Market Snapshot

- L1 Price Performance:

- Since the election, price action among alternative Layer 1s has been mostly positive, with RUNE, SUI, SOL, and APT leading the rally. While most Layer 1s are seeing gains, TRON and TON have lagged behind, showing relative weakness compared to others.

- L2 Price Performance:

- Layer 2s have also seen consistent gains, with METIS up 26% and STRK rising 23%, leading the sector.

- DeFi Performance:

- The DeFi sector outperformed the L1 and L2 sectors, led by ENA, AAVE, and LDO. The uncertainty and risk surrounding DeFi projects under the current administration, could be contributing to the recent repricing of DeFi assets. This political backdrop may play a role in shaping investor sentiment and valuation adjustments within the DeFi sector.

- Ethena even had a proposal from Wintermute to turn on the fee switch.

Key Onchain Metrics

- Median Gas Consumption:

- Ethereum median gas fees have increased steadily over the past month, now exceeding 16 GWEI. ETH price action also increasing alongside it, signalling more usage alongside the positive price action.

- EVM Activity Landscape:

- Transaction volume across L2s remains fragmented, with Base and Arbitrum leading. Scroll activity has seen a drop following its Token Generation Event (TGE).

- Stablecoin Market Cap Trends:

- The total stablecoin market cap saw a sharp decline at the end of October but has since rebounded to around $169 billion. This is still a significant increase from September and year-to-date, with the overall uptrend in stablecoin market cap remaining intact.

Risk Indicators

- Short-Term Indicators:

- The market remains in a risk-on state according to our indicators, with the BTC call-put spread and BTC price momentum both in risk-on.

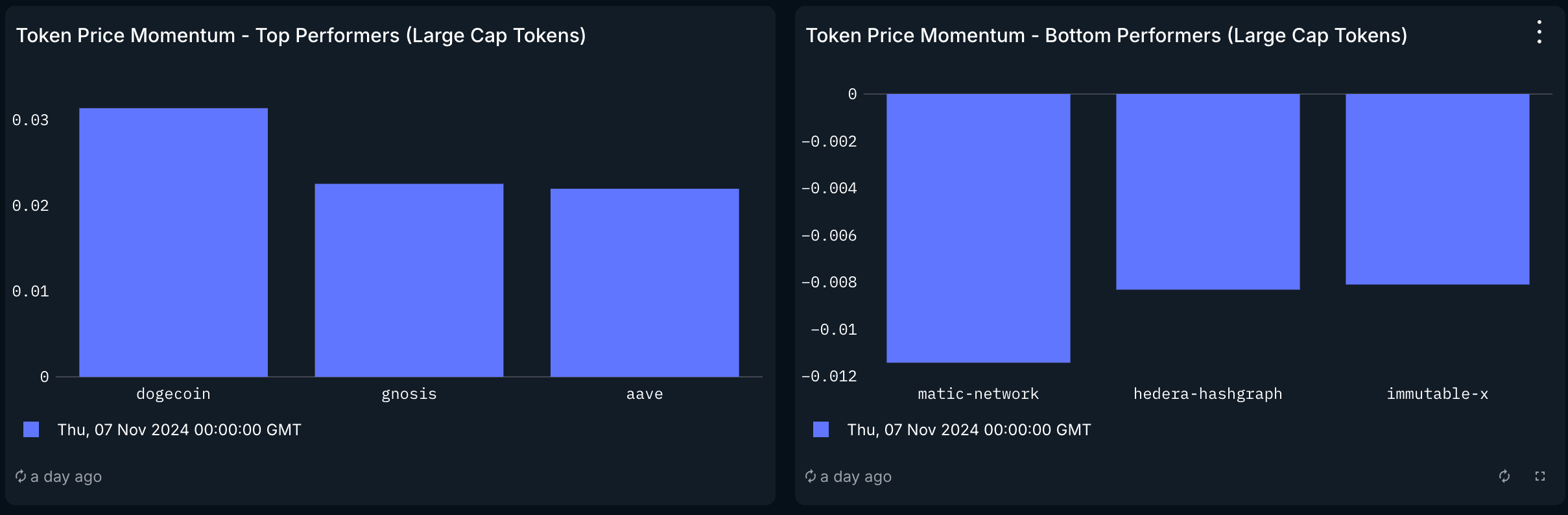

- Top Cross-Chain Momentum Tokens (Large Caps): DOGE, GNO, and AAVE lead in performance.

- Bottom Performers: POL (MATIC), HBAR, and IMX.

Fund Activity

Overall, not much large Fund activity across the board. What is abundantly clear is the bullish outlook they have on AERO, with over $4.5m of buying pressure alone this month across a number of top funds including but not limited to: Spartan Capital, Defiance, Pantera and a few others.

- DEX Trades (7-day):

- Top Buys: PEPE ($406k), POL ($77k), DOGE ($75k)

- Top Sells: COW ($1m), SPX ($424k), UNI ($215k), imgAI ($43k)

- DEX Trades (30-day):

- Top Buys: AERO ($4.5m), VIRTUAL ($239k), SPX ($178k)

- Top Sells: COW ($1.26m)

- Smart Money Activity by Chain:

Smart money activity is shifting towards Base, with Arbitrum and Optimism following. Ethereum’s activity is notably omitted. Below, we visualize daily transaction activity from the smart money segment, grouped by chain.

Source: Nansen Query

Macro Overview

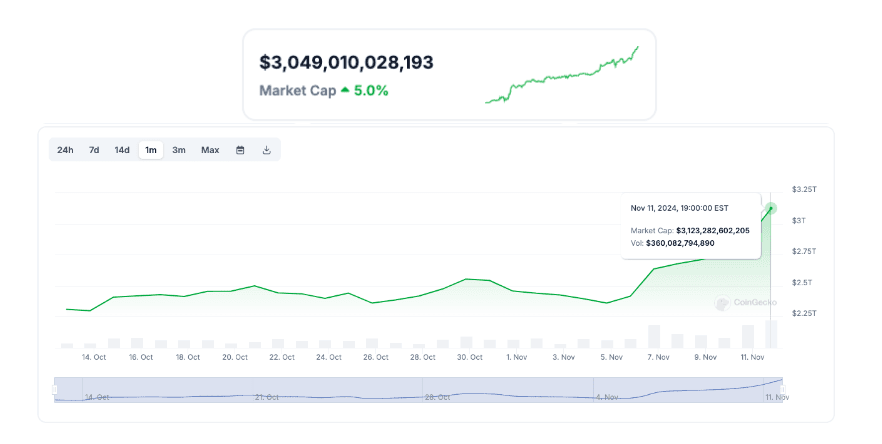

- Total Crypto Market Cap:

- The total crypto market cap has increased dramatically over the past month, up over $700 billion. Mindshare has focused heavily on BTC, alt L1s, DeFi, and meme tokens.

