What happened last week

Monday: China October official Manufacturing PMI 49.2 vs 50e, Non-manufacturing official PMI 48.7 vs 50.2e. German Sept. retail sales 0.9% vs -0.3% MoM expected. Eurozone October CPI 10.7% YoY vs 10.2% expected, core CPI 5% vs 4.8% expected. Euro area GDP up 0.2% QoQ in Q3. US Chicago PMI 45.2 vs 47e. Oct. Dallas Fed Mfg Business Index -19.4 (from -17.2). Australia October Manufacturing PMI 52.7 vs 52.8e. Korean Oct. exports -5.7% YoY vs -3% expected. Korea Oct. Manufacturing PMI 48.2, up from 47.3. Japan Oct. Manufacturing PMI 50.7 as expected. China Caixin Oct. PMI 49.2 vs 49e. The Reserve Bank of Australia hikes 25bps to 2.85% as expected.

Tuesday: Unverified rumors of China exiting zero-covid policy spark a rally in Chinese stocks, copper and commodity-exporting currencies such as the AUD. India Oct. Manufacturing PMI 55.3 vs 54.9e. Russia Oct. Manufacturing PMI 50.7 down from 52. UK Oct. HPI 7.2% YoY vs 8.3%e. Swiss Oct. PMI 54.9 vs 56e. UK Oct. PMI 46.2 vs 45.8e. Brazil Sept. IP 0.4% YoY vs 0.7% expected. Brazil Oct. PMI 50.8 down from 51. Canada Oct. Manufacturing PMI 48.8 (vs 49.8). US Oct. Manufacturing PMI 50.4 vs 49.9e. ISM Oct. Manufacturing PMI: 50.2 vs 50e, Employment sub-index 50 vs 53e, Prices sub-index 46.6 vs 52.5e. New Zealand Q3 employment report: employment change +1.3% QoQ vs 0.5% expected, participation rate 71.7% vs 71% expected, unemployment rate 3.3% vs 3.2% expected. Korea Oct. CPI 5.7% YoY vs 5.6%e. Australia home loans -9.3% MoM. Reserve Bank of Australia’s Governor Lowe explained the RBA’s past decision to step down the pace of hikes: “ We are conscious that interest rates have been increased by a large amount in a very short period of time and that higher interest rates affect the economy with a lag. If we are to stay on that narrow path, we need to strike the right balance between doing too much and too little.”

Wednesday: Sept. German trade balance 3.7bn vs 0.7bn expected. European Oct. Manufacturing PMI: Spain 44.7 vs 47.5e, Italy 46.5 vs 46.9e, France 47.2 vs 47.4, Germany 45.1 vs 45.7e, Eurozone 46.4 vs 46.6e. Germany Oct. unemployment change 8k vs 15k expected, unemployment rate 5.5% as expected. US Oct. Nonfarm employment ADP change 239k vs 195k expected. The US FOMC hikes the policy rate 75bps to 4%. In the press conference, Fed Chair Powell said that “at some point it will become appropriate to slow the pace of increases'' but “that the ultimate level of interest rates will be higher than previously expected” and indicated that the risk of under-tightening outweighed the risk of over-tightening. Australia Sept. trade balance 12.4bn vs 8.85bn expected. Hong Kong Oct. PMI 49.3. China Caixin Oct. Services PMI 48.4 vs 49.2 expected.

Thursday: India Services PMI 55.1 vs 54.6e. Swiss Oct. CPI 3% vs 3.2% expected. UK Oct. Services PMI 48.8 vs 47.5e. Eurozone Sept. unemployment rate 6.6% as expected.The Bank of England hikes 75bps to 3% as expected, and guides for a slower pace of rate hikes than priced in markets: “We think bank rates will have to go up by less than priced in financial markets.There are however considerable uncertainties around the outlook. If the outlook suggests more persistent inflation pressures, the Committee will respond forcefully as necessary.” US continuing jobless claims 1,485k vs 1,450k expected and initial jobless claims 217k vs 220k expected. US Q3 non-farm productivity 0.3% QoQ vs 0.6% expected, unit labor costs 3.5% vs 4.1% expected. US Sept. trade balance -73.3bn vs -72.2bn expected. Canada Sept. building permits -17.5% vs -6.1% expected. Canada Sept. trade balance 1.14bn vs 1.34bn expected. US Services PMI 47.8 vs 46.6 expected. US Sept. Factory orders 0.3% MoM as expected. US Oct. ISM non-manufacturing PMI 54.4 vs 55.5 expected, Employment sub-index 49.1, Prices sub-index 70.7. Australia retail sales 0.6% MoM. Japan October Services PMI 53.2.

Friday: German Sept. Factory orders -4% vs -0.5% MoM expected. Oct. Services PMI: Spain 49.7 vs 48.3e, Italy 46.4 vs 48.5e, France 51.7 vs 51.3e, Germany 46.5 vs 44.9e, Eurozone 48.6 vs 48.2e. UK Oct. construction PMI 53.2 vs 50.5e. The Fed published its financial stability report and flagged “some parts of the nonbank financial sector, where hidden pockets of leverage could amplify adverse shocks” but stated that “household debt [including mortgages] was at modest levels relative to GDP and concentrated among prime-rated borrowers”. US Oct. average hourly earnings 0.4% MoM vs 0.3% expected, average weekly hours 34.5 as expected, non-farm payrolls 261k vs 200k expected, participation rate down 0.1% to 62.2%, unemployment rate 3.7% up 0.2%pts. Canada Oct. unemployment rate 5.2% unchanged MoM, participation rate up 0.2%pts to 64.9%. Canada Ivey PMI 50.1 down from 59.5. In Brazil, President-elect Lula’s team meets President Bolsonaro’s team to organize the transfer of power.

Sunday: Oct. China trade balance up to 95.95bn USD from 84.74bn.

Nansen’s take

“Buy the rumor…”: Chinese equities and commodity-linked assets surged higher from last Tuesday onward, based on rumors that China was looking to exit its zero-covid policies. Beijing did not confirm the rumors. Chinese growth experienced a renewed bout of weakness in the last months, as shown by contracting PMIs, deteriorating consumer sentiment and retail sales, and ongoing stress in the domestic housing and equity markets. From a pure economic standpoint, lifting zero-covid would make sense, but other political considerations have likely prevented this exit so far.

It seems to us that a risk rally based on rumors has little fundamental and sustainable tailwinds, especially following the hawkish message from the Fed’s last press conference, which stated that the terminal Fed Fund rate likely stood above the Committee’s prior projection of ~4.6-4.8%. Effectively, this means that the Fed will not stop hiking until the US labor market “cracks”. The latter is slowing on the margin (workweek hours have been trending down, so have payrolls) but remains at the tightest level since the 1990s. We expect gasoline prices to detract ~20bps-30bps to YoY headline CPI for October (close to consensus of 8.0% YoY). However, the slow down in core CPI will take time: services inflation remains hot (see ISM non-manufacturing price paid index) and the effect of lower house prices is unlikely to affect CPI rent indices before April 2023.

We perceive divergences in DM central banks’ stances: the Bank of England flagged a slower pace of hikes going forward and a reverse-hockey-stick path for CPI. The Reserve Bank of Australia seems also concerned about the impact of higher policy rates on domestic variable mortgage rates. This signifies ongoing pressures on the domestic currencies of the countries which cannot keep up with Fed tightening.

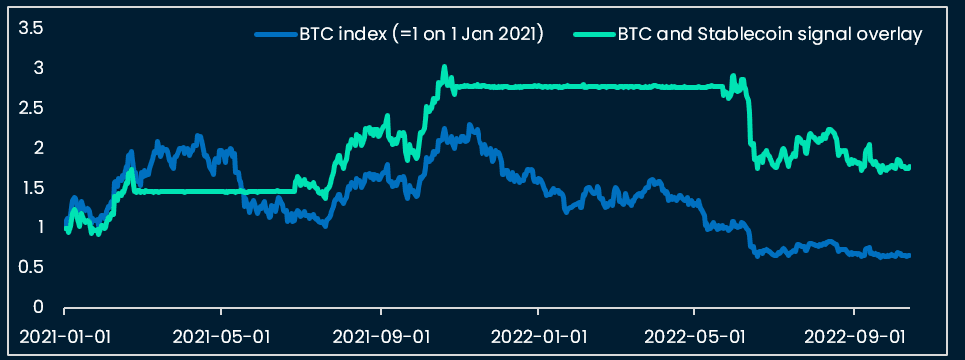

In the context of higher US discount rates for equities and risk assets, tech stocks have been underperforming value stocks further, as visible in earning and price developments (see charts below). Interestingly, BTC and ETH have been slightly outperforming the Nasdaq in recent weeks (see below). Looking at a one-year past horizon, we note that these outperformance periods have occurred and do not necessarily forecast a bottoming in crypto prices. For a bottoming, we need Fed fund rates to peak, which, as analyzed above, is not a scenario backed by fundamental data at this stage.

Nevertheless, we note that positioning indicators, such as our Nansen Smart Money stablecoin ratio (note: revised to include withdraw/deposit functions on Ethereum and structurally higher than our prior version, with trading thresholds at 6% and 20% vs 5% and 11% in v1) have captured some of the tactical “rallies” or “price stabilization” in crypto prices, during this bear market.

What to pay attention to this week: US CPI and US mid-term elections

Tuesday 8: Sept. Eurozone retail sales (consensus 0.3%), China Oct. CPI (consensus 2.4% YoY) US midterm elections (fivethirtyeight projections on Nov. 6: Senate = 54 for Republicans, 46 for Democrats; House = 82 for Republicans, 18 for Democrats)

Wednesday 9: US crude oil inventories, UK Oct. RICS House Price Balance (consensus 20%)

Thursday 10: Brazil Oct. CPI (consensus 6.34% YoY), US October CPI (consensus 8% YoY, prior 8.2% YoY). We estimate that gasoline prices, all other components equal, have detracted ~20-30bps from headline CPI YoY compared to September. US October core CPI (consensus 6.5% YoY, prior 6.6% YoY), US Initial Jobless Claims (consensus 220k), New Zealand Business PMI (prior 52)

Friday 11: UK Q3 GDP (consensus 2.1% YoY, -0.5% QoQ), India Oct. CPI (consensus 7.3% YoY), US Nov. Michigan Consumer Sentiment (consensus 59)

Charts that matter