Likely too early to call for the end of this bear market

- BTC and ETH are up 12% and 30% respectively from Oct. 13 lows, the S&P500 equity risk premium fell by 1.6%point and bond yields came down

- Investors are re-testing the central bank pivot narrative

- Admittedly, the Bank of England temporarily re-started QE, and the Bank of Canada and the Reserve Bank of Australia stepped down the magnitude of their hikes this October

- Also, important US growth data came below economists’ consensus, such as the conference board consumer survey and US PMIs

- However, the US labor market is as tight and healthy as in the 1990s

- Inflation. Gasoline prices have stopped falling. It is possible that US rents could cool down in Q2 2023, but likely not enough to enable a return to 2% inflation in the US

- The Fed committee members’ main messages have been: 1) Ongoing focus on curbing inflation, 2) Data-dependency over forward guidance, 3) A strong labor market leaves some margin for the Fed to hike

- Geopolitical fragmentation is slow-moving but also likely to contribute to long-term structurally higher inflation

- Given these developments, it is likely too early to call for the end of this bear market

- This does not mean that bear market rallies, as the one we are currently experiencing, cannot occur

- The end of this bear market will likely be associated with a marked macro slowdown (negative real growth) and capitulation in risk assets (equity risk premium, US credit spreads at recession levels)

Charts

Equity option pricing shows investors are no longer as risk-averse

Recent rally in crypto coincided with lower medium and long-term US rates

Slow down in hiking in Canada and Australia gave ammunition to the pivot narrative

Inflation surprised to the upside in many countries, which does not validate the scenario of CB pausing

US gasoline prices, which have driven inflation lower in the US recently, have stopped falling

A correction in US shelter prices in Q2 2023 would help CPI come down, but unlikely to 2%

Exceptionally tight housing inventories might complicate housing dynamics in the US this time

US growth is slowing (but remains more solid than in the rest of the world)

The US labor market strength leaves margin to the Fed to keep hiking

US labor market resilience: testimonies and assumptions

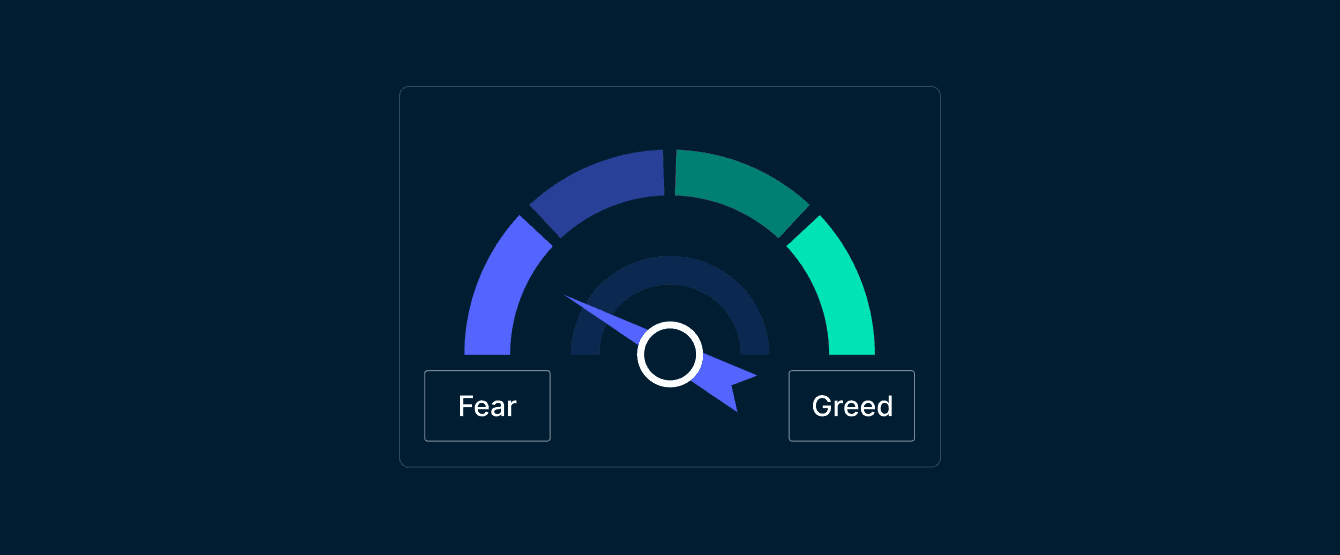

Bitcoin cyclical indicator: Close to risk-on

- Our Bitcoin cyclical indicator recommended to neutralise BTC in February 2021 (hypothetical portfolio of 100% BTC / 0% USDC and vice versa)

- It has not yet moved to “long” BTC but is very close to

- Components: G4 central bank balance sheet growth, US yield curve and Bitcoin market-value-to-realized-value; last data point 28 Oct. 2022

Smart Money Stablecoin indicator

Note: we are using the revised version of the stable coin ratio, which includes withdraw/deposit functions on Ethereum. As a result the estimate of the ratio of stable coins in smart money balances is structurally higher than the original estimate. The new trading thresholds are 6% and 20%; last data point 28 Oct. 2022