Introduction

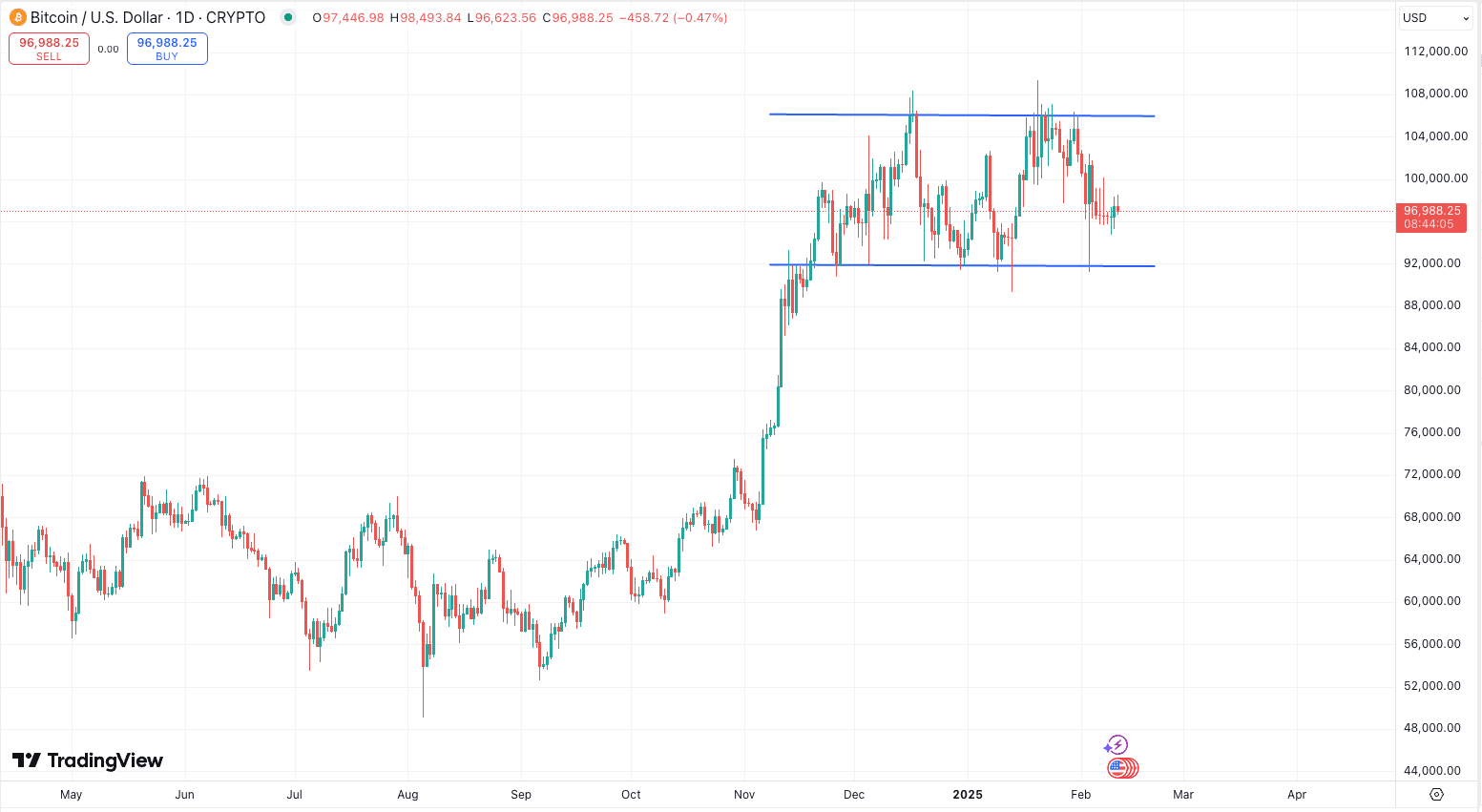

BTC is currently trading about 10% below its all-time high, remaining within a broad range established in November 2024. While there are no immediate catalysts for BTC, ETF inflows continue to trend positively and there are very clear underlying catalysts that undermine investor behavior for the better - most notably, the President of the United States supporting crypto, clear regulatory frameworks for crypto and stablecoins in particular, Strategy (formerly Microstrategy) that keeps buying along with new institutions such as Metaplanet and the bi-weekly bid/allocation to BTC via the ETFs from retirement accounts. We have seen confirmation of these catalysts with institutions such as Fidelity recommending a 2%–5% allocation to BTC.

