Introduction

“The US economy is stronger than what we previously thought. You certainly see that in the blow up job report” said FOMC voting Committee member Bullard in a CNBC interview last week, summarizing the last flow of US data, and the last move in US rates.

We will not dedicate too much (virtual) ink to detailing what future rate markets have already taken notice of, and will instead extrapolate recent trends in data and policy and their potential implications on asset prices. We will then make a detour via Japan, where the Bank of Japan is experimenting with new restrictions on 10yr JGB short-selling a bit more than a month before Governor Kuroda’s hand over to his successor. We will then leave narratives aside and focus on price developments, namely the striking resilience of crypto markets to US rate repricing, and, in contrast, the fizzling out of the “China reopening trade”. Finally we will highlight two crypto themes gaining momentum on-chain.

“Blow up” labor markets in the US and Mature Markets more generally

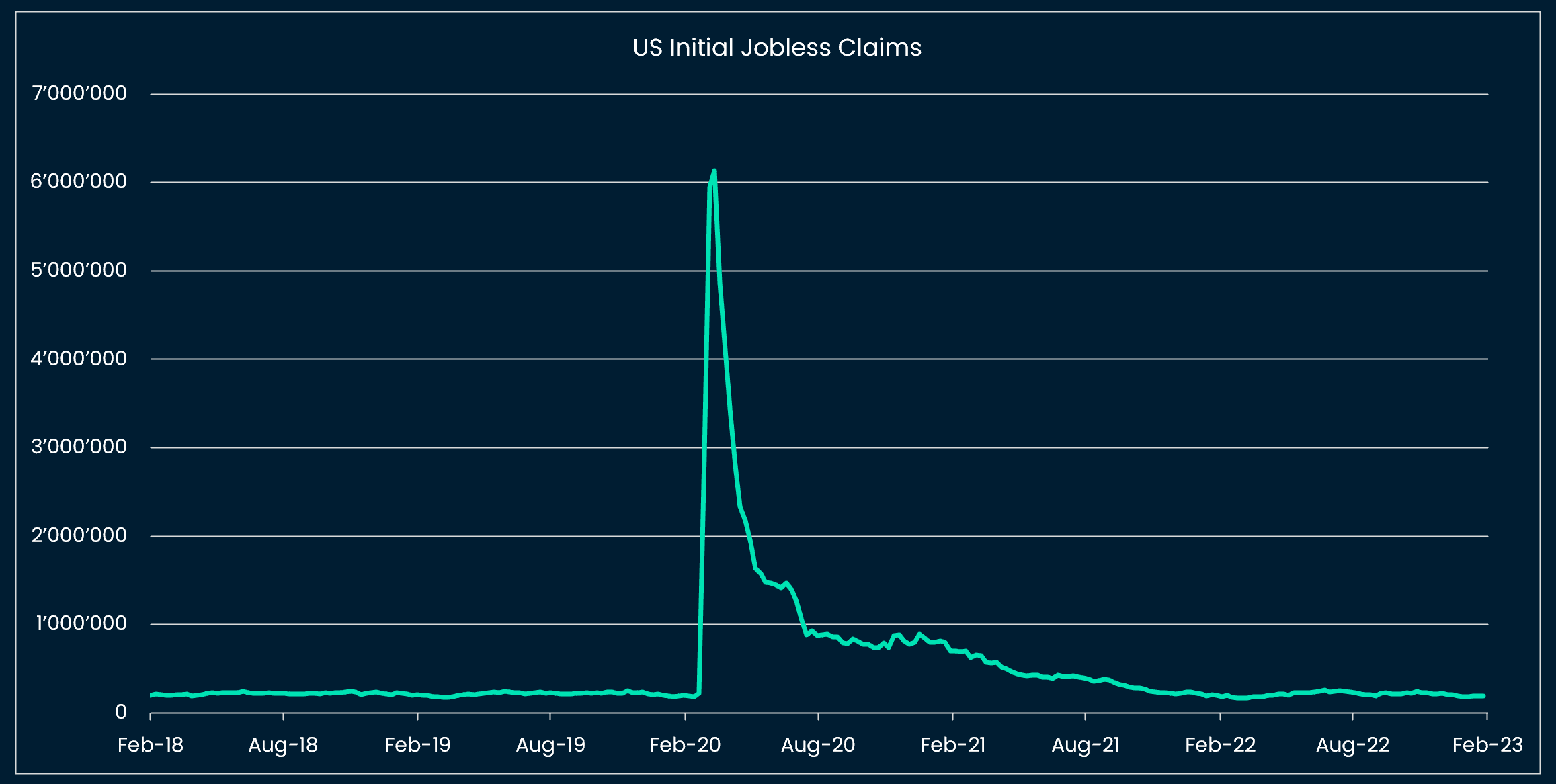

Initial jobless claims tend to lead other US labor indicators because they are released weekly: those are tracking at less than 192k (four-week average) and telling us that “Main street” has so far been able to digest a ~1.5% level of US real rates (highest since 2007).