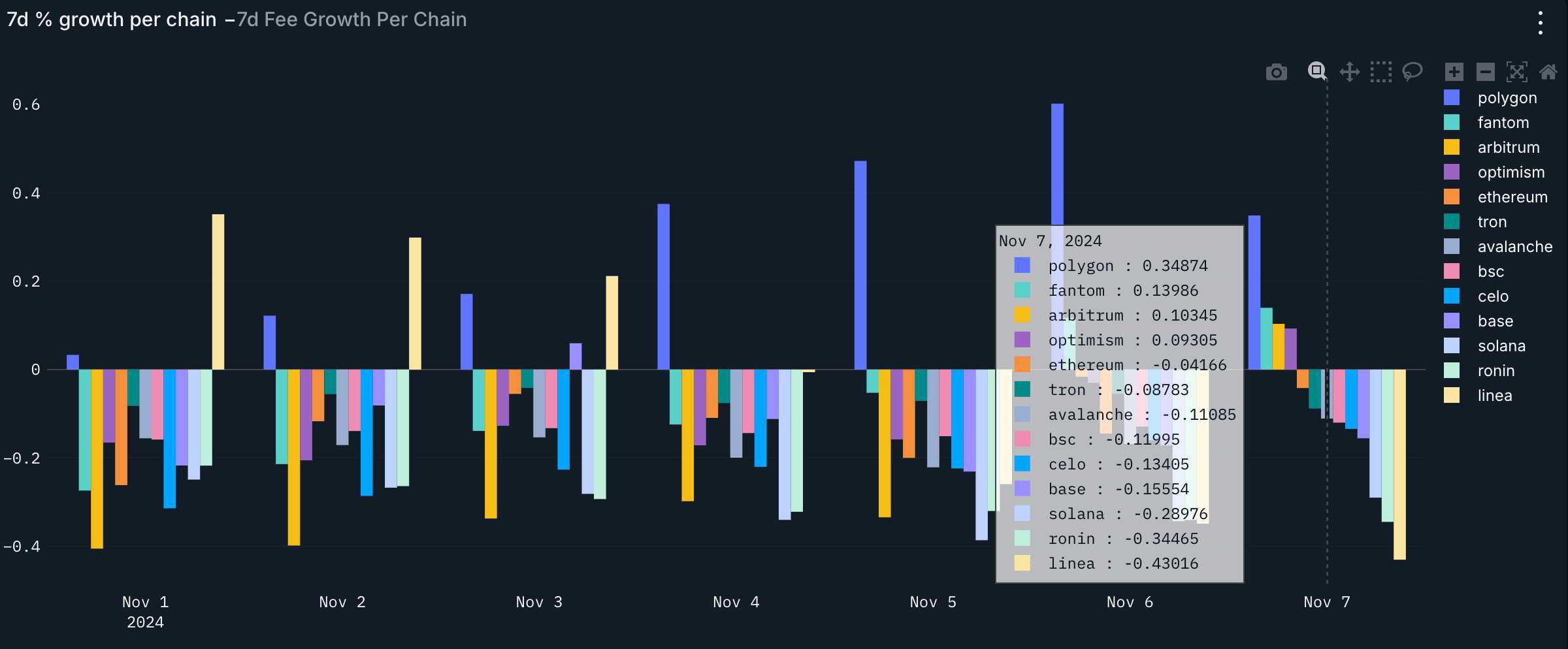

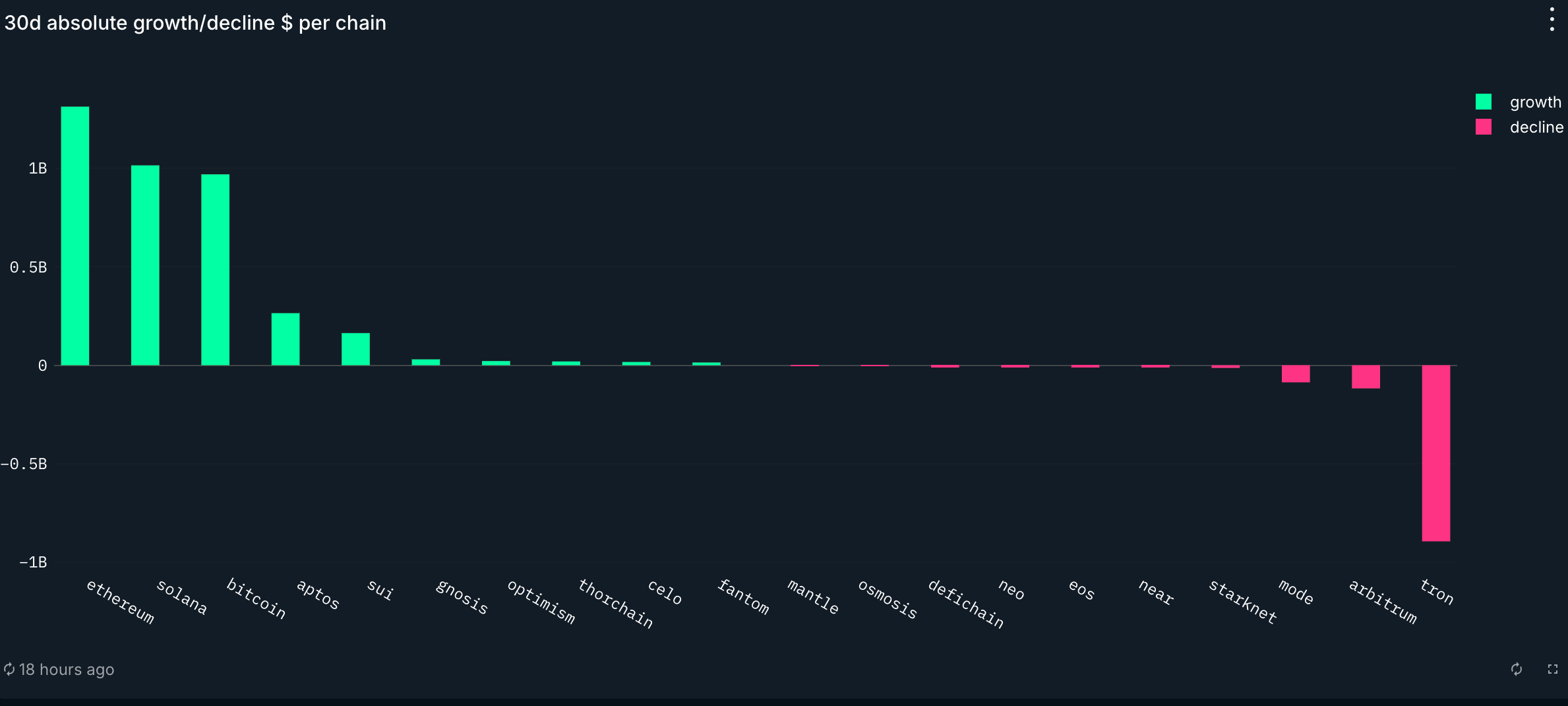

- Fee & TVL Growth by Chain:

- Fee Growth (7-day %): Polygon leads in fee growth, followed by Fantom and Arbitrum.

- TVL Growth (30-day Gross $): Dominated by Ethereum, Solana, and Bitcoin, with Aptos and Sui following closely.

