Introduction

General-purpose L2s like Arbitrum and Optimism are gaining popularity over the past few months. Optimism and Arbitrum are currently positioned as the leading general-purpose L2s. Although ZK-Rollups are starting to gain some traction, Optimistic Rollup solutions are still dominating across most key metrics.

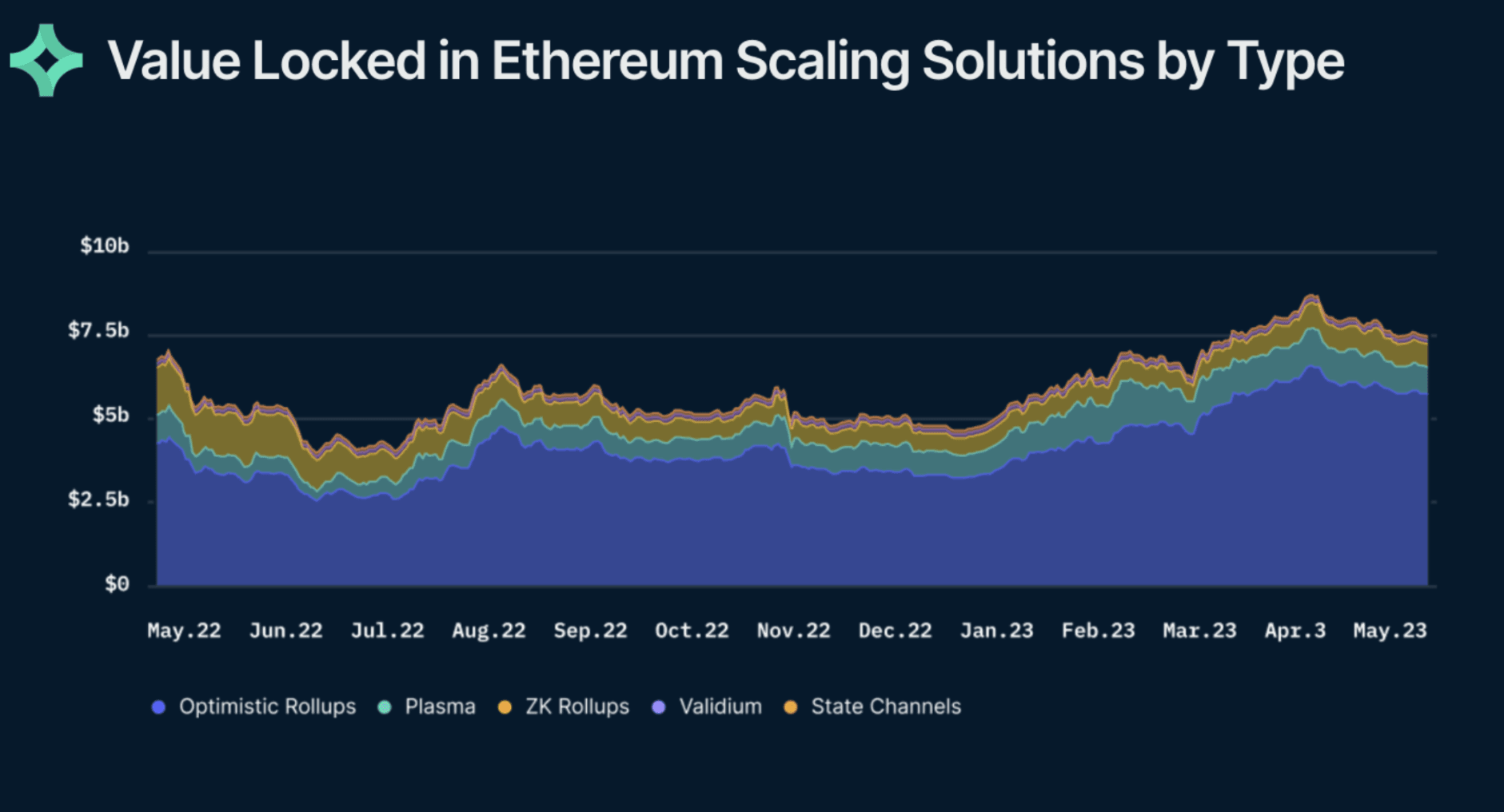

Optimistic Rollups remain the most viable and battle-tested scaling solution in the market, with a $5.7b out of $7.41b dominance in total TVL for existing Ethereum Scaling Solutions.

