“Mr. Market is kind of a drunken psycho. Some days he gets very enthused, some days he gets very depressed. And when he gets really enthused you sell to him, and if he gets depressed, you buy from him. There’s no moral taint attached to that.” Warren Buffett

Narrative change: Resilient growth and stubborn inflation

After “transitory” and “sticky”, “stubborn” is the latest adjective to prevail in central bankers’ rhetoric to qualify inflation. Indeed, while headline inflation is decelerating globally thanks to the normalization of energy and commodity prices, core inflation has hovered around 5-6% YoY in the past six months to take the example of US core CPI (the latest May number of 5.3% came in at expectations). This is driving an ongoing current of hawkishness among mature market central banks, especially among the US Fed and the European Central Bank (ECB).

Before looking at the Fed and the ECB and the impact of their policies on markets we make a detour East where monetary policies are diverging.

First, the odd one out, the Bank of Japan (BoJ). Our slight expectation that the BoJ could normalize policy (hike short-term interest rates and / or normalize its yield curve control) has not materialized. As the BoJ does not practice forward guidance, and does not directly rely on macro data (core inflation ex-energy and fresh food is already above the 2% “target”), timing policy normalization is very difficult. Governor Ueda has reiterated during the press conference last week that he was observing changes in price setting behaviors by corporates, to the upside. So far, these verbal cues have not materialized into action. The implication for markets is, a USD/JPY that will likely slowly revisit its recent highs towards ~150. The trade remains asymmetric for downside USD/JPY though, but it is all about the cost of waiting for the BoJ to normalize (negative carry of being long USD/JPY as US rates are higher). We think that a combination of higher Japanese wage growth (> 2%) and an uncomfortably weaker JPY should provide more incentives to act for Governor Ueda.

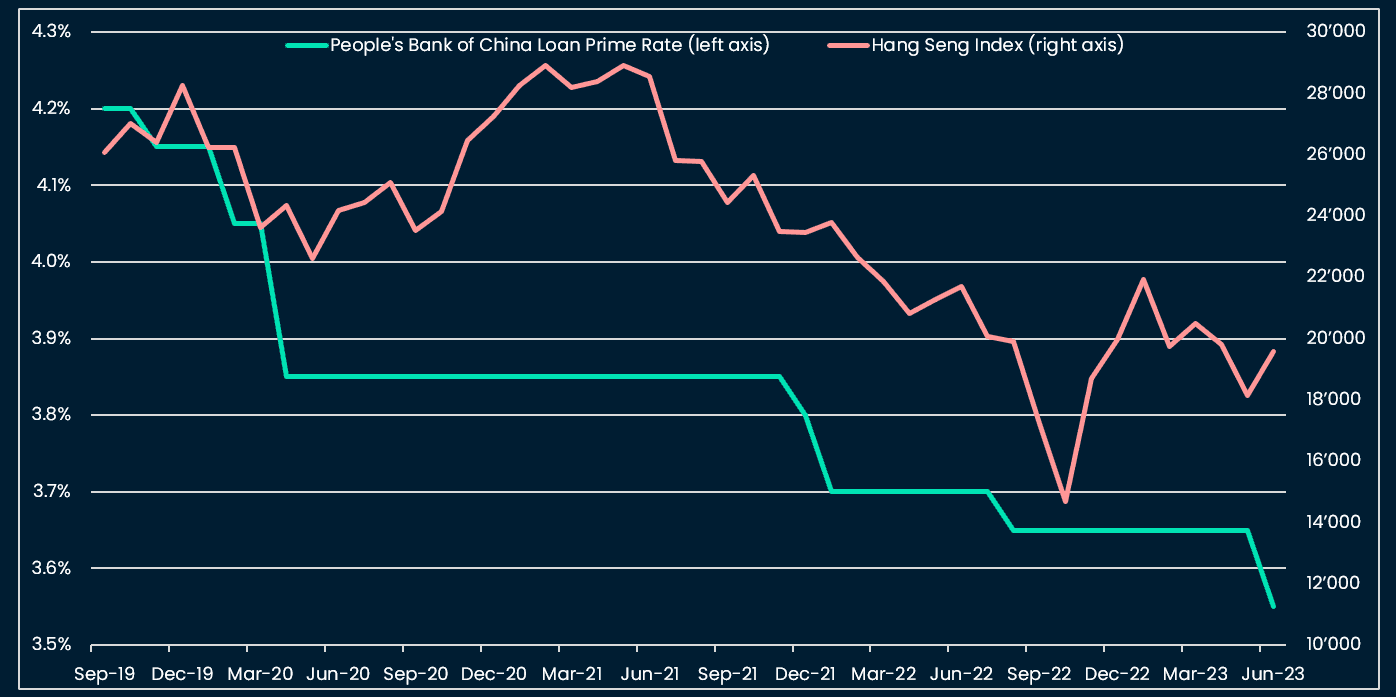

In China, policy makers appear increasingly concerned by the weakness in growth: the youth unemployment rate climbed to 20.8%, its highest level since the inception of the data series in 2018. The central bank, the PBOC, cut its main policy rate, the loan prime rate, by 10bps to 3.55% for the first time in 10 months. More stimulus seems likely, and will, at some point, likely be supportive of Chinese risk assets . Historically this has occurred with a lag after the start of easing (see picture below).

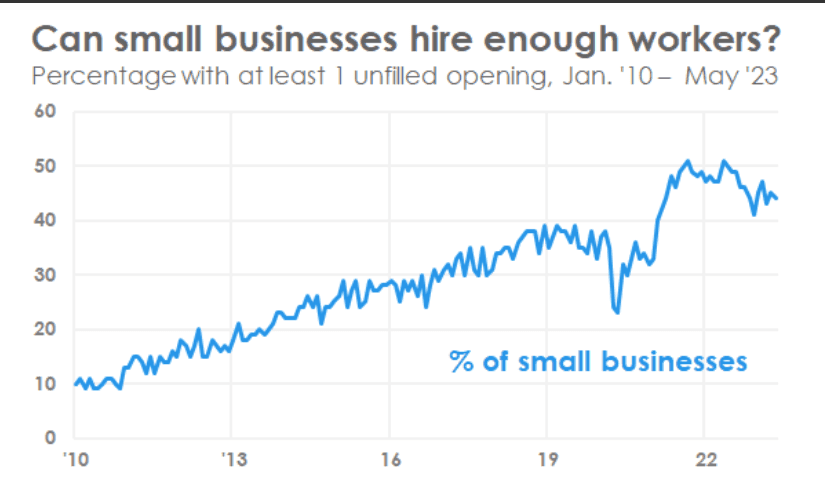

Finally, the Fed and the ECB (and the Bank of England or BoE), have an issue of “stubborn inflation”. In the US, the bank lending “crush” has not materialized so far, although lending conditions are getting tighter. The labor market is cooling slowly, but the demand for jobs remains elevated in the US, Eurozone and the UK.

