Introduction

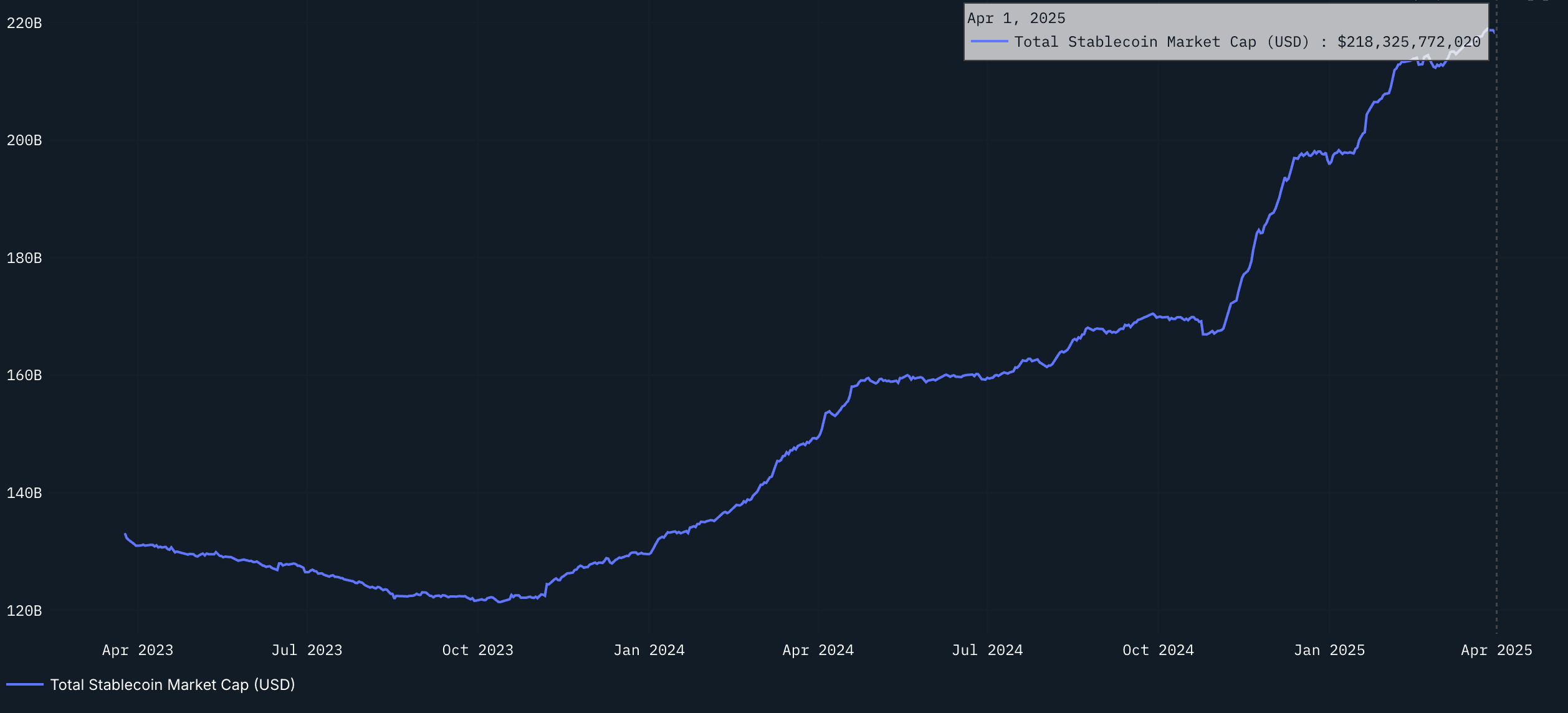

Stablecoins have evolved from fringe utility to core infrastructure in the digital asset ecosystem. As of February 2025, more than $218 billion in fiat-backed stablecoins are in circulation, powering everything from centralized exchange trades to DeFi protocols.

