Key Takeaways

- FTX Withdrawers (ETH network) are mainly risk-off as their token allocation consists largely of stable-coins (63%); namely USDC (46%), USDT (10.9%), BUSD (3.4%), and DAI (2.4%). ETH/WETH and WBTC represents 19.6% and 0.63% respectively.

- Besides majors like BTC and ETH, some interesting tokens held by ‘FTX Withdrawers’ are LINK, UNI, GMX, and LDO.

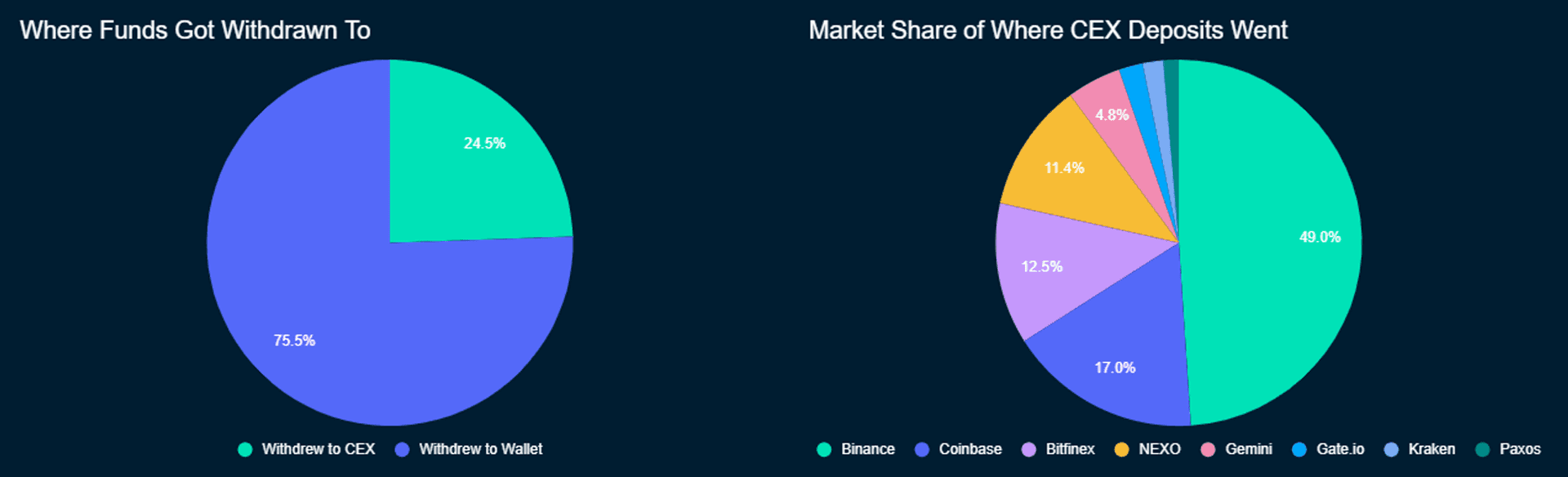

- While the collapse of FTX has eroded a lot of user confidence in CEXes, there was little evidence to support that the whales who exited FTX transitioned to DEX alternatives like dYdX or GMX. In fact, most of the funds withdrawn were eventually sent to another CEX deposit address or sitting idle in a wallet.

- When looking at CEX deposits sent from FTX directly, Binance was by far the top exchange where most of the withdrawals went (24.5%).

- 86% of funds among FTX Withdrawers (ETH network) are simply sitting in their wallets and not being deployed in any protocols to earn yield. This may indicate that FTX Withdrawers are wary of smart contract risk.

- Of the funds deposited into protocols, Aave, Uniswap, GMX, Stargate, and Lido were the most common ones.

Introduction

FTX pausing withdrawals and subsequently filing for bankruptcy in November was undoubtedly a black swan event that affected even the most seasoned and experienced crypto investors. While many had funds stuck on FTX, there were plenty of smart whales who managed to withdraw sizable amounts prior to FTX pausing withdrawals. This report will investigate what these users are currently doing on-chain as well as their current token holdings, protocol usage, and chain allocation.

Methodology

In order to come up with the list of FTX Withdrawers, we decided to look at the hot wallets of FTX on 3 different networks: Ethereum, Avalanche, and Polygon. From there, those who withdrew more than $1m on either Avalanche or Polygon or $5m on Ethereum 1 week prior to FTX pausing withdrawals (31 Oct - 7 Nov) were included. More specifically, we will also investigate whether different network withdrawal methods resulted in varying portfolio constructions.