We like to complement data with qualitative testimonies, as this gives us a hint on the psychology of market participants. The latest US Flash Purchasing Managers’ Index (“PMI” or business survey that tends to lead GDP) qualified employment as “buoyant” in anticipation of consumer demand increases later in the year, and also pointed towards the highest optimism among surveyed firms since May 2022. The UK PMI related a similar surge in optimism and UK respondents signaled “difficulties finding candidates to fill vacancies, despite higher starting salaries.”

PCE data insights

The January core PCE index, the Fed’s preferred gauge of inflation, was unambiguously strong (0.6% MoM vs 0.4% MoM consensus, and on a 3m-annualized tracking at 4.8% vs the elusive 2% YoY official target). Fed Chair Powell’s unofficial target metric of core PCE ex-housing came in close, at 0.58% MoM.

Other macro releases around disposable income highlighted:

- Acceleration in wage growth (+0.9% MoM! Highest rate since July 2022)

- Catch-up in vehicle good spending following a tepid Q4

- Over a 3-month average (to smooth out end-of-year consumption patterns), we can say that services spending is still growing, while good spending has slowed

The next milestones: next CPI releases; fiscal policies to turn less accommodative

The following drivers are likely to influence the next CPI releases:

- Services inflation ex-housing: if we assume that it tracks wage growth, we can see little signs of services ex-housing inflation cool so far

- Housing inflation: if we follow a one-year lagged regression on the Case-Shiller national home price index, rent and shelter inflation should cool from the May CPI print on (still a few months to go)