Yet this rapid growth has outpaced regulation, prompting concerns around consumer protection, systemic risk, and the U.S. dollar’s role in a digitizing economy. In response, U.S. lawmakers introduced the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act in March 2025. The legislation proposes a federal framework for licensing, oversight, and reserve management of stablecoin issuers, effectively laying the groundwork for a regulated digital dollar market.

This research note outlines the bill’s core provisions, explores its implications for crypto-native projects and investors, compares it to the EU’s MiCA regulation, and considers where capital may flow as the regulatory perimeter gets delimited.

What the STABLE Act Proposes

At its core, the STABLE Act establishes a legal and supervisory structure for stablecoins. It defines these instruments as digital tokens denominated in national currencies and redeemable at a 1:1 rate. Only certain entities would be permitted to issue them:

- Federally chartered banks or credit union subsidiaries

- Licensed nonbank institutions under the Office of the Comptroller of the Currency (OCC)

- State-chartered entities meeting equivalent standards to federal rules

To protect users and maintain monetary integrity, the bill imposes a strict full reserve requirement: stablecoins must be backed entirely by cash, central bank balances, short-term U.S. Treasuries (≤93 days), or overnight Treasury repos. Riskier instruments, such as corporate debt or algorithmic collateral, are excluded.

These constraints prioritize liquidity and transparency but also narrow the economic model for stablecoin issuers. Without access to riskier, higher-yield instruments or the ability to pay interest to users, issuers must operate on lean margins. For smaller issuers or crypto-native startups, the capital and operational costs of compliance may become a meaningful barrier to entry, not to mention the difficulty to obtain a license and then garner adoption.

Issuers must publish monthly reserve disclosures, with CEO or CFO attestations akin to Sarbanes Oxley standards. Redemption at par must be honored on demand, but stablecoins remain uninsured, there are no FDIC guarantees. Critically, the bill bars issuers from paying interest, keeping stablecoins positioned as transactional tools rather than yield bearing instruments.

Only licensed issuers may offer new stablecoins after the bill becomes law, and intermediaries (e.g., exchanges or custodians) may only handle compliant stablecoins after a two-year transition period. A reciprocity clause allows certain foreign-issued stablecoins if their home regime is deemed “comparable” by the U.S. Treasury and they agree to oversight terms.

The Act also establishes a dual regulatory track by allowing both federal and state-chartered issuers to participate, provided that state regimes are deemed “substantially equivalent” to federal standards. While this offers room for innovation at the state level, particularly in crypto-forward jurisdictions like Wyoming or Texas, it may also create competitive friction or artificial caps. Earlier drafts proposed a $10B issuance threshold before mandatory federal oversight, a provision that could inadvertently suppress growth or force premature scaling transitions, though it is not present in the House’s current version.

Expected Impact Across the Crypto Ecosystem

If enacted, the STABLE Act would fundamentally reshape the stablecoin market in the U.S., forcing a migration from unregulated models to bank-like structures. For investors, the shift has clear implications across several layers of the ecosystem:

Stablecoin Issuers

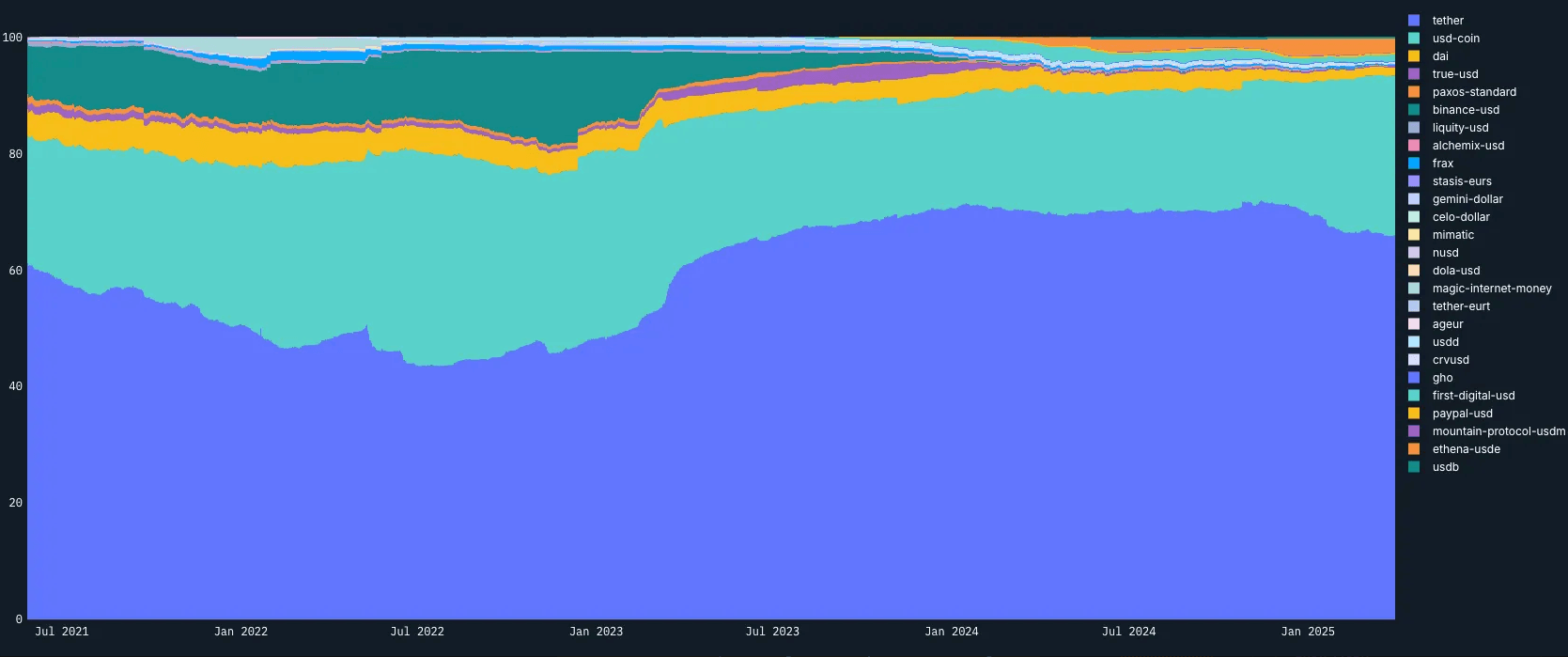

The regulatory bar will rise sharply. Firms like Circle (USDC) and Paxos (issuer of PayPal’s PYUSD) are already aligned with many of the Act’s provisions, monthly attestations, state charters, and high-quality reserves and are well positioned to pursue federal licenses. Circle, in particular, could benefit if it secures access to Federal Reserve accounts, reducing counterparty risk and solidifying institutional credibility. Note stablecoin marketshares below.

Tether, by contrast, would face material headwinds. USDT’s offshore structure and mostly but not fully fiat backings are incompatible with the STABLE Act’s requirements. Unless Tether complies or operates via a deemed comparable foreign regime, it may be delisted from U.S. exchanges after the transition window. With that said, there have been some developments for Tether, and even if they do get “kicked out”, developing markets are where their main interest are and have been.

While larger firms may benefit from first-mover advantages, the overall effect of the STABLE Act could be a consolidation of market share among a handful of regulated issuers. The compliance overhead, licensure, audits, and reserve composition constraints effectively tilt the playing field toward institutions with preexisting relationships with federal regulators. Smaller or decentralized stablecoin projects may face a temporary issuance freeze under the STABLE Act, particularly for those backed by crypto assets. However, the legislation requires regulators to study these models and deliver a report within one year a relatively short window by regulatory standards suggesting that policymakers are keeping the door open for future frameworks that could legitimize non-payment or decentralized stablecoins as a next phase of innovation.

