Crypto Markets

BTC is trading on low volumes with tentative breakouts (higher or lower) from the 25.8k - 26.8k prevalent trading range being very short-lived. Our risk management indicators still warrant caution (see risk dashboard here). So far this has been the optimal risk strategy: below is the out-of-sample live performance of BTC buy-and-hold vs the same strategy overlaid with the BTC call-put spread risk-on / risk-off signal.

Crypto has been trading uncorrelated with equities recently, the latter having benefited from the growing soft landing narrative among central bankers and their reluctance to continue hiking rates. This is not the case of the Bank of Japan, which gave a tentative timeline for policy normalization: end of 2023.

Economy and central banks

The Fed Beige Book published last week painted a picture of the US economy consistent with a “soft landing” scenario.

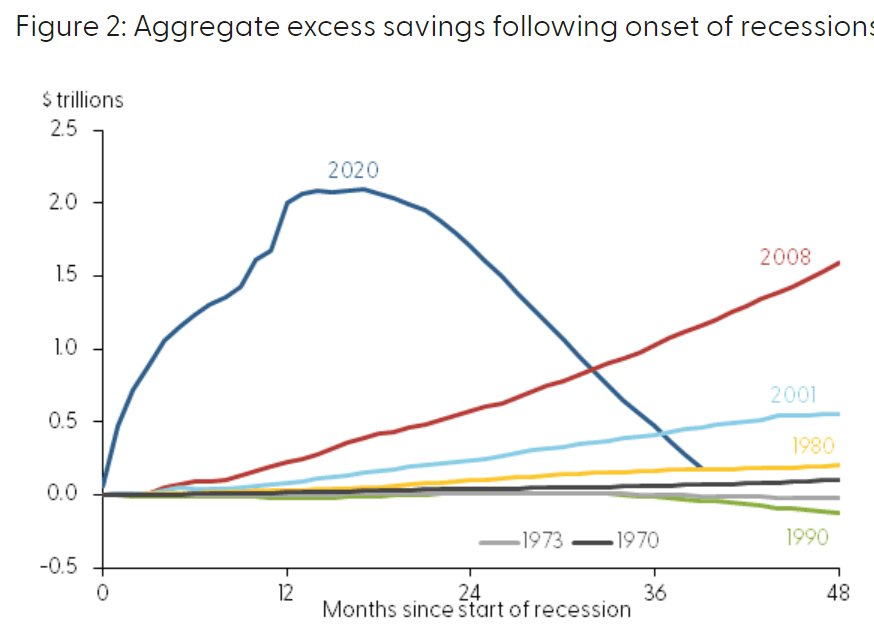

The main economic messages relayed by the surveyed US businesses were around softening consumption, with households perceived as spending the last of their pandemic dollars on tourism, but saving on non-essential goods. These observations are consistent with the US households’ excess saving model of the San Francisco Fed which estimates that USD 190bn of excess savings were left in June 2023, down from 500bn in March 2023 (!), out of the 2.1tn in total accumulated excess savings post-pandemic. The SF Fed forecasts that “these excess savings are likely to be depleted during the third quarter of 2023.”

The Beige Book also pointed to slower hiring but also persistent “imbalances in the labor market as the availability of skilled workers and the number of applicants remained constrained.” Also “nearly all Districts indicated businesses renewed their previously unfulfilled expectations that wage growth will slow broadly in the near term.”

For the Fed, this is all “good” news, suggesting that the economy, inflation, and wage growth are slowly cooling.

We see two scenarios based on the above economic dynamics: if, like surveyed businesses expect, wage growth decreases as output price inflation slows, then corporate margins can be preserved and it’s a soft landing. If wage growth is sticky while corporates are no longer able to pass on price increases to the end-consumer (who has run out of excess savings), then corporates will probably have to reduce labor costs and unemployment will increase.

The Fed is growing more sensitive to the risks of impacting growth negatively. Wall Street Journal Nick Timiraos’s article confirmed the already priced “ Fed hold” in September and also casted some doubt on whether an additional rate hike would happen “Some officials still prefer to err on the side of raising rates too much, reasoning that they can cut them later. Now, though, other officials see risks as more balanced. They worry about raising rates and causing a downturn that turns out to be unnecessary or triggering a new bout of financial turmoil.”

European central bankers were on the wire last week and the consensus seemed to converge towards a “skip” this week for the European Central Bank (ECB). As we wrote before, the ECB is behind the curve in terms of inflation compared to the Fed, but is also facing a weaker economy, notably in Germany.

In the end, the issue around inflation, leaving aside external supply shocks, boils down to the stickiness of wage growth. Some economists believe that we are at the beginning of a great rebalancing from companies’ profits to workers income. We took a look at the latest strike statistics in the US in a historical context, to verify whether this rebalancing was visible. Both the number of strikes and the number of workers on strike have surged in 2023, and are the highest since the early 2000s. It remains to be seen whether this trend persists when the economy weakens. If yes, it would make the soft landing scenario more difficult to materialize.

Next steps for the Digital EUR

We now turn away from pure macro factors to consider other potential tailwinds for crypto: institutional adoption and the introduction of larger-scale use cases for the blockchain technology.

As explored in prior publications, institutional adoption of crypto is progressing through two use cases, stablecoins and central bank digital currencies (CBDCs), as well as traditional passive instruments with crypto underlyings (ETFs, derivatives etc.). The EUR is the second most important currency globally in terms of financial and trade flows. The legislative proposal for a digital EUR is at a key juncture this autumn: if approved by the Governing Council, “the ECB would further develop and test the technical solutions and business arrangements. A possible decision by the Governing Council to issue a digital euro would be taken only after the legislative act is adopted.”

The value proposition from the digital EUR compared to traditional payments is its competitiveness with private closed-loops payment systems, including stablecoins, but also Big Tech payments circuits, highlighted ECB’s Fabio Panetta in a recent speech.

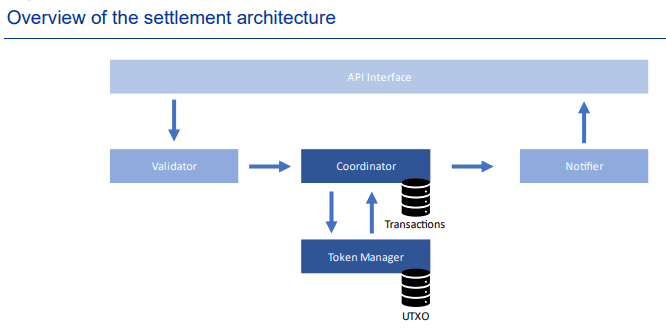

The digital EUR’s architecture is based on the “N€XT" prototype, “a bespoke design developed from scratch by the Eurosystem. The architecture of N€XT is not that of a distributed ledger, rather it is based on a UTXO data”. It will be interesting to see the extent to which regulated blockchain use cases for payments are developed in segregation with existing public permissionless chains. The Bank of International Settlement’s pilots tested several architectures, some of which leveraged Ethereum and its rollups. If the latter solutions are found efficient and secure enough, they can compete with private permissioned blockchains: JP Morgan is considering a blockchain-based digital deposit token for speeding up cross-border payments and settlement.

New on-chain wallets

Has the introduction of new, institutional use cases for crypto translated into higher on-chain activity?

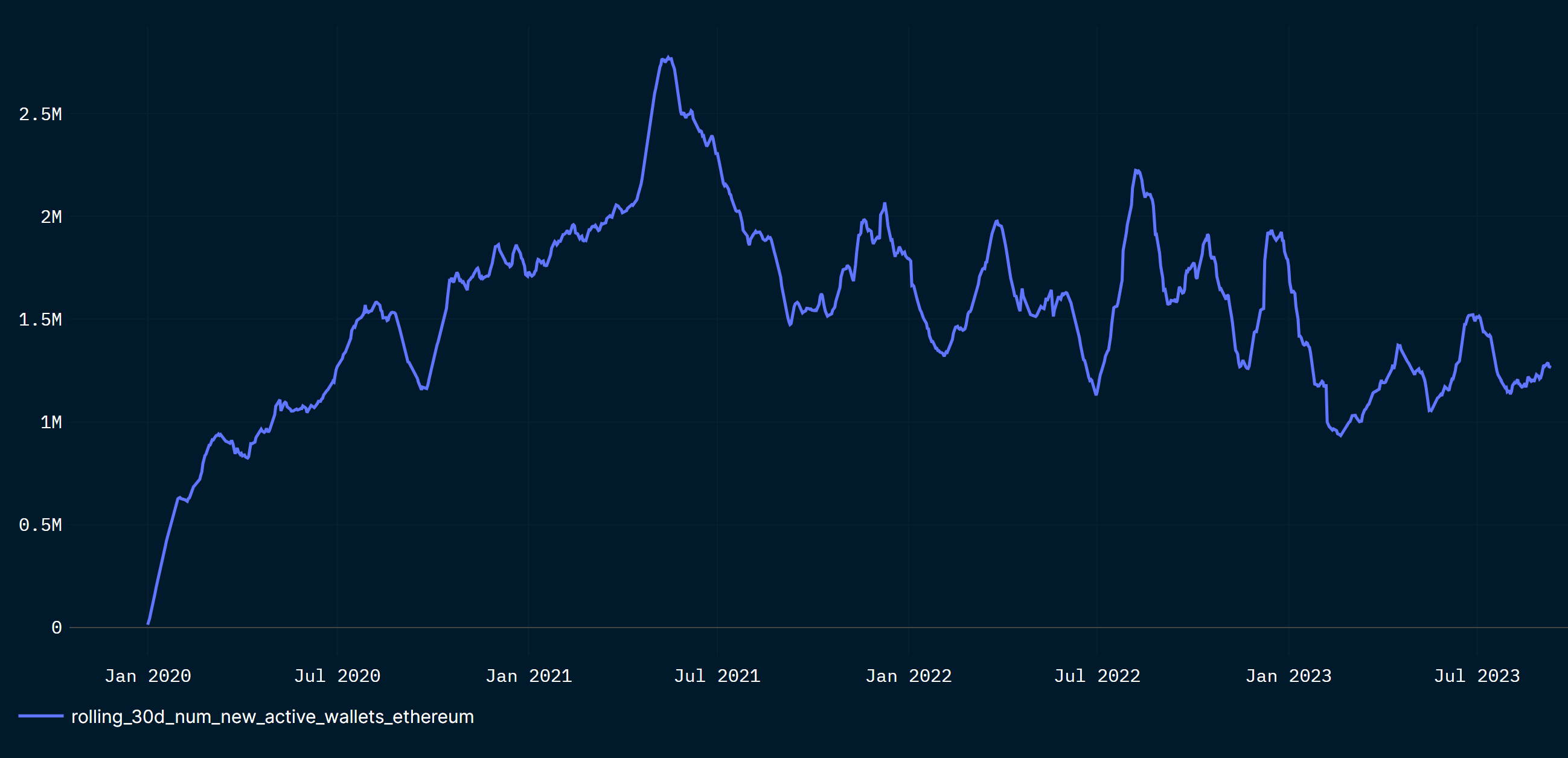

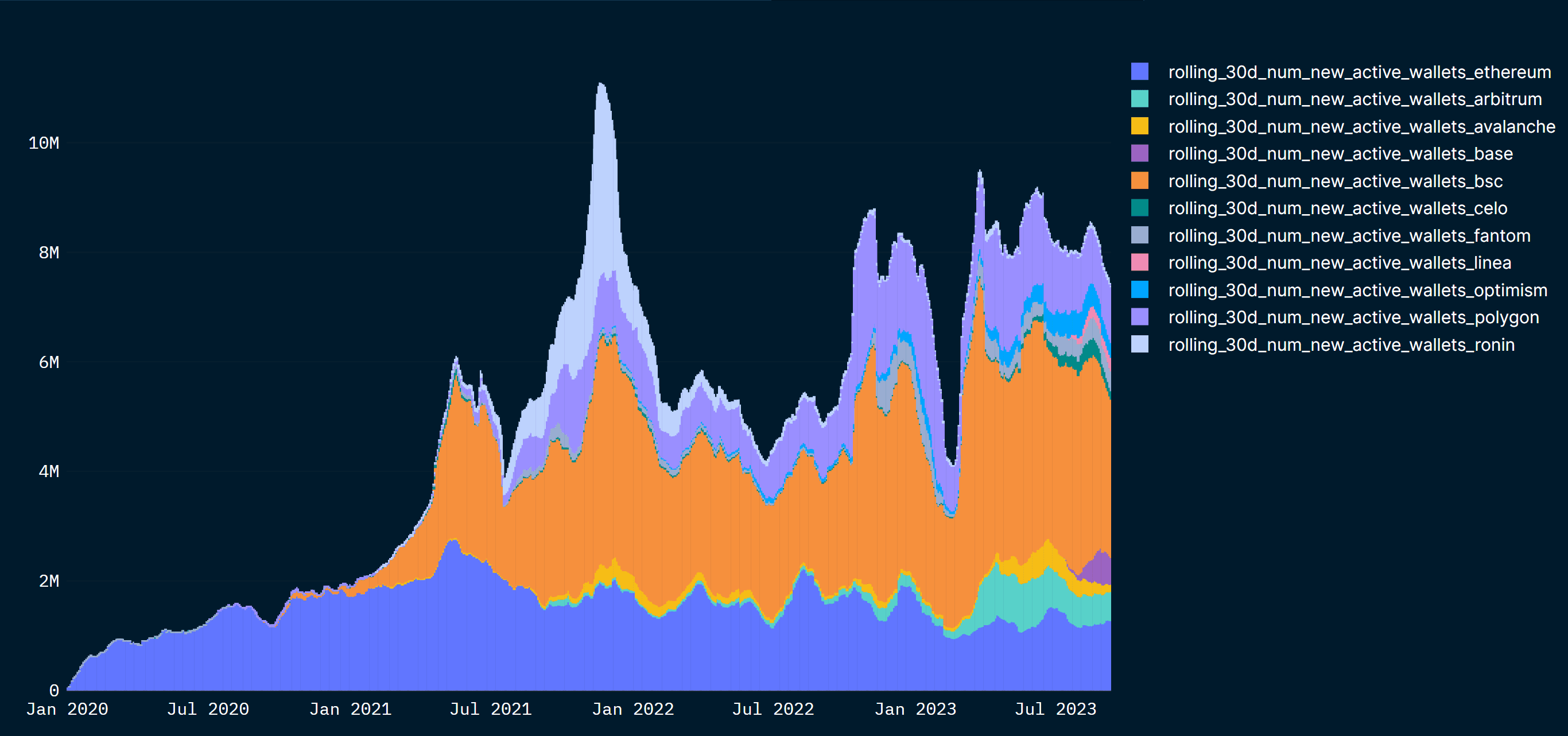

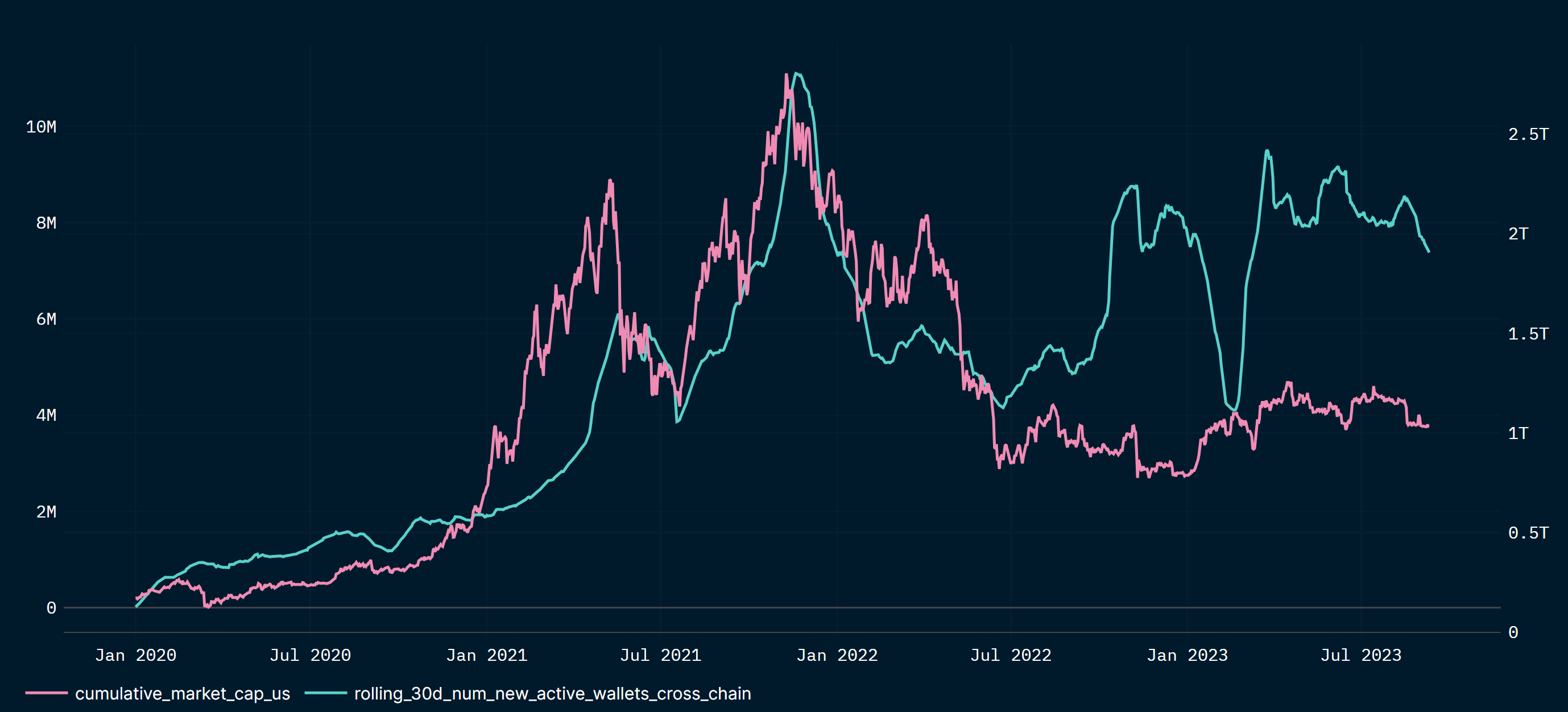

We track the creation of new wallets having done at least one transaction on Ethereum and across 11 chains. The next bull market will indeed need fresh participation from institutions and retail agents. We find that newly active addresses on Ethereum have peaked in May 2021 and may have troughed in May 2023.

Looking at this same metric across 11 chains (sum of newly active addresses) reveals a different picture: new wallet count has recovered since February 2023. This has been driven by the increased activity on roll-ups such as Arbitrum, but also higher activity on the most used chains such as Binance. The correlation with aggregate crypto market cap, which was quite high in 2021 and 2022, is not as strong in 2023, though.

This week: US CPI and ECB meeting

Wednesday 13

- US August 2023 CPI. The consensus for the headline CPI seems right at 3.6% YoY (+40 bps compared to July 2023 for higher energy prices). Core CPI is expected at 4.3% YoY (vs 4.7% YoY for July 2023): this is a chunky deceleration and could be disappointed by a stickier core number

Thursday 14

- ECB’s interest rate decision: The consensus has taken the hint from various ECB speakers and priced the policy rate on hold at 4.25%.

- US August PPI (consensus 1.2% YoY) and retail sales (consensus 0.2% MoM)

- China August activity report

Friday 15

- Eurozone Q2 wage growth