“If it looks like a duck, walks like a duck and quacks like a duck, then it just may be a duck”. Is the US economy experiencing the much desired and crypto-bullish “soft landing”?

Labor markets and soft landing

A “soft landing” can be defined as a shallow slow down of nominal growth, mainly driven by slowing inflation, and that is neither associated with real growth falling significantly below zero, nor with a surge of the unemployment rate.

Both the US and Europe labor markets are currently experiencing a slow cooling, characterized by a decrease in vacancies or job openings (US lowest since April 2021), growing labor participation (US highest since March 2020), lower quit rates (US lowest since January 2021), and a very gradual increase in unemployment.

These developments are positive feedback for central bankers, as they paint the picture of a progressive adjustment of supply and demand of labor, without a recession-like shock in any of these variables.

Last week, bond and equity markets shared the interpretation of the economy moving to a “soft landing” and priced out the probability of an additional Fed rate hike this year (probabilities for September and December 2023 are respectively 7% and 35% as we write). Rate cuts are now seen starting in May 2024. US equity markets experienced short-squeezes with stocks such as the cyclical Caterpillar breaking higher (was likely triggered by the lower sovereign rates, -20bps in the US 2yr yield, plus some reversal of excessive investor pessimism on the Chinese economy).

The “soft landing” scenario is, in our view, reflected in the price of traditional assets, especially equity and credit markets. How could this scenario evolve going forward and trump markets’ expectations?

Oil is back, impact on inflation

One non-negligeable scenario is that we have entered a period of slower nominal growth in the US and Europe that will accelerate and be followed by lower inflation and even lower real growth. The target asset allocation for this scenario would be sovereign bonds over equity, and increased share of crypto, after policy makers react to growth weakness (rate cuts).

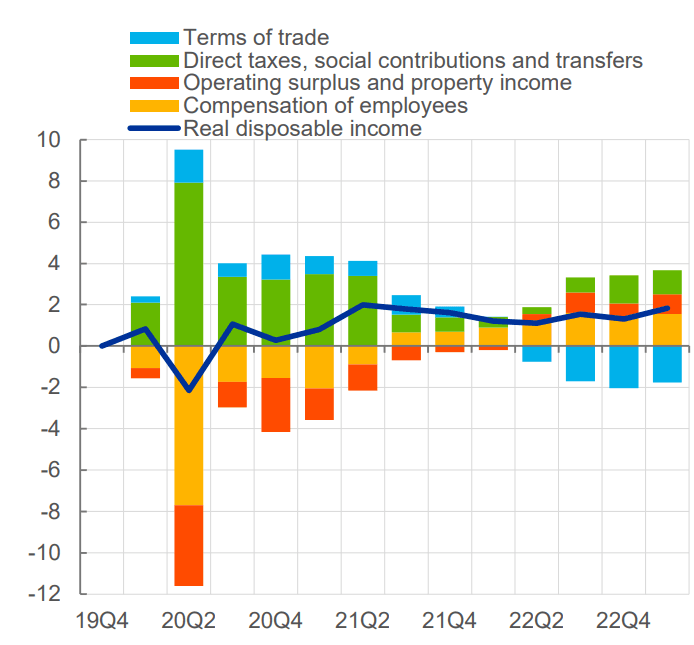

One, in our view, slightly more likely scenario is that both growth and inflation are still too robust for policy makers to change their hawkish stance. We acknowledge the leading signs of slower growth: Services activity surveys contracting (especially in Europe), growing rates of default in the most vulnerable debt segments such as credit card and US speculative grade corporates. However, the consumer in both the US and Europe has been able to find a job, sometimes negotiate a higher wage, and benefit from slower headline inflation in the past few months. This maintains a “cushion” of disposable income that is likely to persist until unemployment rises more significantly.

We are also paying keen attention to the base effect for energy and food price growth: In August 2023, the YoY growth rate of WTI crude oil prices was -6.6% YoY vs a trough of -40.6% YoY in May 2023.

US retail gasoline prices were down ~ -19% YoY in July 2023 and “only” -2% YoY in August 2023. This would represent a +40 bps gain in the US headline CPI for August which would lead to a ~3.6% YoY estimate.

Meanwhile the core CPI will likely progressively decelerate, helped by Shelter (see below our forecast model for Shelter inflation).

These fluctuations will keep US and European central bankers reluctant to ease monetary policy too early.

The second scenario of high rates for longer followed by an economic recession argues for an allocation to Treasury bills and patience in the allocation to risk assets.