At the same time, the Act enhances the legitimacy of regulated stablecoins, which could increase global demand for compliant USD denominated tokens. This presents a dual edged outcome: while U.S. stablecoins may strengthen dollar dominance abroad, overly restrictive requirements may also drive some innovation offshore or into unregulated DeFi channels, reintroducing risk in less visible forms.

Crypto Exchanges and Custodians

Platforms serving U.S. users will be forced to adapt. Only approved stablecoins can be offered post-implementation, meaning exchanges like Coinbase and Kraken, already skewed toward regulated assets, may consolidate their stablecoin offerings. Binance, which previously sunset BUSD due to regulatory friction, may need to revisit its stablecoin strategy under new licensing pathways.

Custodians will also face compliance obligations: monthly audits, reserve segregation, and restrictions on asset reuse. For these firms, regulatory clarity could be a tailwind, enabling deeper integration of stablecoins into account services, payments, and cross-border settlements.

Exchanges may also experience a temporary decline in stablecoin diversity during the transition period. If high-volume stablecoins like USDT fail to meet regulatory requirements, or if their issuers opt not to pursue compliance, exchanges could face liquidity fragmentation if USDT gets kicked out of the U.S. or short-term volatility in non-legalized stablecoin pairs. The STABLE Act’s two-year implementation window is intended to smooth this process, but there is a risk of user confusion or premature capital flight if delistings begin before clear alternatives are adopted at scale.

DeFi Protocols

While the STABLE Act doesn’t directly regulate non-custodial DeFi, the knock-on effects are significant. Protocols that rely on stablecoins, whether as collateral, settlement assets, or trading pairs, will need to assess the viability of continuing to support non-compliant tokens like DAI (if not brought into compliance). Conversely, DeFi applications that lean into regulated stablecoins (e.g., USDC, PYUSD) may be better positioned to attract institutional users or TradFi partnerships.

The bill also affirms that issuing on public blockchains does not disqualify a stablecoin from licensure, which may encourage multi-chain deployment of regulated assets.

The requirement for fiat-backed, fully reserved assets effectively excludes algorithmic or crypto-collateralized stablecoins from the definition of "payment stablecoin." As a result, protocols built around DAI or other decentralized models may find themselves cut off from compliant infrastructure, exchanges, custodians, or fiat on-ramps unless those stablecoins re-architect toward regulatory alignment. This creates friction between the ethos of decentralization and the expectations of financial stability, raising long-term questions about composability and user demand across the DeFi stack. At this point in time, the STABLE act focuses on payment stablecoins, not allowing potential legal stablecoins such as the USDC to produce yields, whilst giving non-algorithmic stablecoins some momentary leeway. Algorithmic stablecoins are still as mentioned still banned during the next two years as per the section “Endogenously collateralized stablecoins”.

End Users

Retail and institutional users alike may benefit from stronger consumer protections and redemption guarantees. That said, the choice may narrow. Niche or experimental stablecoins could disappear from compliant platforms, reducing the diversity of instruments available. Increased KYC requirements around issuance and custody may also reduce privacy for users accustomed to self custody and pseudonymity.

Over time, regulated stablecoins may resemble digital checking accounts: secure, transparent, and subject to standard AML or KYC obligations. While this could invite institutional adoption and reduce systemic risk, it may also erode some of the open, permissionless characteristics that initially drove stablecoin popularity, particularly among privacy-conscious or debunked users. With that said, it is likelt that the majority of users will be happy with the outcome of regulated and centralized stables given it opens the doors for cheap and fast transactions with near immediate settlement.

MiCA vs. STABLE Act

Europe’s Markets in Crypto Assets (MiCA) regulation, which came into effect in 2024, provides a useful contrast. MiCA imposes similar reserve and transparency requirements and also prohibits yield-bearing stablecoins. However, it caps the issuance of non-EUR stablecoins and centralizes supervision under the European Banking Authority.

