What happened last week

Monday: Ukraine’s army reclaimed some of the lost Eastern territories as part of its counteroffensive operation. The G7 confirmed its plan to impose a price cap on Russian oil, despite Russia’s warning that it would not supply any oil nor gas to countries adopting the cap. Germany reported its lowest current account balance in 15 years (5bn in August vs 14bn in July).

Tuesday: UK job claimant count increased for the first time since March 2021 (+6.3k vs -13.2k expected for August). Average UK earnings ex-bonus grew +5.2% YoY (vs 5% expected). Germany August CPI +7.9% YoY (as expected). Spanish August CPI +10.5% YoY (vs 10.4% expected). German ZEW Economic Sentiment Index, which gauges the six-month economic outlook, sunk to -61.9 (vs -60 expected), its lowest level since 2008. US Aug. Small business optimism 91.8 vs 90.8 expected. US August headline CPI 8.3% YoY vs 8.1% expected; core CPI 6.3% vs 6.1% expected and up from 5.9% YoY in July. Food, shelter and medical categories drove upside surprise while gasoline prices cooled. WSJ journalist and Fed “oracle” Nick Timiraos called for a rate hike of “at least” 75bps in September. Japanese government and monetary policy officials hinted at JPY intervention.

Wednesday: UK August CPI 9.9% YoY (vs 10.2% expected). US 30yr mortgage rate 6.01%, highest since 2008. Australia Aug. employment change 33.5k vs 35k expected; participation 66.6% as expected; unemployment rate 3.5% vs 3.4% expected. Japan August trade balance -2,817bn vs -2,398bn expected, all-time low (since series started in the 1970s).

Thursday: Ethereum successfully merged its original execution layer with its new proof-of-stake consensus layer, the Beacon chain. US railroads and labor unions reached a tentative deal for 24% pay increases over 5 years from 2020. US President Biden directed the Committee for Foreign Investment in the United States (CFIUS) to increase its scrutiny on foreign entities that purchase US assets of “emerging and critical technologies, like semiconductors, quantum technologies, biotechnology and AI, as well as supply chain considerations”, likely aiming at China. FedEx CEO said that a global recession was impending, and blamed weakening global shipment volumes for the company’s miss of its earnings targets. Germany in advanced talks to nationalize three large gas importers. US initial jobless claims 213k vs 226k expected, 6th week of consecutive decline. US August core retail sales -0.3% MoM vs 0.1% MoM expected. ” US NY Empire State Manufacturing Index -1.5 vs -13 expected. US Philly Fed Manufacturing Index -9.9 vs 2.8 expected and 6.2 prior (New orders -17.6 vs -5.1 prior, Prices paid 29.8 vs 43.6). August data in China: House prices -1.3% YoY in August vs -0.9% for July; Industrial production 4.2% YoY vs 3.8% expected. Fixed asset investment 5.8% vs 5.5% expected. Retail sales 5.4% YoY vs 3.5% expected.

Friday: The White House released a framework for “responsible development of digital assets”. UK Aug. retail sales -5.4% vs -4.2% expected. Italian August CPI 8.4% YoY as expected. Eurozone August CPI 9.1% YoY as expected. US Michigan Sentiment September: Expectations 59.9 (vs 59.7 expected), 5-yr inflation expectations 2.8% (vs 2.9% prior), 1-yr inflation expectations 4.6% (vs 4.8% expected).

Nansen’s take

“We’re seeing [global shipment] volume decline in every segment around the world, and so you know, we’ve just started our second quarter. […] these numbers, they don’t portend very well. [..] We are a reflection of everybody else’s business, especially the high-value economy in the world.” FedEx CEO.

Signs of quickly deteriorating global growth are visible across several indicators and countries: from German business pessimism, forced “nationalization” of utility companies (Germany following France), the global harbor volume rolling over and the currencies of commodity-exporting countries starting to underperform (see AUD/USD, which also started to weaken prior to February 2020 covid-led global economic recession).