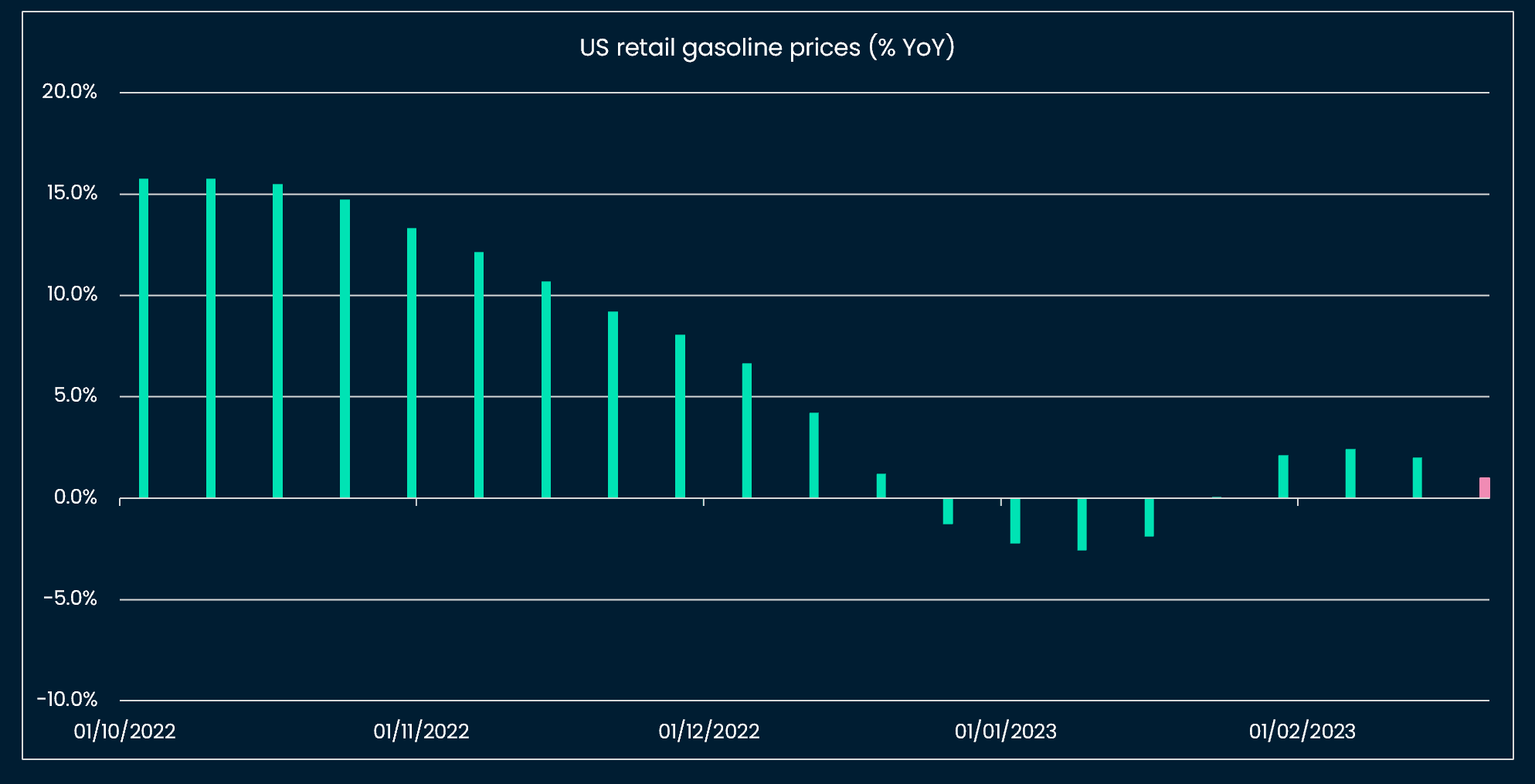

- Energy inflation: Gasoline prices have stabilized in January after deflating. From 1.5% YoY in January, we estimate that they are tracking at ~1% YoY in February

Overall this should lead us to a February CPI print close to January, with maybe some adjustment of expectations to the upside.

Turning to policy, we highlight that fiscal policies in the US, Europe, Japan, remain overall accommodative, which might partly account for growth resilience (that and the less worse than expected energy shock in Europe and the UK).

The UK government spent GBP 10.8 billion in January, mostly in energy subsidies, which is at par with the amount spent during the pandemic in 2020. Meanwhile, the US continues to benefit from the Infrastructure act’s outlays.

The timing and dynamics of fiscal policies matter: it looks like fiscal policy will turn contractionary towards the end of the year and into 2024, just as quantitative tightening will be in full swing in the US and Europe. We would imagine the impact to be higher rates, followed by macro weakness (how weak is the question) and then lower rates, unless governments proceed cautiously (e.g. slow removal of subsidies) and labor markets remain as strong as they are today.

Implications for the rate market

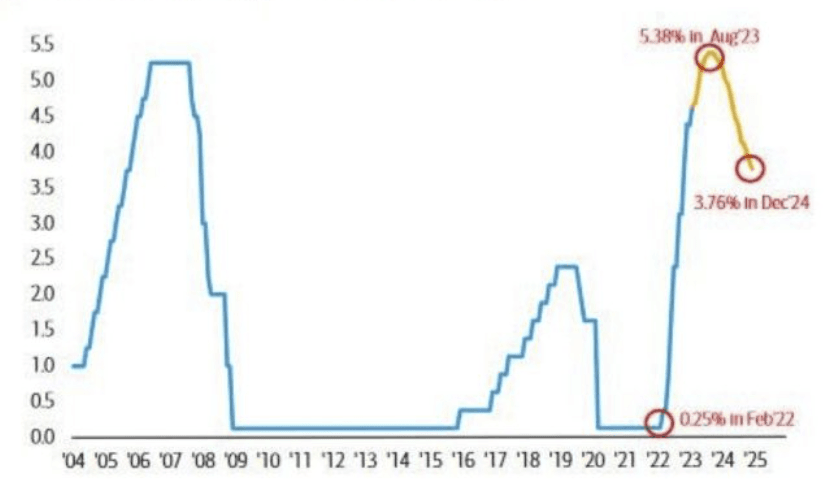

Overall we think that future rate markets are now closer to the economic reality: pricing a terminal rate of ~5.38%, close to the “5 and 3/8th” estimate given by Bullard last week.

The question is what comes next? We could see a further uptick in rates after August 2023 (market peak rate), followed by a sharp drop at some point in 2024 (as opposed to the gradual rate cuts being priced at the moment).

Japan: the difficult path to yield curve control exit

Kazuo Ueda, the nominee for governor of the Bank of Japan (BoJ), testified to lawmakers last Friday and seemed to favor policy continuity, sending the JPY lower.

Meanwhile, the BoJ placed restrictions on the number of JGBs (Japanese Government Bonds) expiring in June 2032 and September 2032 it lends to dealers, to prevent short selling. Prior to this latest measure, the BoJ had been defending the yield trading band by buying JGBs, which translated into pressures on the JPY, which in turn had to be defended by selling foreign reserves.

