Introduction

During the ICO frenzy of 2017, 430 projects managed to raise a staggering $4.6 billion in funds. This period coincided with increasing interest in crypto, resulting in substantial profits for these early investors. Notable projects like Filecoin, Tezos, EOS, and Bancor successfully raised over $150 million each. Although the ICO bubble eventually burst, participating in initial token sales remains as an attractive investment opportunity for many investors due to their potential for good returns.

In the current landscape, projects launching their tokens have a wide array of options to consider. Besides centralized platforms, decentralized alternatives have emerged as a viable choice that gives projects the opportunity to effectively engage their target audience. Various protocols have introduced models like Dutch Auctions and different iterations of Fair Launches to enhance the user experience of participating in token sales, mitigate price manipulation by whales, and optimize token performance. A token’s performance largely depends on a variety of factors, including the token's narrative, the parameters established for the token sale, and the existing market conditions.

This report aims to assess the different token sale models by looking at the past performance to see if there is any trend in how it could affect the return on investment. Additionally, It will examine the relevance of different factors in determining the price performance of tokens following their launch.

Token Sale Models

Protocols employ various models for conducting their initial token offerings, but the two predominant ones are the Dutch Auction and Fair Launch models.

Dutch Auctions

In a Dutch auction, the token's price offering begins at a starting price and gradually decreases to the reserve price over a period of time. The final price of the token can be above the reserve price if the token supply sells out before the reserve price is hit.

The token's value is determined by the participants' demand, enabling them to pay a "fair" price based on their valuation of the project. An iteration of the Dutch auction model is Balancer’s Liquidity Bootstrapping Pools (LBPs) which has been adopted as a renowned initial token offering for protocols like Maple Finance, Perpetual Protocol and Aura Finance. Some pros and cons of the model include:

Pros:

- Allows for more inclusive participation, as it disincentivizes larger investors from monopolizing the token supply during the initial phase.

- Reduces the need to compete with bots and problems of soaring gas fees as the sale is not based on an FCFS basis.

- For Balancer LBPs, capital required for teams upfront is significantly lower than conducting launchpads.

- Helps to reduce volatility in price when tokens first launch, since time is given for the price to settle at a “fair” value. It also allows for more participants as compared to FCFS sale with hard caps, reducing the amount of people that whales can “dump” on upon launch.

Cons:

- There is a risk that projects might raise below their expected value if turnout for the sale is low or investors deem the “fair” value as way lower.

- Participants in the sale may overbid for the token at the start due to fear of missing out and instantly liquidate their assets if the final price falls way below their bid.

Fair Launches

On the other hand, a fair launch involves offering the token at the same time and price to all participants. Participants are able to purchase tokens until the hard cap on deposits is reached, and the token is distributed based on the amount an individual has contributed. Alternatively, some sales may not have a deposit cap over a specific period, with token prices determined by the total contribution relative to the number of tokens available for sale. This model is usually employed for CEX launchpads and may not be entirely “fair” given that holders of the CEX tokens are usually given priority or in some cases, may be a requirement to participate in the sale. This model is also utilized on-chain and by token offering platforms, such as Camelot, Coinlist and DAO Maker.

Pros:

- Participants get to bid at the same time and price, ensuring that there is transparency in the process.

Cons:

- Whales or bots may front-run these sales and monopolize token supply to “dump” on smaller participants when the token launches.

- Given that the sale is on a FCFS basis, gas wars may happen on-chain causing the experience for participants to be suboptimal.

Historical Performance

To narrow the scope of analysis, we looked at these key metrics:

- Projects are only selected after the 2021 time frame to ensure that different market conditions are present.

- Projects selected to be analyzed on the different launchpads are based on the amount raised and the prominence of the project.

Dutch Auction

The Dutch Auction model is not as popular amongst protocols. The only launchpads that offer such services are Sushi’s (now defunct) MISO and Balancer’s LBP. Using this model gives power to participants as they will determine the “fair value” of the token, which means that the protocol must have sufficient confidence in their success.

