Last week’s announcements of the US Securities and Exchange Commission (SEC) pressing charges against Binance (5 June) and Coinbase (6 June) triggered various dynamics in crypto markets. We first review the moves in on-chain and off-chain data following the two announcements, and then consider various future scenarios. The note finishes with an overview of the various central banks’ likely future strategies as this week contains the Fed, ECB, and BoJ meetings!

Anatomy of the market post SEC-announcements

In the week of the SEC announcements, the respective prices of COIN stock and BNB token, sold off by very similar % rates (-17% and -19%, in USD).

This is slightly surprising given the larger size of Coinbase in the US: most of its ~USD 130bn customer assets are likely to be related to US investors (Coinbase does not disclose the split). Meanwhile, according to the SEC, USD 2.2bn are held by the customers of Binance US. It could be that, aside from size, investors are looking at the nature of charges against the two exchanges: both are accused of illegally operating in the US as securities exchanges, broker dealers and clearing agencies, but Binance has been charged with additional allegations (the SEC’s document for Binance is 35 pages longer than for Coinbase).

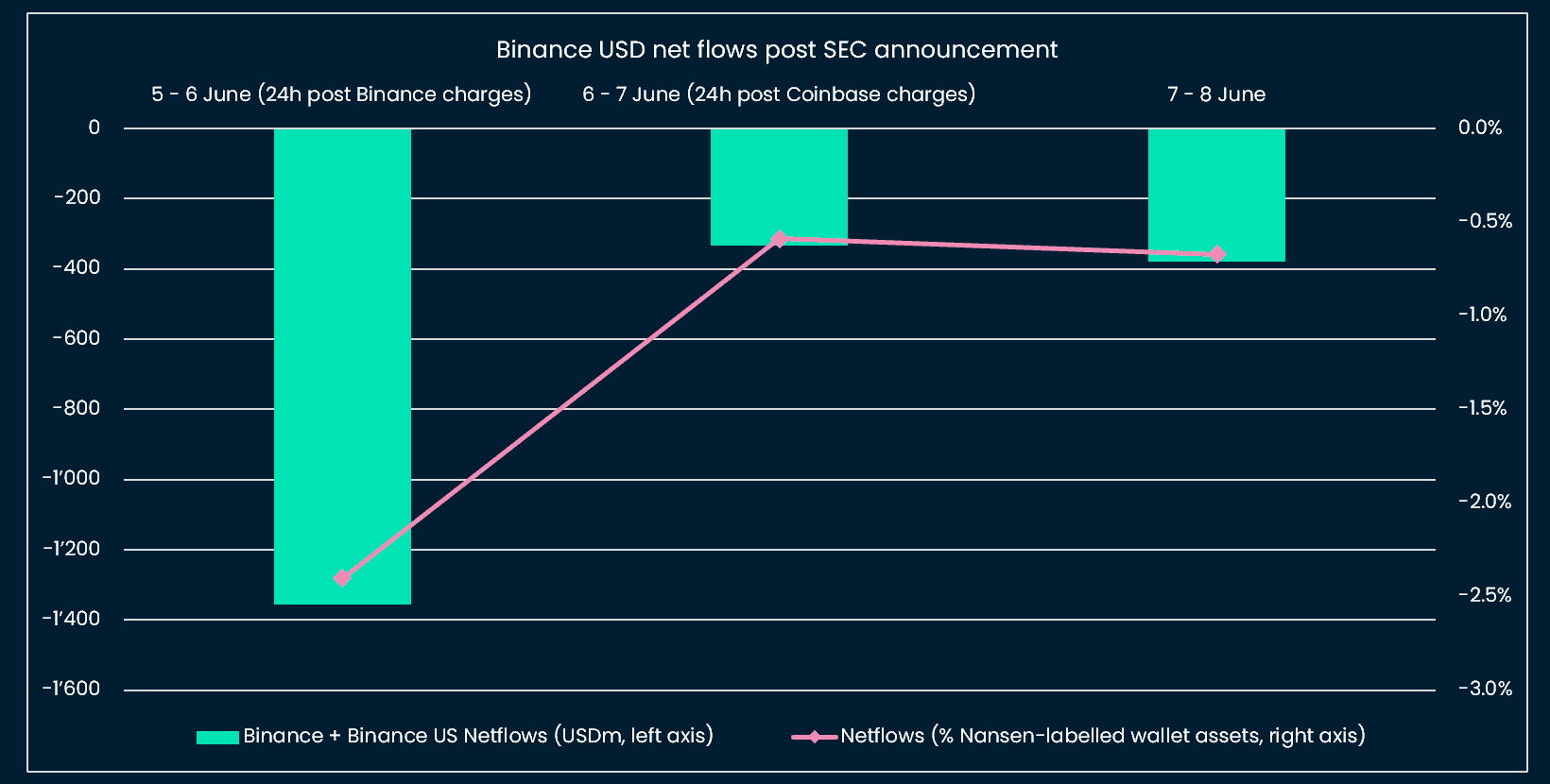

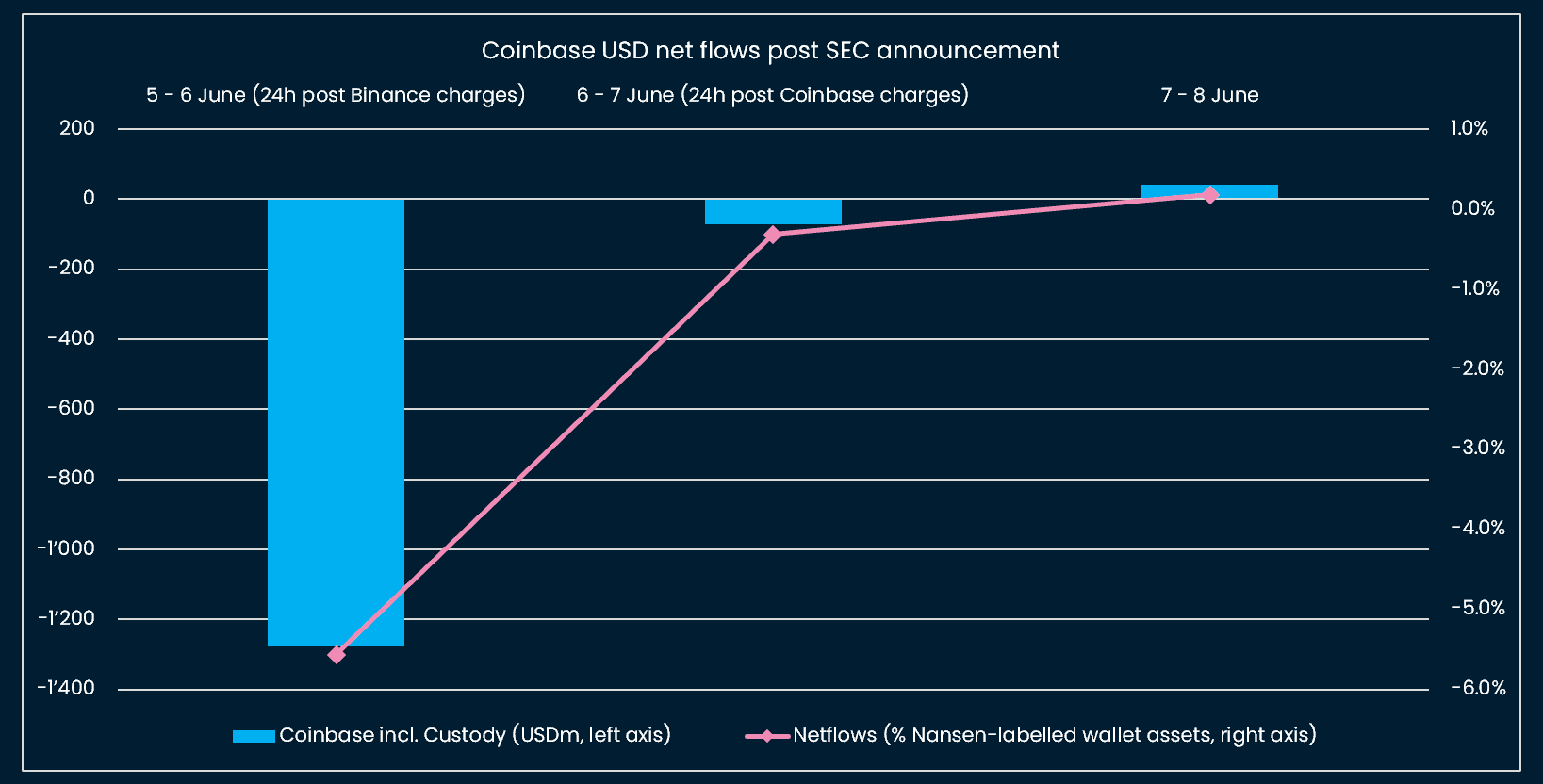

On-chain negative net flows are visible for both exchanges, with a knee-jerk net outflow for both Binance and Coinbase (USD 1bn+) on June 5th, after the first charges against Binance were made public, followed by less severe net outflows the following day. Coinbase even returned to net daily inflows by June 8th.

Considering the scope of wallets labeled by Nansen, net outflows reached ~3.7% of the aggregated value of Binance’s wallets from June 5th to June 8th, and ~5.7% of the aggregated value of Coinbase wallets. One caveat is that the coverage of Coinbase wallets is not as exhaustive, and the latter number is merely an estimate.

