What to Expect

This report aims to examine Genesis’ on-chain relationships with:

- Alameda & FTX

- Three Arrows Capital

- Other Externally Owned Accounts

Who is DCG/Genesis and why are we investigating them?

Digital Currency Group (DCG) is a conglomerate of crypto businesses and the owner of Grayscale and Genesis. DCG and its subsidiary Genesis have been entangled in the FTX contagion.

Three Arrows Capital’s fall has directly impacted DCG via:

- Genesis loan to Three Arrows Capital (outstanding claim of $1.2b).

- Three Arrows Capital’s leveraged investment in Grayscale - GBTC

In a web of leverage, many others have impacted DCG, including:

- Blockfi’s involvement in loans to Three Arrows Capital (Blockfi’s currently filing for bankruptcy

- Celsius (bankrupt)

- Voyager (bankrupt)

The Genesis Situation

Timeline of events for Genesis

- June 17: Genesis CEO confirms large loan loss. Genesis CEO (Michael Moro) at the time discloses a loan loss with a large unnamed counterparty. Figures are not disclosed.

- July 6: Genesis confirmed as a 3AC counterparty. Genesis sold the collateral for the loan reported to originally be $2.36 billion, recovering about $1.26 worth from collateral and leaving an unsecured balance of $1.1 billion.

- July 7: Three Arrows Capital filed a Chapter 15 bankruptcy case

- July 18: Genesis files a billion-dollar claim against 3AC

- Aug 17: Genesis CEO steps down

- Nov 2: Coindesk reports on leaked Alameda balance sheet mostly consisting of self-issued FTT tokens. Read more in Nansen’s Blockchain Analysis: The Collapse of Alameda and FTX

- November 8: FTX freezes withdrawals and Genesis reports to have "No material net credit exposure"

- November 9: Genesis reported losses at $7M, that was in actual fact lower than the actual losses incurred

- November 10: Genesis admission to having $175M locked in FTX

- November 16:Genesis pause on withdrawals

- November 17: Genesis going public on $1B loan required to stay afloat

- November 21: Genesis declaration loan is required to stay solvent

- Today: World’s waiting on results of Genesis debt restructuring/confirmation

Nansen Genesis Wallets

The Nansen team has labeled non-exhaustively the below wallet addresses that belong to Genesis.

Genesis Transactions with Externally Owned Accounts

Below are the aggregated annual count and monthly net flows of Genesis wallet addresses since inception. The data takes into account only send and receive transaction types to externally owned wallets. Genesis wallets have had historically low activity, seeing only a significant uptick in transaction activity in 2022. The below section dives into an observation of each month’s transactions.

Observations: 1) May: Only SCP (market maker) transactions, amounts could possibly be commissions/fees taken by Genesis for its facilitation role over LFG’s BTC OTC trade. 2) June: large top ups, matches the news that Genesis suffered large loan losses from a then-undisclosed entity that is now revealed to be 3AC. USDC inflows from circle $349m total in Q2 with no matching outflows 3) July: More USDC top ups 4) September: FTT and Alameda situation, more unlocks

Genesis Annual Transaction Count Since Inception

| Year | Transaction Count |

|---|---|

| 2022 | 253 |

| 2021 | 4 |

| 2020 | 16 |

Genesis Transaction Flows by Month Since Inception

Genesis Transactions: Q2 2022

May 2022

- Terra Exposure

- Based on this tweet, Genesis had $1b exposure to UST shortly before the depeg.

- However, looking at on-chain transactions (on Ethereum) - Genesis’s (based on known wallets) transactions totals up to around 10m UST, which is a far cry from the actual figure. This suggests that the vast majority of Genesis’ UST was on Terra Chain, where transactions could not be accurately attributed to Genesis due to the lack of information regarding wallets and movement on the chain. Despite this, Genesis likely took significant losses on UST given that the swap happened just a few days before the depeg - giving them less time to hedge or react to their exposure.

- Interacted with 2 entities only over the month of May 2022

- Received a total of $2.3m from different wallets that can be traced back to SCP Market Maker over 6 transactions.

- Sent a total of $2.3m to FalconX over the same 6 transactions almost immediately after receiving funds.

- Possible commission/fees from a $1.5b transaction size but not conclusive due to nature of OTC deal (not on-chain)

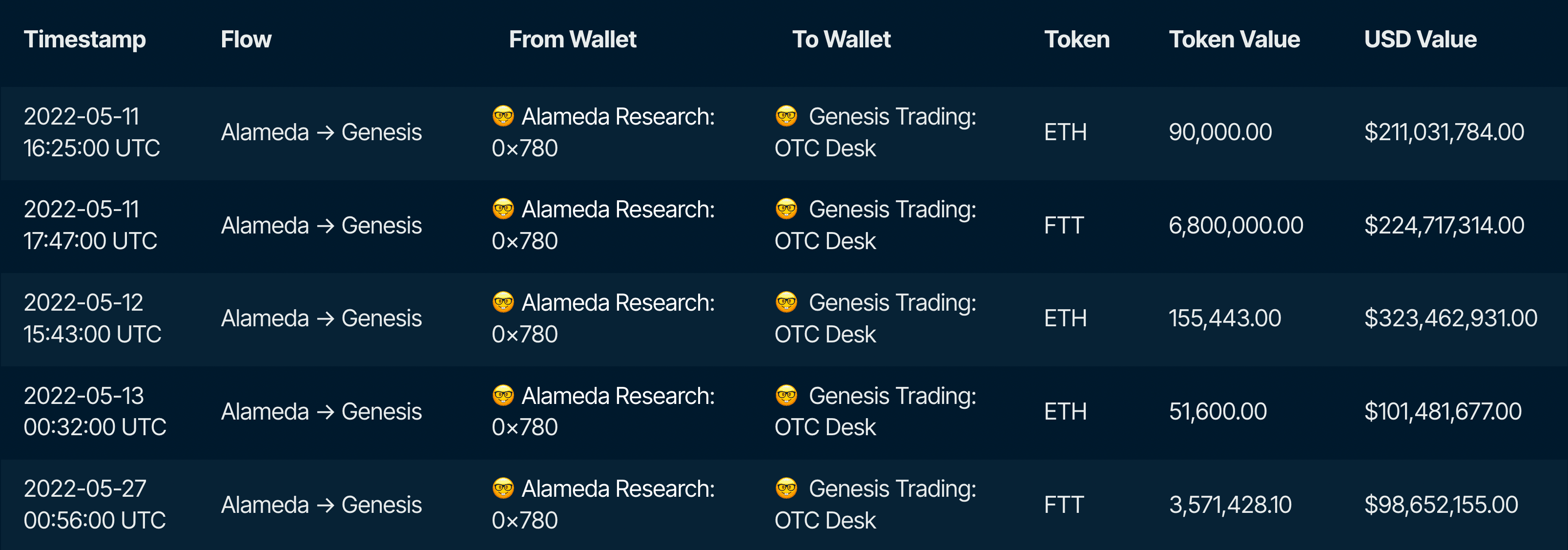

There were also significant flows totalling $959.1m in the month of May between Alameda and Genesis’ OTC desk after UST depeg. There is no clear indication as to what the funds could be used for as it could be Alameda selling assets OTC, providing collateral to loan from Genesis or even paying back loans.

June 2022

Unusually large top ups of USDC by Genesis are observed amounting to $349m in Q2 2022. This matches news that Genesis suffered large loan losses from a then-undisclosed entity that is now revealed to be 3AC.

Genesis <> Three Arrows Capital On-chain Transactions

Summary:

- Labeled Genesis wallets made on-chain transactions with Three Arrows Capital mainly during May to June 2022 during Three Arrows Capital’s decline.

- Genesis had higher transaction volumes than average for the period May-June 2022 due to interactions with Three Arrows Capital. The largest transactions are actually made up of Three Arrows Capital outflows into Genesis that include:

- 6 May & 3 June 2022: $136.1m USDC total outflows

- 12 May 2022: $104m ETH outflows

- 3 May & 2 June 2022: $260k USDT total outflows

- 3 May 2022 $131.2k FTT outflows

- The initial loan to Three Arrows Capital does not show up on-chain likely due to it being an OTC deal.

- The $1.2b filing against Three Arrows Capital was never reclaimed as Three Arrows Capital filed for Chapter 15 bankruptcy in the Southern District of New York on July 1 2022.

Overall, the relationship between the parties is evident on-chain - however, the reported losses against 3AC are not visible.

Genesis <> Alameda On-chain Transactions

Significant flows after Three Arrows Capital implosion:

Assumptions:

- Genesis selling assets to cover 3AC default (Price/Volume of FTT during those periods did not match up to the total amount of FTT sent from Genesis to FTX, hence, the FTT was unlikely dumped on the open market).

- Amount could have come from the 38m FTT (worth $1.7b at that time) transfer from Alameda to Genesis back in Dec 2021, presumably as collateral for a loan so the transfer back is potentially Alameda paying down their loans.

- Genesis facilitating the bailout from FTX to Alameda which is speculated to have happened after 3AC.

Genesis: Q3 2022

- Continued significant top ups on USDC over the quarter amounting to $863m in total in Q3 with no immediate matching outflows, that could suggest that Genesis books needed additional injections to be balanced.

- Other significant transfers between Genesis and Alameda in Q3

- Nothing really too conclusive, flows between Genesis and FTX could really just be normal activities.

- One notable transaction would be a $1.2b FTT transaction on August 16. There’s not much context behind this transaction since prior flows do not add up to $1.2b as well.

- There is an overall netflow of ~$907.2m from Genesis to Alameda in these 2 months (only for larger transactions > $1.5m).

Genesis: Q4 2022

- Large USDC top ups in Circle: Genesis USDC deposit wallet are clearly missing when compared to the past quarter and net USDC inflows looks to be slowing down - is Genesis running out of funds?

- Transfers between Genesis and Alameda a few days prior to FTX collapse were miniscule (<100k)

- Looking at the transactions for Genesis Trading: OTC Desk prior to FTX collapse, the wallet was actively sending FTT to new wallets and Binance amounting to ~5.9m FTT from Nov 7 to Nov 9

- FTT sent to new wallets eventually ended up in FTX or Binance, probably signaling that the tokens were sold

In conclusion, this report has examined the on-chain relationships between Genesis, Alameda and FTX, Three Arrows Capital, and other externally owned accounts. It has been found that Genesis has been heavily impacted by the bankruptcy of Three Arrows Capital and the subsequent events involving Alameda and FTX. The report has shown that Genesis has had historically low levels of on-chain activity in 2020 and 2021, with a significant uptick in transaction volume in 2022. This could mean that Genesis was only involved with entities such as Three Arrows Capital, Alameda, and FTX after the bull run in 2021. However, despite a relatively short time frame - Genesis still went down along with these entities, suggesting that risk management was inadequate as exposure to these entities was not hedged sufficiently. Note that the report does not show the entire picture as most transactions between the entities likely occurred off-chain or through centralized domains.