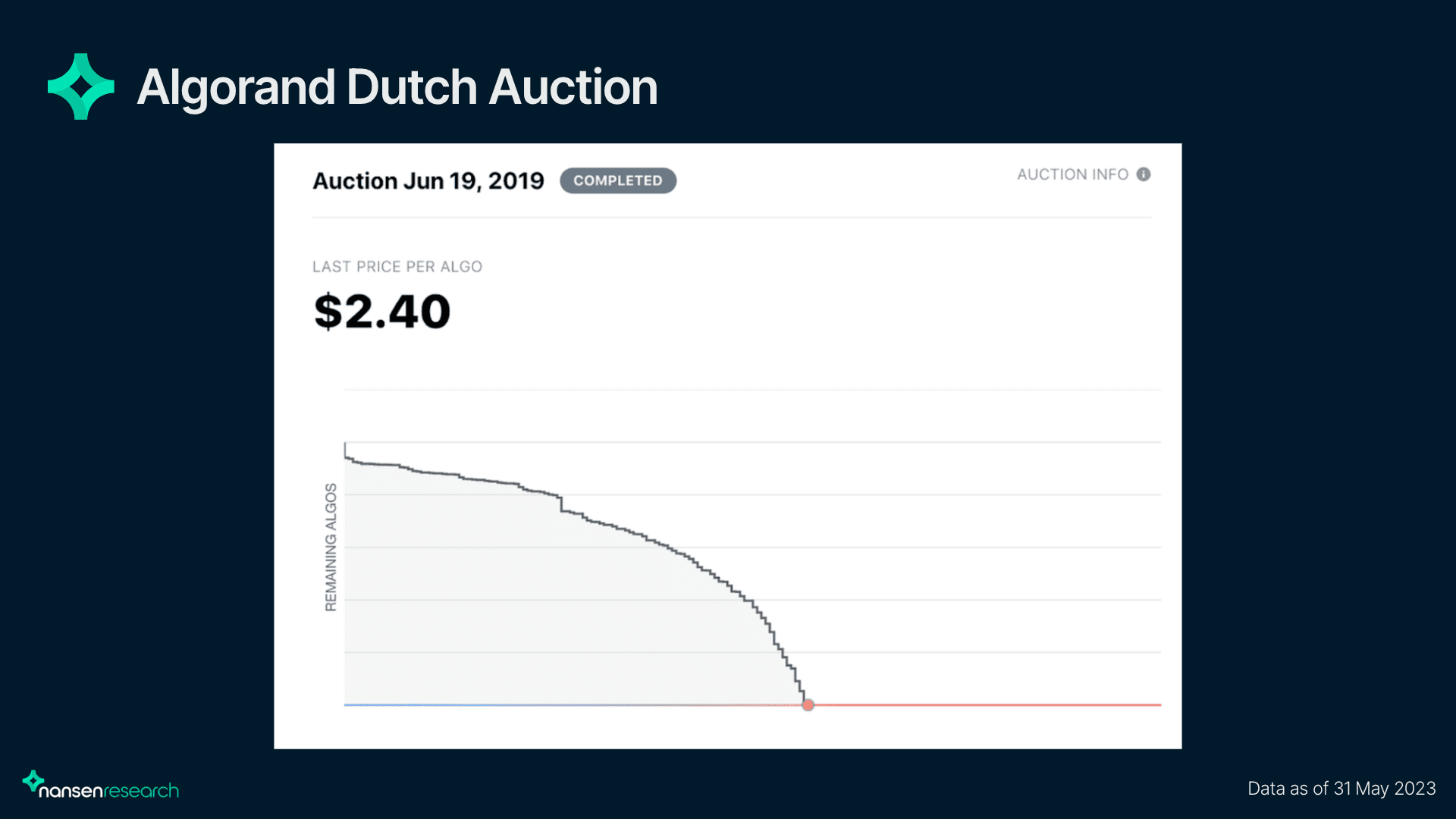

One of the first Dutch Auction sales was done by Algorand, which had an initial sale price of $10 per token but eventually settled at $2.40 per token. A total of 25 million tokens were available for sale, which means that Algorand raised 60 million through their token sale since all investors will receive the tokens at the same price. An example of how the model allows for more equitable participation whereby smaller investors can enter at lower prices is shown below. The idea is that it would be beneficial for larger investors to not commit too much in the beginning since they will not be able to gauge the demand and “fair” value of the token if they dominate the supply right from the start. It also increases the chances of them making a loss if they commit too much at high prices as there will not be many investors willing to buy it off them on the market.

This model also prevents price volatility from FOMO and the token has been given sufficient time to go through a price discovery process during the launch itself.

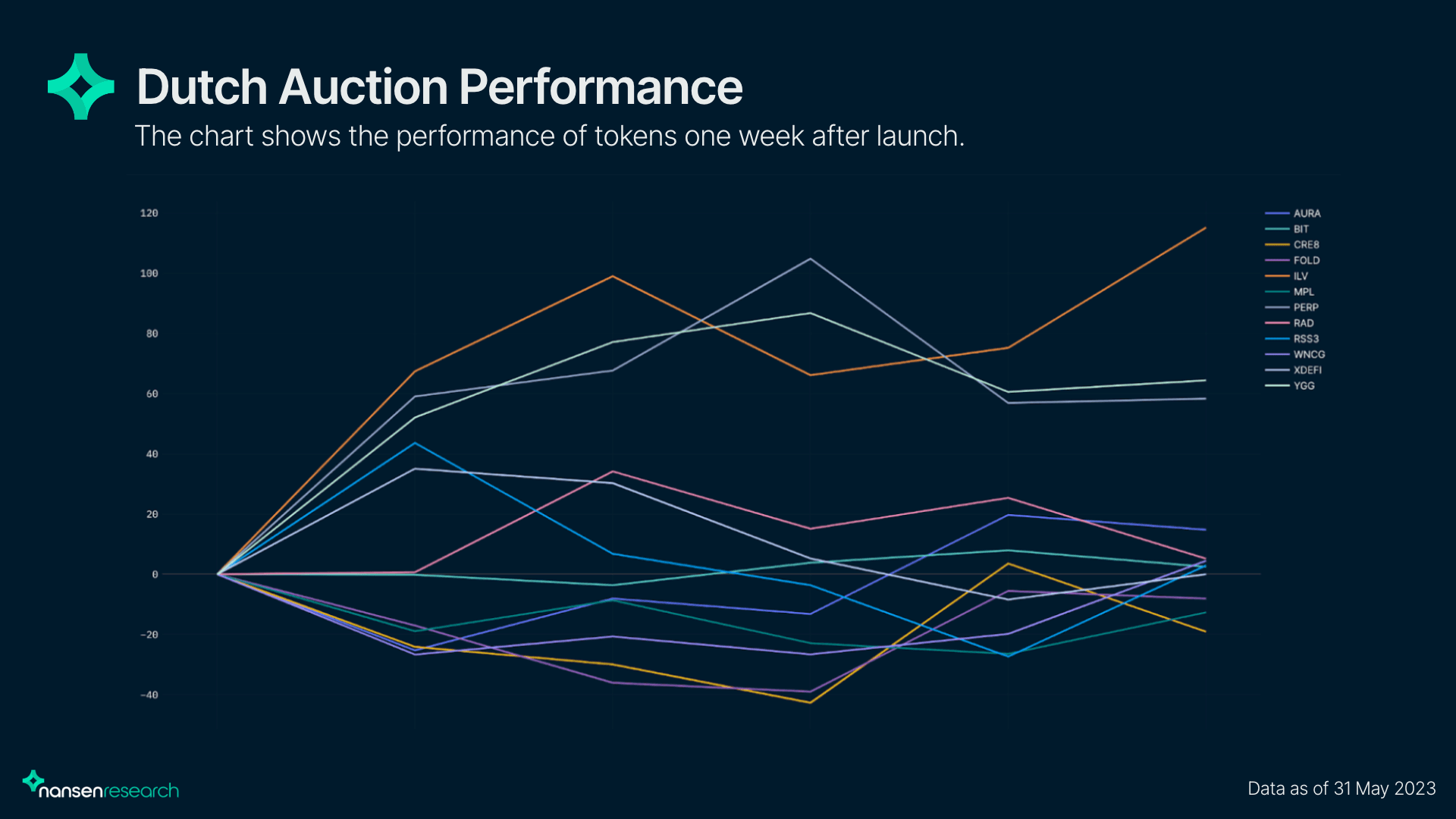

We looked at recent and prominent token sales conducted through Dutch Auctions and the performance of these tokens in the week following its launch is shown below.

Looking at the chart, it shows that 8 out of 12 tokens analyzed continue to be profitable for investors a week after the token sale. Of the 8 profitable tokens, 5 were launched on Balancer (AURA, ILV, PERP, RAD and RSS3) while the other 3 were launched on MISO (BIT, CRE8 and YGG). Most of the profitable tokens had their launch in 2021, with the exception of PERP in September 2020 and AURA in June 2022. YGG, ILV and PERP had the best returns for investors who participated in their token sales with profitability of over 50-100% on their initial investment within a week. Looking beyond the performance for 1 week, ILV and YGG continue to be profitable for investors 1 month after the token launched. Their performance is likely due to the gaming narrative in 2021, coupled with the fact that Illuvium and Yield Guild Games were one of the first few large-scale projects that received significant investments from VCs. This shows that narrative is a key driver of momentum on tokens. Favorable market conditions certainly helped as well, since these tokens were launched during the bull run of 2021.

Fair Launch

There are a variety of launchpads that employ the Fair Launch model. The fair launch model differs based on the requirements and parameters of the specific token sale, which may cause it to be not so “fair”. For our analysis, we will split the launchpads based on on-chain protocols, token offering platforms or CEXs.