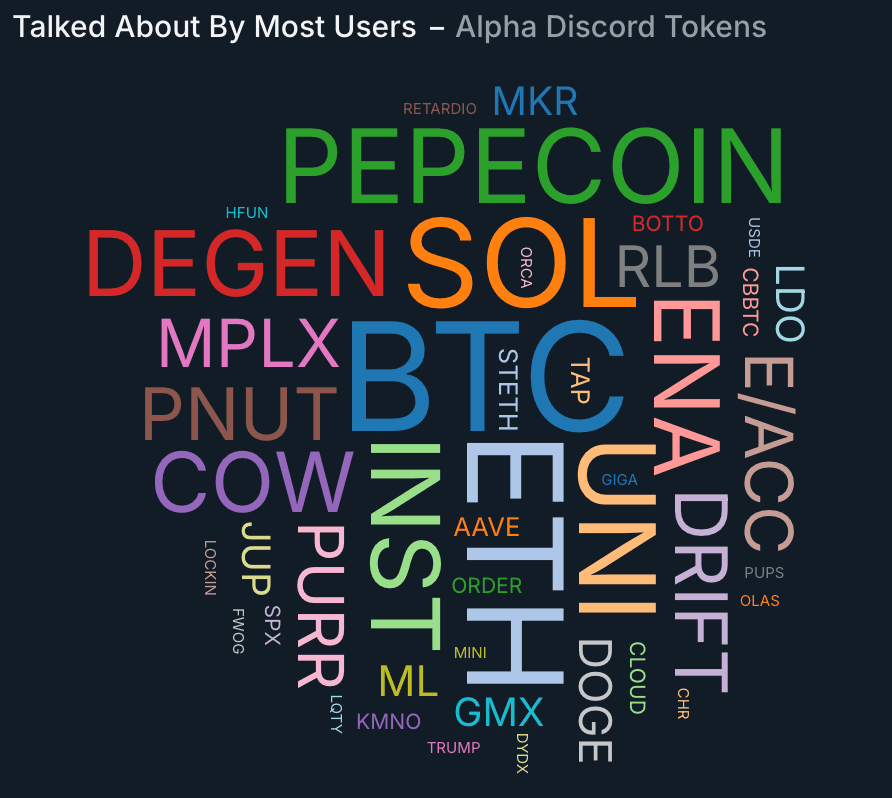

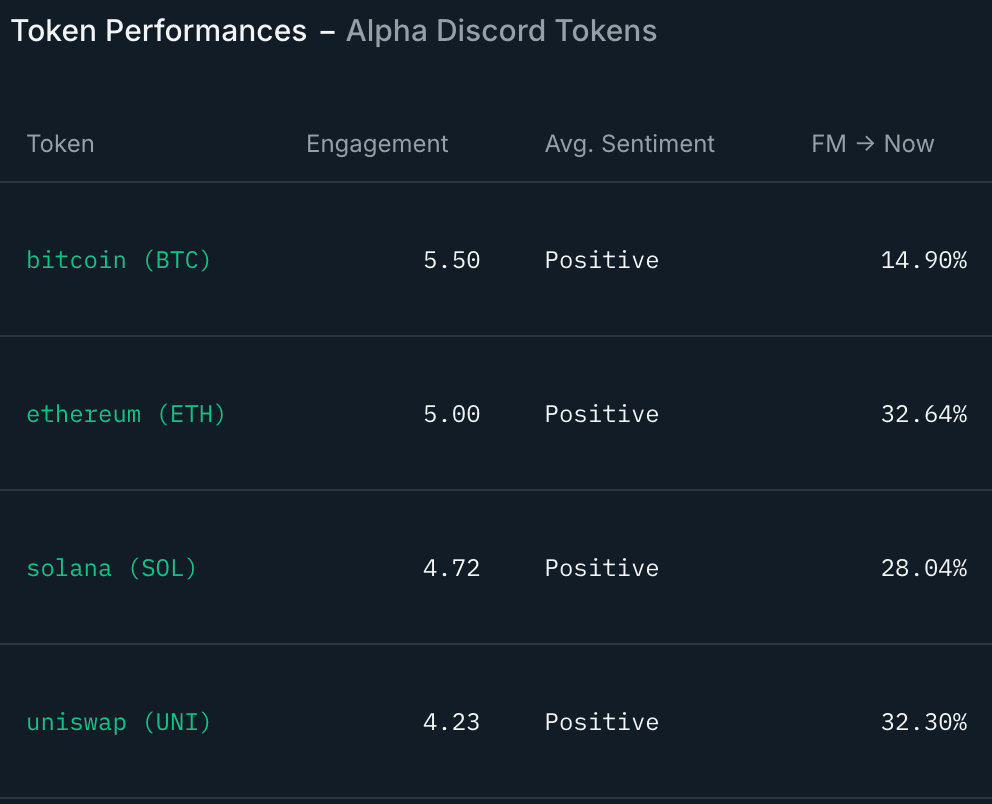

- Token Sentiment (7-day):

- Strong positive sentiment was noted for BTC, ETH, SOL, and UNI (DeFi more generally).

Strategic Insights

- Portfolio & Market Positioning:

- Current holdings include majors (BTC/ETH/SOL), DeFi (AERO + LQTY as a small bet), and stables (Hyperliquid/Ethena/USDC on Coinbase).

- Expecting BTCfi to grow substantially, with Lombard and Solv Protocol as primary issuers.

- Monitoring Hyperliquid TGE, with interest in Hyperliquid Eco coins for potential plays.

- Narrative & Future Focus:

- Not doing much, just sitting on my hands with the majority in majors and punting some longs on memes/DeFi tokens with catalysts etc. but simply put:

- Everything is up, ADA is even seeing large price increases, meaning everything is catching a bid; thus, it is important to find a narrative and position accordingly.

- Not doing much, just sitting on my hands with the majority in majors and punting some longs on memes/DeFi tokens with catalysts etc. but simply put: