Shrugging off bad news

Last week, risk perception priced by financial assets came down sharply. BTC erased the price drop that followed the announcement of the SEC investigations, to test the 24k level again. Credit spreads contracted further and the French stock index CAC 40 reached a new all-time high.

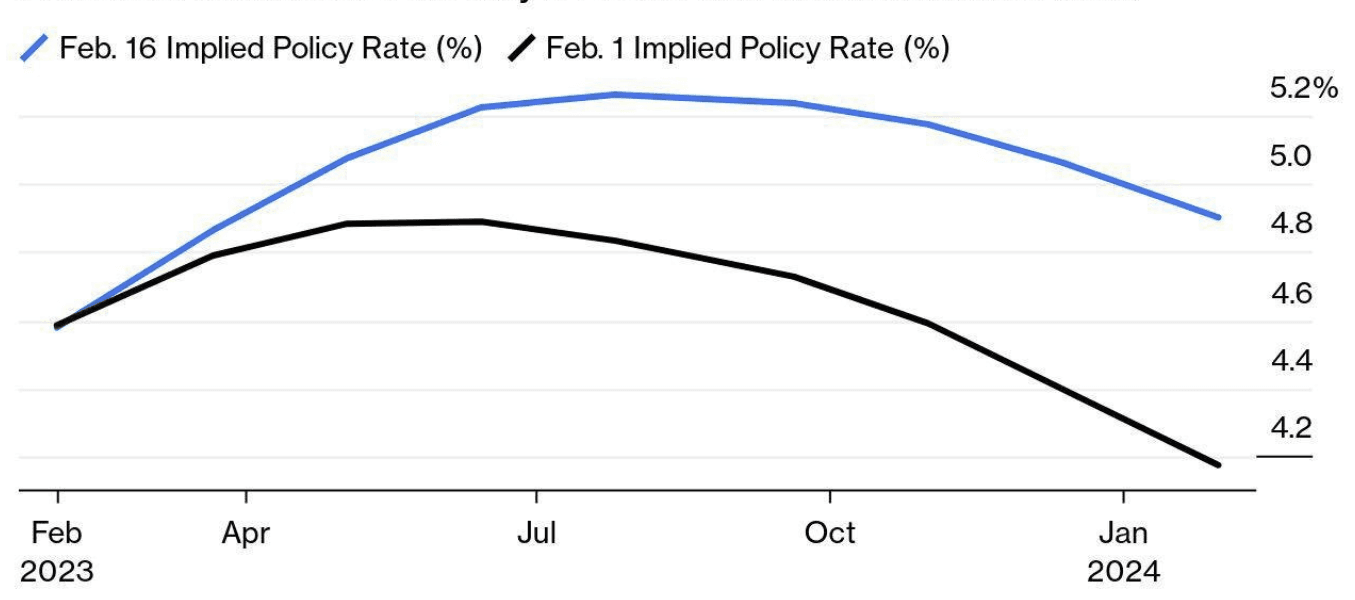

These price moves occurred despite the latest macro data showing sticky wage growth and inflation in the US and other countries (US CPI and PPI both above respective economists’ consensus), and despite the pricing of a third rate hike in Fed Funds rate futures to reach 5.3% in May 2023.

Why this apparent disconnect between expectations for higher rates and outperformance of crypto?

- Less sensitivity to bad news could be linked to all the “very negative news” for crypto being priced in

- Like for traditional risk assets (credit, equity) there could be a perception that the risk premium to be required going forward should come down perhaps because of a belief that policy normalization has occurred and growth is doing ok overall, with nothing in markets having “broken”

The latter interpretation is questionable: as we have pointed out in our last publications, there are areas especially vulnerable to high rates for longer (housing, long-term corporate investment, illiquid investment vehicles). Therefore the “goldilock” scenario can, in our view, last a bit longer (May seasonality?), but will likely be followed by some more rate repricing (e.g. 5.30% Fed Fund rate past June 2023), followed by the probable exposure of a vulnerability in growth that is likely to weigh on risk assets.

Market charts

Crypto prices have retraced the news of Kraken charges and of the Binance USD stablecoin investigation by the SEC, and shrugged off higher than expected US CPI and PPI prints:

US HY credit spreads are pricing out recession risks:

Our US Equity Risk Premium is just above its long-term average of 5%:

Smart Money stablecoin allocation down to 23%, the lowest share since November 2022:

Risk assets holding up despite Fed Fund rate repricing, following strong inflation and employment data:

Macro charts

Some of the Central banks voting members of the US Federal Reserve, European Central Bank, and Bank of Canada were on the wire last week with one common message, data dependency and perception of inflationary risk to the upside.

Energy deflation is likely in the rear view mirror for now, and goods' desinflation ex-housing will also likely slow soon. The focus from central bankers is now especially on inflation of services ex-housing, driven by wage inputs.

Wage growth looks like it is stabilizing around 3.5% - 4.5% YoY in the US and Europe. Surveyed US small businesses, despite expecting negative new orders, were looking to hire at 57% (NFIB small business survey), with 91% of those trying to hire reporting few or no qualified applicants for the positions they were trying to fill. This shows the ongoing imbalance in labor markets which central banks are trying to address.