Both Optimism and Arbitrum have gone through major events this year. Arbitrum launched its ARB token and airdropped tokens to its community alongside other notable developments like Arbitrum Orbit and Nova, and Optimism completed its highly awaited BedRock upgrade on 6 June 2023 and has made strides with the OP Stack. Arbitrum's airdrop on March 23, 2023, resulted in a record high in users and transactions. Interestingly, after the airdrop, the daily count of transactions and users has remained consistently higher compared to the chain's historical averages. Before delving into Arbitrum Orbit and Optimism’s OP Stack, let’s look at how the Optimistic Rollup-based L2s perform at a high level.

General Stats

Daily Active Addresses

Active addresses on Optimism are starting to catch up with Arbitrum after a rather stale start of the year. During the Arbitrum airdrop season in March, Optimism was ranging between 40-50k in daily active addresses. Fast forward to today, Arbitrum and Optimism are both ranging between 100k daily active addresses.

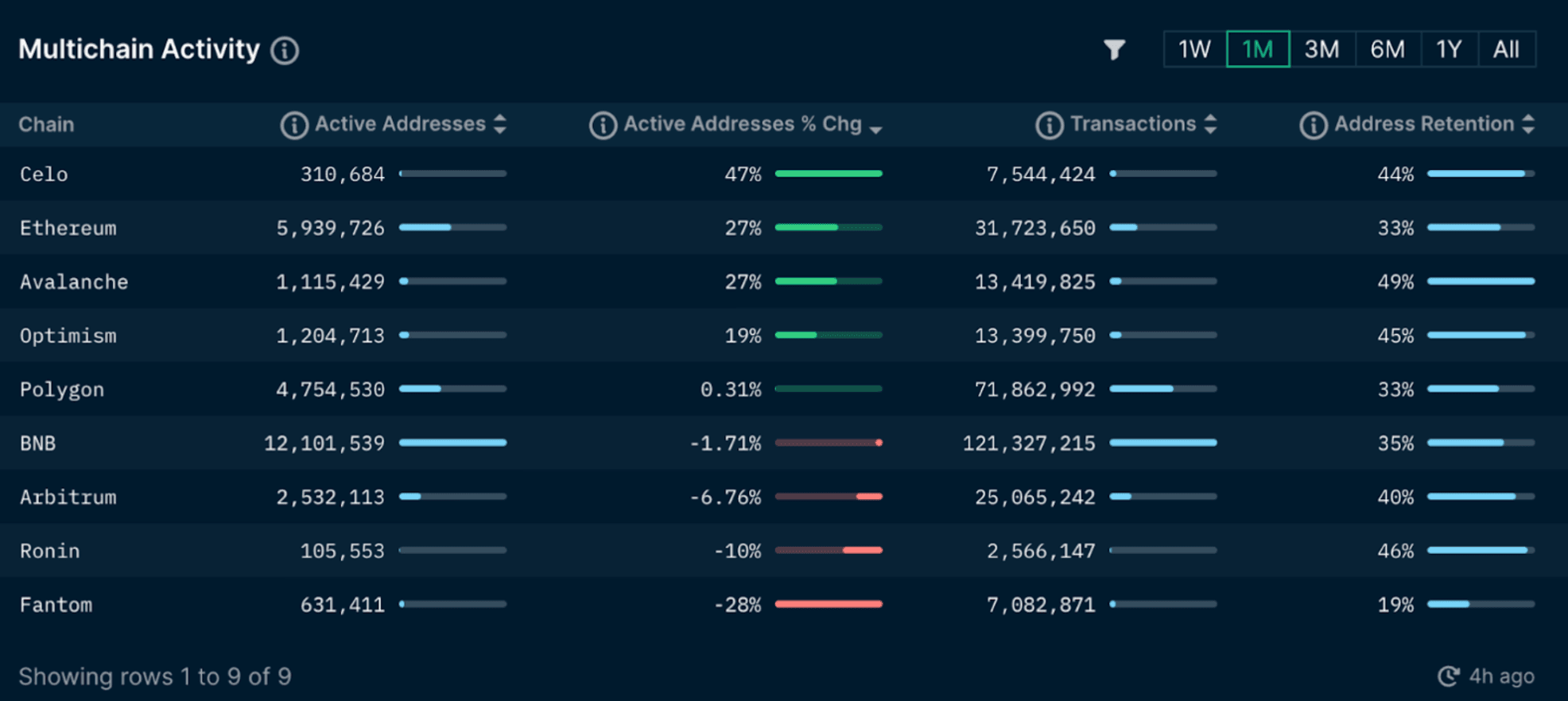

In the last month, Optimism has experienced a +19% increase in active addresses, while Arbitrum has experienced a slight decrease of 6.76%

Daily Transactions

Transactions on Arbitrum peaked on March 23, as expected due to the airdrop frenzy, and surpassed Ethereum’s by 2x (2m on Arbitrum vs. 1m on Ethereum). However, transactions have seen a downward trajectory since, circling back to pre-airdrop levels at around 800k-1m today. While transactions on Ethereum have been relatively flat with no change over the past year (~1m), Optimism is experiencing a surge in transaction count, starting in May 2023.