The economic reality is that Japanese wage growth, which underlies the “trend inflation” that Ueda emphasized, is accelerating and matches the levels in the US and Europe. An exit of the yield curve control appears inevitable in our view. Ueda has not yet been officially nominated as new Governor, and it makes sense for him to insist on policy continuity. Once in office, we still see a high likelihood of Ueda leading the exit out of yield curve control. The when and how are question marks. Under Governor Kuroda, no forward guidance was communicated and policy changes occurred rather abruptly with sharp market moves (JPY volatility to increase from April on).

“China reopening trade”: fading or pausing?

The Hang Seng index, the AUD/USD, copper prices have been taking a breather in the past few weeks. We pay particular attention to price movements that go against consensus narratives (e.g. China re-opening). For now the moves signal a pause in the China reopening trade.

Crypto price resilience: “Is that all there is?”

BTC courageously attacked the 24k level on Sunday, after correcting with other risk assets following news of very strong PCE and job data in the US.

We have to acknowledge the resilience of crypto prices: neither the SEC announcement nor the +70 bps gains in Fed rate pricing since February 3rd managed to lead to a significant sell-off of crypto prices. This resilience could signify that crypto has priced enough “bad news” and that only a significant shock (recession and risk sell-off) is able to break the current trading range.

On-chain: roll-up innovation and landscape

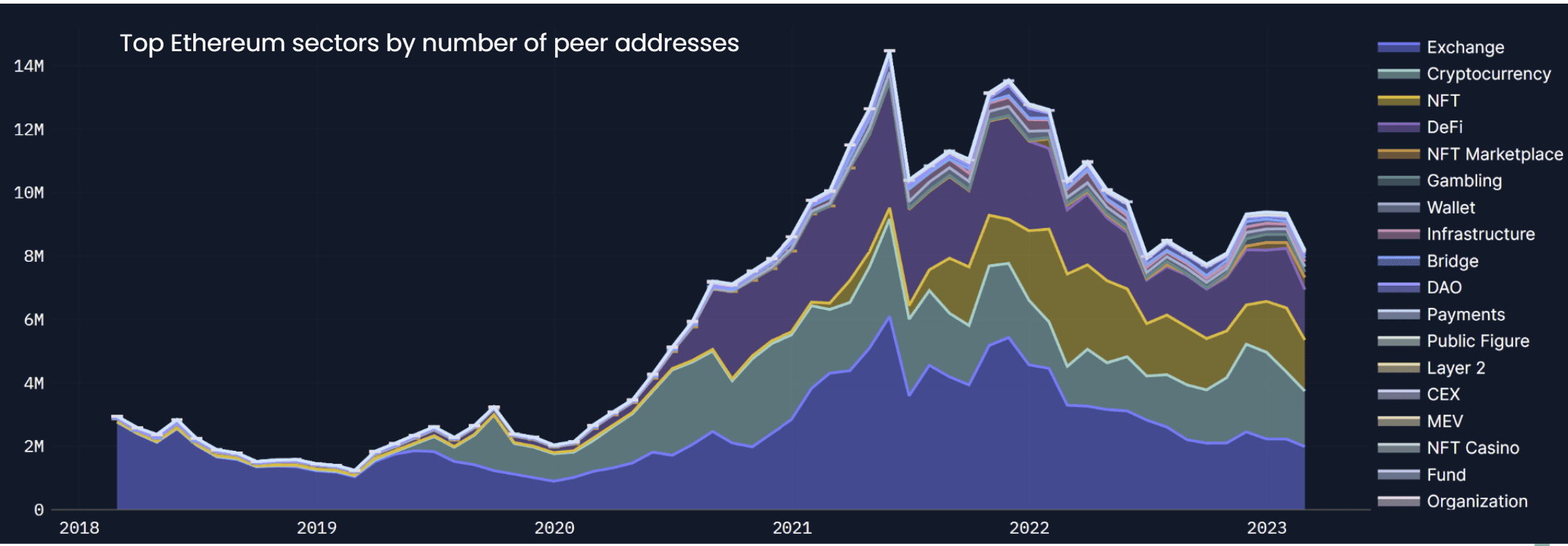

We highlight the two most relevant market themes in crypto at the moment (in our view) with a few on-chain charts: NFT resilient activity, and growing importance of rollup chains.