In comparison, the STABLE Act reflects the U.S.’s dual regulatory model, allowing issuers to access both federal and state pathways and enabling the broader issuance of USD-backed stablecoins. It also introduces mechanisms for international reciprocity, meaning a MiCA-compliant EUR stablecoin could be accepted in the U.S. under Treasury approval.

The strategic divergence is subtle but meaningful: the U.S. model privileges dollar dominance via private sector stablecoins, while Europe pursues a digital euro simultaneously. Unlike MiCA, which places a ceiling on foreign currency stablecoins in the EU and subjects all issuers to a unified regulatory authority, the STABLE Act offers structural flexibility. Issuers can choose between federal and qualifying state charters, though the path to compliance may still be complex and capital intensive.

This divergence also underscores geopolitical competition in digital currency standards. The U.S. approach prioritizes optionality, market incentives, and the global circulation of dollar backed assets, whereas MiCA leans into monetary sovereignty and tighter constraint of non euro stablecoins. The outcome may influence how stablecoins scale globally, favoring the U.S. in institutional dollar denominated rails, while reserving Europe for more controlled monetary flows.

What the Bill Leaves Unaddressed

The STABLE Act draws a tight regulatory circle around fiat backed stablecoins but leaves other areas of crypto untouched:

- Native cryptocurrencies like Bitcoin and Ether

- Nonfiat pegged value tokens (e.g., gold-backed coins or algorithmic stablecoins)

- Tokenized bank deposits or money market fund shares

- CBDCs (central bank digital currencies), which are explicitly excluded from this regime

- Noncustodial DeFi protocols and smart contracts

Excluding algorithmic stablecoins and DeFi native instruments may lead to the emergence of parallel ecosystems. If compliant stablecoins become too restrictive or slow-moving, user demand may shift toward unregulated alternatives, raising new policy and enforcement challenges. This is to say that users that have nothing to hide will welcome regulated stables, while if you wish to hide money flows or earn yields, you will head elsewhere. Some of these assets may re-emerge offshore, in DeFi protocols, or in peer-to-peer networks operating beyond the direct purview of U.S. authorities. This could also drive more demand toward bridges, wrappers, or rollups that blur geographic accountability. Given the 1-year timeframe for a report on algorithmic stablecoins and other unregulated alternatives not included in the current STABLE act, it would be fair to say that these will see regulation sooner rather than later.

Additionally, the Act does not address how the U.S. stablecoin framework interacts with a potential future CBDC. Proponents argue that a strong private stablecoin regime could negate the need for a digital dollar, while others believe only a public option can ensure accessibility and long term resilience. For now, the Act positions regulated private stablecoins as the default infrastructure for a digital dollar economy, but that assumption may be tested as global monetary systems evolve.

Strategic Positioning: Where Capital and Opportunity May Shift

For crypto investors, the STABLE Act signals both immediate and structural realignments in how capital flows through the digital asset ecosystem. At the core of this shift is regulatory clarity, which tends to favor well capitalized, compliance ready entities across both crypto native and traditional financial sectors.

On the crypto side, market share will likely concentrate on fully compliant stablecoin issuers. Projects such as USDC (Circle), PYUSD (PayPal or Paxos), and GUSD (Gemini) already meet many of the Act’s requirements and may capture increased institutional demand. Exchanges and DeFi protocols are expected to realign their stablecoin integrations, potentially phasing out non-compliant tokens or algorithmic models that fall outside the permitted scope. As collateral preferences shift, this could reshape activity across lending markets, automated market makers, and stablecoin settlement layers.

The bifurcation between compliant and non-compliant stablecoins will become more pronounced, especially within regulated U.S. platforms. This dynamic may not eliminate experimentation but could push less regulated stablecoins to the margins, limiting their utility in mainstream financial flows.

In parallel, traditional financial institutions may emerge as key beneficiaries of the new regime. The STABLE Act allows banks and trust companies to issue stablecoins directly or act as reserve custodians. This could drive new deposit inflows and fee-based services tied to digital asset infrastructure. Treasury markets may also see a boost as issuers park reserves in short-duration government debt to meet liquidity requirements.

However, this concentration also raises questions about long term market structure. The STABLE Act’s strict requirements could unintentionally entrench incumbents, particularly those with TradFi heritage or strong regulator access. Startups may find it prohibitively expensive to launch new stablecoins without partnering with a licensed trust or bank.

Payment networks, including Visa, Mastercard, and PayPal, stand to expand stablecoin-based settlement solutions under clearer legal protections. Meanwhile, audit firms and custody providers could see increased demand from issuers seeking to satisfy reserve attestation and segregation requirements. While there is no direct equity proxy for “stablecoin infrastructure,” firms operating in adjacent services, compliance, custody, and transaction processing are well-positioned to gain relevance as regulated stablecoin volumes grow.

Looking ahead, the real growth may occur around stablecoin infrastructure, settlement APIs, compliance software, and attestation as a service rather than the tokens themselves. As regulated stablecoins become more integrated into e-commerce, remittances, and institutional flows, the firms offering the rails, not just the assets, could capture an outsized share of the economic upside.

Nitpicking Session

We’ve made several interpretations throughout this note about how the STABLE Act could reshape the stablecoin market but it’s worth stepping back to consider counterpoints and where those assumptions might not hold up under closer scrutiny.

The STABLE Act brings much-needed regulatory clarity, but it’s not without complications. It’s easy to view the bill as a green light for institutional adoption, but the reality is more nuanced. Yes, clearer rules may attract banks and big tech firms like PayPal or Visa, but the price of entry just got a lot higher especially for startups or decentralized teams without legal teams and banking relationships.

Risk doesn’t vanish under regulation, it often just moves. If fewer stablecoins can trade on U.S. venues, users may migrate to cross-chain bridges or wrappers like Wormhole, LayerZero or Synapse to access liquidity elsewhere. These tools are powerful but have also been major attack surfaces in recent years. Regulatory fragmentation could unintentionally increase dependence on this less transparent plumbing.

There’s also the question of what happens to decentralized options like DAI or crvUSD. If they don’t fit the new “payment stablecoin” label, do they lose access to major apps or fiat onramps? Or do they double down on alternative rails outside the U.S.? A split ecosystem regulated tokens in one corner, decentralized ones in another might be the outcome.

And finally, even if institutional adoption does rise, who benefits? Probably not the teams building wallets or composable protocols. The upside may go to banks, trust companies, and custodians managing reserves or offering compliance tooling. While this shift risks turning stablecoins into another gatekept product stripping away some of the openness that made them valuable it also unlocks a massive benefit: fast, low-cost cross-border payments at scale.

So yes, it’s progress, but whether it’s the kind of progress crypto actually needs is still an open question.

Conclusion

The STABLE Act lays the foundation for a more mature, institutionally viable stablecoin market in the U.S. By enforcing strict reserve standards and licensing requirements, it delivers long awaited regulatory clarity, especially for firms like Circle, Paxos, and traditional financial institutions already aligned with compliance expectations. While the STABLE Act introduces long-awaited regulatory clarity that could boost institutional adoption and enhance cross-border settlement efficiency, its strict requirements also constrain design flexibility and increase compliance cost, and it is difficult for smaller places to get a license, making the outlook more complex than fully bullish.

However, the framework also introduces meaningful headwinds. The exclusion of interest bearing models and non fiat collateral limits stablecoin design flexibility and squeezes issuer margins. As regulatory costs rise, smaller projects may struggle to compete, accelerating market consolidation and entrenching incumbents. This trend is likely to benefit well capitalized, regulator aligned firms, while pushing more experimental or decentralized models to the margins or offshore.