After the OP rewards elapsed earlier this year, Optimism has been rather quiet with less chatter on CT. As seen in the chart, Optimism is moving on an upwards trajectory since May 2023, averaging at 600-800k in daily transactions, coming close to Arbitrum’s in recent days.

Average Daily Gas Fees Paid

Average daily gas fees paid for both Optimism and Arbitrum have decreased since their peak in Mid May.

In the first half of the year, the average daily gas fees paid on Optimism were slightly higher than Arbitrum’s. The trend has now shifted after Optimism’s BedRock upgrade, with transactions falling over 50% for Optimism, averaging around $0.1 at the time of writing. Arbitrum, however, is averaging between $0.13-0.20 for swap fees. Compared to the other L2 and zkEVM scaling solutions, Optimism has the lowest fees when it comes to swapping tokens, averaging between $0.1-0.12, compared to Polygon zkEVM at $0.63, zkSync Era at $0.34, Starknet at $0.56.

For real-time data on L2 fees, check out L2fees.

Development Stack: Arbitrum Layer-3s vs Optimism SuperChains

Arbitrum Orbit - Technology Stack (Arbitrum Nitro), Layer-2 (Permissioned), Layer-3 (Permisionless)

Optimism SuperChain - Technology Stack (OP Stack), Layer-2 (Permisionless), Layer-3 (No)

Arbitrum Orbit

Arbitrum (Offchain Labs) just announced their new Layer-3 also known as Arbitrum Orbit. This is a new development framework for creating L3s. L3s are to L2s what L2s are to L1, in that it refers to a rollup that settles to another L2 rather than the L1.

L3s still retain the security guarantees of an L2 but have the bandwidth to provide a further increase in scalability as it opens up a new avenue for throughput to be compounded on each stack.

Another difference between Arbitrum Orbit and their L2 stack is that Orbit is completely permissionless, allowing developers to create new applications that settle on the Arbitrum chain without the permission of the DAO. Currently, the Arbitrum DAO authorizes the creation of new L2 chains through a governance proposal mechanism. With L3, no authorization is needed, allowing endless possibilities of applications that can be created.

Orbit will also be compatible with Arbitrum Stylus, an upgrade that will allow developers to build applications in traditional programming languages.

Besides Arbitrum Orbit, Arbitrum has also built out an ecosystem of products ranging from Arbitrum Nitro, Arbitrum One, Arbitrum Nova, and the new L3, Arbitrum Orbit. As a recap, here are some details of each of the products:

- Arbitrum One: Arbitrum One is the official mainnet of the Arbitrum ecosystem. It powers the entire ecosystem and processes transactions on the Arbitrum Virtual Machine (AVM) and is compatible with the Ethereum Virtual Machine (EVM).

- Arbitrum Nitro: Arbitrum Nitro replaces Arbitrum’s AVM with WASM that will take care of fraud proofs. This will make the ecosystem more EVM compatible.

- Arbitrum Nova: Arbitrum Nova is built using Arbitrum’s AnyTrust Technology, sharing a similar codebase to Arbitrum Nitro that aims to provide ultra low transaction fees. Nova differs from Arbitrum One by not posting transaction data on chain, but to Data Availability Committee.