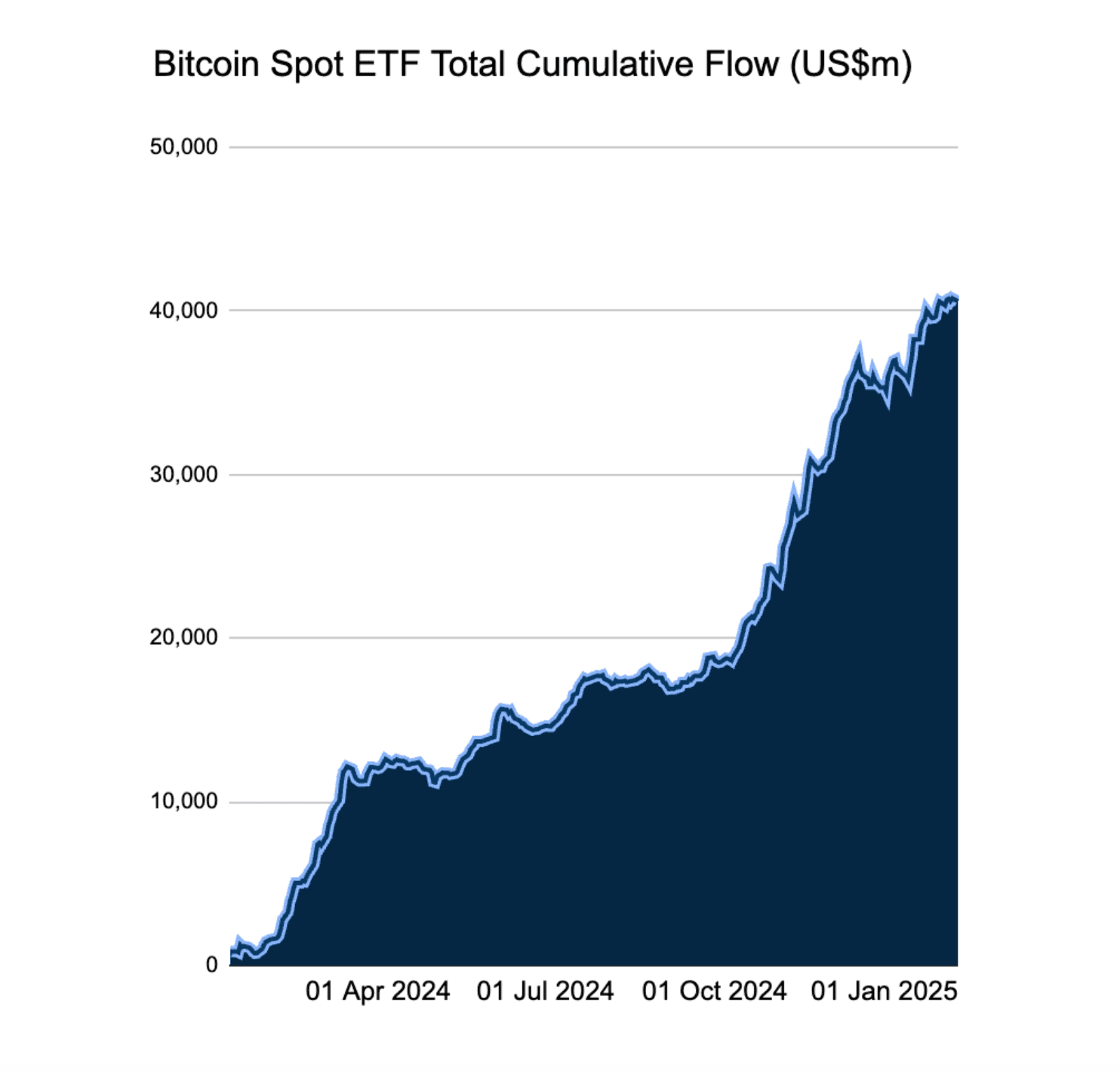

ETF inflows continue to see positive net flows, with the trend remaining very much intact. Considering the constant flows and other factors, we haven’t historically seen BTC trade this long (multiple months), just below the highs, and it continues to go higher thereafter. Most times, we break the trend and see a lot of downsides. Right now, the BTC chart shows prolonged consolidation, having briefly tested the low part of its range and trading in the lower half of the channel, on lower volume.

