Macro uncertainty

The new US administration’s frenetic issuance of executive orders and declarations is introducing a larger-than-usual dose of uncertainty for the outlook of growth and inflation in the US (as well as globally).

We will first attempt to map out a certain logic in the tariff announcements and intentions so far and then estimate the likely impacts on the growth/inflation mix in the US and the Fed’s policy before turning to crypto market implications in the second part of this note.

There is a certain economic coherence to the Trump administration's “tariff” strategy. Regarding the targeted countries, the list is large but prioritizes countries that hold the largest trade deficits with the US, whether or not they have been historical allies of the US, even including geographical neighbors where value chains are already established (see below).

In terms of products and sectors, if we had to make a short list, it would include, from the “rawest” to the most processed goods (or elaborate services): agricultural products, LNG, metals and aluminum, automobiles, defense equipment & services, pharmaceutical products, semiconductors, AI R&D and intellectual property.

The US’s strategy can be summarized as:

- Increasing the volume and value of its exports

- Pushing foreign companies to invest in the US and install local manufacturing facilities (a policy initiated by the Biden administration, but via subsidies as incentives)

- Containing technological and commercial innovations that benefit other countries, especially China (but also the EU, e.g. ASML)

- Reducing illegal immigration to the US (we will not touch upon the latter, but merely say that it is likely mildly inflationary)

What is the impact on growth? The objectives above, if achieved, are ultimately US-growth-positive and RoW-growth-negative. We do see the path to these as slightly negative for US growth too, though, because of the uncertainty linked to existing supply chains (e.g. auto manufacturers in Mexico) and because of possible retaliations/escalations from the most powerful countries, e.g. China has started to look into some of the US tech giants. Overall even with positive initiatives like deregulation and tax cuts, our intuition is that crypto, equity, FX markets should reflect a higher risk premium for growth uncertainty.

On inflation, tariffs and even re-localization of manufacturing are very likely inflation-accretive. The question is, how sizeable will the impact be? Current disinflation trends in services and housing are helping (see this Wednesday’s January CPI release), but we could see tariffs adding +50bps to +70bps, bringing core CPE to 2.6%-2.8% for 2025.

What this means for the Fed: the Fed is likely to hold rates steady for H1 2025 and probably into Q3 2025 unless there is a weakening in the labor market (not the case so far). Fed Chair Powell is testifying in front of Congress today and tomorrow, but should maintain a “wait and see” guidance. Rates should therefore remain elevated for most of the year.

Current US data show that manufacturing activity is accelerating (“Manufacturers report that political uncertainty has cleared and the pro-business approach from the new administration has brightened their prospects.”, US S&P Mfg. PMI) while services activity is losing some steam. However, the survey was conducted before the tariff escalation, so we will pay more attention to February reports.

As for inflation, regional survey expectations have increased significantly to 2.8% on average on a one-year basis, the long-term expectations remain well-anchored, though.

Likely price action

So far, we have witnessed lower and lower trading volume across crypto pairs, especially on “up days”, highlighting the lack of conviction on price direction, probably a consequence of the macro uncertainty described above.

For BTC, the uptrend is intact, but price action is range-bound:

For ETH, the 200-day moving average is now declining, and the 2.7k price level, the top of the Q4 trading range, is the new battleground.

The SOL/BTC ratio sits at the bottom of its multi-month trading range and is holding for now:

Overall, crypto prices warrant a higher risk premium, in our view. We therefore turn to option markets.

Option strategies

For a linear strategy, we see the most optimal as sitting on risk and waiting for a larger drawdown to add to our crypto allocation.

For more “action”, we consider reflecting what we expect to be a range-bound price action with a downside asymmetry for BTC, in the next four months. Our reading is that this is still a crypto bull market: growth is holding up, the US administration is crypto-friendly, therefore, we do not expect a bear-market-like correction but would like to hedge for a double-digit sell-off.

Buying an out-of-the-money put that protects our BTC exposure against a 20%+ sell-off by June is expensive, costing a premium of 6% of notional.

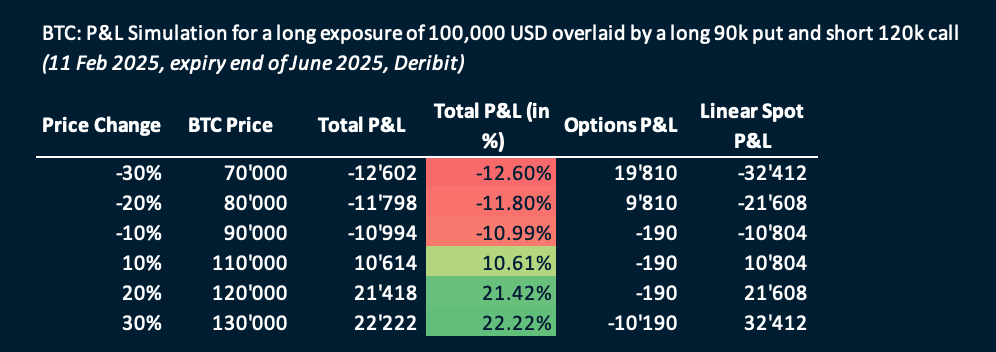

We turn to the following structure to overlay our linear BTC exposure (BTC is trading around 100k spot as we write): long a BTC put at 90k strike to hedge 10% sell-offs, and short a 120k strike call to finance the put, meaning we are giving up a potential BTC upside of over 20%, as we see this market as range-bound in the next four months.

This combination (June 2025 Structure short 120K Call / long 90K Put) brings our premium close to zero, making it quite cost-efficient, and with the following features:

- Premium: -0.19% of notional

- Vega: +0.45% of notional per 1% vol change -> benefits from vol increases

- Delta: 8.04% of notional (very slightly positive delta)

Below is a P&L simulation if we overlay this structure with our linear long BTC exposure: