Regulatory developments and implications for crypto

1. Areas of crypto under regulatory scrutiny: stablecoins, yield products, roles of exchanges and NFT platforms

The increased regulatory scrutiny, and the emphasis on stable coin regulation, “yield” products, and the role of exchanges come as no surprise. Those themes were flagged last September in the White House’s Framework for Responsible Development of Digital Assets.

What are the crypto areas under special scrutiny?

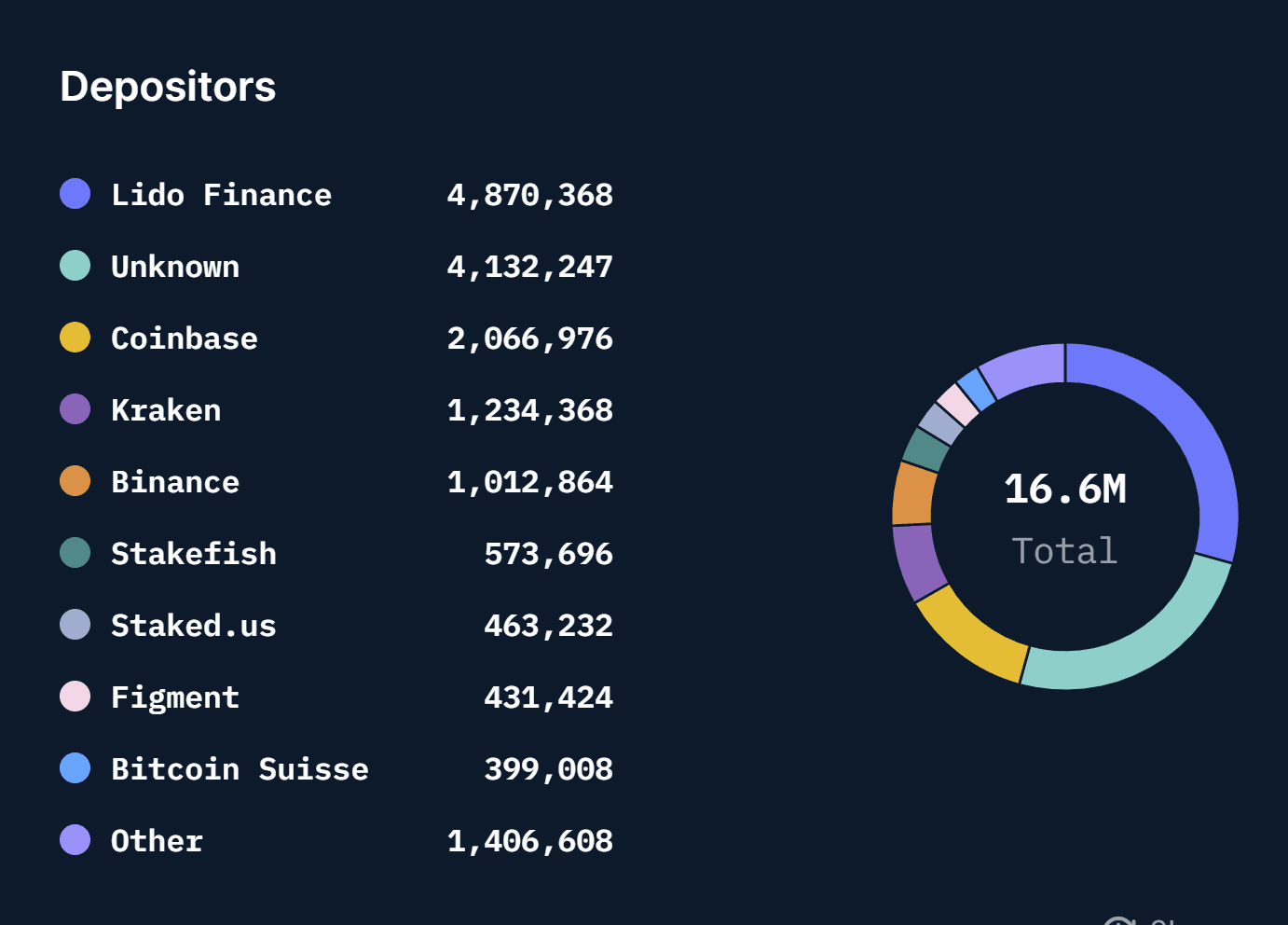

Crypto lending products where the intermediary charges a fee and/or has a say in the allocation of the investment yield have been primarily targeted by SEC legal action in the past year. Aside from receiving fines for “unregistered operations”, the entities usually had to end the activity or product under litigation:

