot of criticism on DAO governance in general. Sam Kazemian (founder of Frax Finance) and other leaders in the space spoke up about this case, citing that the current mechanisms for DAO governance are a bad look for the space.

Therefore, the big question remains: Are DAOs really decentralized? In this report, we will cover the general DAO landscape and dive deeper into some of the trends in DAO activity in the past year. We will also look at some of the most significant DAO proposals that have impacted the outlook on DAOs and what the future could hold.

Overview of DAOs

DAOs have become one of the key features of most decentralized protocols.

The main use case for DAOs would be governance. Governance is upheld through mostly token-based voting, whereby larger holders have more voting power. This hinges on the fact that larger holders have more vested interest in the organization and thus would be incentivized to make the right decision for the DAO. For most DAOs, a quorum is needed in order for a proposal to pass as well. This ensures that a sufficient number of token holders participate so that several individuals with higher voting power do not skew the results. However, quorums cannot be set too high as well, as there would be a higher chance for quorums to fail due to large participating numbers required. Despite achieving greater equality in terms of vote participation, fairness is sacrificed for DAOs as “whales” still hold greater voting power who can swing votes in their favor.

DAO proposals vary from a wide range of topics - from anything related to the operation of the protocol such as partnerships, operations and even financial matters. Depending on the ‘severity’ of the proposal, different mechanisms may be in place to ensure a fairer outcome that represents the interests of most token holders. For example, mechanisms for proposals to pass on Aave are decided by its intended outcomes (i.e. minor changes vs change to core code base). Proposals with minor changes only require a 2% quorum with 0.5% vote differential, while more influential proposals require a 20% quorum with 15% vote differential - which is a significant difference. This allows for the DAO to make sure that more contentious votes have sufficient participation and clear consensus on a particular decision since such proposals will affect all DAO members.

For our analysis, we will be focusing on the Top 20 DAOs in terms of the value of liquid assets in the treasury on Nansen’s DAO Paradise, as shown below.

DAO Trends

Voters, Proposals and Proposers

Gathering data from DAOs using Snapshot for governance shows that the number of DAO proposals YTD has averaged at around 134 proposals per day. The highest number of proposals in a day was on 2 January, with 344 proposals being created on that day. Besides that, the second highest number was on 9 May - the day that UST significantly depegged, causing LUNA to free fall. The trend also shows that DAO proposals tend to be created during weekdays, as most weekend numbers are below the average.

Number of voters for DAO proposals fluctuates quite a bit over time. The spike in voters on April 15, 2022 was brought about by the Arbitrum Odyssey polls which allowed users to vote for the protocols that they would want to see be a part of the event. Overall, the trend shows that the average number of voters for proposals have been increasing in recent months. The number of voters has doubled on average from the start to the end of August while the number of proposals has remained relatively constant.