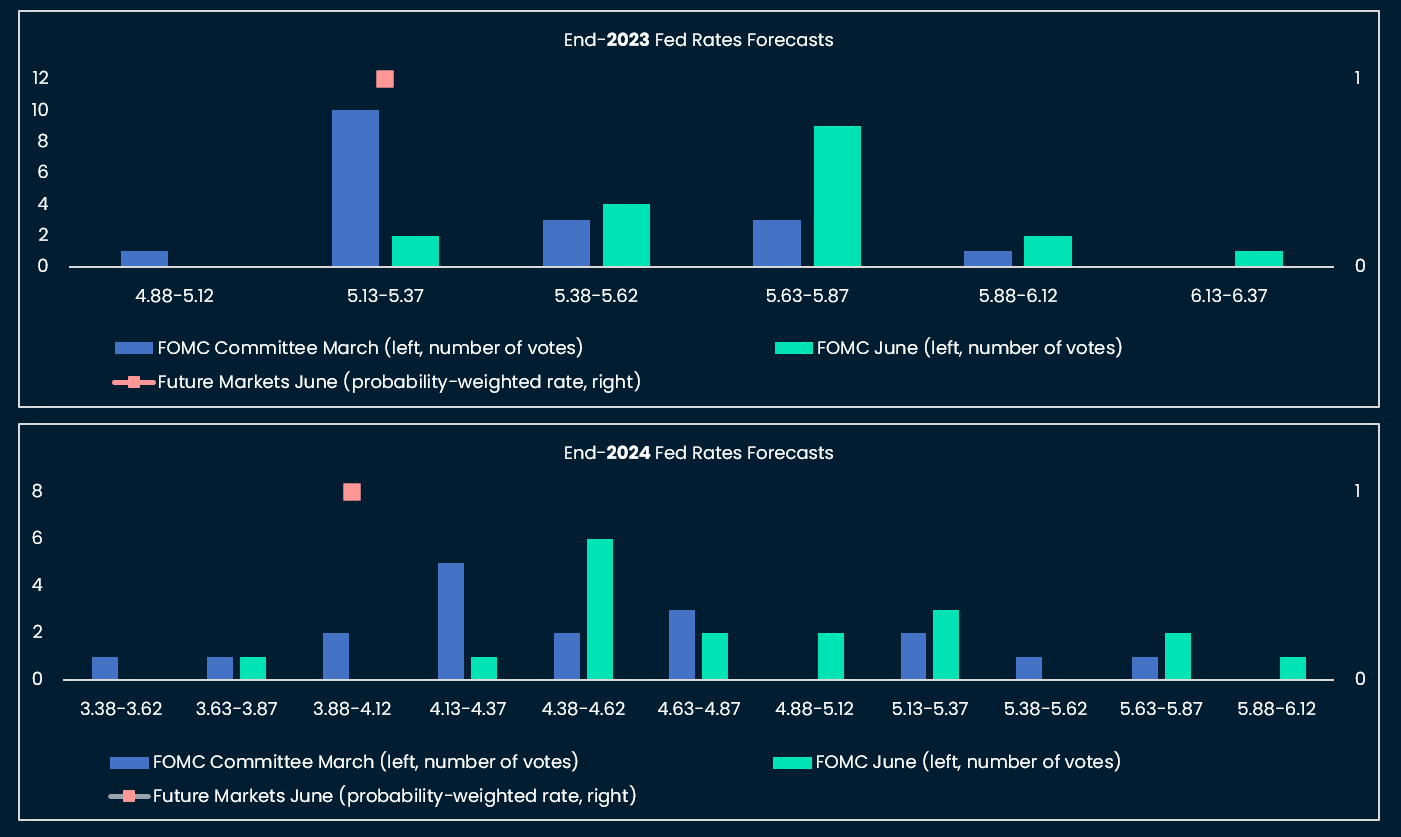

As a result, the FOMC has guided for 50bps more rate hikes (to 5.50-5.75% terminal rate). As can be seen in the US future market pricing chart below, markets are following reluctantly, with rate cuts now being pushed back to December 2023 (it was September 2023 just a few weeks ago).