- February 2023: Centralized exchange Kraken is charged USD 30m and shutting all of its US staking services

- January 2023: Gemini is charged for its Gemini Earn crypto asset lending program

- February 2022: BlockFi agrees to pay USD 100m in penalty and fines, ceases its unregistered offers and sales of the lending product

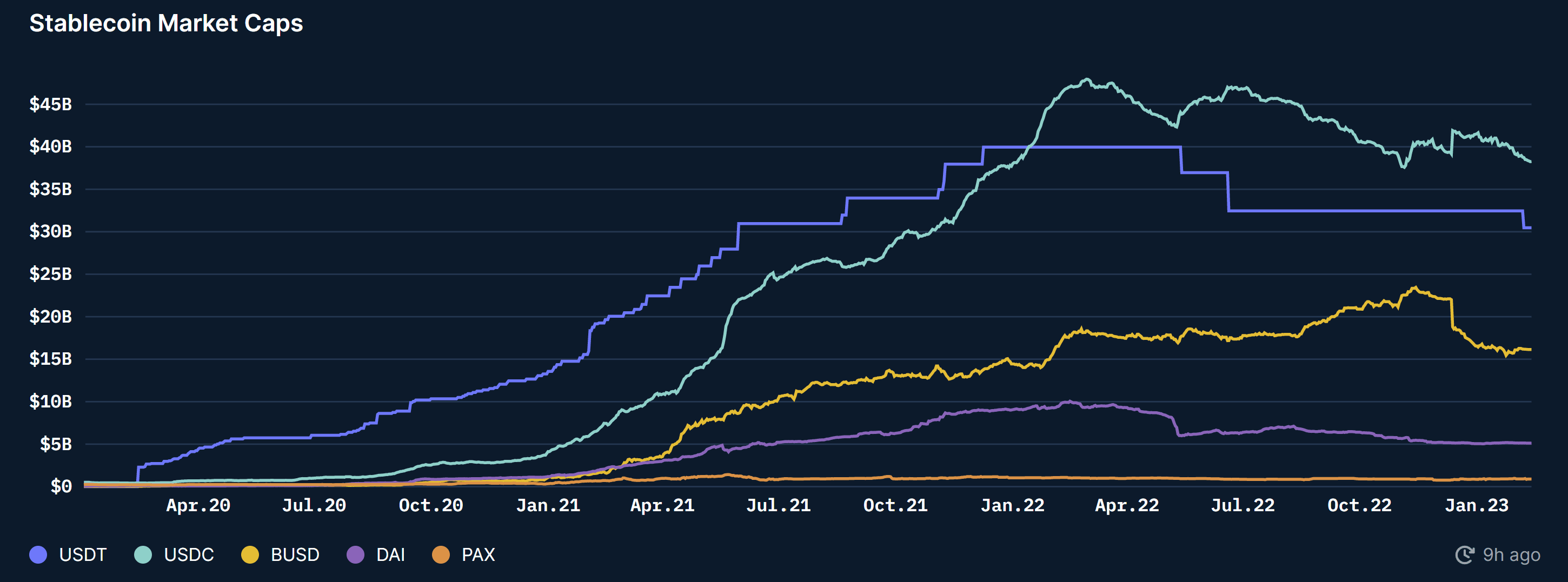

According to the White House’s digital asset framework, making stablecoins safer is a high priority, which has been confirmed by the receipt of a Wells notice (the step before an official SEC enforcement action) by Paxos over Binance USD.

The US digital asset framework also calls for regulating “unlicensed money transmitting”, explicitly quoting digital asset exchanges and NFT platforms. Given the relatively smaller size of NFT finance, this is likely to come under scrutiny at a later stage.

2. What would a regulatory “steady state” for crypto look like?

2023 will probably bring more clarity on US regulations of certain areas of crypto. Several forces are at play:

- The skepticism around digital assets (not blockchain technology) following the FTX and Terra financial contagions and the desire to protect the US retail investor. Fed Governor Waller recently delivered a biting critique of digital assets.: “To me, a crypto-asset is nothing more than a speculative asset, like a baseball card. If people believe others will buy it from them in the future at a positive price, then it will trade at a positive price today. If not, its price will go to zero. If people want to hold such an asset, then go for it. I wouldn't do it, but I don't collect baseball cards, either. However, if you buy crypto-assets and the price goes to zero at some point, please don't be surprised and don't expect taxpayers to socialize your losses.”

- Inter-agencies and regulatory bodies’ competition for crypto oversight: The New York Department of Financial Services has also been investigating Paxos, according to Coindesk

- Lobby from US commercial banks against des-intermediation (watch if BlackRock obtains access to the Federal Reserve reverse repo facility to manage USDC reserves)

According to the motivations above, we could see a few scenarios for the regulatory “steady state” for stablecoins (priority area):

- A US CBDC is created, with the help of private blockchain technology and there is some agreement with US commercial banks (e.g. CBDC can be deposited off-chain in banks in parallel to regular deposits?). This scenario has a small likelihood in the short-term since a US CBDC is still at the R&D stage

- One or a few stable coins gain Fed reverse repo access (that is why the USDC's application is worth watching). In that scenario, the commercial banks would probably lobby for a share of stable coin activity

- In all cases, the decentralized stable schemes do not present much potential of mass adoption in our view, due to the likely competition from regulated versions

The regulatory landscape for other digital assets appears more blurry and uncertain: it will likely be difficult for banks to scale their crypto activities (see the developments for Signature and Silvergate banks). Hybrid models between DeFi technology and other more traditional investment actors could potentially emerge, but it is too soon to be confident in this projection.

Central banks’ next policy moves and asset prices

1. More hawkish stance

Central banks, from India to Sweden, have been more hawkish recently:

- The RBA is fighting a 7.8% rate of headline inflation which was reflected in the change in its official statement: “The Board expects that further increases in interest rates will be needed over the months ahead to ensure that inflation returns to target and that this period of high inflation is only temporary.” vs “The Board expects to increase interest rates further over the period ahead, but it is not on a pre-set course.” in its December statement.

- Fed Governor Waller stated that “The big picture is that the U.S. economy is adjusting well so far to the higher interest rates that are necessary to rein in inflation. But inflation remains quite elevated, and so more needs to be done.”

- Fed Chair Powell reiterated his message from the February FOMC press conference which can be summarized as uncertainty around the macro outlook renders forecasts difficult so the Committee will be data-dependent and especially watch services ex-housing inflation and wages growth

2. Latest developments: tighter lending conditions not limited to housing, the labor market likely to be the last to “crack”

Central banks have become more data-dependent and we must therefore conjecture on the developments of inflation and wage data.

