Introduction

As Bitcoin continues to test new highs and its dominance hovers around 60% a level not seen consistently since March 2021 many investors are asking: Is another altcoin season on the horizon? Altcoin season traditionally refers to a phase in the crypto market where alternative coins outperform Bitcoin for an extended period. This doesn’t mean isolated spikes or meme coin frenzies, but rather a broad shift in capital flows favoring altcoins across categories.

source: TradingView

Given Bitcoin’s strong position, the question remains: could the coming months bring a general shift toward altcoins, or are we witnessing a more concentrated market trend?

Past Seasons

The crypto market has seen several explosive altcoin seasons, each driven by distinct trends and rapid growth. Two of the biggest altcoin seasons unfolded from late 2017 to early 2018 and then again from late 2020 into early 2021.

The first, in 2017-2018, was powered by the ICO boom, which brought a wave of new retail investors. Ethereum climbed from the low hundreds to nearly $1,400, while Ripple’s XRP shot up over 1,400%. This surge cooled down as regulatory scrutiny increased, but it set the stage for future innovation in the space.

Then came DeFi Summer in 2020, when decentralized finance projects like Uniswap and Aave grabbed the spotlight. DeFi Summer helped launch the next altcoin season from late 2020 into early 2021, with DeFi and NFTs at the center. Ethereum surged past $4,000, driven by demand from both DeFi and NFT markets, while BNB saw similar gains as users turned to Binance Smart Chain for lower-cost DeFi transactions.

Following this growth, the market experienced "NFT Winter" from late 2021 to early 2022. NFT trading volumes and prices dropped as the initial excitement faded, and the market recalibrated.

Each of these phases whether it’s the ICO craze, DeFi boom, or NFT surge illustrates how crypto evolves in cycles, with each wave building on the last and setting the tone for the next big trend.

It’s important to remember that altcoin season typically lasts only a few weeks to a few months. While some altcoins may continue to surge beyond that period, the gains are usually limited to a select few that fit a narrative rather than the entire market.

Will we all Make it?

The crypto market has exploded in scale and diversity over recent years, marked by thousands of new projects entering the space. As of late 2024, there are around 9,952 active tokens. This growth reflects a steady demand for new blockchain applications, yet it also tells a story of market volatility and high project turnover. In other words, traders are chasing constantly changing narratives.

During the first major altcoin boom from late 2017 to early 2018, the number of tokens increased from 644 to 1,335. ICOs were in full swing, but many of these projects couldn’t sustain long-term viability. Around 70% of the projects launched in that period have since ceased operation, signaling a high attrition rate that tempered the optimism of early altcoin enthusiasm.

By the time of the next major cycle in 2020-2021, DeFi and NFTs had entered the scene, driving another wave of rapid expansion. The number of cryptocurrencies jumped from 4,501 in early 2021 to over 8,700 just a year later. Yet this cycle followed a similar pattern: more than 70% of those new projects are no longer active, a reminder of the market’s unpredictability.

It is important to note that these numbers relate to active tokens listed on platforms like Coingecko, Coinmarketcap and Investing. In contrast, the total number of tokens ever created is in the millions.

The growth of altcoins and the idea of “WAGMI” (We’re All Gonna Make It) have brought optimism to the crypto community; however, the high failure rate of these projects serves as a reality check, further solidifying the fact that following the right narrative is important.