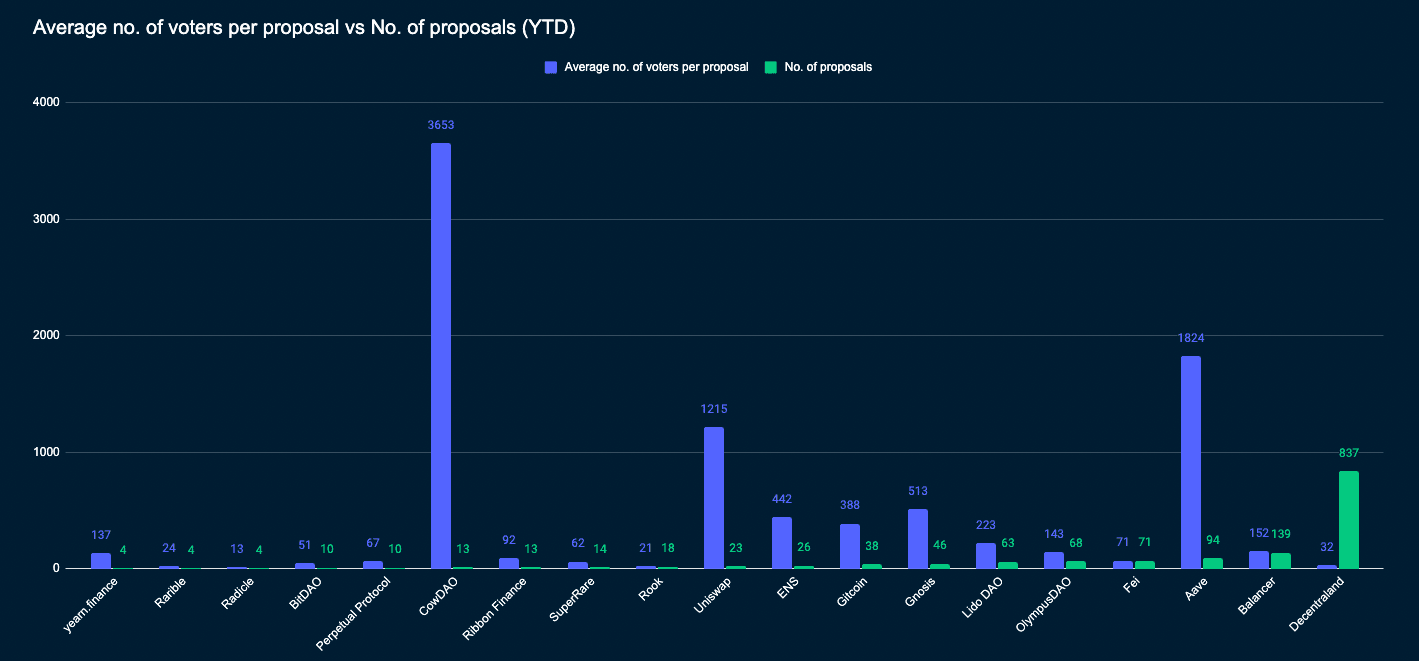

Analyzing the Top 20 DAOs* in terms of liquid assets on Nansen’s DAO Paradise - the table below shows the number of proposals, proposers and voters across DAOs year to date, ordered by the number of voters.

The most active DAO in terms of the number of proposals would be Decentraland - having a whopping 848 proposals created year to date. Despite such a high volume of proposals, the engagement of the community is low - with an average of 32 voters per proposal. In contrast, CowDAO, which has had 13 proposals, has the highest engagement at an average of 3,653 voters per proposal. Other DAOs with significant engagement would be Aave and Uniswap, having over 1000 voters on average per proposal.

The number of proposers for DAO proposals YTD varies quite a bit across DAOs. The most centralized DAO would be Decentraland, having only 1 proposer for 848 proposals. DAOs with significant engagement tend to have a good number of proposers - averaging at 2 proposals per proposer for Aave, Uniswap and CowDAO. This suggests that DAOs with engagement generally have more decentralized governance as users get to participate in the proposal creation process as well.

However, this metric could also depend on protocol-specific requirements for creating a proposal. Uniswap requires a proposer to have at least 2.5m UNI delegated to their wallet address in order for the proposal to get on Snapshot, which is a considerable amount that most users will never reach. Even though it allows users to propose on behalf of others, there are still limitations for smaller holders in proposing. In contrast, protocols like Aave and Balancer do not have such restrictions.

*Synthetix is excluded from the list as data is unavailable in Snapshot

Looking at the number of proposals vs the average number of voters per proposal YTD - there is no clear trend as to what could be the optimal number for proposals. Besides outliers such as CowDAO, Uniswap and Aave - the DAOs with higher engagement have around 25-50 proposals.

Treasury Value and Portfolio Diversity

Analyzing the top 10 DAOs based on treasury value as of September 16, 2022 - it shows that values of DAO treasuries have fallen across the board. This is likely attributed to falling token prices since the start of the year. Besides overall treasury value, the percentage of governance tokens held in DAO treasuries as of total treasury value was also used as a point of analysis. Governance tokens often fluctuate significantly in value and having treasuries that are majorly denominated in one’s own token may not be a good strategy, especially in volatile market conditions.