- Arbitrum Orbit: Arbitrum Orbit is a new development framework for creating L3s

Optimism SuperChain/ Bedrock

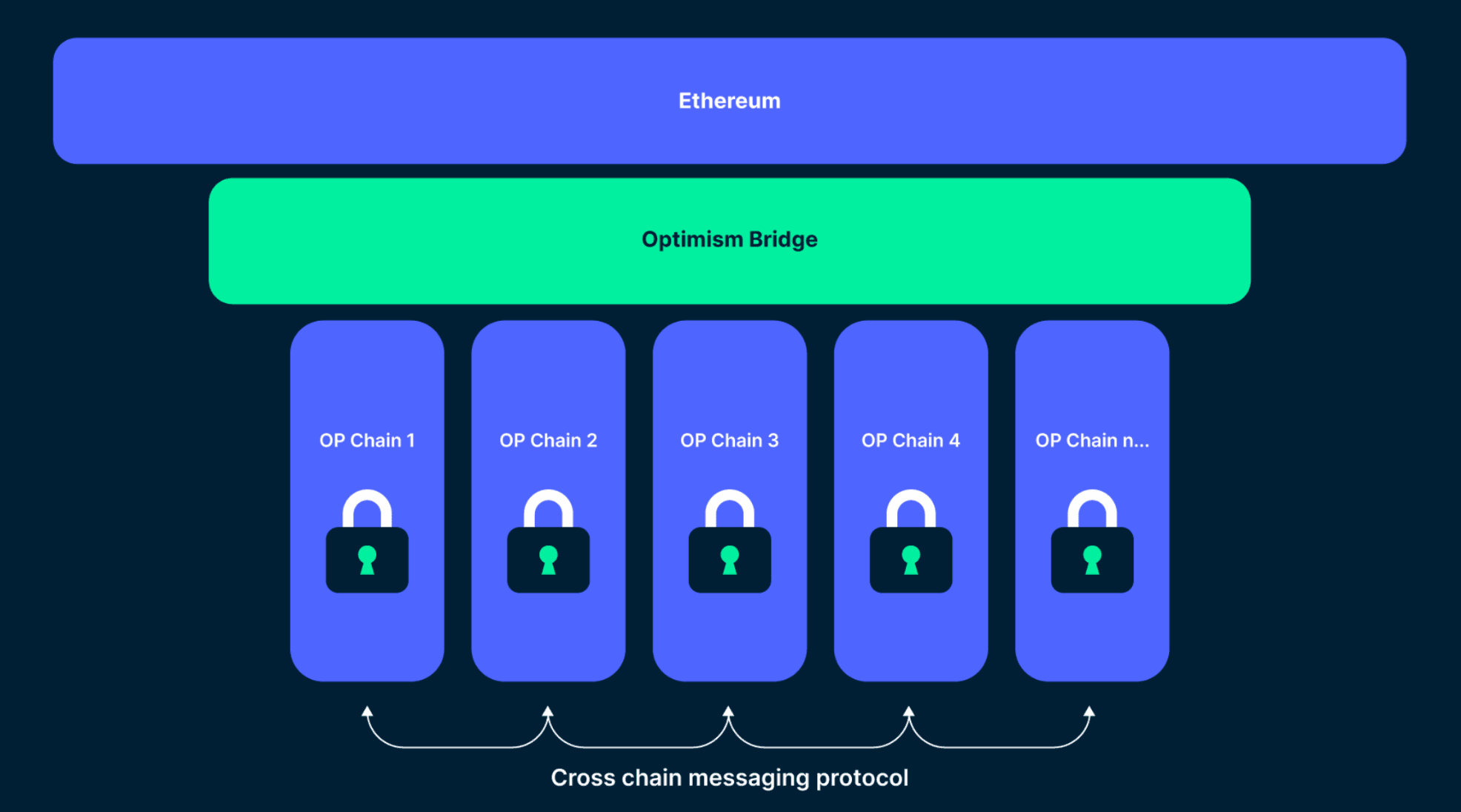

Optimism completed its Bedrock upgrade on June 6, 2023, and paves the way for Optimism’s Superchain vision, where developers can leverage the OP Stack’s tools to build applications. Optimism is building on the thesis of creating a horizontally scalable network of chains, forming a Superchain. OP Stack is a permissionless, open-source development stack that allows builders to build their own L2 with their stack.

The Superchain infrastructure works by allowing each OP Chain to communicate horizontally using their cross-chain messaging protocol that is dependent on the Optimism Bridge to bridge assets back and forth from Ethereum. Because each of the OP Chains relies on the same bridge to bridge their assets to and from Mainnet, this enables OP chains to have standardized security properties.

One of the biggest changes from the BedRock upgrade is that it lowers transaction fees by up to 50%. Before the Bedrock upgrade, the average daily gas paid on Optimism was around $0.40-0.50. Post upgrade, the daily gas paid is averaging between $0.10-0.13. Considering that the daily gas paid is also dependent on the network congestion and how much the ecosystem is actually being used, daily transactions on Optimism were actually on an upward trend for Optimism, while their daily gas paid has decreased by >50%. Hence, this was a testament to the BedRock upgrade significantly improving the daily gas paid on Optimism.

