It ain’t a recession

After market sentiment reached extreme fear last week, with some investment banks bumping up their US recession probability to 40% this year, hard economy data has calmed these fears. We will only quote three data points.

First, the US March flash PMI is the “freshest” one (yesterday), and reached 53.5 for the Composite index, a 3-month high, consistent with US GDP real growth tracking at an annualized 1.9% rate in March (the quarter tracks lower at 1.5%, because of the weaker PMI in January-February). There were some distortions linked to bad weather that were pinning Services activity down in the past two months. Manufacturing was weaker in March, but appears distorted by tariff front-loading and activity is tricky to assess given these distortions.

Second, US February retail sales show that Q1 will likely be a slow quarter for US private consumption, but this is nothing out of the normal “oscillations” that we can observe over the past two years:

Third, Fed regional surveys that measure business capex intentions for the next 6 months did slow, yet to still elevated levels:

Overall, the macro data flow is so far consistent with a US growth slowdown to below-potential (below 2%), not with a recession.

A quick word on US equity valuations: the S&P 500’s PE is down to 21x or 1 standard deviation (SD) above its 10-year average, the Nasdaq is down to 25x or 0.5 SD above its 10-year average. Our assessment is that US equity valuations are less onerous but still expensive at the average index level (not necessarily at the single stock level).