Even though BitDAO saw the greatest decrease in value from $9.2b to $3.5b, Radicle experienced the greatest decrease percentage wise - perhaps due to the fact that around 90% of its treasury (on average) is held as its native token - RAD. The price of RAD has fallen by over 80% since the start of the year, which contributed to the decline in treasury value similarly. An exception would be Uniswap, who had 100% of its treasury (other tokens are of negligible value w.r.t treasury value) held in their native token but did not experience as much of a drawdown.

Comparatively, Fei Protocol experienced the least drawdown in overall treasury value, decreasing by around 15% in the past year. Looking at the treasury composition over time, they began introducing a sizable portion WETH to its treasury in late January - which has experienced less volatility and downwards price action than TRIBE in that timeframe.

Hence, treasury management is an important part of DAOs as well. DAO members should assess risk in treasury management by responding to market conditions. Introducing blue chip tokens (BTC, ETH) or stablecoins into a treasury could be a good risk management strategy in volatile market conditions and can prevent circumstances where DAOs run out of funds.

Top Voters

Analyzing top voters across the Top 20 protocols, the table below highlights a list of top addresses with large voting powers across different protocols. These addresses are among the top token holders in the respective protocols and have voted for at least one proposal year to date.

Note: the results only show addresses that are part of the top token holders for at least two DAOs.

| Address | Number of Proposals voted | Highest voting power |

|---|---|---|

| 🤓🤖 Dragonfly Capital: 0x641 | - 3 (Perpetual Protocol) - 1 (Lido DAO) | - 4.4m PERP -15m LDO |

| wintermutegovernance.eth | -6 (Lido DAO) -1 (Perpetual Protocol) | - 9.5m LDO - 40k PERP |

| 🤖 Argent Wallet | - 5 (Fei Protocol) - 1 (OlympusDAO) | - 7.5m TRIBE - 55k OHM |

| itamar.eth (co-founder of Argent) | - 14 (Lido DAO) - 5 (CowDAO) | - 5.0m LDO - 333k COW |

| @CalBlockchain | - 13 (Fei Protocol) - 1 (Uniswap) - 1 (Aave) | - 2.5m TRIBE - 4.6m UNI - 10k AAVE |

| 🤓 @MonetSupply | - 34 (Lido DAO) - 19 (ENS) - 13 (Gitcoin) - 10 (Fei Protocol) - 10 (Uniswap) | - 46k LDO - 26k ENS - 163k GTC - 9k TRIBE - 3.9m UNI |

| sgeorge.eth (co-founder of Gnosis) | - 22 (Gnosis) - 8 (CowDAO) - 2 (Uniswap) | - 50k GNO - 3.1m COW - 1k UNI |

| eswak.eth | - 29 (Fei Protocol) - 11 (Balancer) | - 3m TRIBE - 107k BAL |

| @PennBlockchain | - 54 (Aave) - 6 (Uniswap) | - 10k AAVE - 3.0m UNI |

| 🤓 Defiance Capital | - 5 (Aave) - 2 (Lido DAO) | - 61k AAVE - 1.3m LDO |

| 🤓 Defiance Capital | - 4 (Aave) - 2 (Lido DAO) | - 78k AAVE -2.0m LDO |

| llamagov.eth | - 6 (Aave) - 2 (Uniswap) | - 183k AAVE - 501k UNI |

| Alex Van de Sande (co-founder of ENS) | - 23 (ENS) - 19 (Gitcoin) | - 240k ENS - 1.2m GTC |

| @BlockchainatCU | - 5 (Uniswap) - 2 (Aave) | - 2.5m UNI - 10k AAVE |

Source: Nansen Query (as of 16 September, 2022)

The trend shows that top token holders of DeFi protocols such as Lido, Aave and Uniswap are often top token holders of other DAOs as well. Among them, UNI and AAVE token holders overlap the most and are mostly wallet addresses of blockchain communities of US universities - including UC Berkeley, University of Pennsylvania and Columbia University. These voters hold large voting powers at one point in time and have the ability to impact governance decisions greatly due to the voting power that they hold.

Looking at some of the proposals that these addresses have voted for year to date, there were some interesting votes.