Policy makers’ next moves

The European Central Bank (ECB) is in a more ambiguous and interesting position than the US Fed at the moment. The ECB is concerned about survey weakness in the Eurozone (especially Germany), negative money growth, and the lagged impact of slowing growth on employment: “Unemployment could then also jump more abruptly later on. This risk was exacerbated by the services sector employing a large share of temporary and part-time workers. It was observed that there were already the first glimpses of a softening in labour market conditions, namely in manufacturing, and it was suspected that more such signs could follow across sectors.” excerpt from the Minutes of the July ECB meeting

Nevertheless, contrary to the US, European inflation prints have been surprising markets to the upside, and wage growth has kept accelerating. In summary, the ECB has an inflation problem, more so than the Fed, and real rates are still negative (policy rate < inflation estimates). Therefore the ECB has to keep hiking and go on with balance sheet reduction, despite ongoing signs of slower real growth.

Crypto markets

Crypto markets have traded uncorrelated with equity and rate markets last week. The positive BTC price reaction to the news that Grayscale would be allowed to introduce a Bitcoin ETF was retracted within the week. BTC is back to the 25.5 - 26.5k range it has traded within for most of the past three weeks.

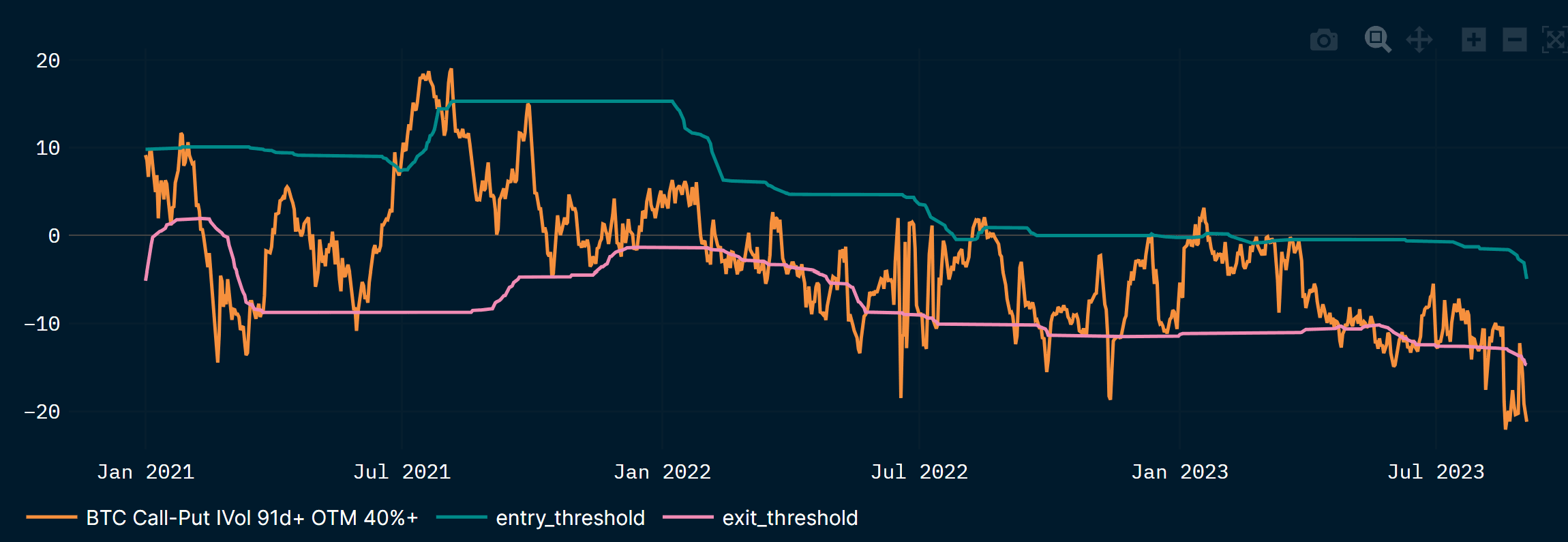

Our indicators warrant ongoing caution: the call-put spread became more negative, while the BTC price momentum is just below zero.

In terms of next catalysts, the US August CPI will be important and so will be the ongoing news on crypto regulations and SEC lawsuits.

This week: Services PMIs

Monday 4

- China Aug. Caixin Services PMI (consensus 53.6). Chinese PMIs have come up better than consensus so far, fuelling Chinese equity markets’ rebound.

- Japan: 10-year government bond auction

Tuesday 5

- Reserve Bank of Australia meets (consensus for policy rate to be held steady at 4.10%)

- Eurozone and UK Aug. Services PMIs (consensus 48.3 and 48.7, respectively)

- ECB’s Lagarde, Schnabel and De Guindos speak

Wednesday 6

- US S&P Services PMI and ISM Non-Manufacturing PMI for August (consensus resp. 51.0 and 52.5)

- US Beige Book

- Bank of Canada meets (consensus on hold at 5.00%)

- Chinese Aug. exports and imports (consensus -9.8% YoY and -8.8% YoY)

Friday 8

- Germany Aug. CPI (consensus 6.1% YoY)

- China Aug. CPI (consensus 0.1% YoY)