Amid these signs of distress, the US economy appears relatively resilient, which is illustrated by US small business optimism recovering, in contrast to European or Asian confidence indices. Ongoing strength in the US dollar supports the US’s purchasing power and a relative energy self-sufficiency stands as a competitive advantage vs Europe and Japan. In our view, the US economic “exceptionalism” will likely be interrupted by: tightening financing conditions as the Fed tackles its “single mandate”, inflation, or possibly a contagion from financial markets to the US. We are waiting for the very tight US labor market to show signs of weakness. Those are not visible in the US yet, contrary to other mature markets like Germany, Canada, UK, Australia where labor market data have started to disappoint consensus.

On inflation, last week reminded us that secular macro trends have long timeframes but follow a relentless momentum once “started”. The US increased its scrutiny on foreign acquisition of US intellectual assets, and yielded double-digit wage increases to railroad labor unions in the same week. These developments illustrate two relevant macro trends for crypto: de-globalization and re-shoring of industrial production domestically (see USD/TWD +13.7% YTD), coupled with some redistribution of wealth to labor.

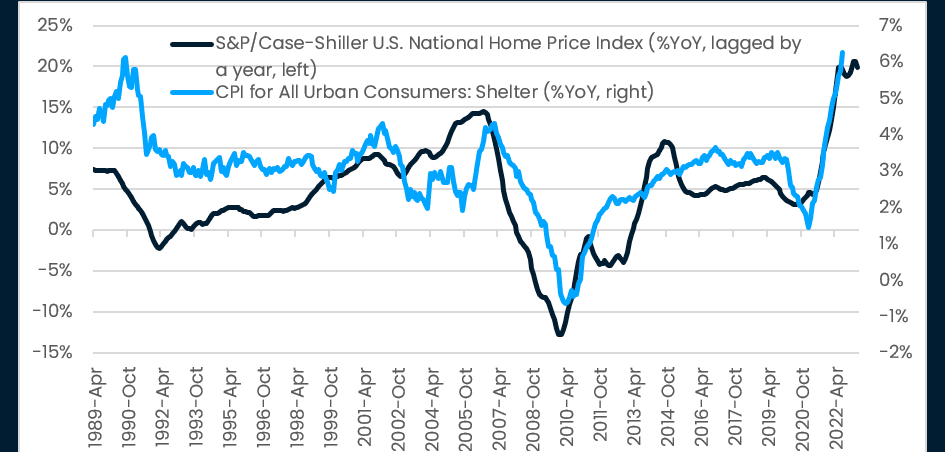

What are the implications for crypto? Inflation continues to surprise to the upside (US) or meet expectations (Europe). Meanwhile, real growth is “muddling through” in the US, with evident power of negotiation belonging to employees vs employers as a corollary of a tight labor market. We need to see: inflation consistently below investor expectations (unlikely to occur before April 2023, see our leading indicator of US shelter CPI below) and US growth disappointing as well, especially jobless claims and labor market data. This would likely be reflected in bond markets by a re-steepening of the US yield curve.

Aside from macro, regulatory drivers will also likely influence crypto as early as Q1 2023 with the US announcing its goal to enact “laws against unlicensed money transmitting to apply explicitly to digital asset service providers” (see https://sharedcontacts.com/articles/first-ever-comprehensive-framework-for-responsible-development-of-digital-assets). The implications for decentralized exchanges and decentralized NFT platforms will be interesting and illustrate whether regulation can coexist with “decentralized” economic models. Once a clearer regulatory framework has been laid out, investors should be able to focus on improving technological “fundamentals” following last week’s Ethereum Merge.

What to pay attention to this week: All about central banks

Wednesday: Fed expectations are for a +75bps rate hike (80% priced vs 20% for +100bps according to CME). It would be unusual for Fed Chair Powell to act against market expectations but those are unusual times and there are signs that forward guidance is being slowly set aside. Speaking of lack of forward guidance, the Bank of Japan will be watched: monetary and government officials have expressed discomfort with the Yen’s cheapness but Governor Kuroda gave no sign of bulging so far. Thursday: Bank of England, +50bps rate hike expected. Swiss National Bank: +75bps expected: Switzerland is about to exit its almost 8-year-long negative interest rate policy (“NIRP”).