On-chain Protocols

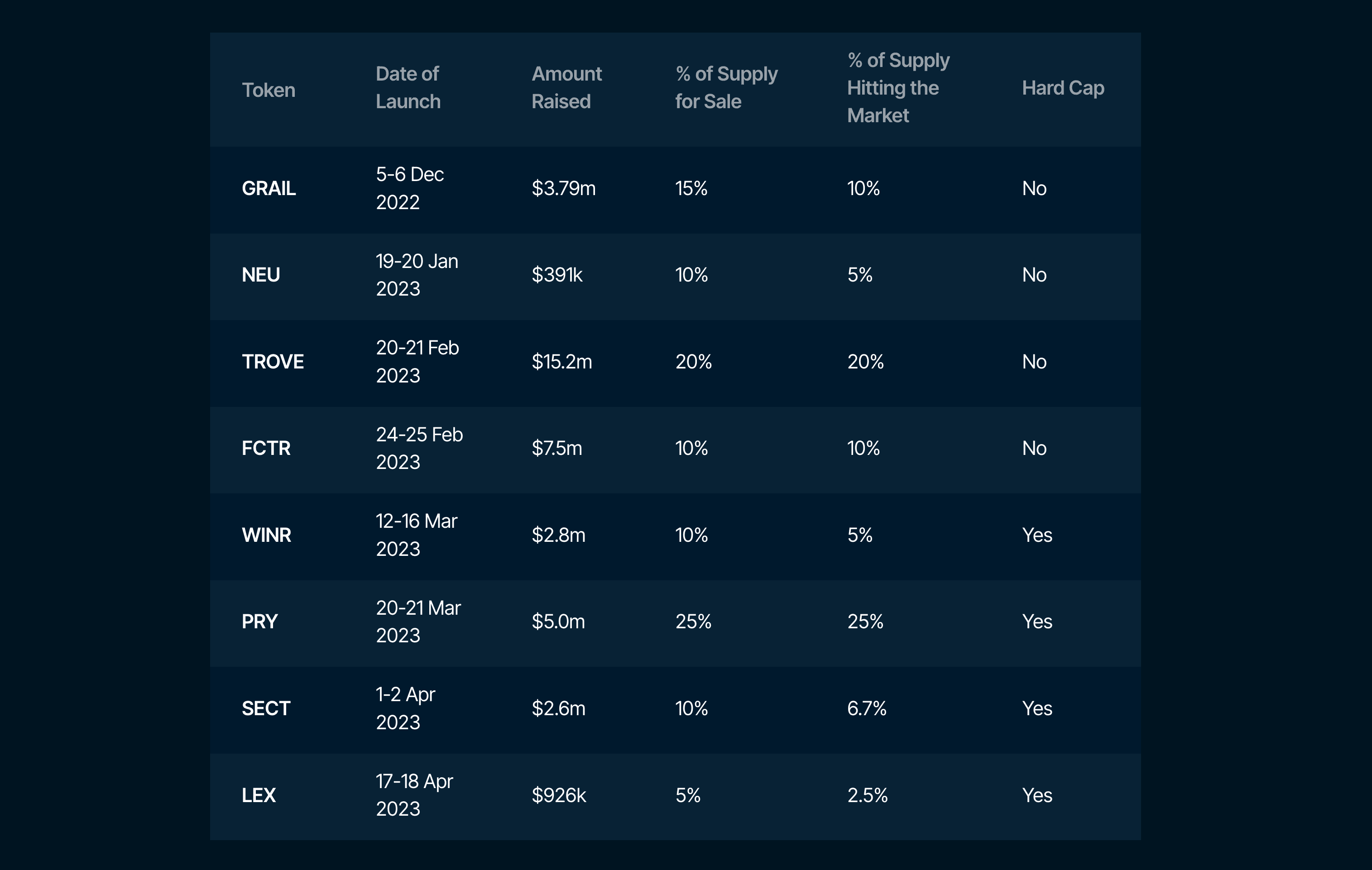

The launchpads covered for on-chain protocols include Camelot and Impossible Finance. These launchpads were chosen based on the size and recency of token launches as well as the relevance of these tokens based on the market narrative.

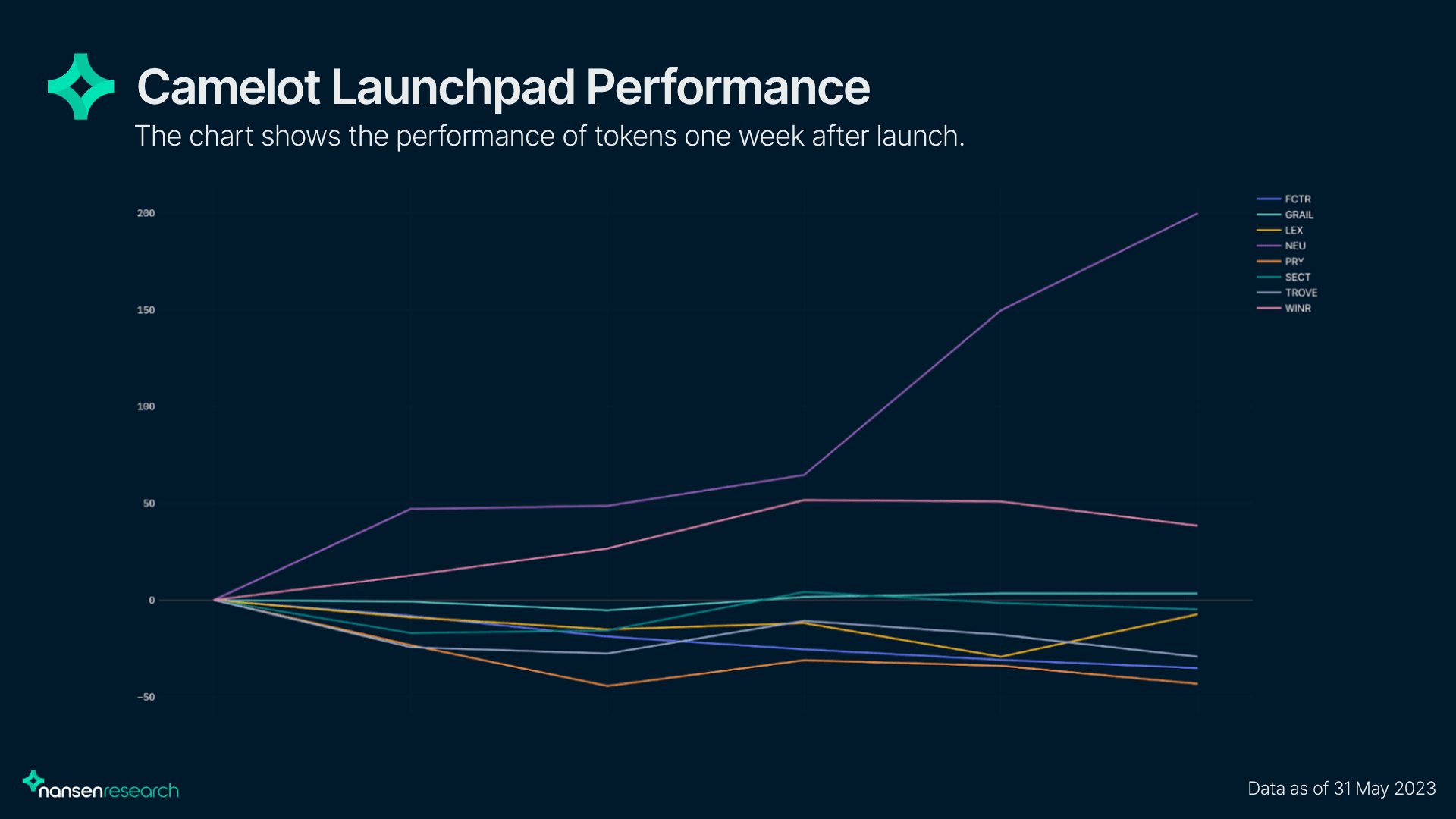

Camelot was all the rage in the past month during the Arbitrum airdrop narrative. Its native token - GRAIL, experienced a parabolic run-up of 2300% from January to its ATH in March which put the spotlight on the protocol. Following GRAIL, many other projects launched their token on the platform during the start of 2023 as well.