NFT resilience: the share of addresses interacting with NFT entities has been oscillating between 15% to 25% of activity throughout the bear market:

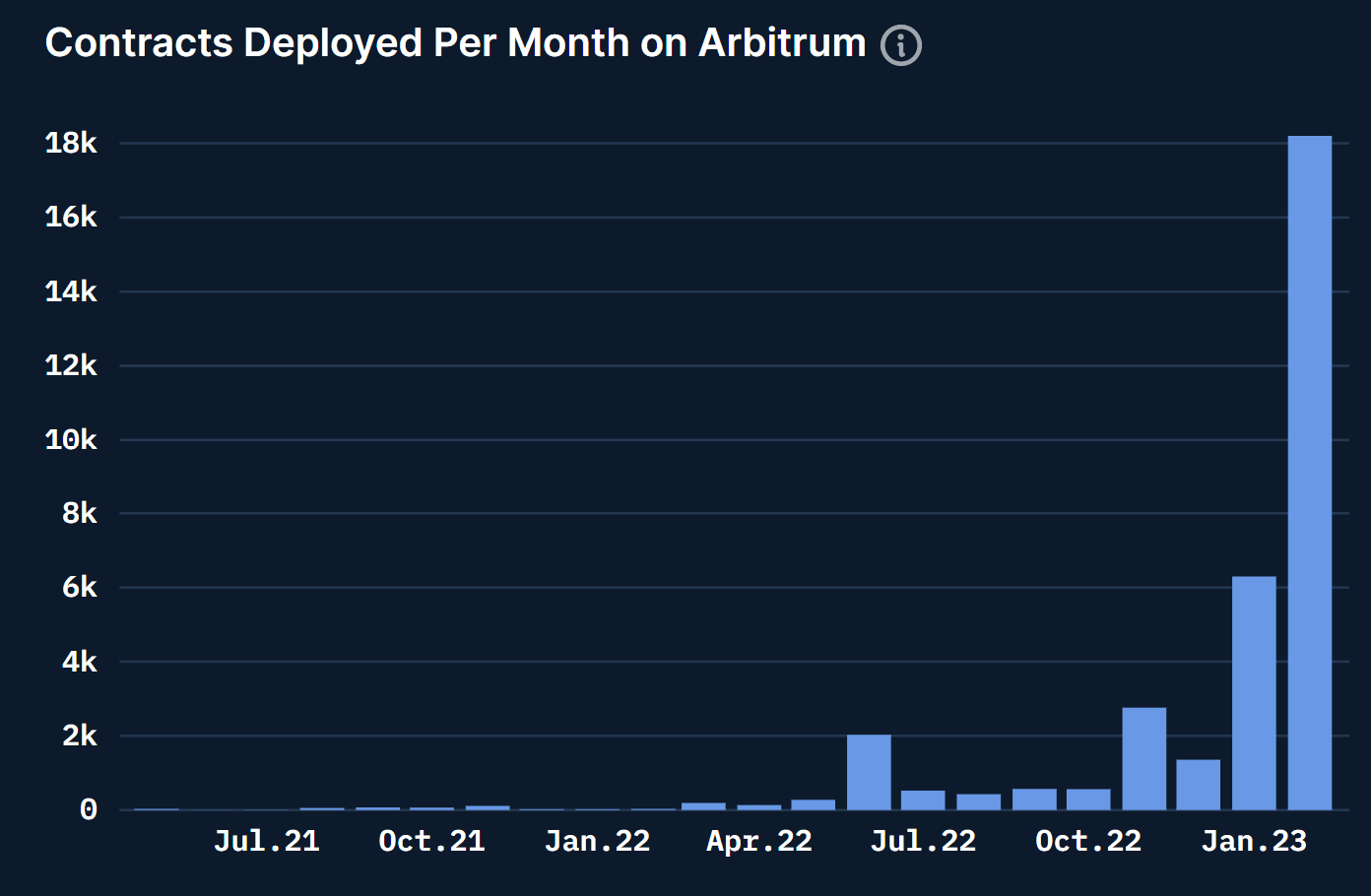

Coinbase’s presentation of its new testnet chain, Base, built on Optimism rollup stack, is exciting in several ways:

- It presents the first experimentation of a centralized entity (potential more mass adoption) interacting with the DeFi ecosystem

- It tackles a few of the architectural issues of optimistic rollups e.g. how to shorten the challenge period and simplify bridge proofing architecture

The testnet can be followed on Base block explorer.

This week: US ISM PMIs, German and European inflation

Tuesday 28 February

- US Feb. CB consumer confidence (consensus 108.5). Is the US consumer in as good a shape as the latest retail sales number indicate?

- China official and Caixin manufacturing PMI (consensus respectively 50.5 and 50.2). Will help gauge the stage of the reopening

Wednesday 1 March

- German Feb. CPI (consensus 8.5% YoY)

- US Feb. ISM manufacturing CPI (consensus 48.0)

Thursday 2 March

- Eurozone Feb. CPI (consensus 8.2% YoY)

- US Feb. ISM non-manufacturing (consensus 54.5)