Aggregate Chain, Token, and Protocol Allocations

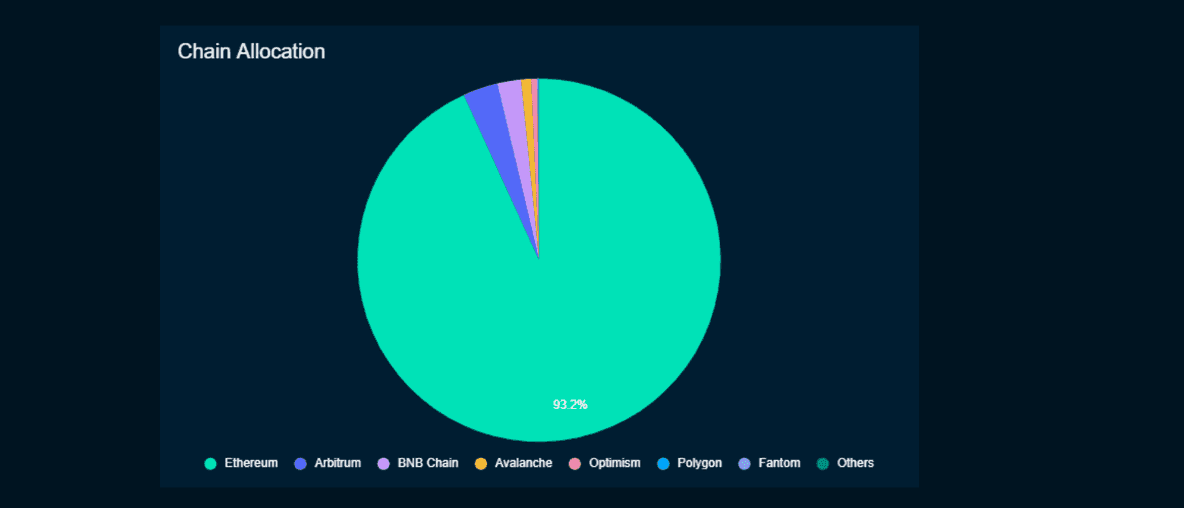

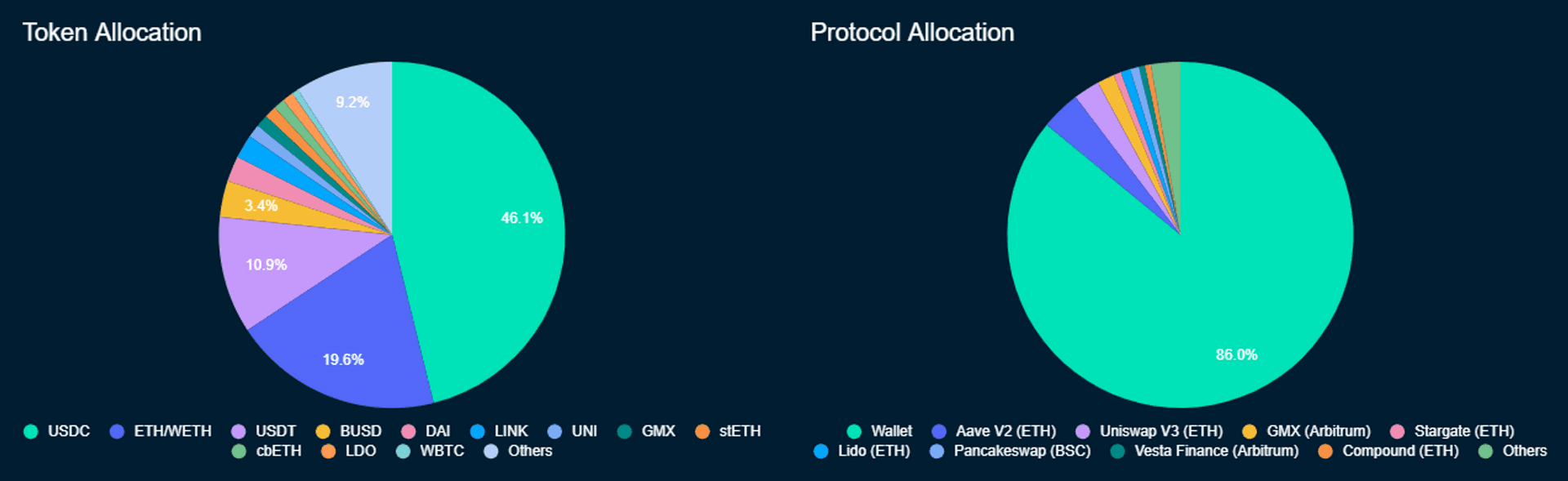

Ethereum Network Withdrawals

There were a total of 224 wallets that withdrew more than $5m from FTX with an aggregate sum of $5.1b. Looking at the total asset allocation, a large majority of assets (93.2%) among FTX withdrawers are on Ethereum, followed by Arbitrum at 3.1%, and lastly 2.1% for BNB Chain. Given the state of the market where competing L1s are offering very low yields in addition to users prioritizing security, the consensus among these whale wallets is to park funds on Ethereum.

By looking at the token and protocol allocation, it further reinforces the fact that the wallets are exhibiting risk-off behavior and prioritizing security. The make-up of their token allocation consists largely of stable-coins (63%); namely USDC (46%), USDT (10.9%), BUSD (3.4%), and DAI (2.4%). ETH/WETH and WBTC represent 19.6% and 0.63% respectively and some other nominal positions include GMX, LINK, LDO, and UNI.

In addition, 86% of funds are currently sitting in the wallets idle while only a small fraction is deployed to protocols like Aave (3.7%), Uniswap (2.5%), GMX (1.6%), and Stargate (0.7%). This suggests that users rather keep their funds idle in their wallets as the yields offered are often not high enough to compensate for the risk of exploits.

