Let’s dive in on what to look for to understand future price trajectory.

Growth: Worries about the consumer and private investment

Investors and economists are worried about private consumption which makes up 66% of the US growth. There are three sources of concern: What if tariff-driven inflation eats into real income? What if the consumer is too worried to spend significantly? What if the stock market correction affects household assets too negatively?

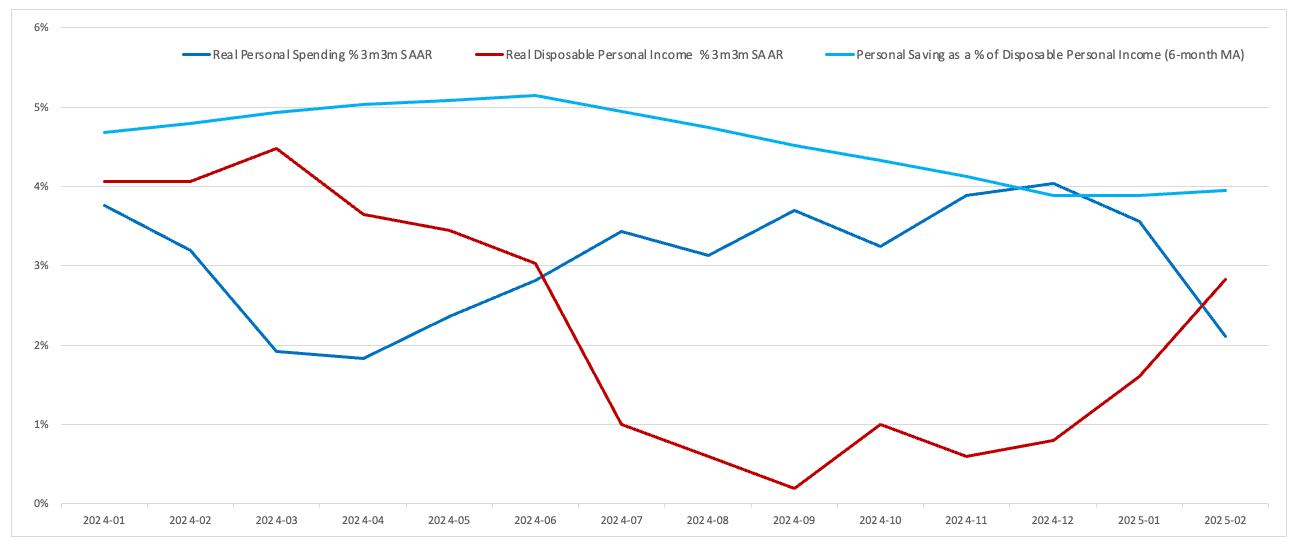

On concern #2, confidence and spending, we are seeing signs that a downbeat consumer (Conference Board Confidence Survey published last week at 8th 10-year percentile) started to put a break on spending: on a 3m3m% annualised basis, real private spending decelerated to 2.1% in February, from 3.6% and 4.0% the prior months. This is still a high level, but the question mark is around the extent of a further slowdown (level vs. dynamic).

On concern #3: US households’ equity wealth represented about 6.5x their income as of end-2024, according to the Fed. The S&P 500’s peak-to-trough sell-off year-to-date was -11.6% so far. We would expect that this makes the more asset-rich households a bit cautious, without restraining consumption too significantly. Of course, there is an important negative feedback loop here if US equity markets continue to correct.

On concern #1: So far real disposable income is quite strong (and has re-accelerated as households have increased their saving rate). Yes, tariffs will likely push core inflation closer to 3% YoY in 2025, but households should be ok as long as the job market is “chugging along” and labor income growth can match inflation.

-> What to look for this Friday on Employment: A March non-farm payroll number between 139k (economist consensus) and 191k (6-month average) combined with an unemployment rate < 4.3% would be interpreted positively for the prospect of US employment (“good news is good news” is market set up at the moment given growth concerns).

Moving on to the other area of uncertainty, business investment. Last week, we flagged that neither the flash PMIs nor the regional Fed surveys’ business capex intentions were flagging a significant slowdown in capex.

We will add the latest Atlanta high-frequency capex tracker below. It shows that the two largest sources of investment, equipment and intellectual property, have steady to slightly accelerating growth.

-> What to look for this Tuesday and Thursday on the ISMs: We do expect the Manufacturing ISM to dip below 50 because of a payback effect following tariff anticipation in prior months (frontloaded production/ exports). It is critical that the ISM Non-Manufacturing index can balance this out by staying in the 52-54 range.

Tariffs: “Lenient” negotiations or lingering uncertainty?

In the last few trading days (with some notable stabilization on Monday’s US session bucking the trend), US equities and crypto sold off further.

Two elements are likely spooking markets: the 25% auto tariffs were announced on March 26th for an implementation on April 3rd, with no significant time or room for negotiations. There will probably be some more space for concessions on auto parts’tariffs, though (implementation targeted in May). Yet, this precedent goes against the narrative of tariffs as a negotiation tool.

The anticipation of reciprocal tariffs’ details being released on April 2 is another source of worry: President Trump tends to “start strong” in negotiations (e.g. he promised to consider non-tariff barriers such as Domestic Added Value Taxes to quantify imposed tariffs). At the same time, at the worst of the S&P 500’s sell-off last week, President Trump promised a “lenient” approach to reciprocal tariffs.

All in all we stay constructive in the sense that we do not expect the US administration to work against the US economy for too long. We also found out there is a certain threshold of tolerance on the stock market’s selloff and a dependency on “popularity” numbers for the President.

