Solid growth so far, but the direction of travel is down

Growth in the US and other mature markets remains resilient, as demonstrated by a hefty rebound in leading Services business surveys: the Flash PMIs for the Services sectors ranged from 52+ to 56+ in the US, Eurozone, UK, Australia and Japan. As a reminder, a reading above 50 indicates a likely future expansion of the aggregated Services sector over the coming month.

The strength of Services consumption was equally highlighted in the earnings guidance given notably by airline companies in the S&P 500, with this summer’s travel bookings flagged as very robust.

Outside of Travel & Leisure and Services more generally, growth is clearly slowing. Most mature markets exhibited Flash Manufacturing PMIS below 50, indicating a further contraction in global Manufacturing activity. As pointed out in our prior publications, the monetary and fiscal stimulus in China has so far failed to revive a rebound in global manufacturing and global trade, but, instead, has benefitted Services and Consumer Goods. The French Luxury company Hermès managed to grow its sales by 23% YoY in Asia in Q1 2023 (mostly driven by Chinese sales), even after raising its prices by 7% YTD.

Aside from Manufacturing PMIs, more clues indicate that the direction of travel is down for global growth, namely the grind higher in initial and continuous jobless claims in the US, coupled with firms' testimonies gathered in the Fed’s Beige Book, a publication which gives the temperature of the US economy, district by district. We highlight three quotes from the US firms and business contacts surveyed in the Beige Book:

- “Lending volumes and loan demand generally declined across consumer and business loan types.”

- “A small number of firms reported mass layoffs, and those were centered at a subset of the largest companies. Some other firms opted to allow for natural attrition to occur, and to hire only for critically important roles. Contacts reported the labor market becoming less tight.”

- “Contacts noted modest-to-sharp declines in the prices of nonlabor inputs”

Looking at a static picture of the economy, the US is heading towards a soft landing. But investing is about pricing future economic outcomes, and the latter usually follow non-linear trajectories. We have established that US (and DM) growth is slowing from decent levels, but are unsure about the future developments of this slowdown. The feedback loop of monetary policy will represent a major driver, as fiscal policy will likely remain constrained until the 2024 US elections. To be more explicit: if the Fed holds rates as US growth deteriorates, then the likelihood of a severe downturn increases. Vice versa, if the Fed “flinches” and decides to ease, as bond investors are expecting from Q3 2023 on, this would boost the likelihood of a “shallow recession”. The first scenario is negative risk assets and crypto, the second scenario is positive.

Let us then turn to the analysis of the Fed’s potential actions in the coming months.

Fed and Bond Markets in Alignment Until September 2023

There is a new “Bull” in the FOMC voting committee, Austan D. Goolsbee, president and chief executive officer of the Federal Reserve Bank of Chicago, has joined this year and so far voted in agreement with the rest of the Committee in favor of rate hikes. Following his speech at the Economic Club of Chicago, in May, Goolsbee is likely to vote to hold rates: “I think we need to be cautious. We should gather further data and be careful about raising rates too aggressively until we see how much work the headwinds are doing for us in getting down inflation.”

Goolsbee is likely to be in the minority of the FOMC voters, with most of the members expected to endorse a 25 bps rate hike in May. Indeed, speeches by Committee members Daly and Bullard have highlighted the great uncertainty on lending and growth, but also flagged inflation as still too high. 1) With core inflation ex-rent tracking between 4% and 5% (depending on the metric and lookback period), the Committee will want to secure Fed Fund Rates > core inflation, based on the academic theory that positive real rates are needed to ensure slower inflation. Moving to 5%-5.25% Fed Fund rates makes sense following that logic. 2) We know that the Fed usually guides market expectations (sometimes via unorthodox channels, e.g. the press) and chooses not to surprise: the 25 bps rate hike is already priced by Bond Future markets, 3) Growth and the labor market are cooling but not “falling off a cliff” yet.

More interesting will be the post-May monetary policy decisions: the “high for longer” regime where the Fed holds rates even as growth deteriorates is likely to cover most of 2023 in our view. Bond markets used to forecast rate cuts from June 2023 on but have now postponed cuts to September 2023, thereby getting closer to Fed’s guidance and our view. In the short-term, we expect some volatility in rates. The US April CPI will likely disclose slower shelter inflation, which could seduce investors into pricing a Fed pivot yet again. Ultimately, as long as wage growth persists above 4% YoY and the labor market does not “crack”, a pivot is unlikely.

We highlight that in the UK, Eurozone and Australia (and of course Japan), central banks remain behind the curve with the respective core inflation rates >> respective policy rates. Hence, leaving the US Fed aside, the pricing for rate hikes needs to come up in these countries (bearish US dollar in the next few months, although we could see some USD strength in anticipation of the debt ceiling drama in the short-term).