Who’s Building Applications Using The OP Stack?

- Coinbase’s upcoming L2, Base, is expected to go live on Mainnet later this year. Base also announced that it plans to return 10% of transaction fees to Optimism, which would add massive value accrual to Optimism’s ecosystem.

- WorldCoin has committed to building on the OP stack. World App has more than 1.6M sign-ups in beta and over 500k+ monthly active addresses, which is only 1/2 less than Optimism’s current number of active users. Moreover, WorldCoin has already established partnerships with Optimism way before this current OP Stack infrastructure, dating back to EIP-4844 discussions.

- Aevo, a decentralized options exchange, has launched its OP-based rollup.

- opBNB on the BNB chain also utilizes the OP Stack.

- Zora Network developed by ZORA is an L2 solution built on the OP Stack.

General Developments for the L2s

Arbitrum

AIP-1.1

The Arbitrum DAO has approved a recent proposal to lock up the 700m ARB tokens (~$770m) in a vesting contract over the course of 4 years. The proposal elapsed with an overwhelming majority of 99.56% voting “For” and 0.38% voting “Against”, and 0.04% voting “Abstain”. The largest entities voting “For” was TreasureDAO (23.3M ARB), followed by delegate.l2beat, olimipio.eth, PlutusDAO, ChainLinkGod, and Camelot.

This proposal was put forth after the controversies from AIP-1: Arbitrum Improvement Proposal Framework, specifically the Arbitrum Foundation Aminstrative Budget wallet that was created. The proposal highlighted that 750m ARB tokens will be transferred to this wallet for operational costs, etc.

Optimism

BedRock Upgrade

The BedRock Upgrade was successfully completed on June 6, 2023. The Bedrock upgrade features a complete rewrite of Optimism’s rollup stack and is the biggest update since OP Mainnet.

The Bedrock upgrade features significant changes for Optimism. One is related to a reduction in protocol costs and security fees of up to 50%. Currently, the two main costs associated with the rollup architecture are L2 transaction fees and L1 data/ security fees. As seen above, the L1 data/ security fee dominates most of the costs when transacting on Optimism. In Bedrock, large amounts of data are compressed before being sent back to Ethereum L1. Bedrock uses a compression algorithm called zlib that offers a good compression ratio and allows for more efficiency in how data is sent to L1.

OP Stack

Optimism has captured significant adoption in terms of projects building on top of the OP Stack. Worldcoin and Coinbase’s L2, Base, has committed to building on their OP Stack/ Superchain thesis. Additionally, A16z has also mentioned that they are building a new Rollup client for Optimism called MAGI. The question lies in whether value will ultimately be accrued to OP’s native token. In the case that they continue capturing more prominent players to build on their OP Stack, the DAUs and volumes on Optimism could skyrocket, creating a flywheel effect in its ecosystem. The team proposed what they believe to be the final form of blockchain’s “super-chain” thesis. The Superchain leverages OP Stack’s modular architecture and single shared sequencer set, which will enable atomic cross-chain composability between chains and ultimately trustless rollup maintenance. Read more on the OP Stack in our latest research on rollups-as-a-service.

Upcoming Catalysts

The highly waited Cancun Upgrade will benefit both Arbitrum and Optimism.

EIP-4844 represents the initial step in Ethereum's sharding design, addressing one of the most critical scaling bottlenecks: data availability. Data availability refers to the proof that the underlying data associated with a transaction has been published on a public board for verification. The objective of EIP-4844 is to enhance data availability capacity within the Ethereum network by introducing a new transaction format known as "blob-carrying transactions".

So, why will fees on Layer 2 solutions (L2s) become lower following the implementation of EIP-4844? The answer lies in the separation of fees for transaction computation and storage. L2s will employ a distinct function to submit "blobs" to Ethereum Layer 1 (L1). These blobs contain data that does not need to be available indefinitely but rather for a specific duration before being pruned.

The ultimate aim is to provide end users with significantly reduced fees, resulting in a much-improved user experience on L2s. By introducing separate fees and optimizing data storage, EIP-4844 strives to enable more cost-effective transactions and enhance the overall usability of Layer 2 solutions.

Arbitrum and Optimism are both leading Optimistic Rollup L2s, each with their own thriving ecosystem and communities.

While both L2s are poised with upcoming upgrades and developments, the L2 with the best user adoption and usable applications will ultimately steal the show.