It showed that the University of Pennsylvania (@PennBlockchain) and Columbia University (@BlockchainatCU) had voted for the consensus check on the Uniswap DeFi Education Fund proposal which was highly controversial. Even though their votes were not the largest, they still added up to around 12% of the total “Yes” votes. Most of these university blockchain communities have vested interests in the proposal as its success could provide more funding for them in the future. Only Columbia University voted for the actual proposal vote addresses but it still passed with majority. More details on the Uniswap DeFi Education Fund proposal are covered below.

Another interesting vote was related to the Lido Treasury diversification proposals. A proposal was created on July 21, 2022 - to sell 10m LDO tokens to Dragonfly Capital at $1.45 per LDO. The proposal seemed like it was set to pass with Dragonfly Capital themselves voting to proceed with the proposal - with a voting power of 15m LDO tokens. The community responded with sufficient voting power to overcome the 21m votes for the proposal, which was largely denominated by 2 wallets - Dragonfly Capital: 0x641 and 0x82a8439BA037f88bC73c4CCF55292e158A67f125 (who is a Lido Vesting recipient and a close counterparty of DeversiFi). A second proposal was then created on July 28, 2022 with greater details about the terms of the token sale - specifically including a 1 year lockup term in the proposal and at a price that was responsive to the price of LDO then. These terms were more favorable for the community as the proposal passed with a 99% majority.

Hence, this is one instance that showed that governance was effective in protecting the community’s interest despite the involvement of “whales”. Despite this, there were differing opinions on the validity of Dragonfly Capital being able to vote on a proposal that would directly benefit them. Therefore, this is one limitation of the current token-based governance mechanism.

Significant DAO Proposals

Besides what happened with TribeDAO as mentioned above, many other contentious proposals prompted discussions surrounding the effectiveness and viability of DAOs.

Uniswap DeFi Education Fund

In June 2021, a proposal was created by Harvard Law Blockchain & FinTech Initiative to allocate 1m UNI for a “DeFi Education Fund” (DEF) which aims to fund education, research and advocacy related to DeFi. It was a contentious proposal but it passed with majority as mainly users with large voting power were able to skew the vote towards a “Yes”. 28m of the 32m “Yes” votes came from just 3 individuals, signaling a high degree of centralization for a proposal that took out a significant amount (~$20m) from the treasury.

Just about a month later, over half of the UNI funds allocated to the DEF were sold which angered many community members as they felt “dumped on”. Furthermore, the proposer mentioned that tokens were supposed to be allocated over the next 4-5 years so that there will not be a significant dilutive effect of selling UNI.

It was also revealed that some of the key voters may have vested interests. Large votes for “Yes” from 3 individuals totaled to 28m, which is 87.5% of the total “Yes” votes for the proposal. With 10m of votes equivalent to 20% of the voting power coming from the proposer itself, it is no surprise that the passing of the proposal caused discontentment within the community.

| Address | Votes | Voting Power for Proposal (%) |

|---|---|---|

| @HarvardLawBFI | 10m | 20% |

| @nkennethk | 10m | 20% |

| 🤓 Variant | 8m | 16% |

Source: Snapshot

The DEF has also not been transparent on what the funds have been used on, until Cobie called them out in a tweet - in which they replied with a thread on what has been done. With no tangible outcomes to measure the effectiveness of the usage of funds, most community members would be disillusioned with companies coming in to try and get funding support from Uniswap. This could have explained why there was greater attention on the Uniswap Flipside proposal which was eventually canceled due to strong pushback and discontentment from other analytics companies like Dune, Defillama as well as the community.

Merit Circle vs Yield Guild Games (YGG)

In May 2022, a Merit Circle DAO contributor initiated a proposal to cancel YGG’s investment agreement with Merit Circle by refunding their initial investment. The reason cited was a lack of support in value adding to Merit Circle as a seed investor. The result was a resounding “Yes” - becoming the first instance where a DAO could overpower decisions involving legal agreements and against the terms laid out in the Simple Agreement for Future Tokens (SAFT). A follow-up proposal was passed on the buy-out terms, which concluded at $0.32 per MC token for YGG’s allocation. Even though YGG still made a 10x return on their initial investment of 175k USDC, the consequence of breaching a legal agreement could have been way more costly for Merit Circle and YGG if they did not choose to settle matters amicably.