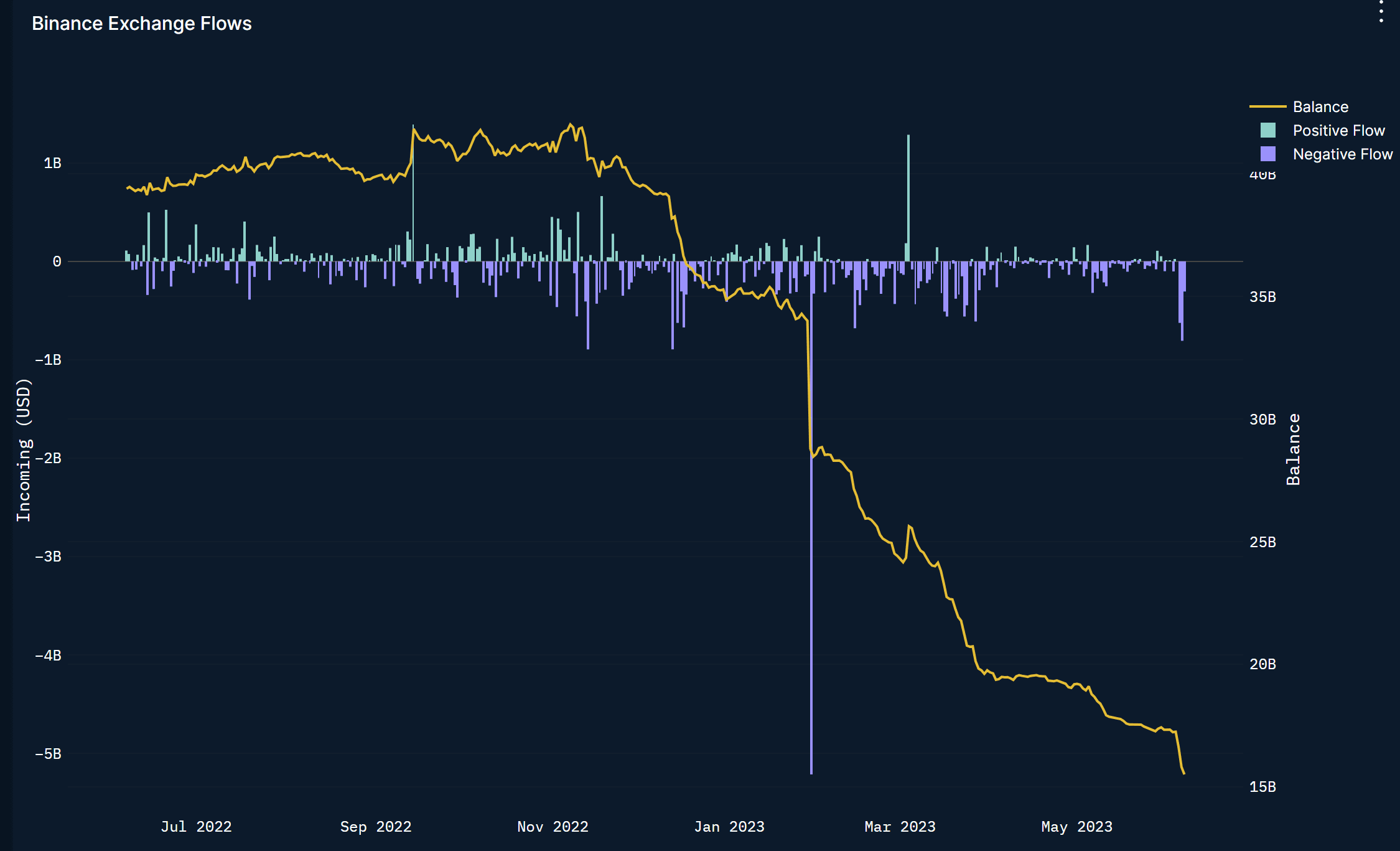

Taking a step back, net outflows from centralized exchanges had already accelerated post FTX-blow-up in November 2022. This trend has persisted until today. Year-to-date, Binance’s daily net outflows were the largest on January 29th, followed by June 6th. So the net outflows that followed the latest SEC’s announcements were non-negligible, and also part of a longer trend that originated in the aftermath of FTX’s collapse.

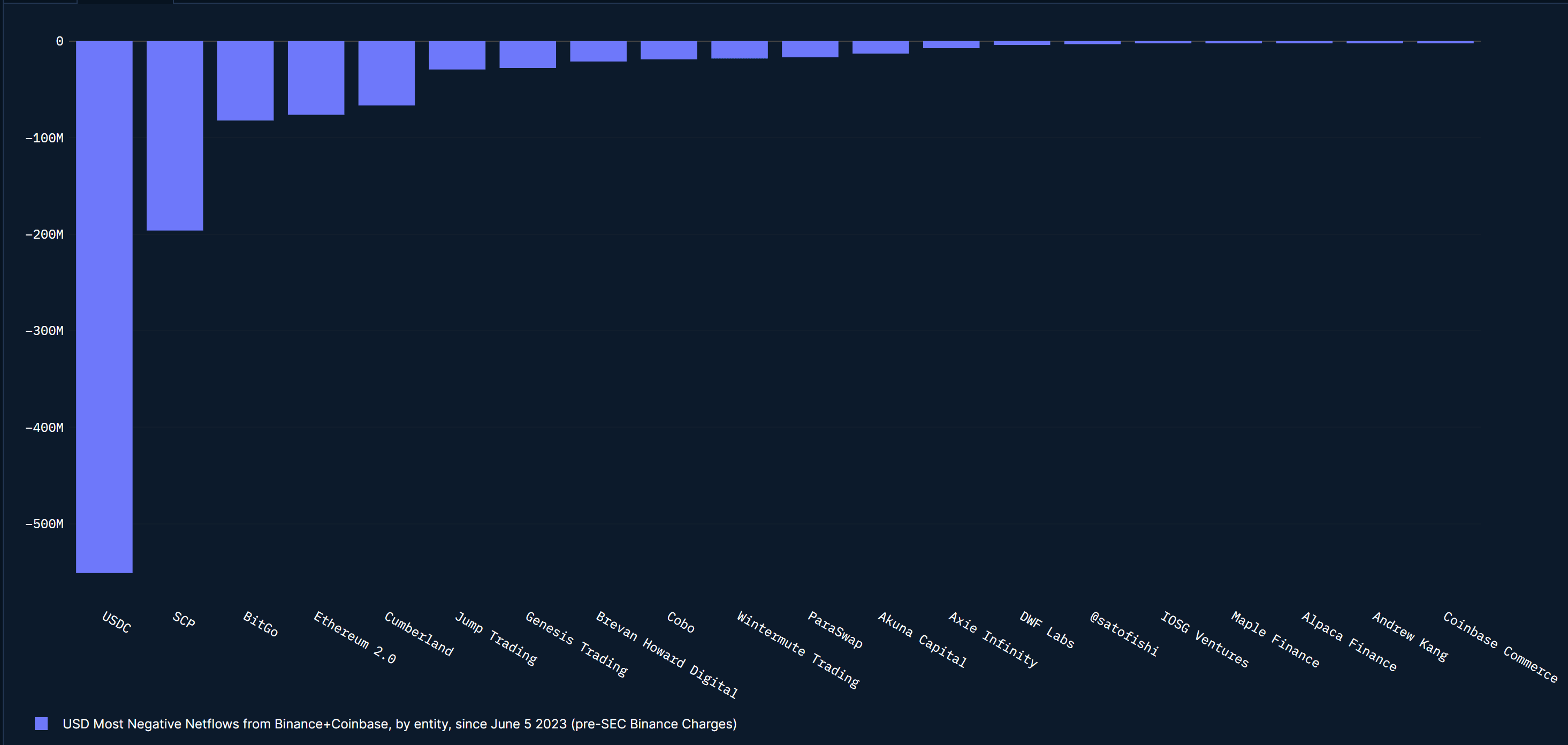

Turning to the entities that were the largest net withdrawers of funds from Binance and Coinbase last week, we recognize a few institutional fund names:

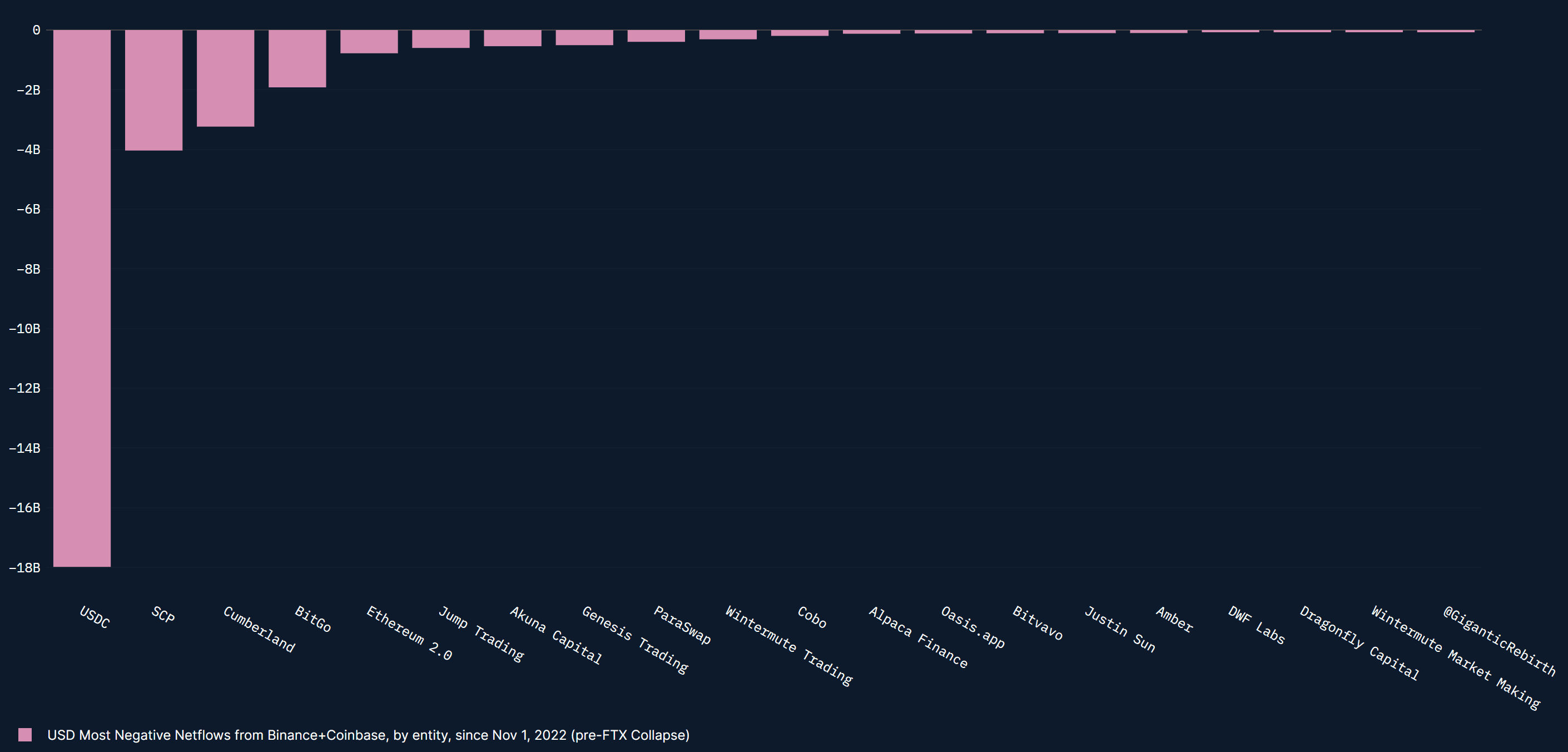

These are the top net withdrawers of funds from Binance and Coinbase since FTX’s collapse:

Finally, some tokens took the “spotlight” with the SEC documenting them as securities: SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO represented around USD 40bn of market cap or ~3.3% of total crypto market capitalization on June 4, 2023. The quoted tokens sold off more severely than ETH and most other altcoins, losing ~25% to 35% of their value from June 4 to June 11, 2023 (with the exception of NEXO which sold off much less).

Future scenarios: the endgame for crypto?

There are multiple forward-looking scenarios for Binance, Coinbase, and the compliant trading of crypto in the US more largely.

Before we reach one of these end-scenarios, there will likely be a long period of uncertainty when the various SEC charges are being disputed by Coinbase and Binance. Why this long period? Fed Chair Gensler’s mandate expires on June 5, 2026. Also, the ongoing case of Ripple vs the SEC has not been resolved yet, after it started in December 2020.

This will create a vaccuum for investors wanting to trade crypto in the US: with some taking the uncertainty risk and others not. This, aside from the macro environment, will probably put a cap on crypto prices, until the uncertainty gets resolved.

Looking into the case of XRP price in ETH gives us little information on the price effects of SEC’s charges: the price of XRP in ETH had been trending down even before the SEC’s charges against Ripple in December 2020. The price has continued to decrease since then.

What are the various scenarios?

The Coinbase and Binance cases feel very much like crypto is entering the final stages of regulatory clarity (at least in the US) because what is at stake is the definition of crypto assets, are they securities? Which are and which aren’t? A clear regulatory definition would facilitate institutional adoption, assuming a settlement is found between the SEC and the exchanges.

The most likely scenario, in our view (this remains dependent on new political and market developments) is for an agreement being reached between the SEC and exchanges on some crypto assets falling into the security bucket, and others not, leading to a significant financial settlement (at least from Coinbase, which has more to lose than Binance given the importance of the US market). This will likely create a precedent for a security framework for crypto that will put a higher bar for crypto projects, leading the number of alive projects to decrease.

A less likely scenario is for Coinbase to prove entirely, against the SEC, that “Coinbase does not list securities or offer products to customers that are securities.” and “Coinbase Wallet is a technology, not an exchange or broker or centralized platform”.

Finally, a tail scenario would lead to the slow exit of crypto activity from the US. This would impact crypto negatively and globally. According to Nansen’s estimates, ~28% of the transactions initiated on Ethereum so far have come from the Americas, and ~28% of unique wallets.

Meanwhile in the central bank universe

It is worth following the various dynamics in central banks’ policies to understand more around 1) FX dynamics, 2) The future price of money for risk assets including crypto.

The dynamics are becoming more heterogeneous. In China the PBoC has engaged in a dovish path. This will likely lead other EM central banks, in Latin America first (where inflation has been coming down and where policy rates are high) to start cutting rates in the next few months.

In Mature Markets (MM), the Fed has led the hiking cycle, and is among the central banks with the highest real policy rate: forward measures of inflation oscillated between 4 and 4.5%, leading to real policy rate of 1.25% - 1.75%. We see the Fed holding rates this Wednesday, unless CPI released on Tuesday significantly surprises the consensus higher (consensus 4.1% YoY for headline and 5.2% YoY for core CPI). We do not think it should be the case: energy prices have declined further YoY and the Shelter CPI should continue to drift slowly lower.

We see the Fed on hold for slightly longer than what investors expect though (rate cuts are priced from December 2023 on). On the other hand, the bar to hike further is higher than in March: the labor market has slowly started its supply/demand rebalance, US lending growth is slowing, lending conditions are tight and regional banks continue to seek liquidity help (the Bank Term Funding Program has reached USD 100bn last week).

The remaining mature central banks are mostly lagging the Fed, with the European Central Bank (likely to hike by 25bps to 4.00% on Thursday) having to deal with a negative real interest rate for the Eurozone (policy rate < forward inflation). Bond investors expect the ECB to be close to pausing, which seems wrong given the level of inflation.

And then there is the Bank of Japan (BoJ), which stands out by having maintained a negative policy rate despite Japan’s core inflation, excluding fresh food and energy, having reached 4% YoY in April for the first time in more than four decades. BoJ Governor Ueda has pushed back the scenario of policy normalization, but has become more nuanced on inflation recently: “We’re starting to see activity that could lead to sustained inflation. [...] There are positive developments . . . such as companies feeling that they need to raise wages in order to secure talent since others are doing the same.” The BoJ does not practice forward guidance, on the contrary, it usually chooses to surprise markets (see the various yield curve control announcements). It is not data-dependent either, like the Fed. So making a prediction on the BoJ’s timing is close to impossible. We do know however that the next moves will be to hike the policy rate outside of negative territory and relax the yield curve control thresholds. This could happen as early as this week although, again, timing is hard to predict (the BoJ meets on Thursday).

Overall, China PBOC’s easing is not enough to compensate for hawkish monetary policy in mature markets (global commodity prices are a barometer of global growth and have failed to stabilize so far). The BoJ is a wild card, and could normalize policy in a very unexpected way. It feels like we are getting closer to late cycle dynamics. As we write oil is down 4% on the day, and there are increasing signs that growth and inflation are slowing. We just need to remain patient in this unusual cycle.

This week: "the unholy trinity" ECB, BoJ, Fed

Tuesday 13 June

US May CPI (consensus 4.1% YoY) and core CPI (consensus 5.3% YoY)

Wednesday 14 June

Chinese May cyclical data

US May PPI (consensus 1.5% YoY)

US FOMC meeting (consensus on hold 5.25%, we agree with the consensus); Risk of Summary of Economic Projections showing rates on hold at 5.25% into H1 2024, in our view

Thursday 15 June

ECB likely to hike its policy rate by 25bps to 4.0%

US Philadelphia Fed Manufacturing Index for June (consensus -13.5); US core retail sales for May (consensus 0.1% MoM)

Bank of Japan meets. Very difficult to predict when the BoJ will hike rates and relax the yield curve control band. This meeting is a candidate for an announcement given high core inflation in Japan in April.