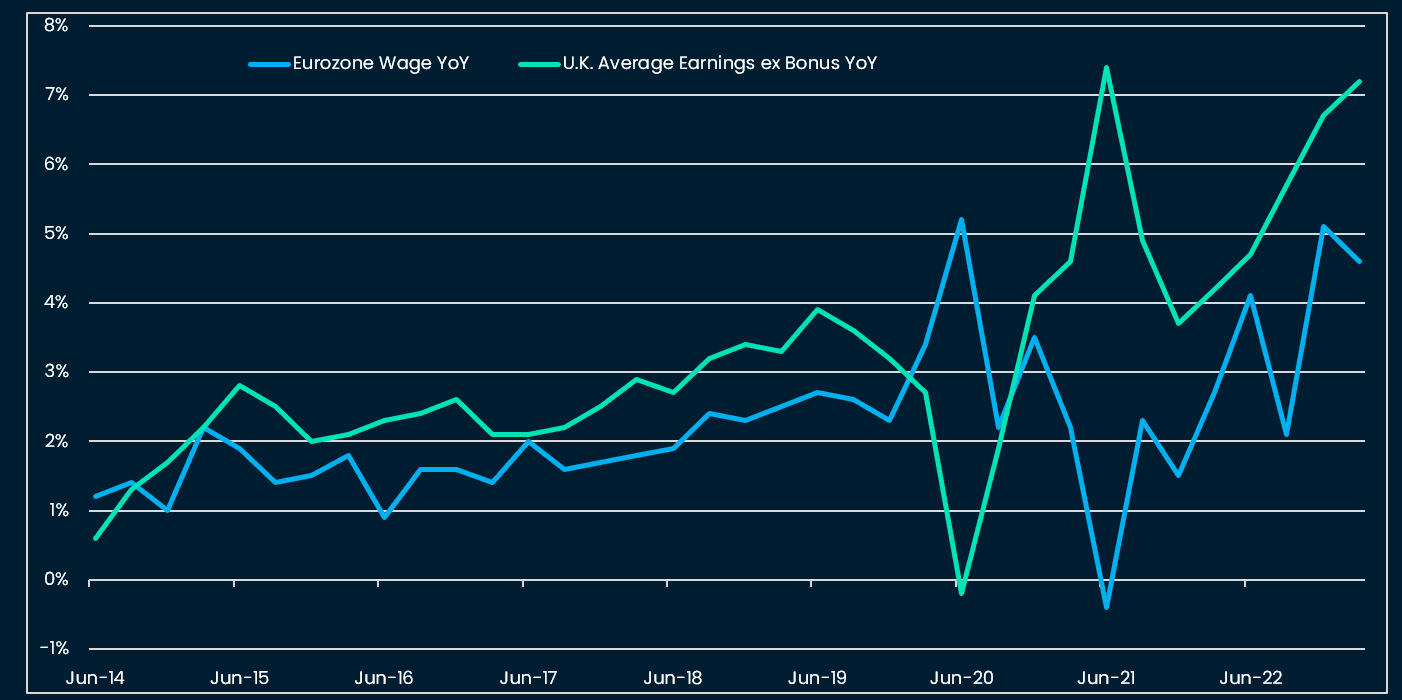

The ECB appears even more “behind the curve” in its fight against inflation. Last week’s press conference was dominated by questions on core inflation and wage growth, and the ECB, like the Fed, revised its inflation projections higher. « We have not begun thinking about it (pausing) because we have work to do.» said President Lagarde.

The reaction in rates was telling: UK 2yr rates jumped by 40bps, German 2yr rates by 19bps and US 2yr rates by 10bps, reflecting the work that is left to be done by each central bank to tackle inflation. The EUR/USD and GBP/USD appreciated accordingly.

This persistence of core inflation, associated with resilient spending and growth, is, we think, partially the product of the extraordinary fiscal-monetary stimulus post-pandemic. The latter has delayed the onset of an economic slowdown, despite many traditional indicators flagging a recession. Historically, the US yield curve, which first inverted in April 2022 in this cycle, would have flagged a recession by February 2024 (looking at the lead time between inversion and recession since the 1960s). Maybe this statistical upper bound of “lead times” will be pushed higher in this unusual cycle.