Neutron

NEU was the first project to launch following GRAIL, and saw its price increase by 200% in the week after its launch. Factors that could have contributed to it were the start of the Arbitrum narrative and the fact that 50% of the tokens sold were distributed in esNEU, which has to vest for 12 months to become NEU. This would help to reduce sell pressure by mitigating the circulating supply of tokens hitting the market upon launch.

WINR Protocol

Another token that was profitable for investors - WINR, had a hard cap and similar strategy of splitting 50% of the tokens into vWINR, which has to vest for 6 months to become WINR. However, vesting of tokens is likely not a determinant factor given that SECT and LEX had similar mechanisms but were not so profitable after launch. PRY, SECT and LEX also had hardcap for their launches, but turned out unprofitable for investors in the week after the launch.

Thus, narrative likely remains the most important factor in determining the profitability of token launches, since demand is the key driver for price appreciation. Factors like reduced sell pressure only add to the momentum for price appreciation.

Token Offering Platforms

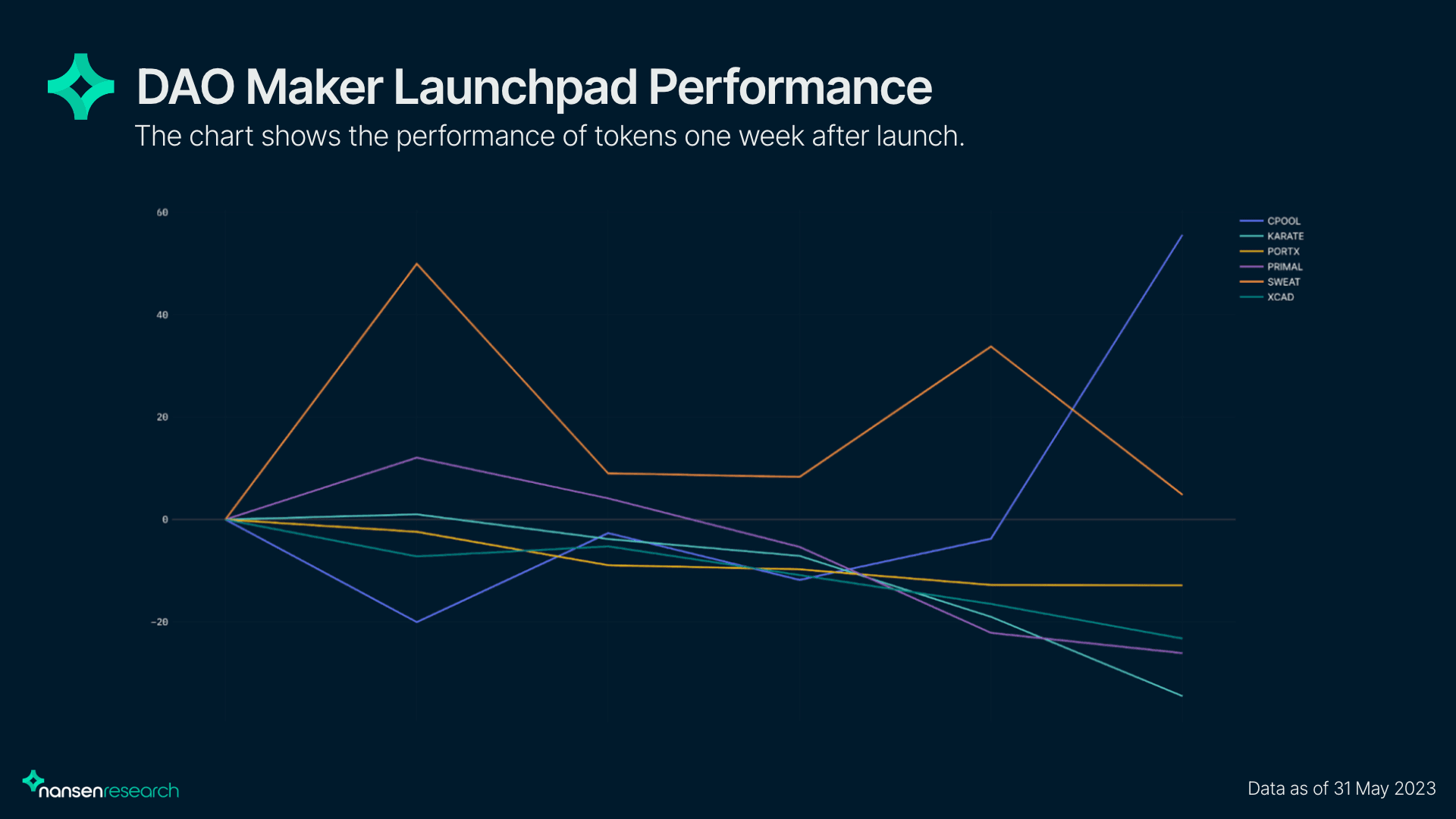

DAOMaker is an all-in-one platform that provides projects with a range of services, including initial token offerings, DAO management, and incubation support. To participate in a token sale on the platform, individuals are required to KYC. While numerous initial token offerings take place on the platform, many of them are small allocations whereby the tokens are also launched on other platforms. Therefore, our focus will primarily be on noteworthy projects that have either exclusively launched or conducted a significant portion of their token sale on DAOMaker.

