Introduction

Our new Tokens Paradise dashboard contains a DEX PnL leaderboard that can help surface interesting wallets. With the current volatile market structure, token prices move very quickly depending on narratives. Hence, it is important to utilize on-chain data to further investigate top wallet activity for discovery and defense. This report focuses on the most profitable wallets trading narratives in the past month and what they are looking into next as a rotation.

The analysis will be segmented to different baskets of tokens - namely LSD, AI, and app-chains tokens based on narratives in the past month. We will also look into the wallets’ current positions to see if we can spot any patterns of a next rotation.

Analysis of DEX PnL

The current DEX PnL leaderboard allows users to surface the most profitable wallets based on a timeframe of 24H, 7D, 30D or 90D. However, most of the top wallets are MEV bots, which is not entirely actionable given that they mostly profit on arbitrage and would be hard for normal traders to execute similar trades. Hence, we removed MEV bots from our analysis and segmented the tokens into different baskets, based on the current narratives in the market.

LSD Basket

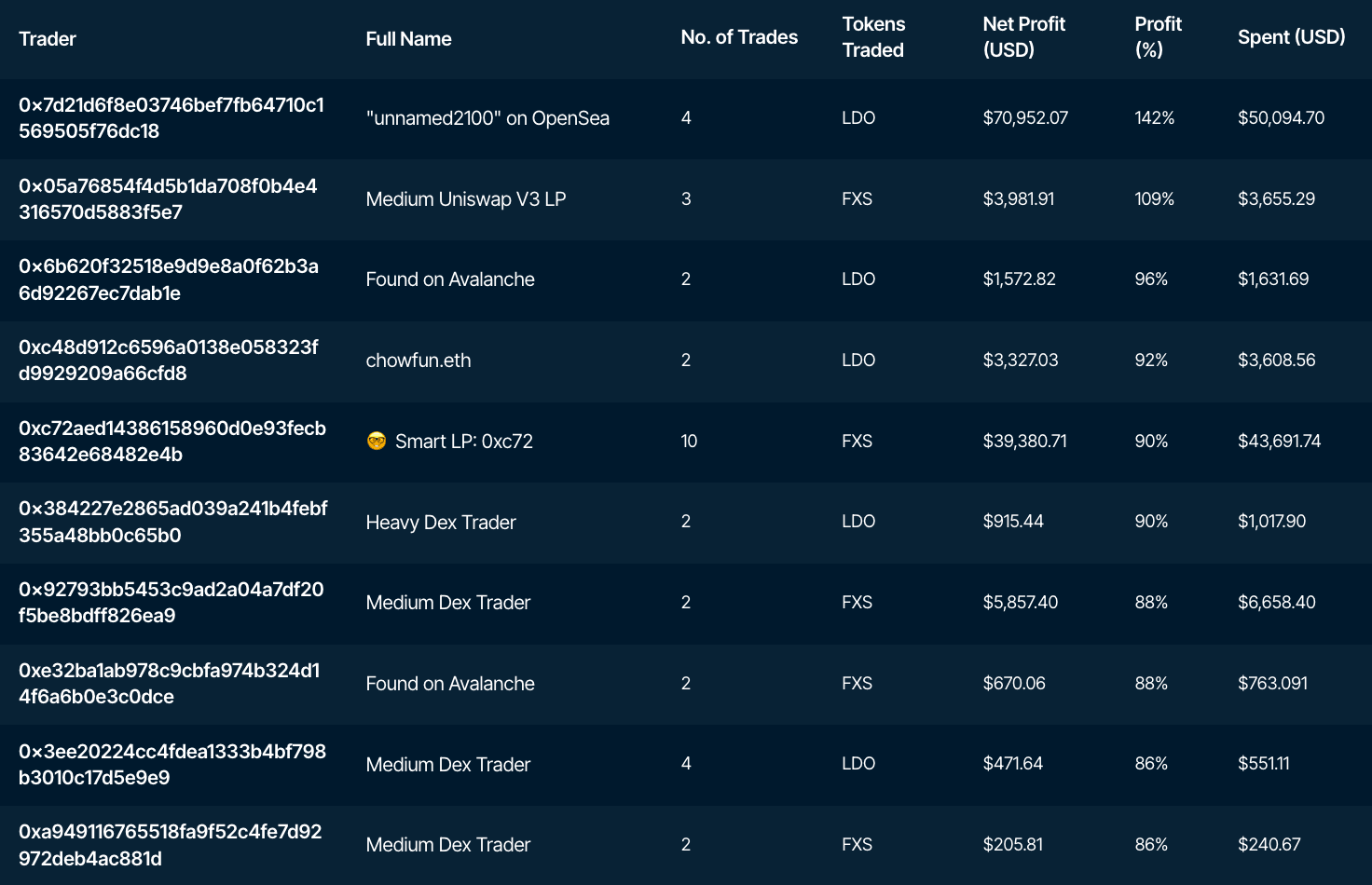

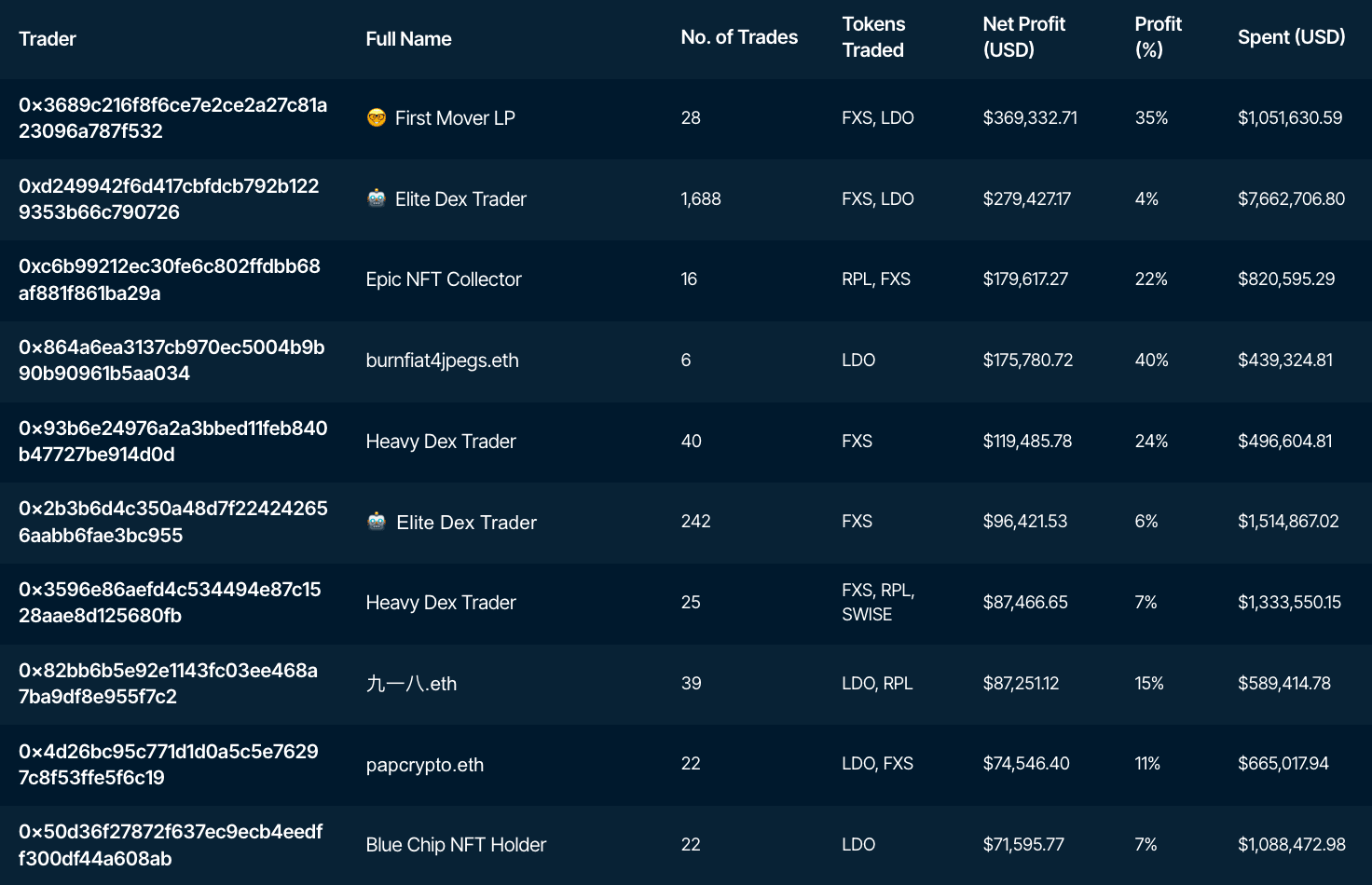

Tokens included in this basket are LDO, RPL, FXS and SWISE. These are the main LSD protocols based on market cap and their share of ETH staked on their protocol. The table below shows the top profitable wallets in the past 30D, filtered by the profit percentage and net profit (USD).

Looking at the data, it shows that most wallets have profited the most from LDO and FXS - closely attributed to both the tokens gaining over 70% and 100% in price respectively in the last 30 days. The overall trend shows that wallets that made the most profit percentage-wise tend to have a lesser amount of trades in comparison to wallets that made more net profit, suggesting that these wallets may have been earlier to the trade.

The most profitable LDO trader - tagged as "unnamed2100" on OpenSea (0x7d2), entered at ~$1.0 and managed to sell near the top at ~$2.4. Other similar wallets such as Found on Avalanche (0x6b6) and chowfun.eth (0xc48) also managed to gain significant profits percentage-wise by entering LDO at ~$1.0 and selling it for 2x one week after entering the trade.

Interestingly, wallets with larger capital holdings tend to have traded more LSD tokens on average. Wallets such as Heavy Dex Trader (0x359) rotated between FXS, RPL and SWISE. The top wallet 🤓First Mover LP (0x368) also rotated between LDO and FXS. On average, these wallets entered the trade later than wallets that were mentioned above but still managed to book significant profits.

