What happened last week

Monday: Iran signs memorandum to join the Shanghai Cooperation Organization (SCO). The SCO summit ends with more nuanced communication from China around its relation with Russia. US Sept. NAHB housing market Index 46 vs 47 expected. Japan August CPI 3.0% YoY vs 2.6% expected. China PBoC Loan Prime Rate 3.65% on hold.

Tuesday: German Aug. PPI 45.8% YoY vs 37.1% expected. US Aug. building permits 1.517m vs 1.610m expected. Canada Aug. CPI 7.0% YoY vs 7.3% expected.

Wednesday: Russian President Putin calls up to 300k reservists, announces staged referendums in occupied Ukraine territories, and hints at possible use of military weapons against the West. The European Union finalizes the full text of its landmark “Markets in Crypto Assets” (MiCA) legislation, with a rumored special emphasis on regulating algorithmic stable coins, trading and digital asset issuing platforms, and with inclusion of NFTs. US 30 yr mortgage rate 6.25% highest since Nov. 2011. US Aug. existing home sales 4.80m vs 4.70m expected. US Fed hikes by 75ps to 3.25% as expected; Fed dot plot shows policy rate revised up by 100bps to 4.4% for end-2022 and up 80bps to 4.6% for end-2023; unemployment rate median projection for 2023 up 50bps to 4.4%; core CPI median projection for 2023 up 40bps to 3.1%. Bank of Japan holds its policy rate at -0.1%. Governor Kuroda indicates no change in stance.

Thursday: Japan intervenes by selling FX reserves to prop up the JPY. Swiss National Bank hikes by 75bps to 0.50% as expected. Bank of England hikes by 50bps to 2.25% as expected. US initial jobless claims 213k vs 218k expected. South African central bank hikes 75bps to 6.25% as expected. Australia Flash Sept. manufacturing and services PMIs 53.9 and 50.4 vs 53.8 and 50.2 expected. Singapore Aug. CPI 7.5% YoY vs 7.2% expected.

Friday: Google CEO defends the company’s cost cutting new measures as stemming from a necessity to be “more responsible through one of the toughest macroeconomic conditions”. Hong Kong lifts its mandatory quarantine. UK fiscal announcement (~1% of GDP spent in tax cuts and ~5% in energy subsidies in 2022-23) sends the GBP down by 2.5% and UK 2 yr gilt yield up by 45bps on the day. French Flash Sept. manufacturing and services PMI 47.8 and 53, vs 49.8 and 50.5 expected. German Flash Sept. manufacturing and services PMI 48.3 and 45.4, vs 48.3 and 47.2 expected. UK Flash Sept. manufacturing and services PMI 48.5 and 49.2, vs 47.5 and 50 expected. US Flash Sept. manufacturing and services PMI 51.8 and 49.2, vs 51.1 and 45 expected.

Monday (+1wk): The Italian right-center coalition wins ~40% of the vote, with Brothers of Italy in the lead. German Ifo Sept. Business Climate Index 84.3 vs 87.0 expected, lowest level since May 2020. The Bank of England commented that it “will not hesitate to change interest rates by as much as needed to return inflation to the 2% target sustainably in the medium term.”

Nansen’s take

The cross-currents of war, hawkish central banks, risquées monetary and fiscal decisions in Japan and the UK, respectively, led to markets pricing a global growth “scare” last week. In our prior newsletter, we highlighted the many signs of weakening growth, especially in Europe/ the UK and Asia. Last week, risk asset prices have been catching up with deteriorating fundamentals.

Of notable interest is the asset performance ranking. Lumber futures corrected by 20% week-on-week. This signals an ongoing slowdown in housing, as US mortgage rates reach their highest level since 2008. This slowdown will be felt with a lead of several months in US CPI shelter (estimate ~April 2023, see prior newsletter). Energy dropped further (crude oil WTI down 7.7% week-on-week), signaling that concerns over real growth are starting to overshadow concerns over inflation. US energy stocks also underperformed other sectors last week (S&P500 Energy -11.3% vs S&P500 IT down “just” 4.2%). Energy together with Financials (GS down 8.9%, JPM down 7.8% week-on-week), and Industrials (Boeing -12.7%, Chevron -9.8%, Caterpillar -8.6%) led the sell-off. This stock “rotation” highlights that investors believe central banks' hawkishness (Fed focus remained on inflation in last week’s meeting, with all regional Fed presidents but Evans reiterating the Jackson Hole message).

Interestingly, crypto asset prices outperformed the equity markets mentioned above. It is tempting for an investor to revisit the question of when the Fed is likely to pivot, which is the next logical step of a worry on “growth”.

Looking at sentiment indicators like equity risk premium (ERP) estimates (see chart below), the level of ERP is back to May highs, indicating that equity investor sentiment is in “fear” territory. Considering the longer timeline of this indicator, the recessionary level is not yet reached. US high yield credit spreads present a similar picture (512bps vs last high 599bps in July 2022 and last recession high 1087bps in March 2020). It seems to us that we are entering the phase of slower growth that will at some point likely support crypto, but, patience is warranted as traditional risk assets capitulation is not there yet.