Notable projects such as Clearpool, Sweat Economy, and XCAD Network have successfully launched on the platform. However, in terms of post-launch performance, only CPOOL and SWEAT proved to be profitable within the first week. CPOOL launched in October 2021, benefiting from more favorable market conditions. It was one of the first decentralized protocols offering uncollateralized borrowing options for institutions. SWEAT launched in September 2022 and gained significant attention due to its existing user base of over 100 million. This highlights the importance of having a compelling narrative to sustain demand for a token after its initial launch, in order for the token to do well.

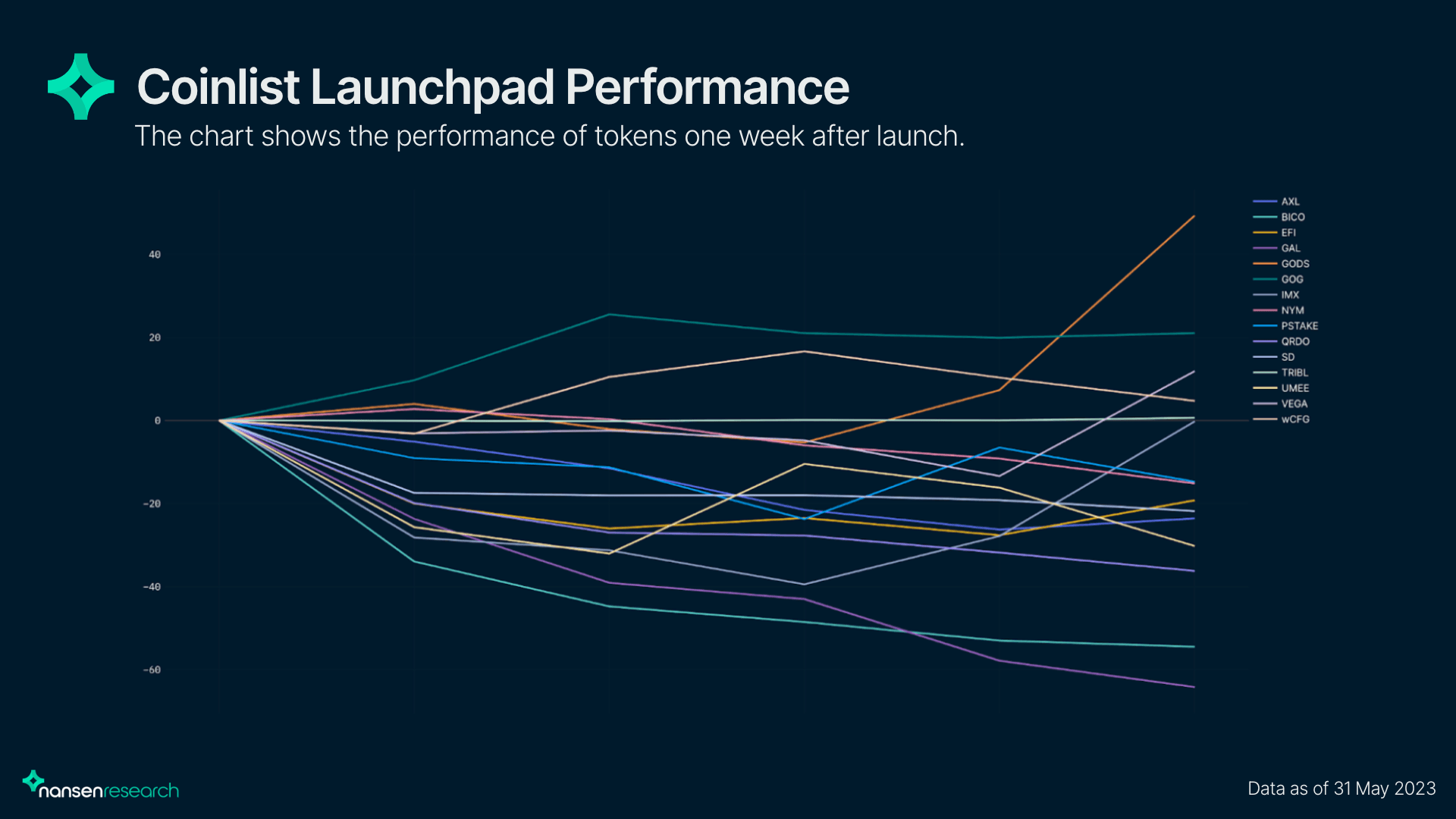

Coinlist is a well-known launchpad that has helped to launch tokens for notable projects. Projects such as Solana, Celo, and Flow have successfully launched their tokens through Coinlist. In order to participate in token sales on Coinlist, users are required to undergo KYC, which is similar to CEXs.Thus, the user base could lean toward retail investors. Coinlist's prominence and the reputation of the teams launching their projects on the platform have likely contributed to the ability to raise significant amounts of funding. The average funding raised by the tokens shown below is around $22.3m, which is higher than average compared to other launchpads.