Implications for risk assets and crypto

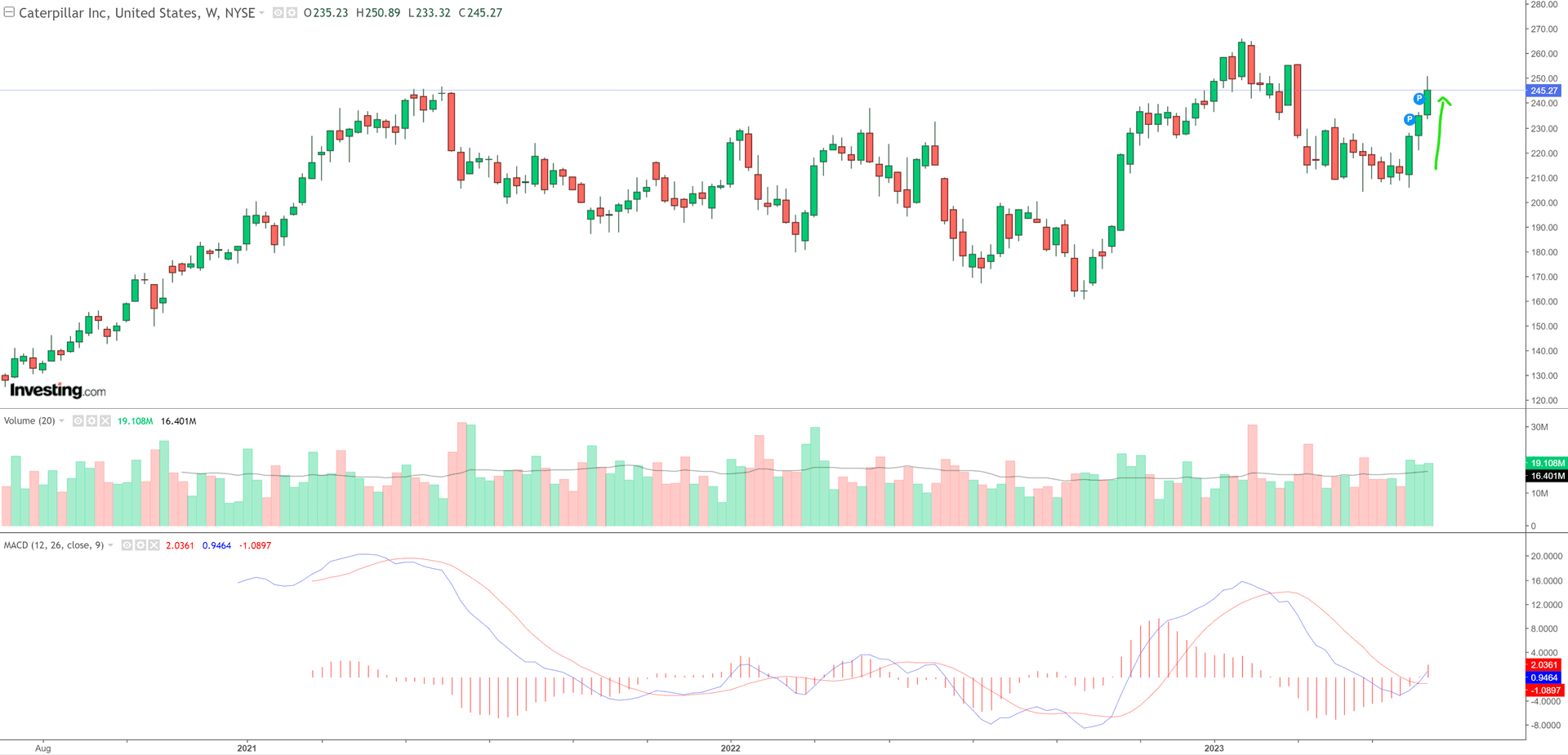

Equity markets are also signaling a push back of the recession scenario. Global commodity prices are stabilizing although not yet recovering, and some cyclical equity names have rebounded in the past month (see Caterpillar stock price below).

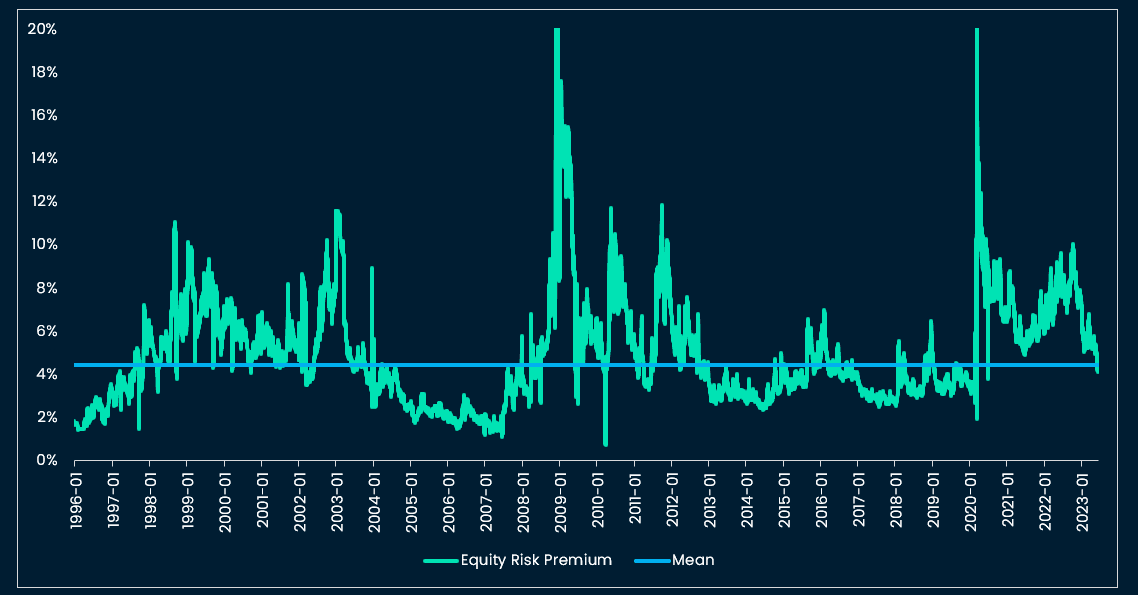

The equity risk premium has come down further, now close to the 2019 levels, indicating lower macro risk being priced by US equity markets (push back of the recession scenario):

In the end, the less investors and policy makers are worried about growth (and the more they are surprised by inflation stickiness), the longer policy will be restrictive. We then enter into a non-linear process of policy reacting to growth and in turn impacting growth, until “something” breaks.