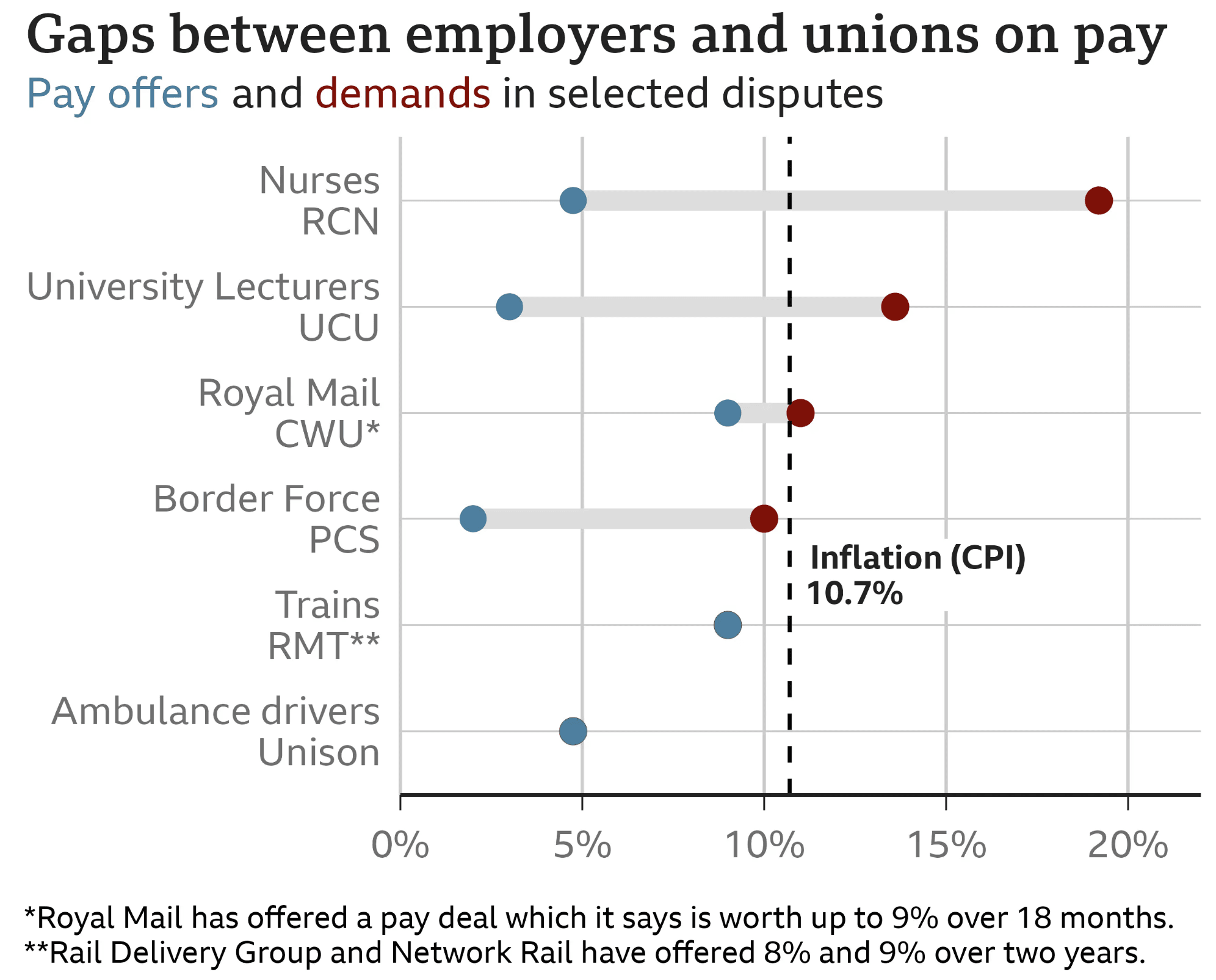

DM labor markets remain very tight, and we continue to see the negotiating power tilting towards the employees. The UK and Europe are experiencing strike movements at the moment with some groups gaining concessions on wages close to inflation (see picture below). These developments are worth monitoring to assess the stickiness of inflation.

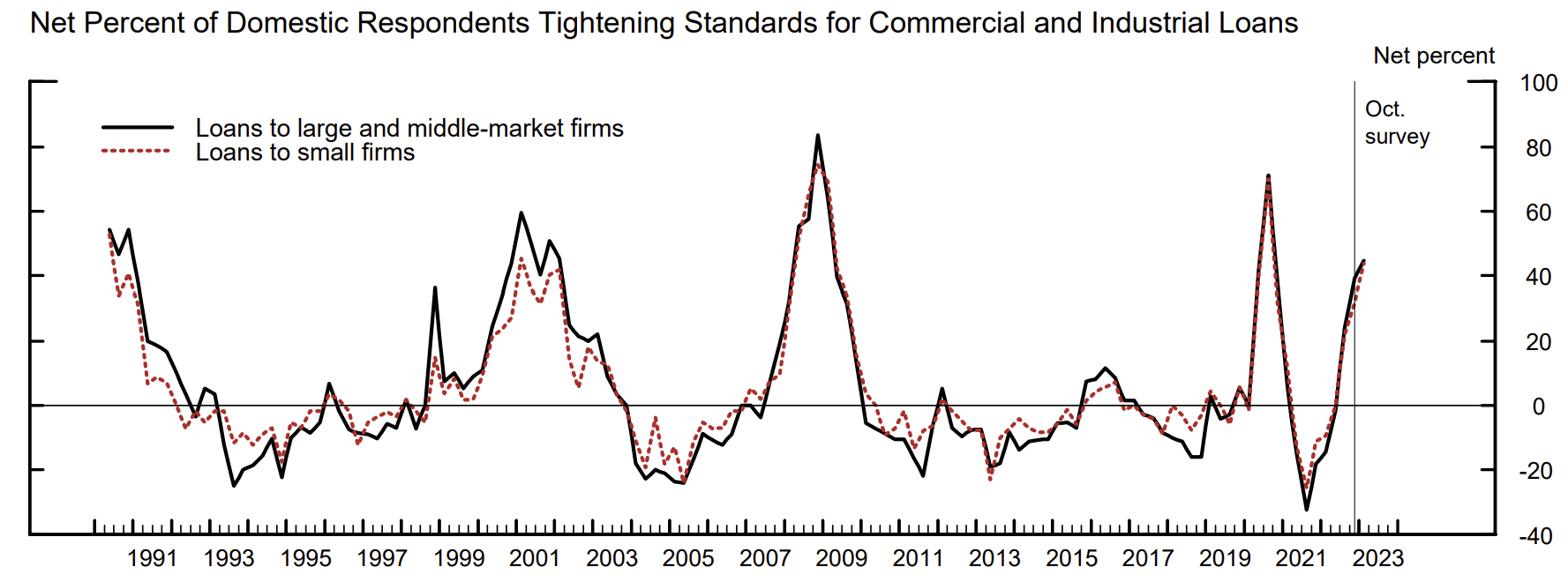

Higher wages are not incompatible with a macro recession or a sharp slow down. The labor market will probably be lagging other indicators as in prior cycles. In the US, the Senior Loan Officer survey on Bank Lending Practices was just released. The survey has a strong track record in predicting US recessions. The share of surveyed banks tightening their lending standards for commercial and industrial loans has climbed to the 2020 levels.

3. What is priced in and how is pricing likely to evolve?

- On Fed Fund rates: the market is pricing an increased probability of a third 25bps rate hike (from only two more rate hikes last week) and a reduced pace of cuts in Dec 2023-Dec 2024. We could see the path for rate cuts being further reduced (e.g. “higher for longer” narrative as wage growth is sticky). This would be possibly followed by a sharp drop in rates some time in 2024 in case of recession (as opposed to the gradual 25bps cuts currently priced in).

- On equities: US equities remain priced for sustained growth and desinflation, which is an unstable scenario in our view given the macro flow of data. Our equity risk premium has ticked up to 5.6% but is at its lowest level since May 2021. Similarly, credit spreads have compressed to price in lower odds of recession

- On crypto: we continue to see a likelihood of crypto prices range-trading with episodes of bear market rallies, until US rates come down

4. Contrarian developments in the East

In China, contrary to the US and Europe, money growth is accelerating (please see chart below) which counters some of the tightening from the West.

In Japan, former Bank of Japan Board member Kazuo Ueda will reportedly be the next Governor, against market speculations of a more hawkish candidate getting the job. Kazuo Ueda has historically favored loose monetary policy but also declared in one Nikkei interview last year: “At some point, we must seriously consider the future of the unprecedented monetary easing framework, which has continued longer than most would expect”. This nomination points towards a likely transition out of yield curve control (Japanese average cash earnings reached a record 4.8% YoY!) but likely a gradual one.

This week: all about CPI

Tuesday 14:

- US Jan. headline CPI: consensus is at 6.2% YoY (and 0.5% Mom). 6.6% YoY would include the impact of higher gasoline prices, all else equal. There are a lot of uncertainties due to methodology adjustments and 2023 cost reset.

- UK Dec. Average Earnings Index + Bonus. Consensus is at 6.2% YoY. Wage growth is one of the most relevant inputs to central bank policy at the moment.

Wednesday 15:

- UK Jan. headline CPI (consensus 10.3% YoY)

- US Jan. retail sales (consensus 1.8% YoY)

Thursday 16:

- US initial jobless claims (ticked up last week, consensus 200k)

- US Jan. PPI (consensus 0.4% MoM)