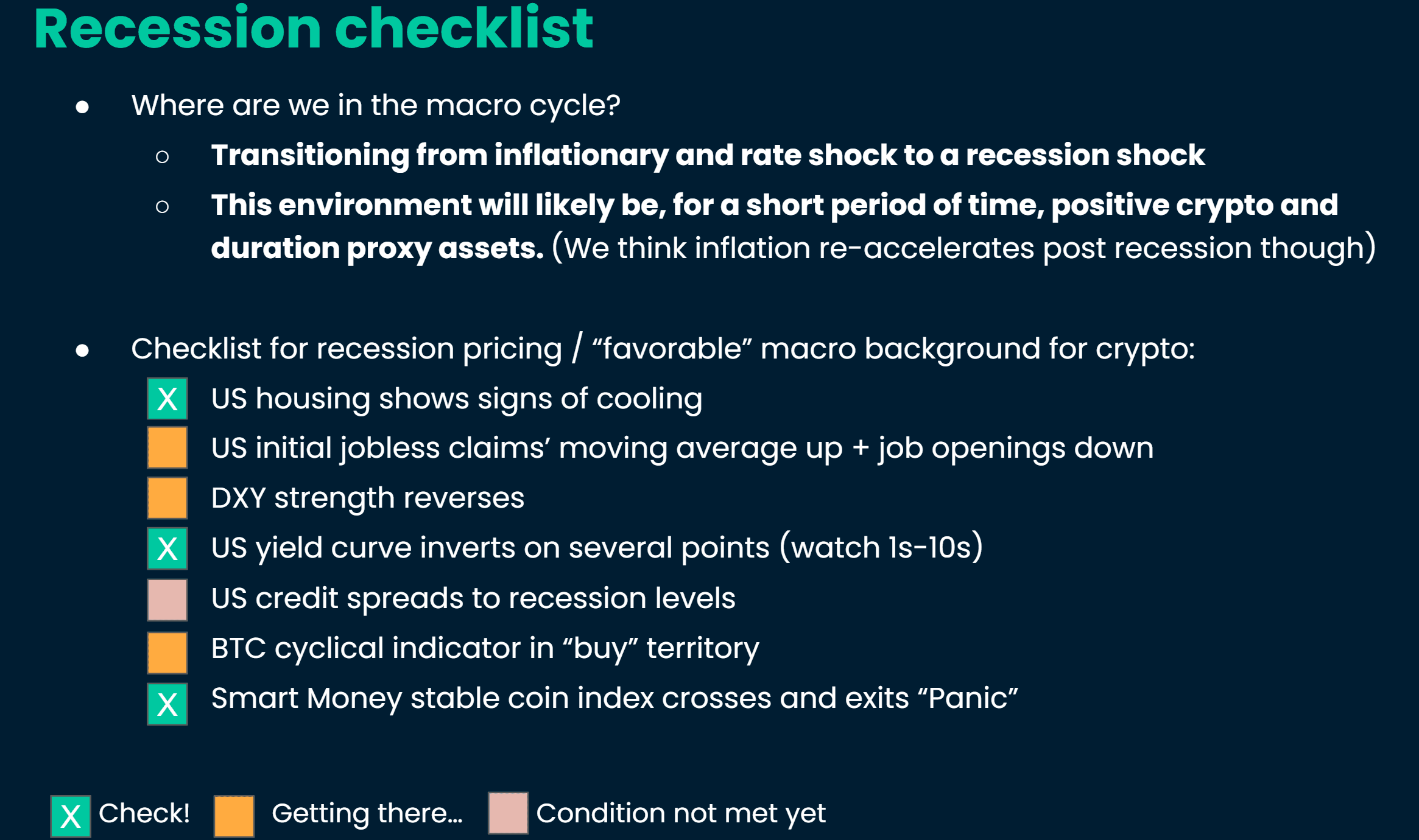

On the macro front, despite ongoing pessimism by American multinational CEOs (Google last week), the highest frequency job data, initial jobless claims, continue to paint a strong picture of the US labor market. In our recession checklist (see below), we highlight the necessary conditions of a US recession We are still missing : peak US dollar, US 1yr - 10yr yield curve re-steepening, credit spreads higher, and initial jobless claims above expectations for a few weeks. These could materialize quickly given the visible signs of macro weakness outside the US, and market stress globally.

A wild card is geopolitics: President Putin is in difficulty and China seems to have subtly indicated less patience towards the ongoing Ukrainian conflict (see this insightful analysis of Chinese diplomatic communication: https://thediplomat.com/2022/09/is-china-breaking-with-russia-over-ukraine/ ).

What to pay attention to this week

Wednesday: ECB President Lagarde and Fed Chair Powell speak. Thursday: German Sept. CPI 9.4% YoY expected. US initial jobless claims 215k expected. US final GDP Q2: -0.6% qoq initial estimate. Chinese September manufacturing and Caixin manufacturing PMIs expected at 49.2 and 50.2. Friday: Indian RBI expected to hike 50bps to 5.9%. German Sept. unemployment change expected at 20m. Eurozone September CPI expected at 9.7% YoY. US August Core PCE Price Index expected at 4.7% YoY.

Charts that matter