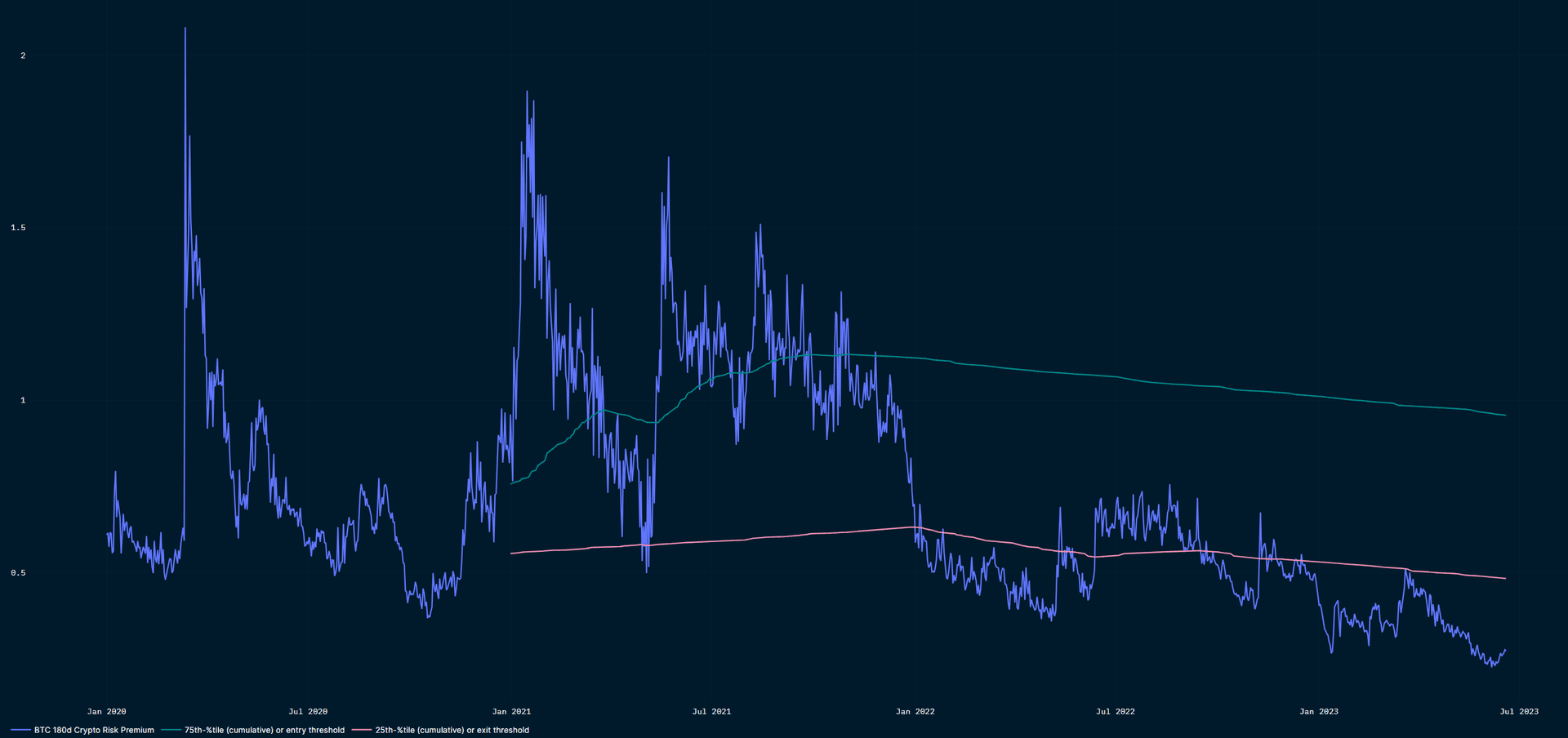

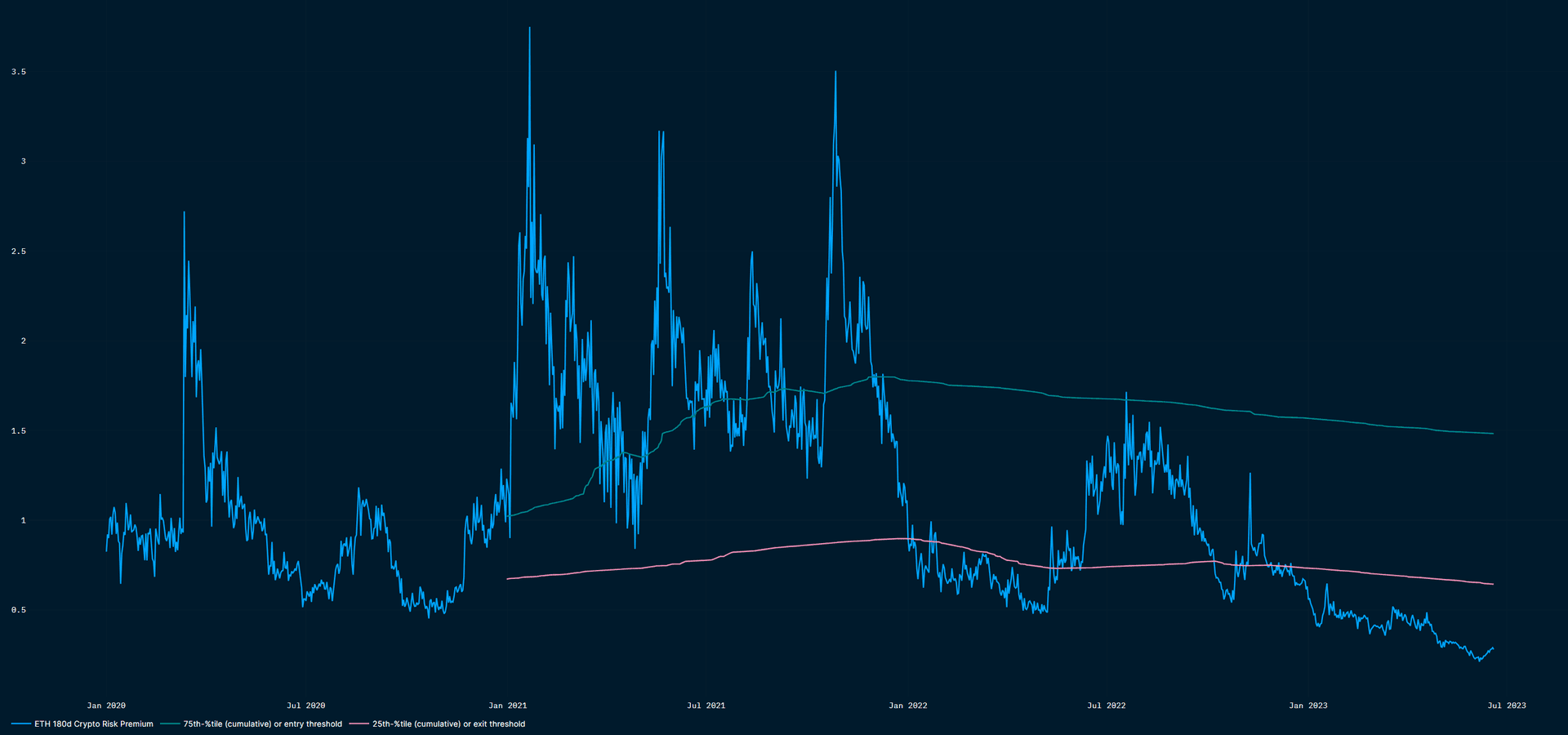

High rates for longer will keep a lid on crypto prices. We reiterate this simple observation that staking ETH for an annual yield of ~5% is less attractive than investing in 5%+ US Treasury bills, when considering the risk profile of the former.

Nevertheless, crypto sell-offs are becoming shallower, this has been proved again by the relatively muted price reaction of BTC and ETH to the news of the SEC prosecutions of Binance and Coinbase in the US.