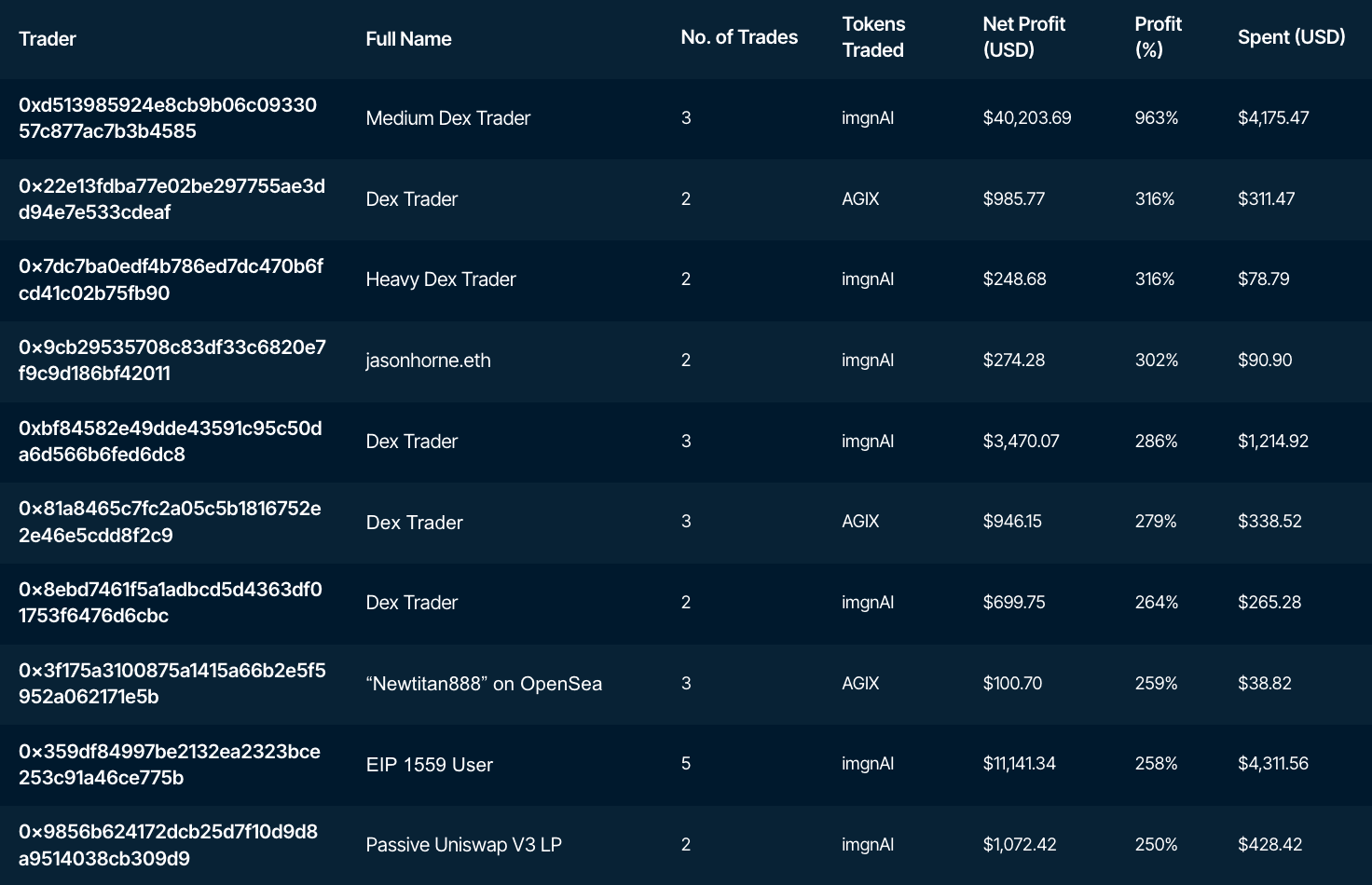

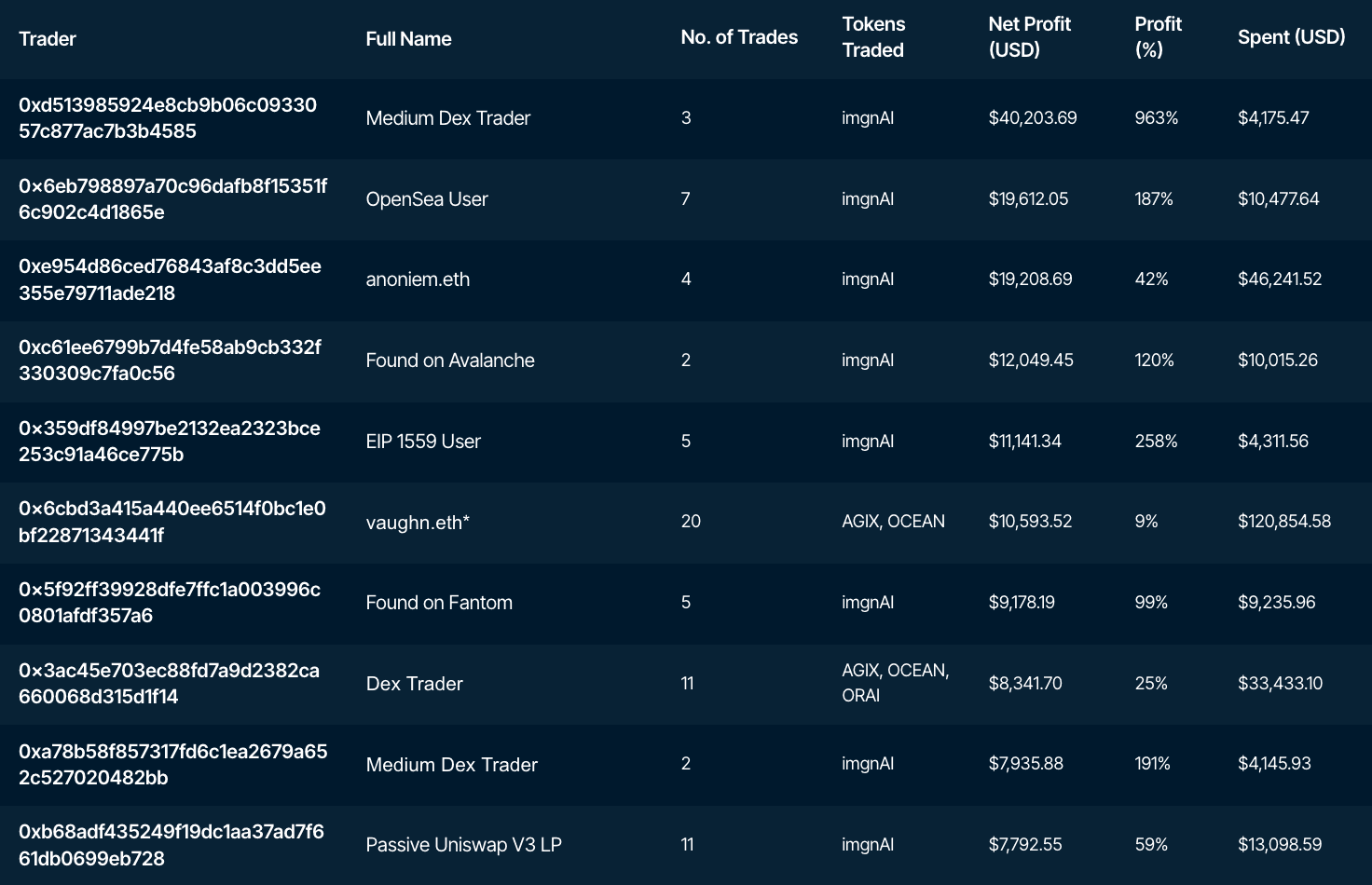

AI Basket

Tokens included in this basket are OCEAN, AGIX, FET, NMR, ORAI and imgnAI. These are tokens of top AI protocols by market cap, with the exception of imgnAI which took CT by a storm given its memeability and saw its token price rise exponentially in the past few weeks. Read more about the different AI protocols in our report here.

Not surprisingly, the wallets that made the most profit percentage-wise mostly traded the imgnAI token. The token has gone up by over 7000% in just under a month, which is significantly greater than all other AI tokens in the basket.

The top wallet in terms of both net profit and profit percentage tagged as Medium Dex Trader (0xd51) was extremely early to the move in price for imgnAI - accumulating on 16 Jan and 28 Jan, right before the price took off significantly. Other wallets which carried out between 2-4 trades were also early to the move, and it would be interesting to see what other tokens are in their portfolio as well.

Overall, the capital allocated for this narrative is rather low compared to the other narratives. One reason for this could be that the AI narrative only took off as a result of ChatGPT adoption. Even though these “AI protocols” have been live for years, they have yet to capture any real adoption.