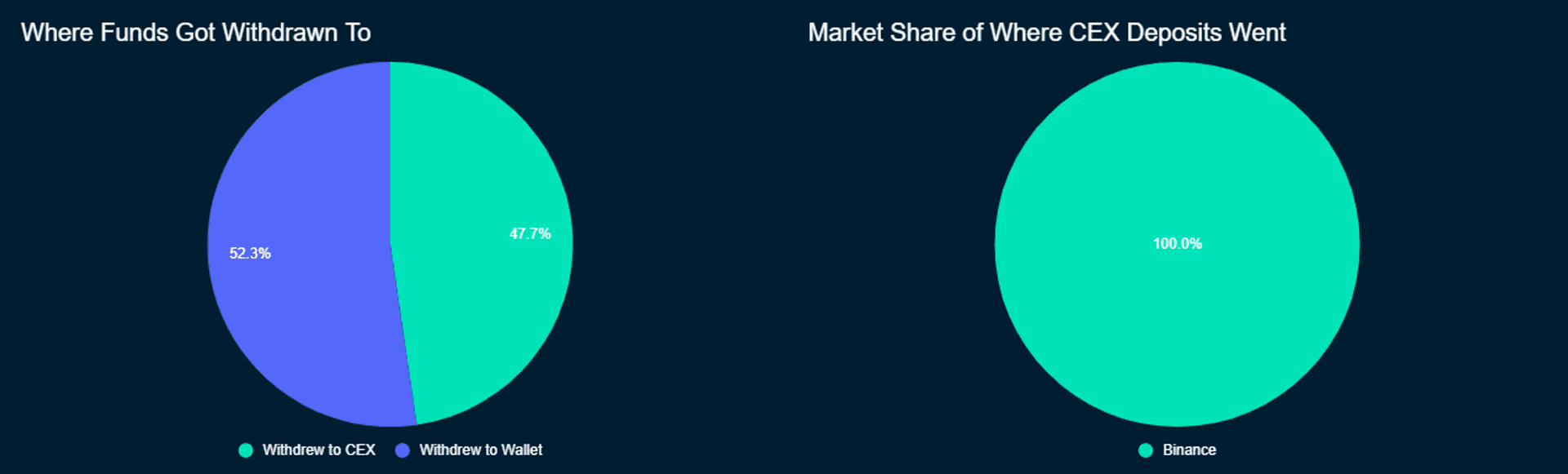

Of the $5.1b withdrawn from FTX, $1.2b or 24.5% of the funds were withdrawn directly into a CEX. Binance continues its dominance in capturing even more market share as roughly half (49.0%) of the CEX deposits went into Binance. This is followed by 17.0% into Coinbase, 12.5% into Bitfinex, 11.4% into NEXO, and 4.8% into Gemini.

% of Funds Withdrawn to a CEX

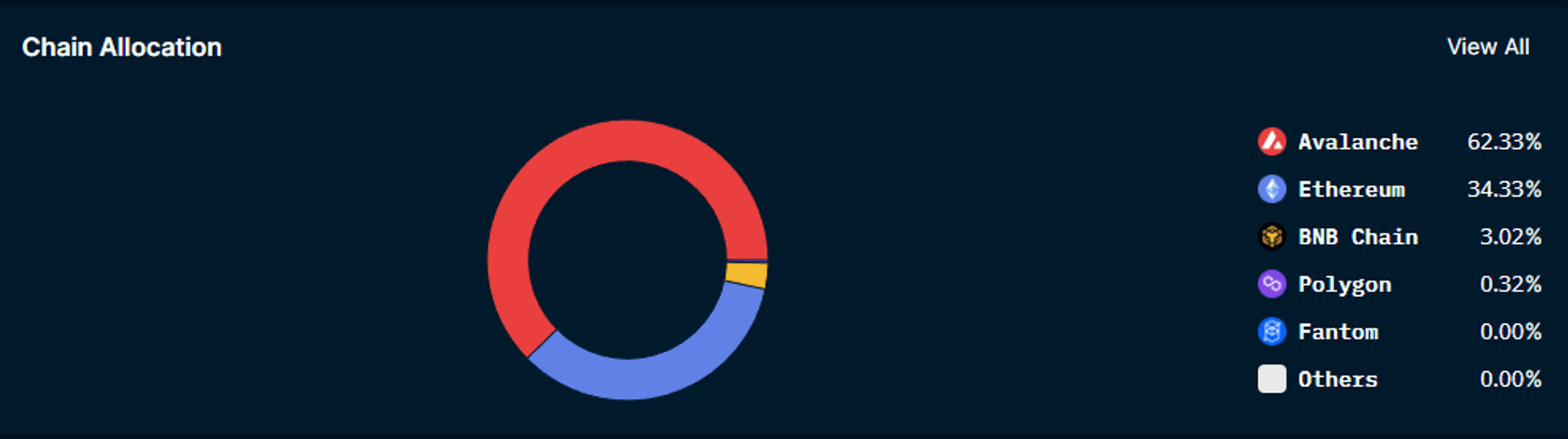

Avalanche Network Withdrawals

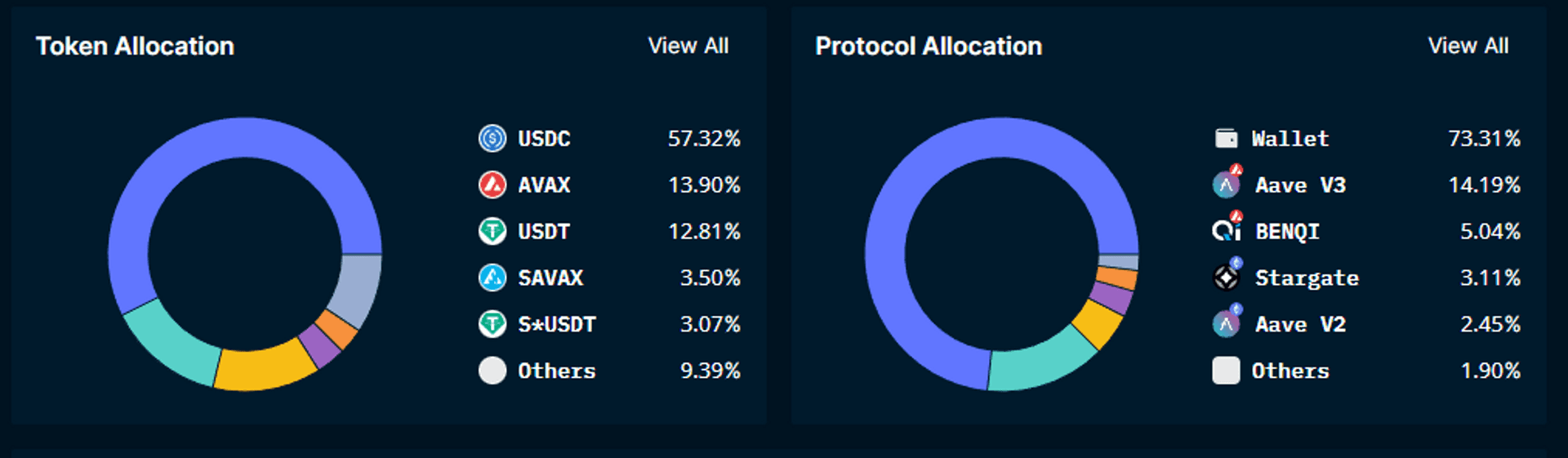

There were a total of 37 wallets that withdrew more than $1m from FTX with an aggregate sum of $142.6m via the Avalanche network. Looking at the total asset allocation, 62.3% of assets among FTX withdrawers are on Avalanche, followed by Ethereum at 34.3%, and lastly 3.02% for BNB Chain.

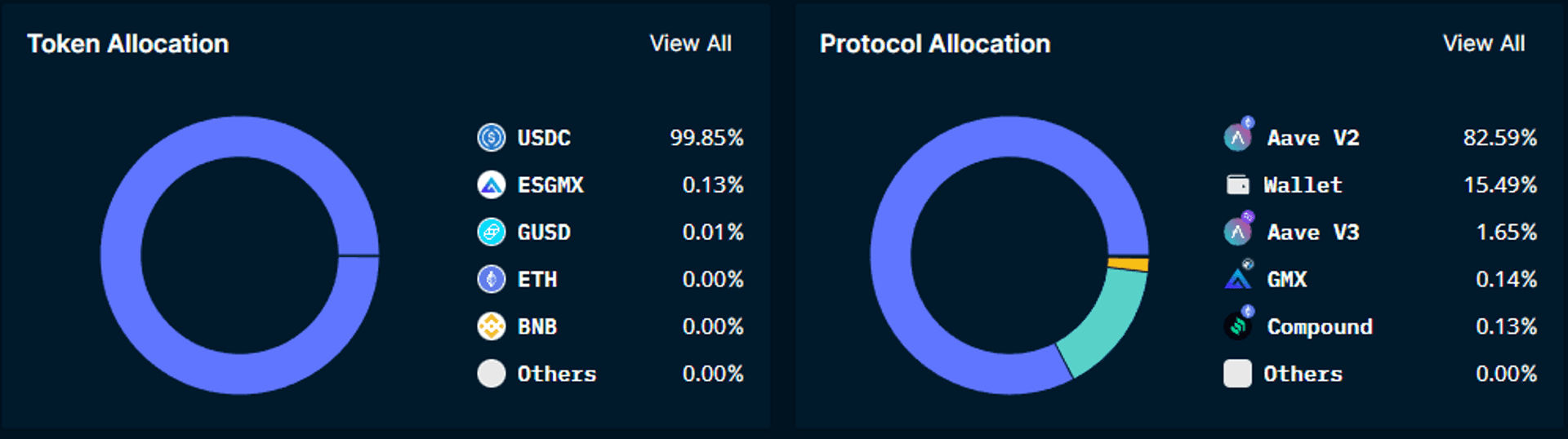

The wallets are largely risk-off as USDC and USDT represent 57.3% and 12.8% of their token allocation respectively. While AVAX appears on the token allocation list at 13.9%, it is heavily skewed as there’s one wallet that owns $20m worth of AVAX tokens. A majority of the assets are sitting inside wallets (73.3%) while some have been deployed to Aave (14.2%), BENQI (5.0%), and Stargate (3.1%).

% of Funds Withdrawn to a CEX

Of the $142.6m withdrawn from FTX, $68.1m or 47.7% of the funds were withdrawn directly into a CEX. Surprisingly, 100% of the CEX deposits (18/37 wallets) were all sent to Binance. There were a few users who first withdrew onto a wallet but then subsequently also moved funds into Binance afterward.

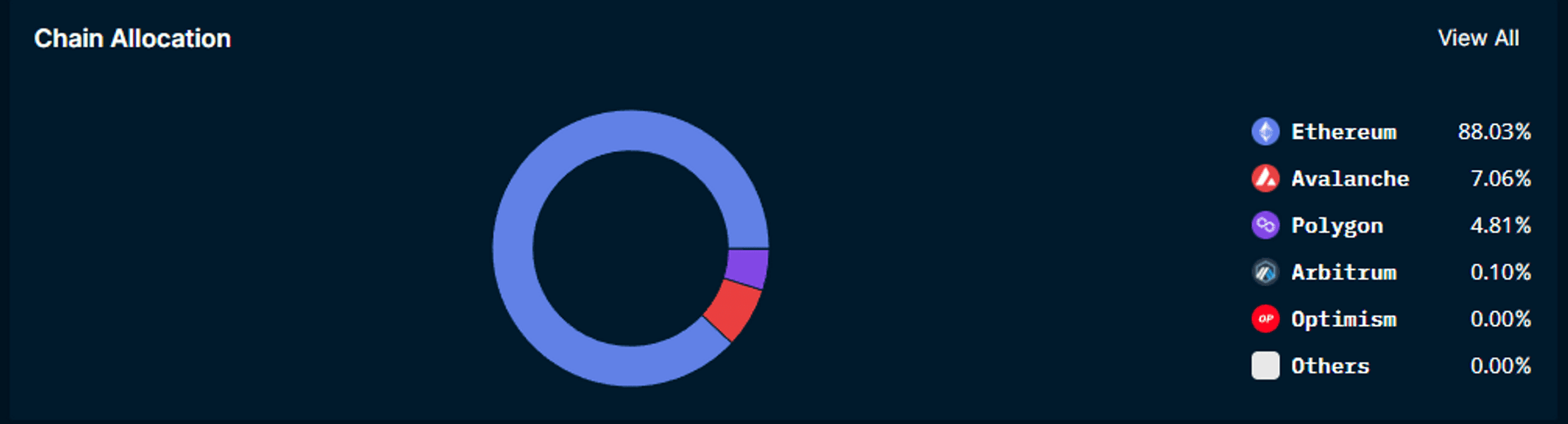

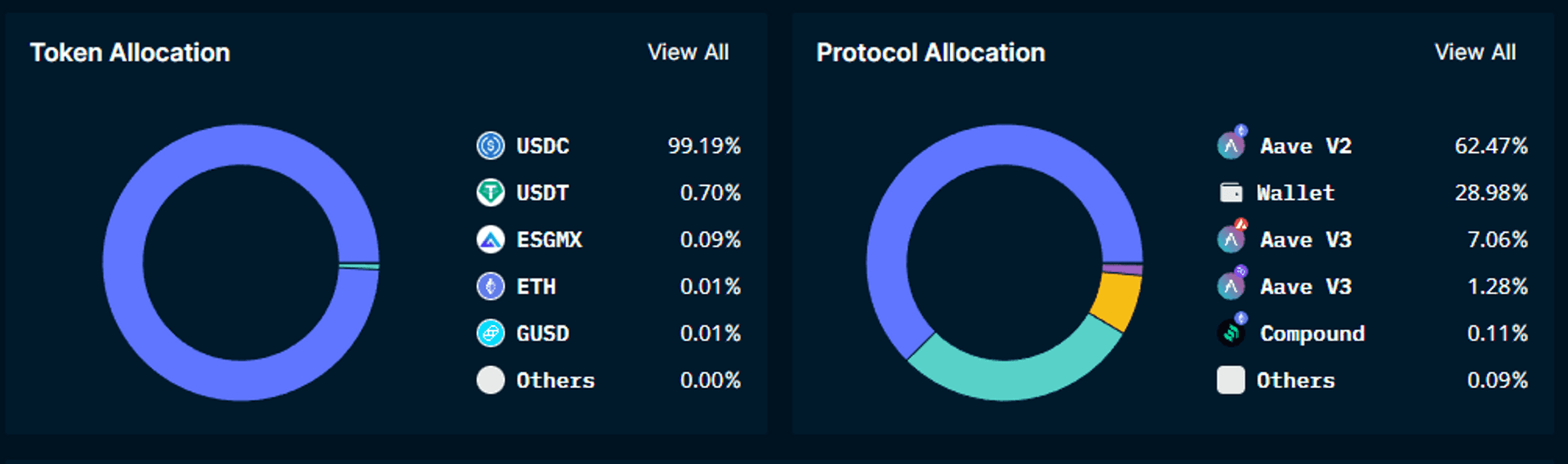

Polygon Network Withdrawals

There were a total of 12 wallets that withdrew more than $1m with an aggregate sum of $32.9m. Although the funds were withdrawn via the Polygon network, from looking at the total asset allocation we see that 88% of the wallets’ current funds are sitting within Ethereum. Interestingly, Avalanche is at 7.1% while Polygon sits at 4.8%. This suggests Polygon may have just been used as a more efficient withdrawal network and the end goal was to still have funds on Ethereum.

Looking at the token allocation, the wallets are entirely risk-off and holding only stable-coins of which USDC represents 99.2% followed by USDT at 0.70%. A majority of the USDC is actually deposited into blue-chip DeFi protocols like Aave. In fact, Aave represents 70.8% of the protocol allocation when summed up across chains while the remaining 28.98% sits inside the wallets.

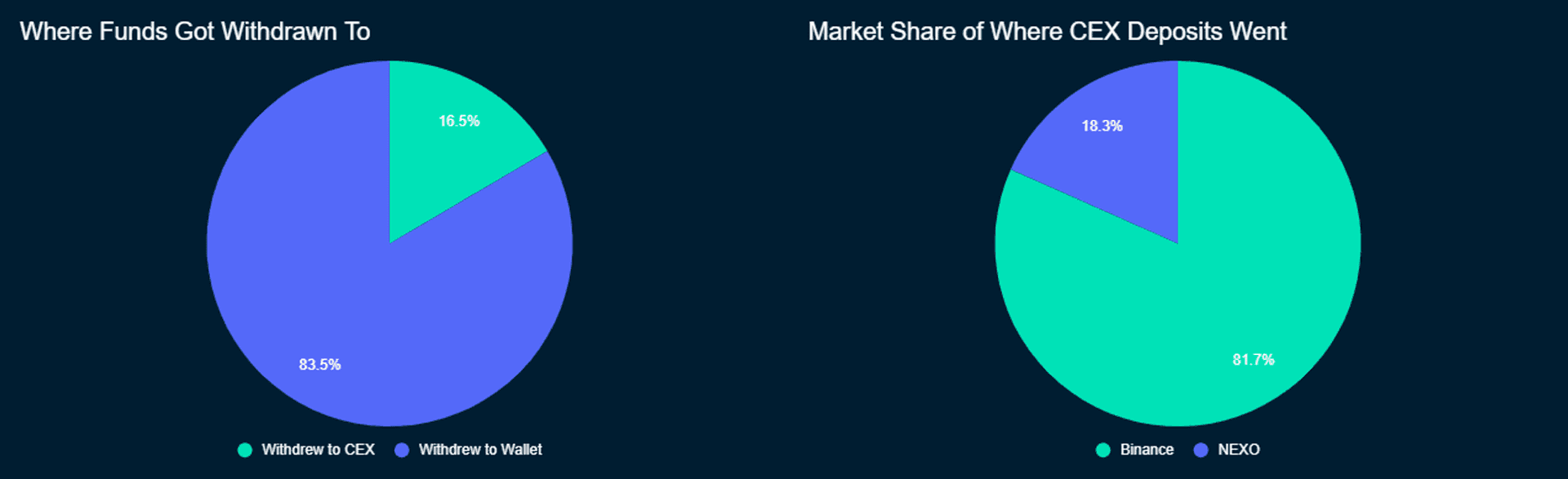

% of Funds Withdrawn to a CEX

Of the $32.9m withdrawn from FTX, $5.45m or 16.54% of the funds were withdrawn directly into a CEX. A majority of the funds (81.7%) were sent to Binance while the remainder was sent to NEXO.

Notable Wallet On-Chain Behaviors

Below is a table with a curated list of 11 active FTX Withdrawer wallet addresses. Later on, we’ll be breaking down each wallet address and highlighting any interesting on-chain activity that may allow us to make more informed decisions.

| Wallet Address | Label on Nansen |

|---|---|

| 0xf731f4c74eae61dfa88e0b6a13f9d2624bf2b16f | 🤓 Smart Dex Trader |

| 0x5d17b355538a9ea9b45a0018e11b36947fc16376 | 0xppl.eth |

| 0x65b1b96bd01926d3d60dd3c8bc452f22819443a9 | VaultedNFT" on OpenSea |

| 0x6b6310bd7fb278c7d6a12f888a0360b44d209e33 | Token Millionaire |

| 0x07b23ec6aedf011114d3ab6027d69b561a2f635e | Token Millionaire |

| 0xe52f5349153b8eb3b89675af45ac7502c4997e6a | Token Millionaire |

| 0x5e12fc70b97902ac19b9cb87f2ac5a8593769779 | Found on Avalanche |

| 0x9681319f4e60dd165ca2432f30d91bb4dcfdfaa2 | Token Millionaire |

| 0x3c8d1abf82599f54519e477e194199720b06541f | jackgao.eth |

| 0x9611d4093f3430ea059877ff232584693f80f9e8 | Token Millionaire |

| 0x857f876490b63bdc7605165e0df568ae54f72d8e | Medium Uniswap V3 LP |

0xf731f4c74eae61dfa88e0b6a13f9d2624bf2b16f (🤓 Smart Dex Trader)

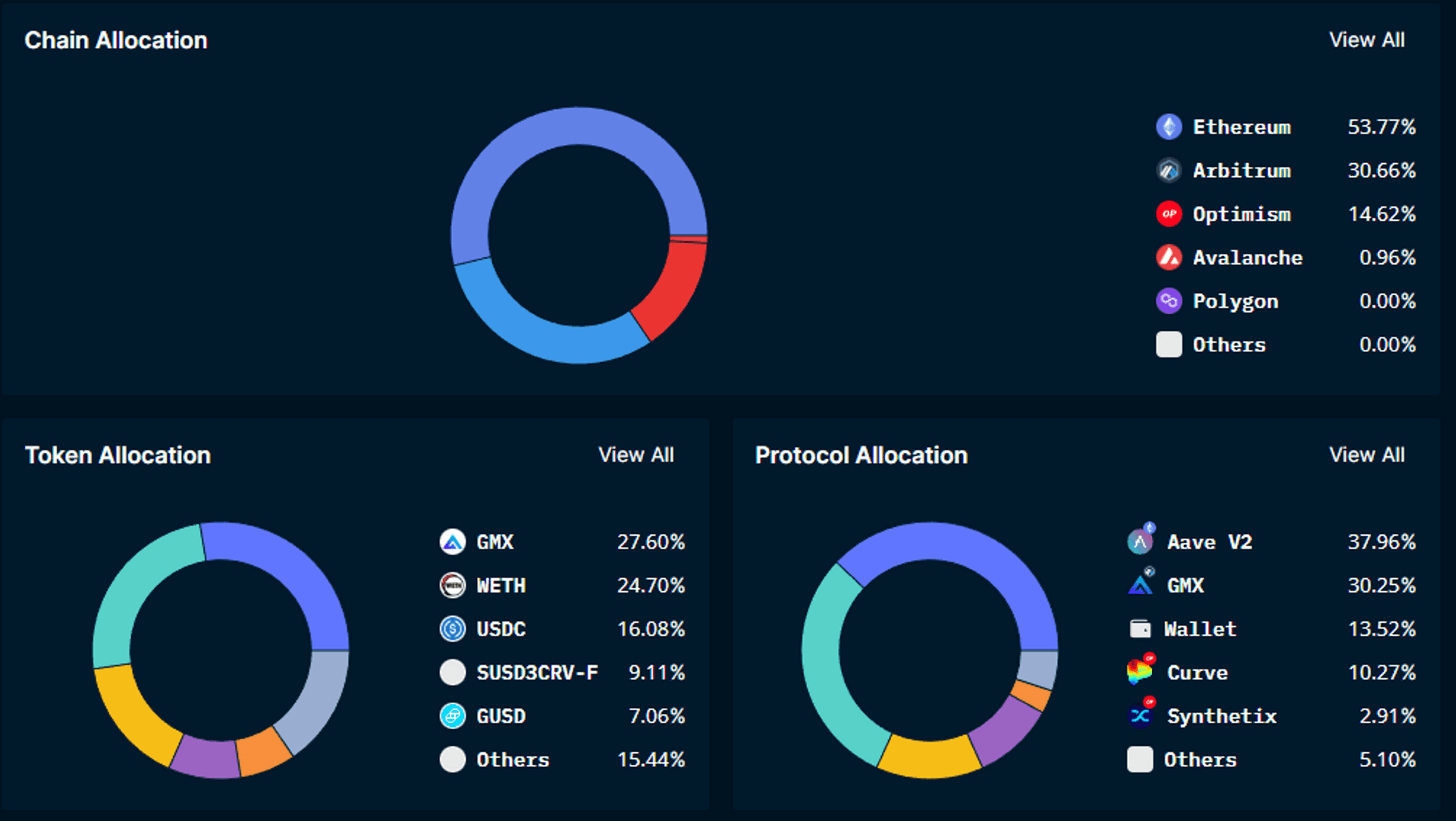

This wallet has allocated roughly 50% of its portfolio to assets like GMX (27.6%) and WETH (24.7%) while the remainder is split between stable-coins like USDC, GUSD, sUSD, and DAI. In fact, this wallet is labeled as an Early GMX Staker and has been staking GMX for over a year since 11 Sept 2021. Other positions include $7m ETH in Aave, $2.6m sUSD3CRV on Curve and $1.1m SNX on Synthetix.

0x5d17b355538a9ea9b45a0018e11b36947fc16376 (0xppl.eth)

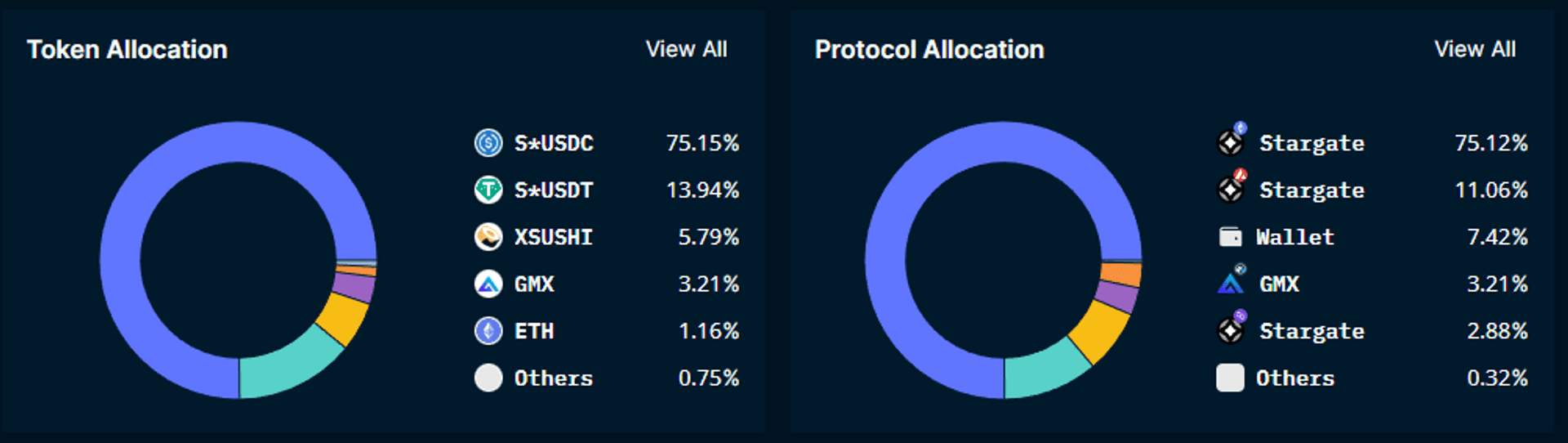

While the wallet is mainly risk-off and holding a combination of USDC (75.2%) and USDT (13.9%) stable-coins, the user is clearly very comfortable parking the funds within Stargate. Stargate Finance is currently offering 4.23% APY on USDC (Ethereum) and 6.24% APY on USDT (Avalanche). With $356m in TVL and notable institutional backers like Sequoia and a16z, Stargate offers this user a healthy risk-reward ratio with its higher yields relative to Aave, Compound, or Curve.

The wallet also has funds deposited into Across bridge, Maker, SushiSwap and GMX.

0x65b1b96bd01926d3d60dd3c8bc452f22819443a9 ("VaultedNFT" on OpenSea)