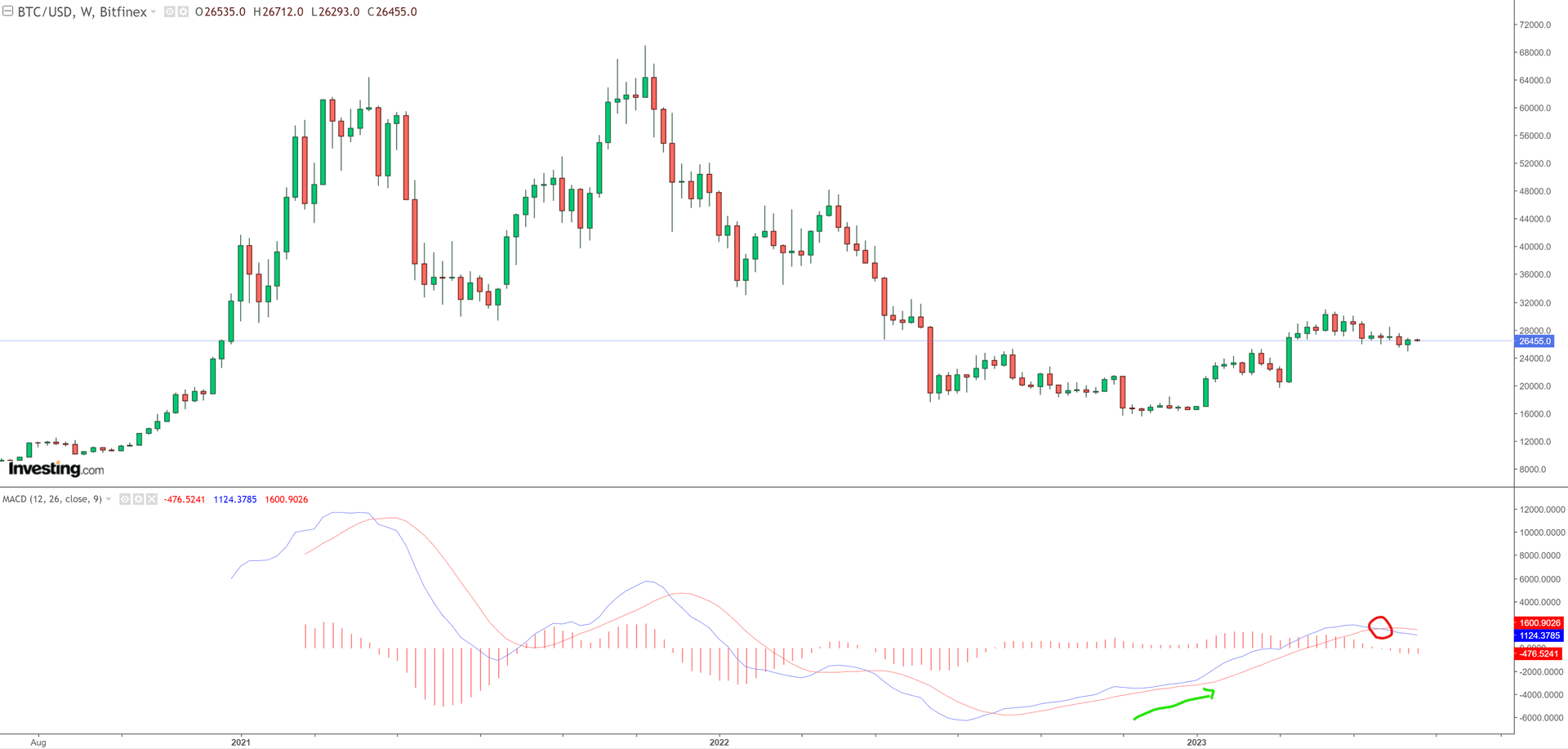

Looking at technicals, the MACD crossed lower marking the current pause, but the pattern still marks a bottoming from last November, for BTC.

We also note the ongoing decrease in implied volatility in crypto options (proxy for risk premium), the same pattern as for S&P risk premium. This indicates less “uncertainty” being priced by BTC option investors. See here for our Crypto Risk Premia backtest.

Overall, our view is that more regulatory clarity and also a clearer path for lower inflation are two necessary conditions for crypto prices to break higher. In the meantime, it looks like the low-volatility range-bound price action might last longer.

This week: Powell testifies; Bank of England meets

Wednesday 21

- UK May CPI (consensus 8.5% YoY)

- Chair Powell’s semi-annual Congressional testimony in front of the House

Thursday 22

- Chair Powell’s semi-annual Congressional testimony in front of the Senate

- Bank of England’s interest rate decision (consensus is for a 25bps hike to 4.75%)

- Swiss National Bank’s interest rate decision (consensus is for a 25bps hike to 1.75%)

Friday 23

- Flash PMIs in the US, UK, Eurozone, Japan, Australia