While there has not been a similar case happening with other DAOs yet, many fear that it could set a precedent for such cases being prevalent in the future - especially in the current market where capital is scarce. If that does become a common occurrence, it would definitely have an impact on funding coming into the space, with investors fearing such repercussions. On the other hand, one could argue that this is an example of decentralization working well, since the interests of the community were represented - regardless of whether it was the “right” decision.

The Future of DAOs

While DAOs are now focused on token-based governance, better infrastructure and tooling are being built to allow an expansion from this singular model. As outlined above, token-based governance gives power to “whales” who can turn the tide of the votes in their favor and often at the expense of the greater community. This contravenes the purpose of governance as ownership of making decisions for the DAO only lies in the hands of few individuals. Furthermore, when significant decisions are made that could impact the larger community, their interests will not be represented in some cases.

DAOs in the near future could see a move toward other forms of governance such as credential-based governance. Protocols like Galxe (also known as Project Galaxy) are building the infrastructure to verify an individual's credentials both on-chain and off-chain (partnering with Snapshot, Twitter etc.) which can be integrated into DAO governance. Having customizable credentials allows DAOs to adapt based on their needs and determine voting power based on an individual’s contribution to the DAO. This could motivate contributors to put more effort into the DAO and allows for clearer recognition between high and low quality contributors.

Similar tools to Galxe include Rabbit Hole and Gitcoin. These tools help to manage an individual’s contributions to the DAO that can be verified on-chain. As compared to current forms where individuals are often recognised by their “role” in Discord, which is often manually assigned and managed - these tools help to add an additional layer of trust and transparency for members within a DAO. By ensuring that contributors are recognized and rewarded accordingly, it ensures that the DAO is not burning money and members are aligned on moving the DAO forward.

Besides that, there is a possibility that protocols may rethink the ability of DAOs in decision making by introducing limited governance. By reducing the parameters of governance control over DAO decisions, it could prevent cases like Merit Circle vs. YGG which could have legal ramifications. As mentioned in Vitalik’s article on “Moving beyond coin voting governance” - protocols like Reflexer Finance are already taking steps to do so by introducing “ungovernance” whereby governance control over the core contracts will slowly be taken away following 14 - 18 months post launch of the protocol. Uniswap governance is also limited as it only covers certain parameters such as community treasury allocation and swap fees. Limiting governance parameters could solve scaling issues as DAOs grow, as giving governance control over a wide range of issues has proven to be counter-productive.

DAO infrastructures are also improving over time, which would allow governance to be a smoother process in the future. Snapshot announced their plans to build a better voting framework - Snapshot X, earlier this year. It will be built on StarkNet which allows for cheaper fees and storage. Currently, transactions are manually carried out through DAO multisig when proposals are passed, which opens up an avenue for human interference. With Snapshot X, the process is automated since the proposal goes on-chain and can execute any action based on the results of the vote in real-time. This improves the overall experience and efficiency of voting by bridging the gap between off-chain voting and on-chain execution. This also helps to reduce cases of delayed action which was what happened with TribeDAO and the repayment of the Fuse debt.

Key Takeaways

Overall, DAOs are still important for decentralization and will remain a key feature for decentralized applications. However, it is crucial to rethink the current models that shape governance as more could be done to improve the processes. The current token-based model rewards “whales” with larger voting power even though they may not necessarily contribute to the DAO positively, which disregards legitimate DAO contributors who want the best for the DAO. Similar to how smaller DAOs work, when a group of people are aligned on the same goal - it would be easier for decisions to be made and carried out. Therefore, DAOs could create a core committee of most active contributors to recognise these individuals for their work and gather like-minded individuals together.

As DAOs scale, it is also important to balance the decision making power of DAO members with regard to controversial issues. In the case of Merit Circle vs. YGG, the DAO acted against a legal agreement which could have more severe consequences if the matter were to be brought up to court by either party. By limiting governance powers and giving higher leverage in terms of voting power to key contributors, it allows for a varied form of governance that considers the interest of different groups, not just “whales”.

DAOs are pretty much still an underdeveloped area in the industry and with more builders looking to develop better DAO infrastructure and tools, we can definitely expect greater innovation and accessibility to the space in the near future.