“Fed put” already priced

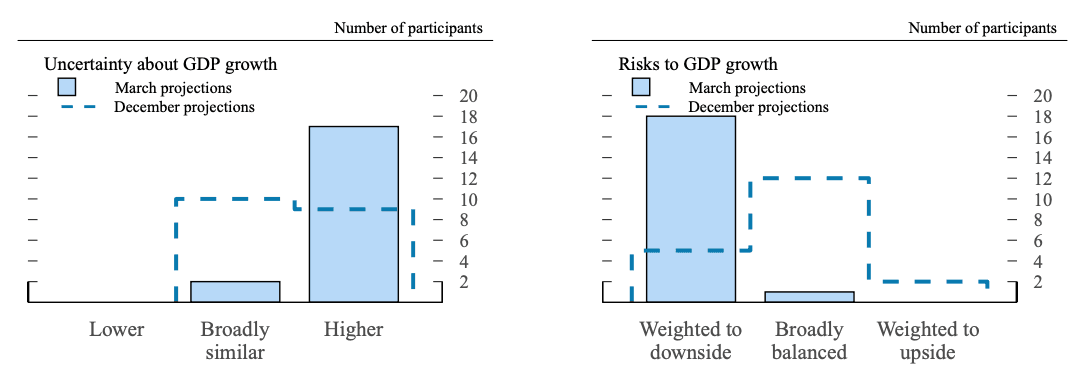

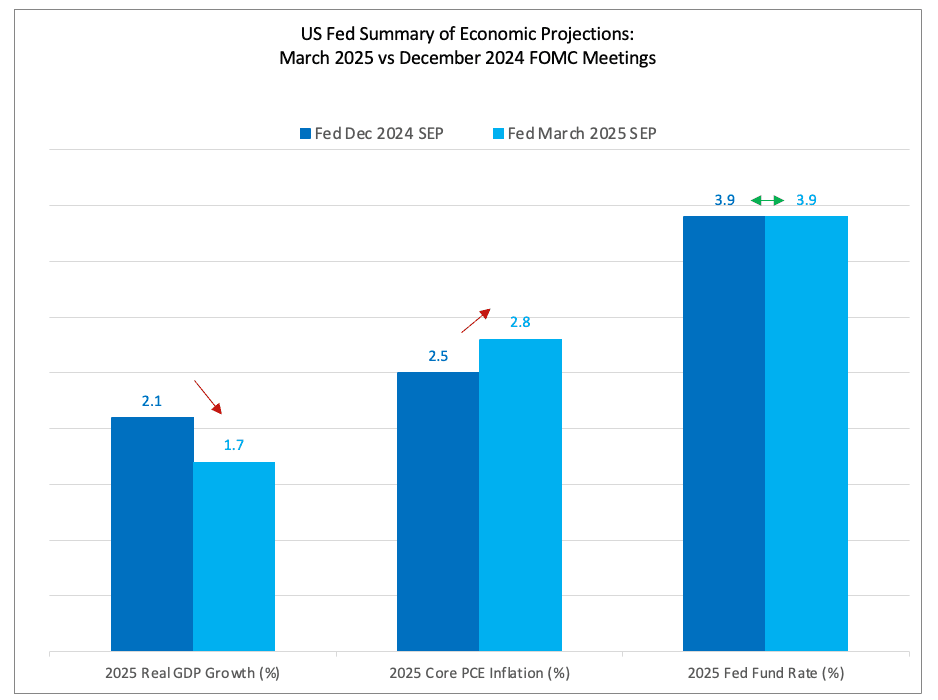

Last week, Fed Chair Powell delivered a moderately dovish message (slowing of Treasury QT pace and readiness to cut rates in a more stagflationary environment, as the Committee appeared more sensitive to downside growth risks than to upside inflation risks linked to tariffs).

After last week’s FOMC, pricing of Fed rate cuts climbed to almost three cuts (70bps+). As we write, rate cut bets in OIS markets have been shaved to 63bps. Better data and the FOMC’s message that it would cut, but only in case of more tangible evidence of a growth slowdown, led to this repricing (see also Bostic’s speech on moving from two to one rate cut).

Overall, our view is that the “Fed put” will not be a tailwind for crypto markets in the next few months.

Has tariff uncertainty peaked?

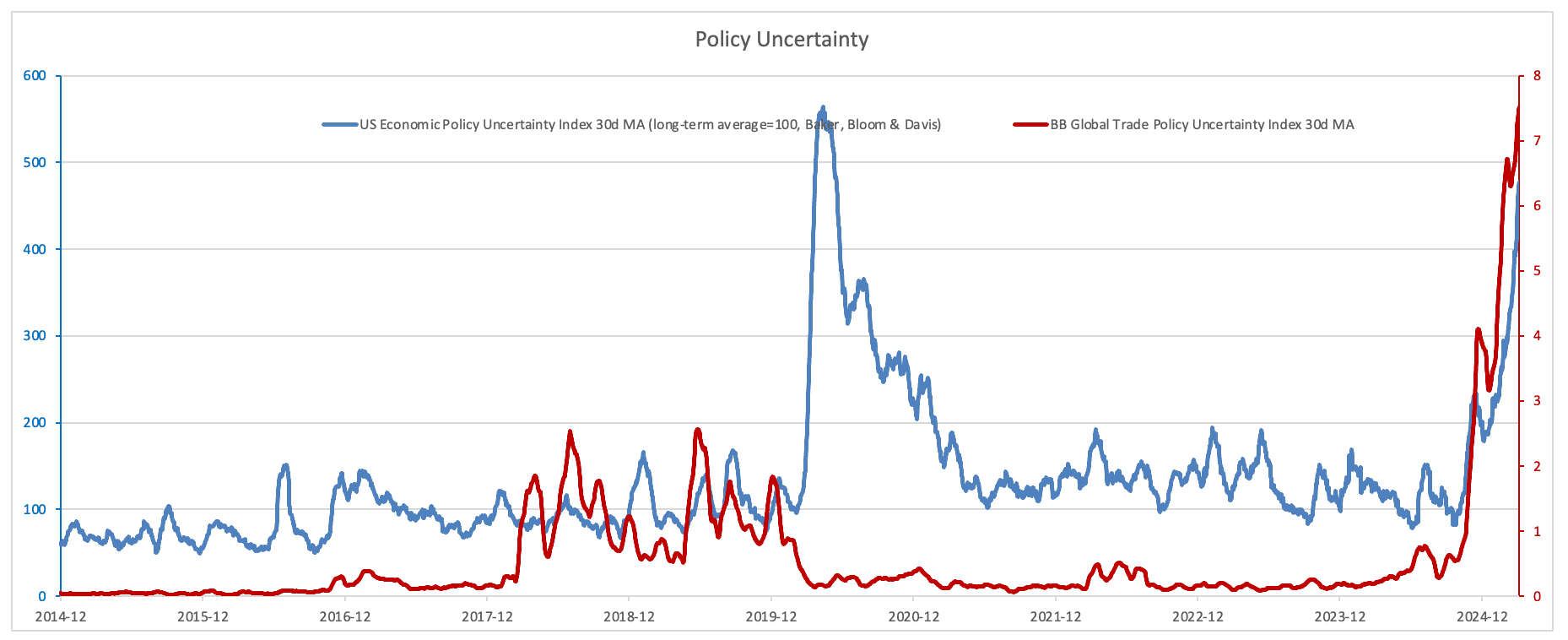

The US policy uncertainty index has surged to its highest level since the 2020 covid sell-off. Meanwhile, the recent jump in the global policy uncertainty index has dwarfed its 2018-2019 increase during President Trump’s “trade war” with China.

The message is once more that there has been a high level of fear experienced by the public (the sources of the indices are the press, social media), and fear could very well have peaked. The hope of peak fear has been fed, after Treasury Secretary Bessent last week (who mentioned that many trading partners were already negotiating with the US, notably to lower their own trade barriers), by President Trump himself over the weekend, who opened the possibility of tariff “exemptions” in certain situations. At the international company level, we are witnessing increasing investment commitments to the US in a bid to avoid tariffs/ placate the US (see Hyundai).

Overall, once over, the whole tariff negotiation might result in a growth win for the US. That said, we acknowledge the lingering uncertainty post-April-2 and would only put a 50/50 odds that we are past peak-tariff-uncertainty. We still see this peak as more likely between April and June (tariff negotiation period flagged by Bessent + start of US tax cut package discussions).

Nansen Risk Barometer

Our ongoing "neutral" Nansen Risk Barometer has not given us the “go-ahead” yet to add crypto risk more consequently. This is due to our BTC momentum sub-indicator, which has increased, but not crossed its zero risk-on/neutral threshold, yet.

Technicals and Flows

Technicals and flows indicate that the “dip” is being bought, for BTC and for US equities. BTC ETFs recorded a seven-day streak of net inflows, a first since crypto price peaked.

Also, the daily BTC price chart is giving some convincing signs of having overcome the 200-day MA resistance.

The S&P 500 has also hit a local trough. Especially noticeable is the strong daily volume that went with the price recovery (similar picture for the Nasdaq). Anecdotally, retail investors and hedge funds are buying the dip.

Crypto narratives that thrive

Institutional adoption of crypto is progressing, which is the main argument for the view that this is still a bull market.

The simple story is that positive drivers remain in favor of BTC vs altcoins: the executive director of the Council of Advisers on Digital Assets hinted at more BTC buying for the “strategic reserve”

Then there are stablecoins, the “GENIUS Act” is about to go to congress and will clearly favor centralized, US-Treasury-bills- and US-bank-deposit-backed stablecoins. Centralized US corporations such as Coinbase stand to benefit from an eventual adoption of the bill, and so do other protocols such as Ethena (ENA) that has partnered with institutional players e.g. with BlackRock’s BUIDL as a collateral for the USDtb issuance.

See below the recent TVL gain in BUIDL:

Putting it altogether

We could be wrong, of course, and it could be that markets are already past peak tariff fear and growth/ earning growth downward repricing. Our main scenario is that crypto (BTC) has reached a local trough mid-March, but is unlikely to revisit all-time-highs before April-June.

- US growth: slowdown, no recession

- Tariff uncertainty: local peak, could reaccelerate after April 2

- US equity valuations: less expensive, still not cheap (at the index level)

- Nansen Risk Barometer: Neutral

- Technicals: Encouraging, key price levels being regained with growing volume for BTC