Introduction

Yesterday, President Trump announced the new imposed levels of reciprocal tariffs, per trade partner. Here is a quick note that summarizes what surprised markets, followed by a suggested strategy for crypto and risk assets. This builds upon the note we published two days ago.

Retaliatory tariffs: The bad

- President Trump was always going to open the negotiation forcefully, but still managed to surprise markets negatively.

- The minimum reciprocal tariff rate of 10% is higher than expected, ensuring that most countries will undergo double-digit tariffs across their US exports.

- Asian exporters, or most of the Chinese delocalized supply chain, appear as the relative “losers” following this first tariff announcement. With respective announced reciprocal tariffs of 34%, 24%, 46%, 25%, 36% China, Japan, Vietnam, South Korea, and Taiwan could end up with post-product-exemption rates of close to 50%, 20%, 46%, 16%, 28%.

- For the Eurozone, announced reciprocal tariffs of 20% could result in post-exemption tariffs of 14%.

- The implementation timeline is lightning fast this time (auto tariff playbook): April 5 for the minimum additional tariffs of 10% and April 9 for the higher individual additional tariffs. “Strike first, negotiate after” seems to be the strategy.

The ambiguous

- There are exemptions on already tariffed products, such as steel and aluminium products and automobiles, but also on “strategic sectors”: pharmaceuticals, semiconductors, lumber, and copper that are under study for future “sectorial” tariffs. We think that the US might try to achieve other goals than pure tariffing for those, e.g. try and repatriate pharma fiscal revenues and intellectual property to the US, re-localize semiconductor production.

The good

- Canada and Mexico are faring relatively better: no new additional tariffs, and exemptions of tariffs if goods are part of the USMCA. Aggregate tariff rates in the single-digits for both countries. The best case would be if other countries end up experiencing the Canada/ Mexico playbook (started rough but settled in), although this might be too optimistic a view.

- The UK, Singapore will likely end up with aggregate tariffs < 10%. Singapore could be used as a port of exports for Asian manufacturers in the future.

Risk assets and crypto

“As long as you don’t retaliate, this is the high end of the number.” declared US Treasury Secretary Bessent after the Rose Garden announcement, implying that the US is open to negotiate initial tariff levels down. Now is probably the worst of the tariff uncertainty, at the same time, the negotiation is likely to linger: these are a lot of countries with often complex economic topics at stake. The Eurozone (even with President Macron flexing his rhetorical muscles), said it had opened the dialogue on various topics such as digital taxes, food regulatory standards, and potential military and LNG imports from the US. Japan said it would not retaliate but try to negotiate too, while providing fiscal support to its exporters.