Despite its popularity, the majority of the recent prominent raises on Coinlist tended to go underwater within a week of launch. The exceptions were GODS, GOG and wCFG. GODS and GOG were both GameFi projects that launched in October and December 2021 respectively. One reason for this could be that Coinlist’s launch process often involves purchase limits per person. While these limits ensure that the token has more participation, it also increases sell pressure due to the larger number of small holders who are likely looking to exit upon a listing pump. These limits also deter larger investors who believe in the project, as they would need to explore alternative methods (such as buying KYC accounts) to bypass the limits, thus creating an additional barrier to entry. Furthermore, the token offerings often include a lockup period where only a percentage (ranging from 25-50%) of tokens is released at the time of the token generation event (TGE), or after a specific period like a 90-day cliff. Thus, it shows that these factors are not particularly effective in preventing significant drops in price.

CEXs

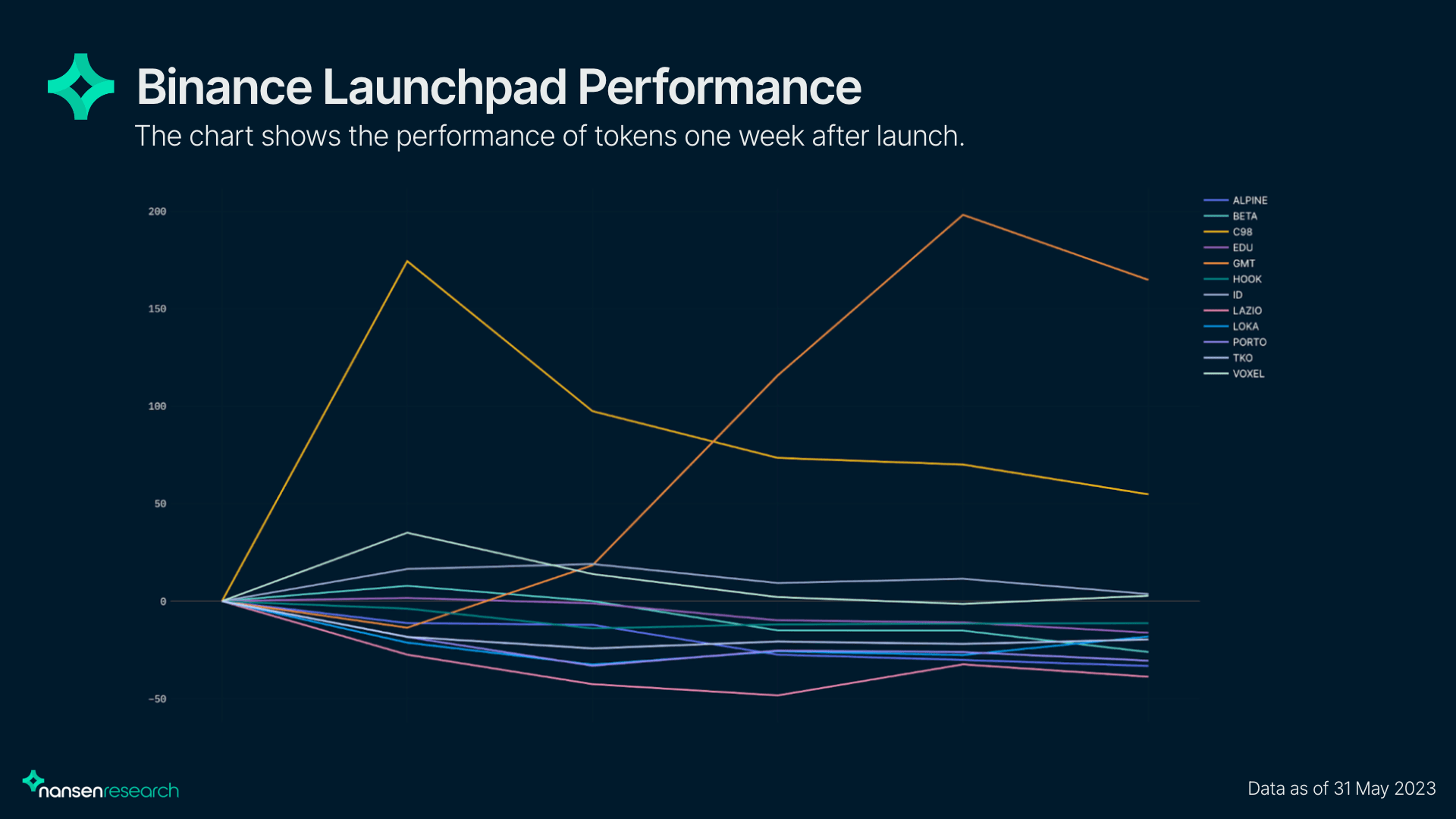

The launchpads covered for CEXs include Binance. Tokens that launch on Binance are known to be profitable for investors given that the tokens often appreciate in value upon listing, and only holders of a certain amount of BNB are allowed to participate in the sale, which creates a sense of FOMO among investors.

Looking at the chart above, GMT is the clear outlier in the recent launches on Binance. The token launched in March 2022, which coincided with the period when StepN NFTs were starting to gain traction, which could be the primary driver for the price appreciation of the token. Minting of the NFTs required GMT and there were also burn mechanisms in place, which probably helped to propel the token price. Another token that performed well was C98, which launched in July 2021. That period was around the start of the bull run in 2021, which likely contributed to the token's positive performance. Besides that, we can also see that fan tokens tend to underperform in general - even in favorable market conditions, as they often lack compelling incentives for long-term holding. Therefore, the performance of a token primarily correlates with emerging narratives, the utility of the token, and is further supported by market conditions.

Do note that the percentage change in prices reflected in the charts above is taken as a daily snapshot at the end of each day. Hence, it does not take into account token listing pumps which contribute to the short-term profitability of these CEXs launchpad tokens.

Statistics

Based on cryptorank, the number of initial token offerings peaked at the end of 2021, which was close to the period of the market top. Since then, the number of offerings has been falling steadily, increasing only slightly when there were periods of slight market resurgence.

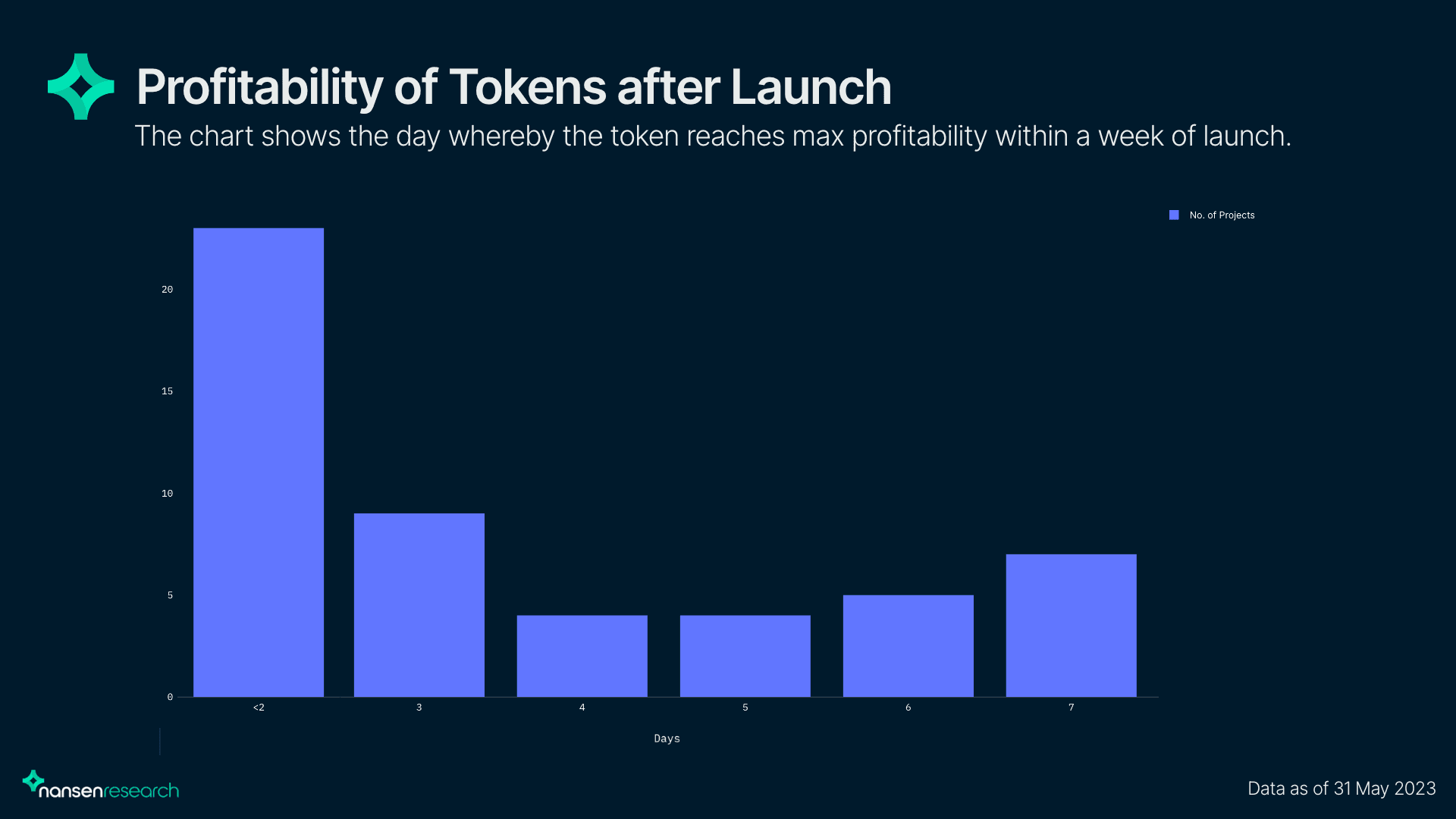

Based on the projects analyzed above, we looked at the optimal day for investors to sell these tokens in order to achieve maximum profitability. The results show that it is the most profitable for investors to sell upon listing, followed by 3 days after and 7 days after.

Note that the chart shows ‘<2’ days as Coingecko data for new tokens only registers price changes from the second day onwards. Hence, the price for ‘<2’ days would mean the initial closing price on the first day after launch.

We also examined the profitability of tokens based on their category to identify any patterns. The findings indicate that Fan Tokens generally lack profitability, whereas GameFi projects tend to have a higher likelihood of being profitable. Nonetheless, the limited sample size of certain categories prevents us from drawing conclusive findings, so it should be regarded as a general estimate rather than a definitive assessment.