This brings us back to our main scenario (still 70%): once the toughest part of the negotiation is behind us, we see a cleaner opportunity for crypto and risk assets to finally mark a bottom (sometimes between now and June).

_-> What to look for between now and June: We want to see evidence of constructive negotiations, concessions, other countries lowering their trade barriers and tariff rates, especially for the largest economies e.g. Eurozone, Japan (China is on a separate track for now).

Fed: Policy in times of stagflation

Fed Chair Powell will be on the wire this Friday to share his economic outlook. His latest FOMC press conference’s message was that, in a stagflationary environment (lower growth higher inflation) the Fed would cut. Since then, FOMC voters have delivered individual speeches mostly stating that they were concerned about inflation but saw the economy as still solid (more hawkish).

_-> What to look for in Powell’s speech on Friday: We would like to hear Fed Chair Powell reiterate his FOMC’s press conference rather dovish stance, e.g. concerns over growth will be prioritized and the Fed will be comfortable with cutting rates even with core inflation close to 3% YoY (the FOMC’s latest forecast was for 2 rate cuts this year with core PCE at 2.8%).

Market psychology

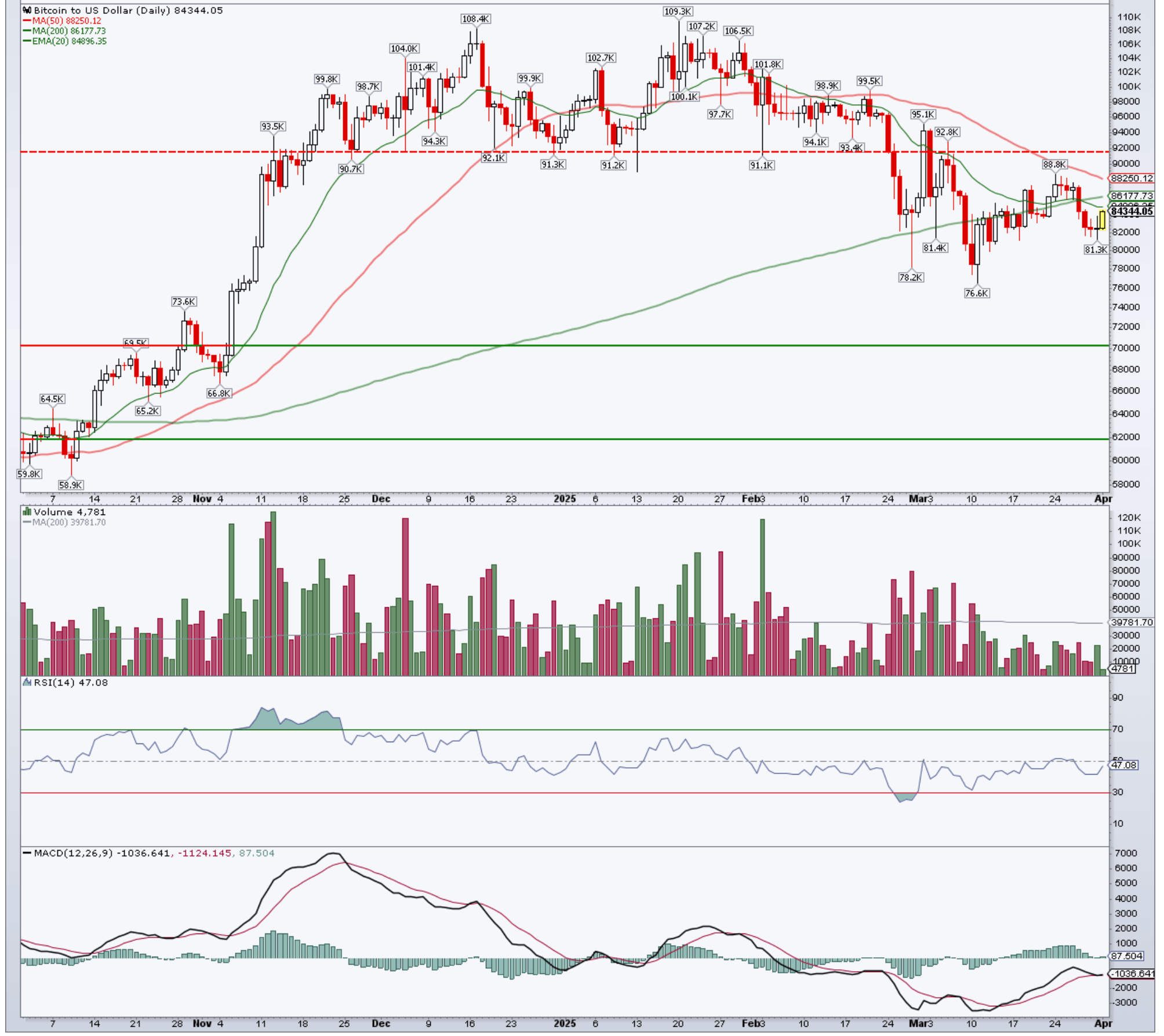

There has been a very tentative stabilization in market prices and flows, marked by a streak of BTC ETF net inflows and some resurgence of activity on Solana, notably via memecoin trading (Solana fees up 50%+ over the past 7 days).

That said, technical indicators are not really that encouraging yet: for the main US equity indexes and for BTC, the respective price charts failed to resurface above their 200-day moving averages significantly, while lower-lookback price moving averages are falling.

For most altcoins, the sell-off is more advanced with daily moving averages having formed dead crosses:

Fragile market psychology highlights the necessity of “good news”, mainly on US growth and on tariffs.

Good luck!