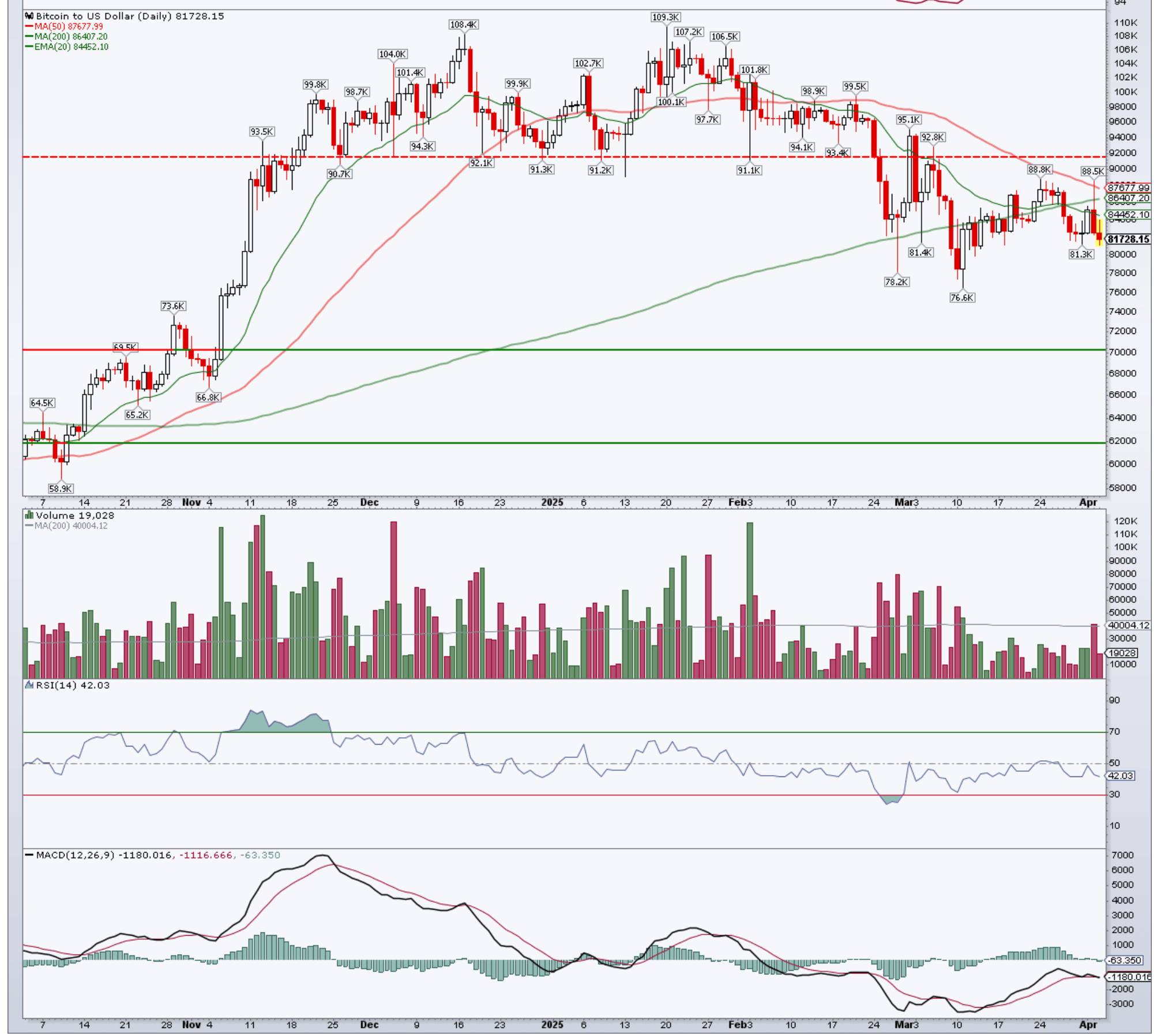

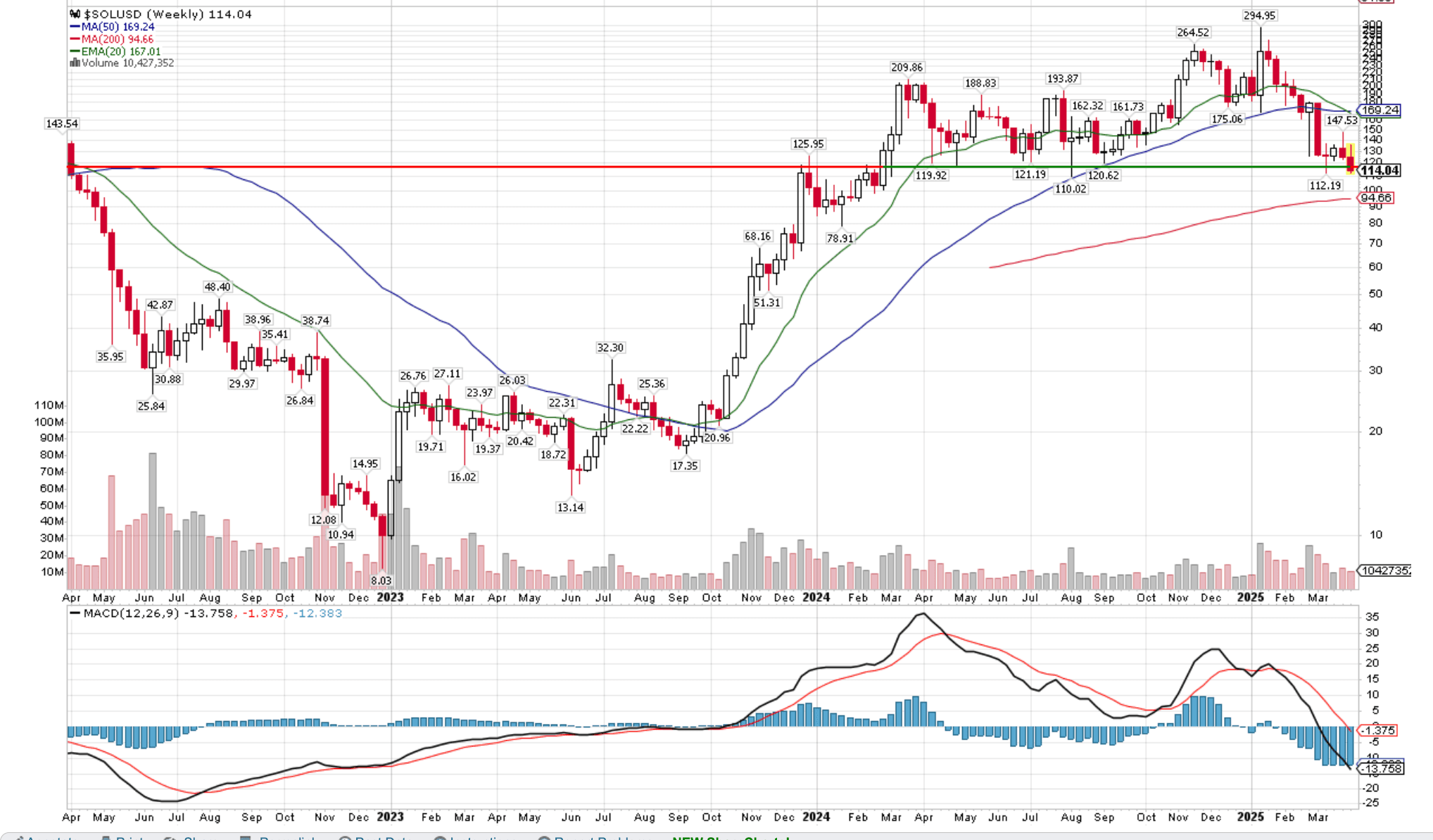

This is all very constructive and polite so far, yet, for investors, “patience is a virtue”, and it seems to us asymmetrically rewarding to wait and see, rather than try and catch crypto asset “falling knives”.

Additionally, the macro data we received so far this week only comforts us partially about US growth: averaging ISM Manufacturing and Non-Manufacturing barely brings us to 50, on the verge between expansion/ contraction, and, the jump in the ISM Manufacturing Price sub-index, to 69.4, brings us back to July 2022 at a time when US inflation was much more volatile. It does all smell a bit like stagflation. Next stop, the labor market data on Friday (ADP employment data was encouraging, but the Challenger survey did show some pick up in layoffs in the auto, retail, and tech sectors). On Friday, Fed Chair Powell will have the difficult task not to disappoint rate markets, which now expect 3.6 Fed rate cuts by December 2025 (“Is inflation transitory, dear Chair?”).

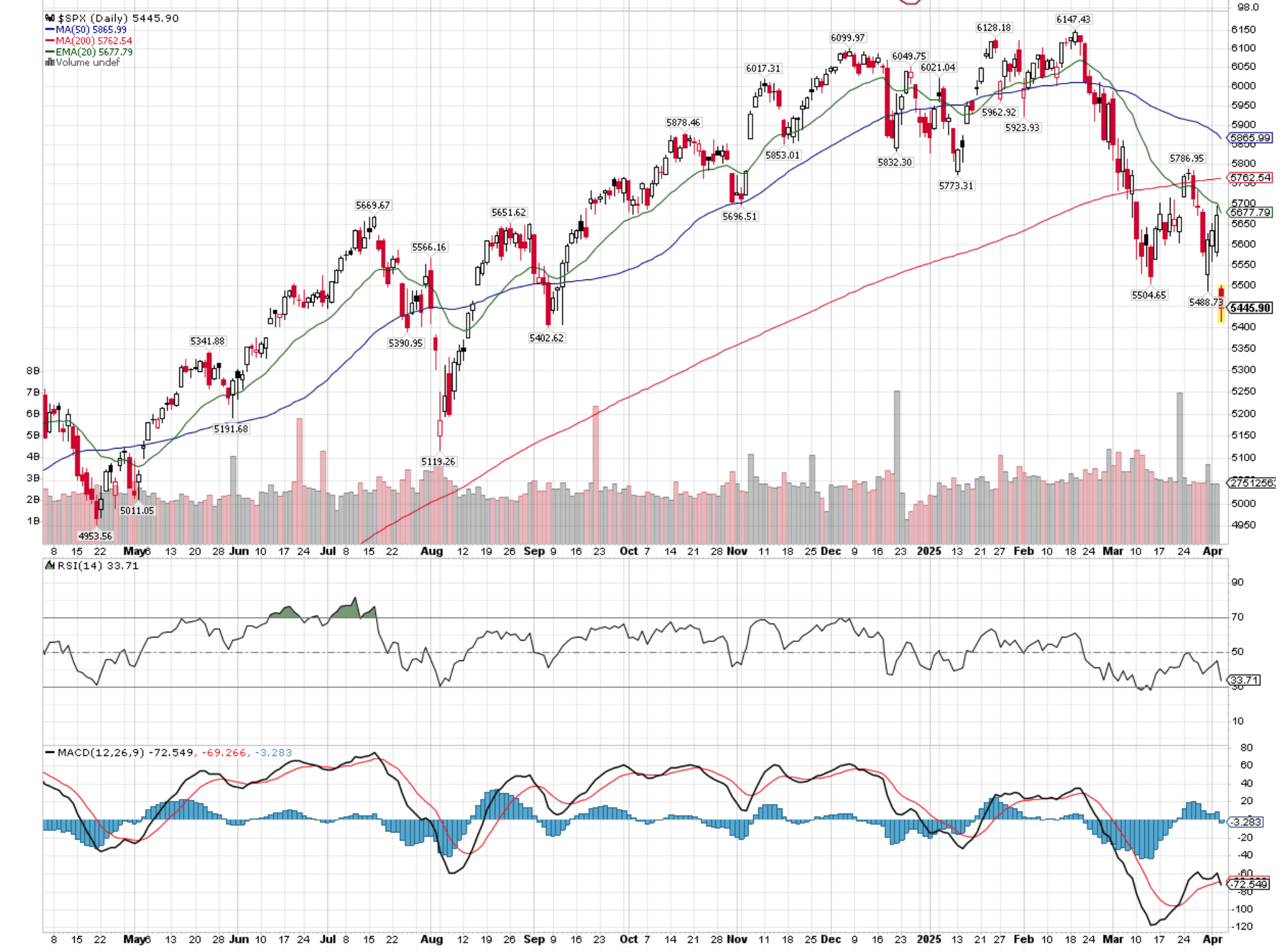

Don’t fight the tape

Post-reciprocal tariff announcements, US equities led the sell-off, especially US Small Caps, followed by Japanese equities and Eurozone equities. The EUR/USD surged by over 1% and the DXY weakened vs most currencies, the US yield curve bull flattened (the 10yr rate fell more than the 2yr). Apple and consumer stocks that rely on the Asian supply chain underperformed. The message from markets is clear: tariffs are bad for the targeted countries, but are also very bad for the US (uncertainty + stagflationary fears). We also suspect that unloading of heavy positioning in US stocks continued.

Technically, dead crosses are approaching for US equity indices and for BTC daily charts. SOL’s weekly chart is breaking a key support level. Let’s not fight the tape, and wait for more silver linings on the macro, the Fed, and tariff negotiations. Good luck…