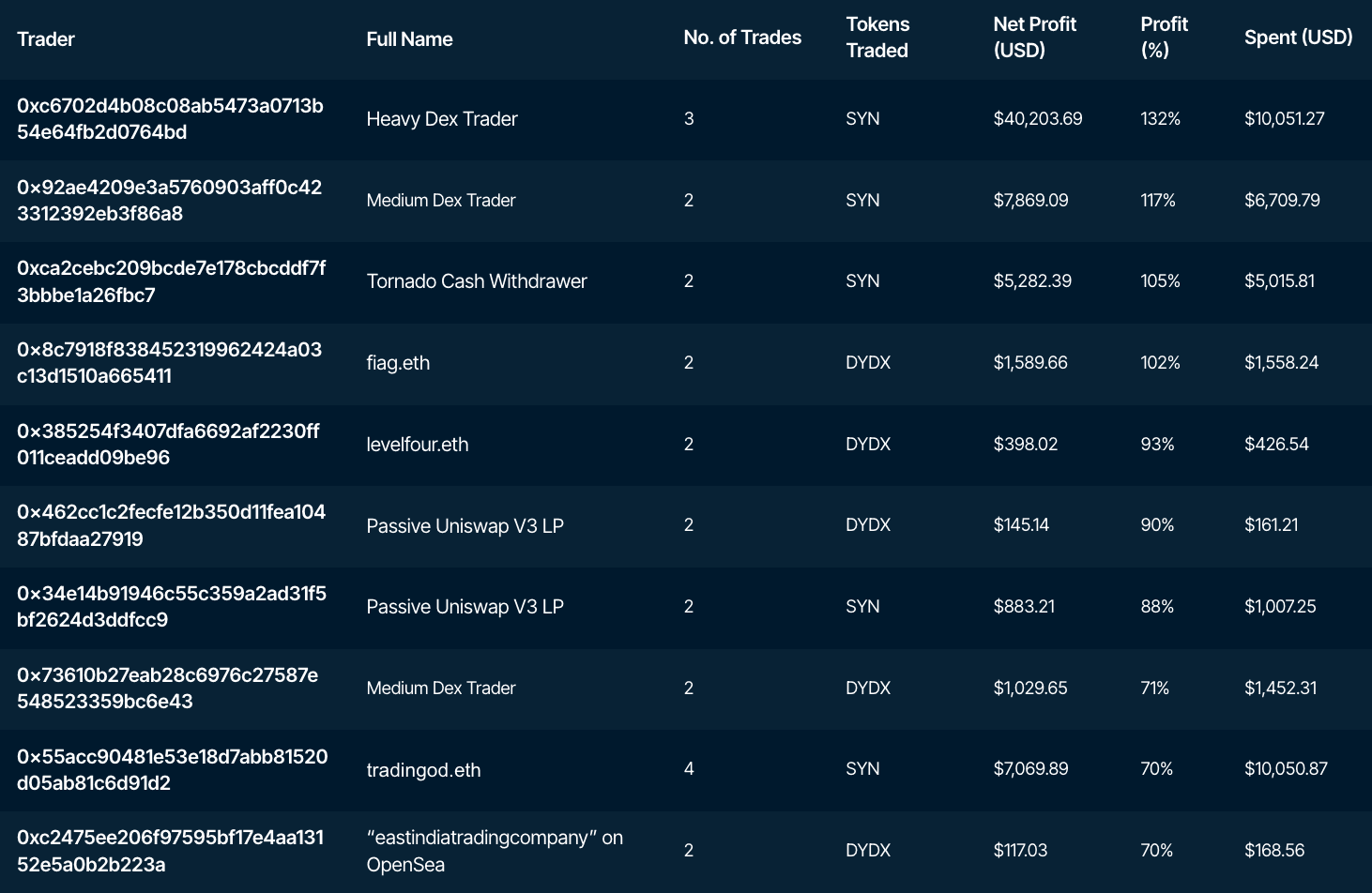

App-chains Basket

Tokens included in this basket are DYDX and SYN. The app-chain thesis has been taking off as a solution to scalability and interoperability for apps to specialize in one vertical. Despite dYdX v4 and Synapse Chain being still in development, the market has driven up their token prices due to positive expectations.

Similar to other token baskets, top wallets by profit percentage such as Heavy Dex Trader (0xc67) were early to the trade, entering SYN at sub $0.50 as well as fiag.eth (0x8c7) who entered DYDX at ~$1.18. These wallets have a longer holding time on average, perhaps signaling that they had conviction in the thesis. The amount of capital in the trade would likely be a contributing factor as well, since smaller costs would represent ‘lesser risk’ - these wallets are able to sit on such trades for a longer timeframe which allowed them to catch most of the upside.

Looking at the top wallets in terms of net profit, High Balance (0x792) stands out from the rest. While the wallet has profited from SYN and DYDX, a look into its historical transactions shows that it has been rotating between LDO, FXS and RPL as well for the month of January. Thus, the wallet has been actively trading two prominent narratives in the past month, and it could be useful to track what it is rotating into next as a potential signal.

Top Wallets

Most of the top wallets for each of the baskets were non-Smart Money wallets. Therefore, it would be interesting to dive deeper into the wallets who have made profits across the different narratives - which could signal their role as emerging Smart Money wallets. The wallets below have traded across at least two narratives, and are ranked according to their profit percentage as well as net profit in USD.

Top 10 Wallets by Profit %

Based on these wallets, we look into their holdings to see what they could be rotating into. Looking at the portfolio of the Top 10 wallets in terms of profit percentage, around half of users’ funds are still in USDC and ETH. Over 90% of users’ funds are also held in their wallets, perhaps signaling that users are trading the current market, rather than looking for yield somewhere. Besides the narratives that have already been traded significantly, tokens that stand out are FLEX, SNX and FTM. The portfolio of these wallets can be found here.

- tradingod.eth (0x55a) has over 95% of its portfolio in FLEX (worth ~$400k), which it received from High Balance (0xd56) - likely a distribution wallet based on historical transactions.

- EIP 1559 User (0xf05) which profited from AGIX has recently bought back in and sold some as the token price went up. It currently still holds over $41k worth of AGIX. A recent accumulation by the wallet would be on 7 Feb, whereby the wallet swapped USDC for $50k worth of FTM - which is the current largest position of the wallet. The wallet also received around ~$20k worth of FET from Coinbase on 8 Feb.

- Two other wallets - Heavy Dex Trader (0xb11) and Dex Trader (0x7d3) are still holding onto AGIX, and look to be trading other AI coins as well - namely NTX and FET. Holdings of AI coins take up 40% and 90% of the wallets respectively, showing that they still have conviction in the narrative.

- Recent trades from other wallets include:

- dpx.eth (0x5d1) received $55k worth of SNX from Binance on 8 Feb. It was previously trading in and out of SNX from 4 Feb to 7 Feb.

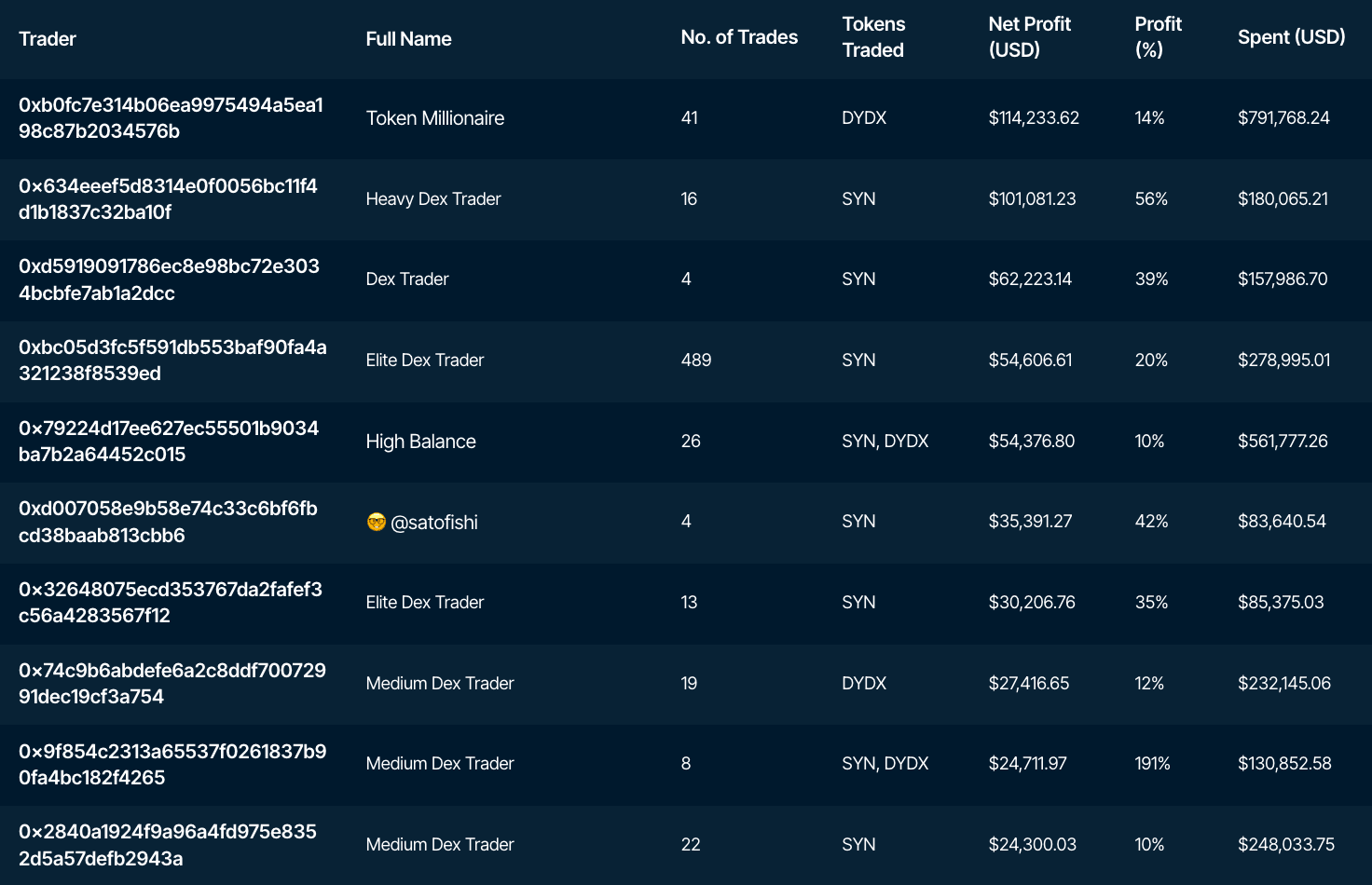

Top 10 Wallets by Net Profit (USD)

Looking at the Top 10 wallets in terms of net profit - it shows that over 49% of funds are held in LDO, more than triple of ETH and stablecoin holdings of these wallets. Interestingly, none of the wallets are holding other LSD tokens. Over 94% of funds are held in users’ wallets - similar to above, suggesting that most are trading rather than looking for yield in the current market. The portfolio of these wallets can be found here.

- The top wallet for LDO - Token Millionaire (0x160) holds over $3.8m worth of tokens, contributing to over 80% of the total number of LDO tokens held by the Top 10 wallets. The wallet is rumored to be Arthur Hayes/related to NorthRockLP. It has also accumulated significant positions in DYDX, LOOKS and X2Y2.

- Elite Dex Trader (0x758) has 50% of its portfolio in DIGITS, a position which the wallet has held since April 2022. DigitsDAO has gained attention in the past month following good trades in the past month and holders of DIGITS get paid in DAI.e from the profits that the DAO makes. The wallet has also recently acquired 100k worth of FOLD, following speculations that Manifold is looking to enter the LSD market.

- Medium Dex Trader (0x6db) has significant positions in Synapse

- having around $300k in the nUSD pool on Metis and $125k in the nETH pool on Optimism. The nUSD pool on Metis and the nETH pool on Optimism currently offer 28.35% APY and 10.86% APY respectively. The wallet’s recent accumulation has been EUL, acquiring over $30k worth of tokens at an average price of ~$5.20.

- Heavy Dex Trader (0x359) has been trading significantly on Arbitrum, having gathered positions in GRAIL, RDNT and VELA in the past few days. In return, the wallet has been selling GMX for these tokens given that they are newer protocols part of the Arbitrum narrative right now. It is interesting to see such conviction in these coins given that the wallet has acquired them at prices after they have pumped significantly.

- Elite Dex Trader (0xd24) has been trading in and out ILV, DYDX, LOOKS, IMX in the past day. Its current portfolio consists of over 50 coins, but its largest positions are in FXS and ILV.

- Recent trades from other wallets include:

- Elite Dex Trader (0x82b) swapped USDC and LDO for STG on 6 Feb

- burgerwithfries.eth (0xca4) had acquired some VTX on 7 Feb and is up over 10% on its position now.