New vs Old Tokens

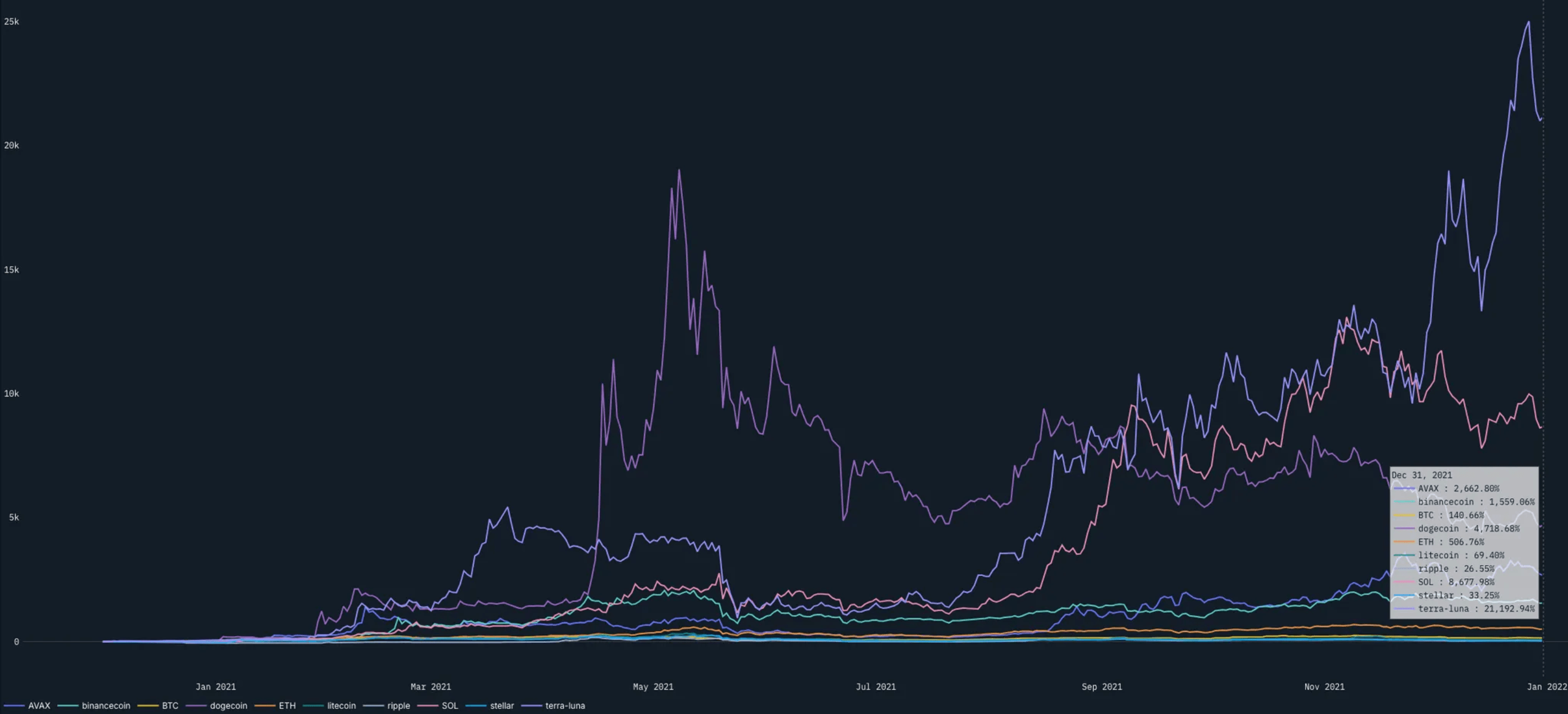

source: nansen query

The image shows how newer tokens like the now infamous Terra (LUNA), Avalanche (AVAX), and Solana (SOL) became the market’s "shiny new objects," vastly outperforming older tokens like Bitcoin, Ethereum, Litecoin, Ripple, and Stellar during the 2020-2021 bull run. While these established tokens saw steady growth, newer tokens captured investor excitement and led in performance. This is also true during the altcoin season itself. Older tokens faced sell pressure from long-term holders looking to cash out, while newer tokens rode the enthusiasm surrounding emerging technologies.

The rise of meme tokens like Dogecoin (DOGE), which peaked with a 19,000% gain by May 8, 2021, often signals the tail end of an altcoin season. Dogecoin’s spike suggested the market was reaching a peak, followed by a final surge in NFT interest that carried into early 2022—known as NFT Winter. This pattern illustrates how newer, trend-focused tokens lead during bull runs, but a surge in meme tokens often hints that a market correction is approaching.