On-chain insights

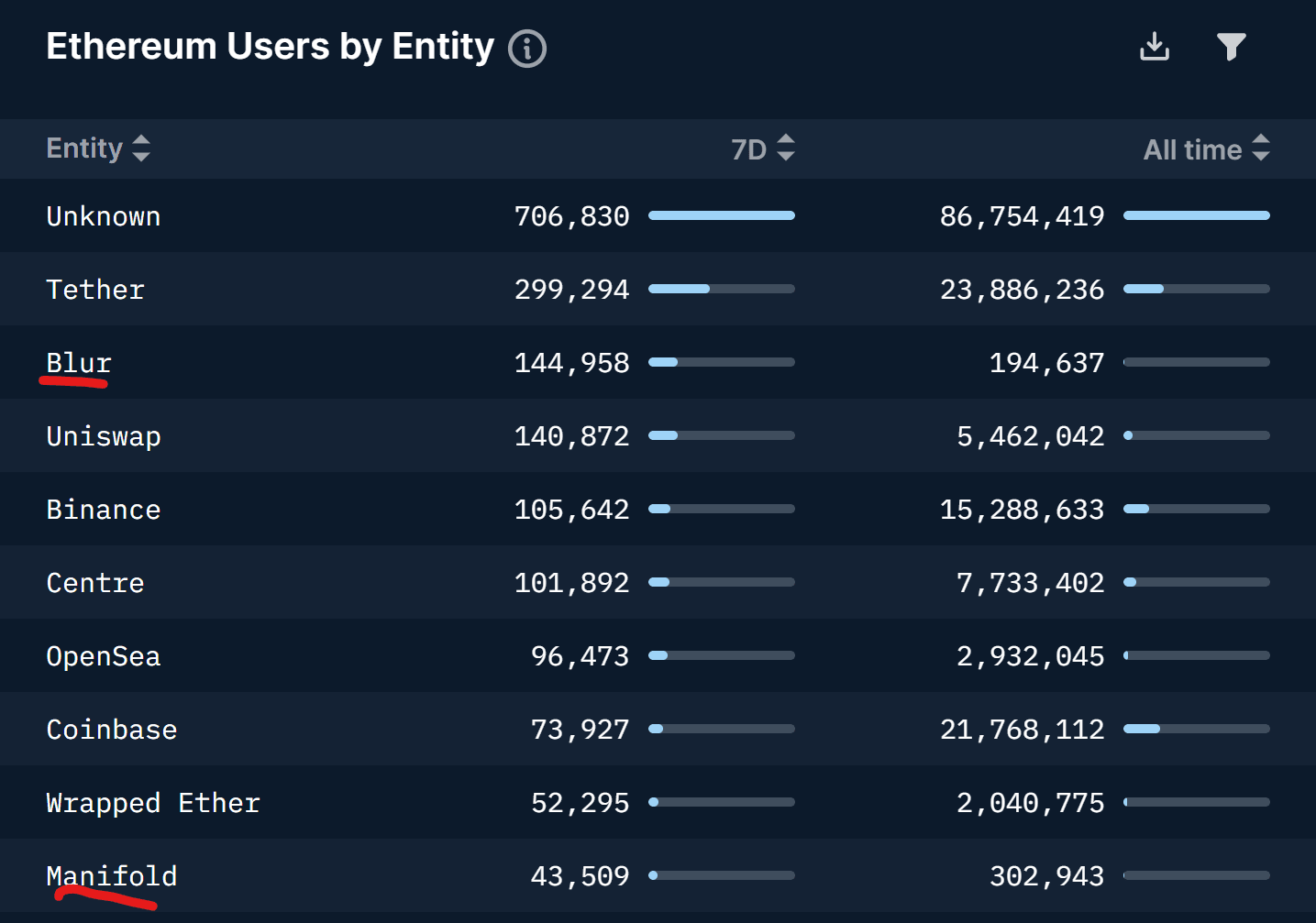

The crypto airdrop season seems to be making a comeback, as a corollary of higher prices and lesser investor fear. In our prior on-chain sections, we have highlighted increased NFT activity via higher minting volume and lending on NFT Finance platforms YTD.

Blur’s airdrop has established new competitive norms (0 trading fee and optional creator earnings) that the leader OpenSea had to follow.

It remains to be seen whether the revival of NFT trading / lending persists. The positive drivers so far are increased Dapp offers and competition to attract users/traders, and a rather lower priority on the US regulatory timeline, compared to DeFi.

Unsurprisingly, Blur made the list of the top entities by increase in activity last week, together with another NFT platform, Manifold :

This week: February flash PMIs. Otherwise data-light

Tuesday 21 February

February Flash PMIs

- Eurozone composite (consensus 50.6)

- US composite (consensus 47.5)

Thursday 23 February

- Eurozone January CPI (consensus 8.6% YoY and -0.2% MoM)

Friday 24 February

- US January core PCE index (consensus 4.3% YoY and 0.4% MoM)