While short-term speculation is not the focus, this long-term consolidation below the ATH is fundamentally a new paradigm for BTC. With the BTC-driven market and a bullish-leaning outlook for 2025, the key question shifts from “Should I allocate to BTC?” to "How can I earn additional yield while maintaining spot BTC exposure?” Enter BTC restaking yields.

ETH was historically considered the more productive asset - you could borrow against it, trade alt pairs against it on DEXs, and much more. BTC was siloed to a few centralized custodians, such as wBTC, but this has changed in recent years.

With platforms like Babylon Chain laying the foundation for “restaked BTC”, we are now seeing a surge in BTC LSTs (Liquid Staking Tokens), with highly anticipated points programs and expanding liquidity. Even Coinbase launched its own canonical version of BTC, cbBTC. The trend of BTC moving onchain is accelerating, and points programs such as Babylon and BERA are being actively farmed. Among the most notable opportunities for passive and fixed yield on BTC are the PTs (Principal Tokens) offered by Pendle.

Fixed Yield on BTC

The BTC markets on Pendle offer a range of fixed-yield opportunities. Below, we briefly break down key providers and their respective risk factors. It’s important to note that these markets vary in centralization risk, counterparty exposure, and liquidity constraints so always conduct due diligence before participating. For a deeper analysis of Babylon, the leading restaking platform, and its two largest LST issuers—Lombard and Solv Protocol, refer to our comprehensive breakdown here.

Key Risks:

Exiting the pool early can lead to losses. The best case scenario is that you either want to hold BTC beyond the maturity or, if wanting to leave prematurely, think that yields will be lower than now.

- Rising Yields: If market conditions improve and Pendle yields increase, your PT may be worth less before maturity.

- Urgent Exit: If you need to sell BTC at a peak or redeem due to protocol issues, you may take additional losses.

Holding until maturity ensures full redemption, but premature exits carry risk depending on yield fluctuations and protocol stability.

Below, we highlight the top BTC PT markets, focusing only on high-liquidity opportunities with at least $10M TVL and offering a minimum of 5% APY at the time of writing.

Berachain Strategies

Use LBTC and other LSTs to earn high fixed yields through Pendle PTs. These returns are driven by points farmers (YT holders) looking to maximize reward incentives from multiple sources, including Babylon, Berachain, Lombard, Concrete, Enso, Kodiak, and Dolomite. YT holders seek leveraged exposure to rewards, leaving high fixed-rate income opportunities for passive BTC holders.

- Funds remain locked until April 14, 2025.

- You can switch freely between Pendle PT, YT, and LP positions.

- You can exit into ctLBTC/ctWBTC, but these tokens remain subject to the same lockup period.

- Lombard: 11.97% APY on LBTC (Bera Concrete), maturing in 57 days ($24M liquidity).

- Solv Finance: 12.05% APY on SolvBTC.BERA, maturing in 57 days ($24M liquidity).

- EtherFi: 11.4% APY on LiquidBeraBTC, maturing in 57 days ($28.3M liquidity).

Corn

- EtherFi: 10.5% APY on eBTC PT, maturing in 43 days ($25M liquidity).

- Lombard: 7.7% APY on LBTC PT, maturing in 15 days ($10M liquidity).

- Bedrock: 7.3% APY on uniBTC PT, maturing in 15 days ($53M liquidity).

Lombard

- LBTC (Ethereum): 6.3% APY, maturing in 43 days ($37M liquidity).

- LBTC (Base): 6.3% APY, maturing in 106 days ($19.5M liquidity).

Solv Protocol

- SolvBTC.BBN (Ethereum): 7.2% APY, maturing in 43 days ($10M liquidity).

- SolvBTC.BBN (BNB Chain): 5.1% APY, maturing in 43 days ($71M liquidity).

Many of the above markets take exposure to a few protocols, and you can even decide to leverage farm the PTs even further (i.e., through Morpho, Gearbox, etc.). Navigating to Pendle, users can explore the specific applications/chains that are behind a given market, so please exercise caution and do your own research for what types of counterparty exposure you're comfortable with. At present, BTC yield markets on Pendle rival, if not exceed, some of the highest APY PTs available for ETH. The divergence in these yields comprise mainly of the number of apps/chains the market is built on, which increases risk given all the strategies involved and different protocols it touches. In other words, there is increased counterparty risk and other downstream risk factors at play so DYOR.