Equity markets pricing a soft landing

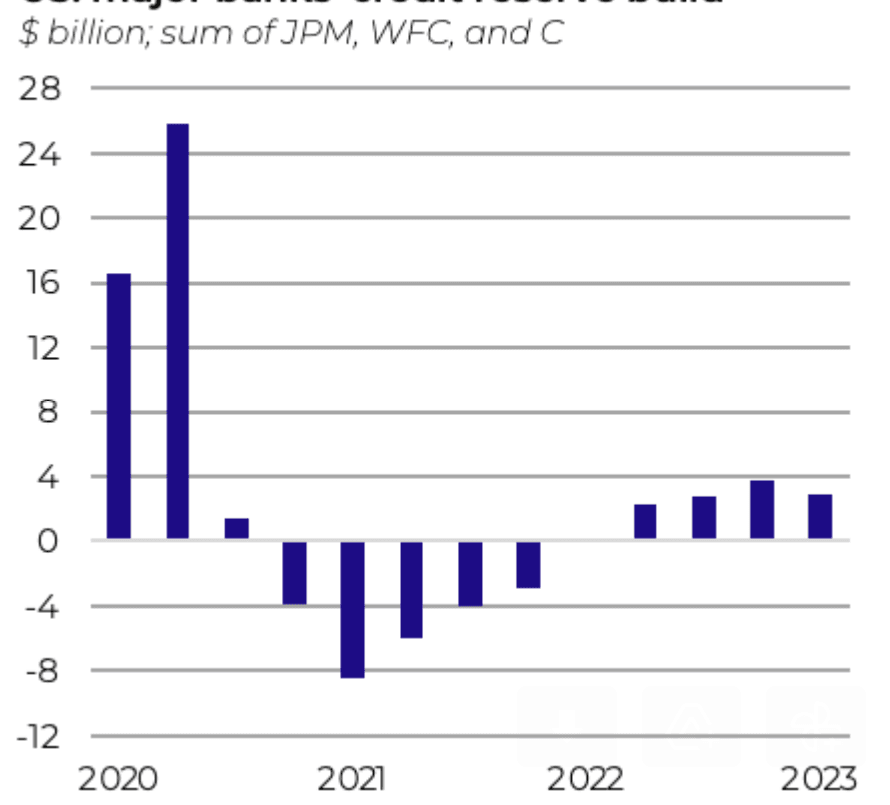

The consensus of economists and investors is overwhelmingly pricing a “shallow recession” or “soft landing”: the large US bank provisions for loan defaults, which tend to rise in anticipation of an economic drawdown, have been creeping up but are still shy of levels provisioned in 2020:

We like to track the equity risk premium (ERP) as a measure of equity investors’ risk appetite. The ERP kept falling year-to-date, indicating complacency by equity investors (the consensus is now that the banking crisis was “idiosyncratic”).

Credit investors’ risk appetite is not as strong but certainly does not project credit stress:

Under the hood of global indices, defensive stocks such as Walmart have started to outperform cyclical stocks like Caterpillar, which shows that an economic slowdown is starting to be priced, although still as a low-probability scenario:

To summarize, growth in the US and Europe is holding up so far, and Chinese demand is helping, but risk premia, credit spreads and investor consensus all appear too complacent. A series of “known unknowns” will strike from May on: poor seasonality (e.g. the statistical phenomenon of risk assets underperforming in May vs the rest of the year), the debt ceiling drama, less tailwinds in fiscal spending, a stubborn Fed etc. Maybe all of these factors will matter and maybe only a few will, but, in any case, positioning and sentiment are not prepared for any major negative surprises.

Crypto: Watch BTC Call-Put spread

Turning to crypto assets, we observe that the tactical BTC call - put spread is very close to risk-off…

... there is no new strong signal from the Smart Money stablecoin indicator…

… while BTC and ETH price momentum remain positive but close to zero. We will monitor these carefully.

From a fundamental point of view, the newsflow has turned less bearish for crypto: the US SEC could still reserve more surprises, but, in Europe, the MICA regulation has passed, lessening regulatory uncertainty. We also highlight the first positive speech in a while by a Fed member on asset tokenization and its potentialitiesl, see Waller’s words: “These efforts are still in early stages, but I expect that as functionality expands with more currencies, eligible securities, and new products, there will be more participation and growth.”

For crypto investors, it makes sense to maintain a careful risk management approach as long as the ambiguity around a future soft vs hard landing persists, while taking advantage of price sell-offs as more asymmetric entry points (we are curious to see if the negative “known unknowns” lead to a crypto sell-off in May).

This week

Tuesday 25 April

- US April CB Consumer Confidence (consensus 104)

Thursday 27 April

US Q1 GDP (consensus 2.0% QoQ)

Bank of Japan’s Governor Ueda first meeting: no change expected but we will scrutinize his rhetoric for any future intention communicated on lifting the yield curve control scheme or enlarging the band

Friday 28 April

German April Flash CPI (consensus 7.3% YoY)

US March Core PCE (consensus 4.5% YoY)

US Q1 Employment Cost Index (consensus 1.1% QoQ)

The US economy is in no-man’s land: bank lending, consumption, employment growth are all slowing but are not indicating a recession yet.

Investors, especially in equity markets, believe in the next oasis, namely in a “soft landing” that would be bullish risk assets.

Because of this optimistic positioning, we see risk management as paramount when dealing with crypto and other risk assets, e.g. being disciplined with entry points and not chasing risk-on rallies seems relevant until we get a little more clarity on whether we are heading towards the next oasis or towards the death valley.