In late 2023 and early 2024, there was another profitable window for altcoins, though many argue we didn’t see a full alt season regardless of the price performance. Among tokens with a minimum market cap of $100 million, Nosana (NOS) led in performance. For tokens with a $500 million minimum, AOIZ Network (AIOZ) was the top performer, while Bonk (BONK) took the lead among those with a market cap of at least $1 billion. Aside from BONK, the other two projects both fit into the AI and compute category which indeed saw higher levels of interest during this time.

What is hot now?

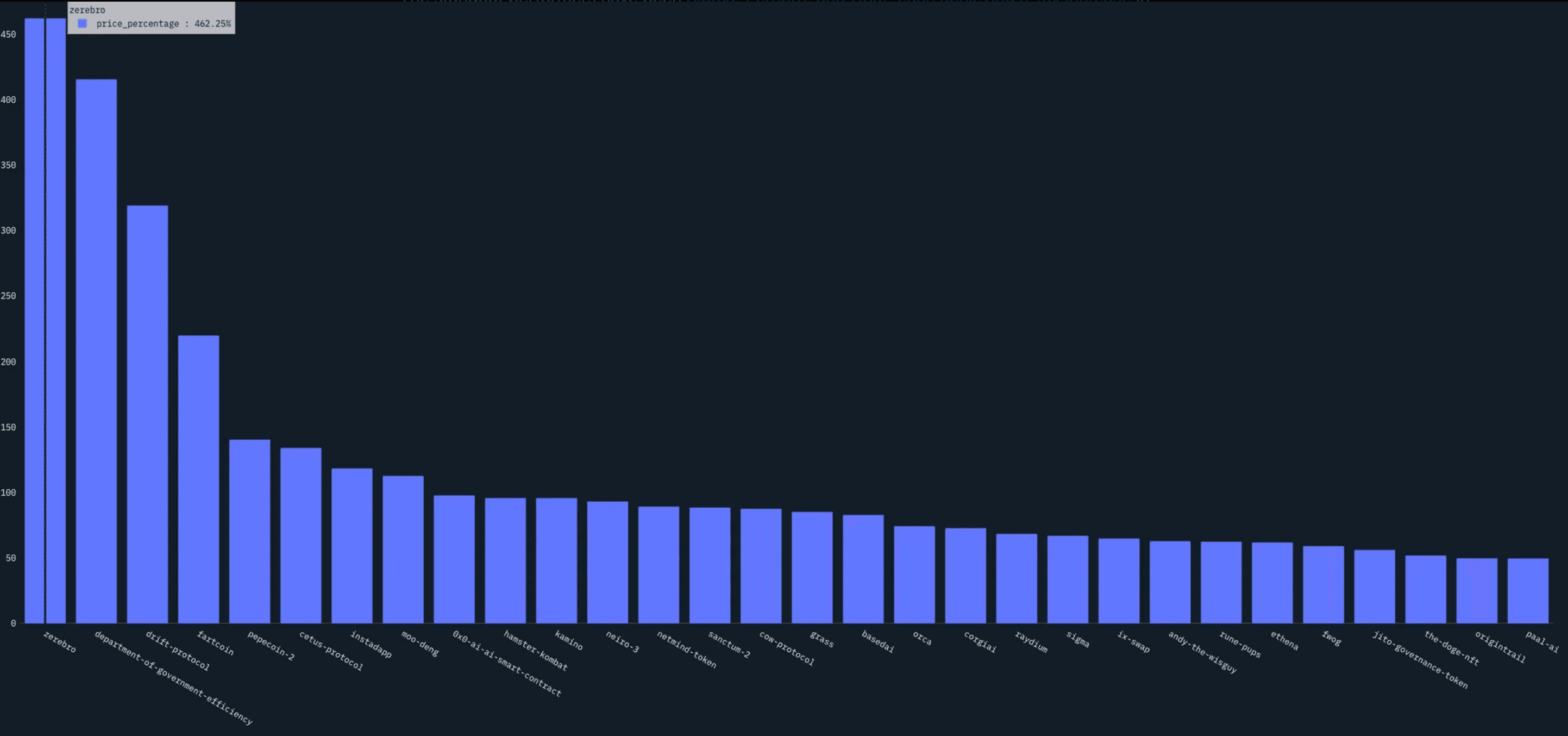

Since October, several tokens have seen impressive returns, with memecoins leading the pack. The standout performers have been Sigma, Zerebro, and Goat, each achieving a 10x increase in value from October 1st to November 10th. These memecoins have outpaced most of the market, reflecting the ongoing appeal of speculative, community-driven tokens.

Alongside Sigma, Zerebro, and Goat, most of the other top 30 tokens in terms of percentage gains are also memecoins, underscoring the current popularity of speculative assets. Beyond memecoins, DeFi tokens have also made a comeback, with Raydium, Drift, and Kamino each gaining over 100% since October with most of the price action having happened in the past week.

source: Nansen Query

Can We Anticipate Altcoin Seasons?

Anticipating an altcoin season involves analyzing macroeconomic factors and specific market indicators. The Federal Reserve's monetary policy, particularly decisions from the Federal Open Market Committee (FOMC), plays a significant role. On November 7, 2024, the FOMC reduced the federal funds rate by 25 basis points to a target range of 4.5% to 4.75%, aiming to support economic growth amid a cooling labor market and lower inflation.

Such easing measures can increase liquidity, potentially creating a favorable environment for riskier assets like altcoins. Conversely, tightening policies can reduce liquidity, potentially dampening altcoin growth.

Bitcoin dominance, which measures Bitcoin's share of the total cryptocurrency market capitalization, is another key indicator. A decline in Bitcoin dominance suggests that investors are reallocating capital into altcoins, signaling the onset of an altcoin season. However, this indicator lags behind market movements, often confirming trends after they have begun.

Similarly, the TOTAL3 index, representing the market capitalization of all cryptocurrencies excluding Bitcoin and Ethereum, reflects the broader altcoin market's strength. An increase in TOTAL3 indicates growing interest in altcoins, but like Bitcoin dominance, it lags and typically confirms trends post-factum.

Most indicators for identifying altcoin seasons are indeed lagging, making it challenging to time the perfect entry. While the FOMC’s policies and statements can offer some guidance, relying solely on previous meeting outcomes to anticipate an altcoin season is uncertain at best. Timing the market perfectly is difficult, and using broader economic signals can help, but it doesn’t guarantee precise entry points.

Finally, according to this alt season indicator from blockchainchenter, we are not yet in an altcoin season even with people calling for it as we see Cardano (ADA) with positive price action after a long time. Given that indicators often lag and with Bitcoin (BTC) currently exploring new price levels, the market environment might suggest a closer look at altcoin opportunities. As Bitcoin stabilizes in this discovery phase, altcoins could present interesting potential for those considering a higher risk allocation.

Conclusion

In conclusion, the current market landscape reflects both familiar patterns and new dynamics in the world of altcoins. Historically, each bull market cycle has brought its own wave of “shiny new objects” from ICO tokens in 2017 to DeFi and NFT projects in late 2021 each attracting high levels of interest and often outperforming older tokens. While we’ve seen some notable returns in newer sectors like DeFi and memecoins since October, it’s still uncertain if we’re on the brink of a full altcoin season or merely experiencing isolated rallies.

Indicators like Bitcoin dominance and the TOTAL3 index offer insight into capital flows, but they tend to lag behind actual market shifts, making it difficult to anticipate the perfect entry. Macroeconomic factors, such as the Fed’s recent rate cut, can create a favorable backdrop by boosting liquidity, but there’s no clear formula to predict exactly when a broad shift to altcoins might occur.

As Bitcoin explores new price levels, it’s possible that investor interest could start rotating into altcoins. While no single indicator guarantees the onset of an altcoin season, the ongoing performance of certain sectors like DeFi and emerging tokens suggests that opportunities for altcoin growth remain, especially as broader market conditions continue to evolve.