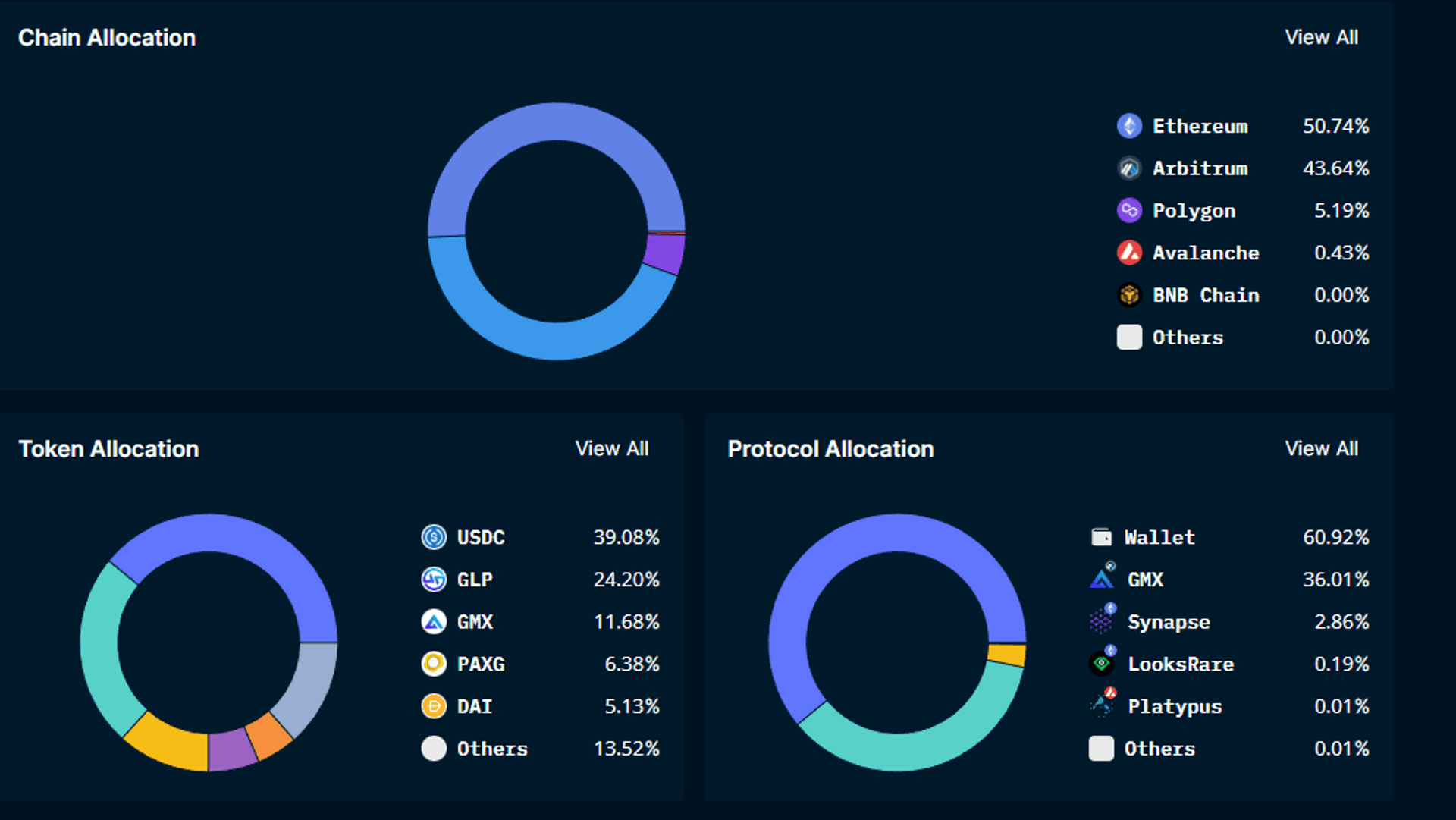

This wallet has roughly half its assets allocated to Ethereum (50.7%) while the remainder is in Arbitrum (43.6%) and Polygon (5.2%). Token allocation is split into stable-coins and yield-bearing assets like GMX, GLP and GNS.

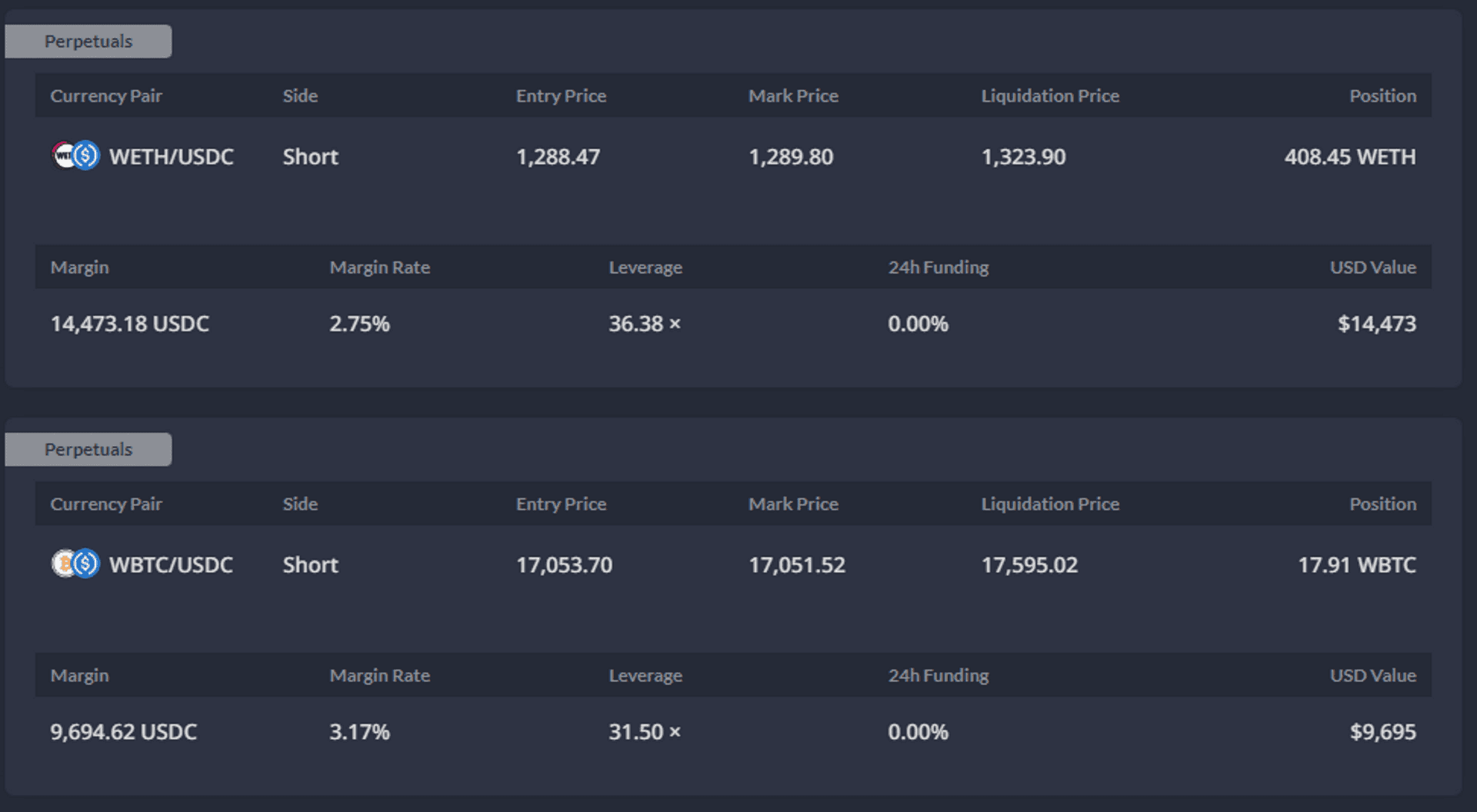

Funny enough, this wallet also has 2 degen ~30x leverage short positions on both WETH and WBTC. Given how this wallet has a $3.2m position in GLP, the leveraged short positions are most likely used to partially hedge out the directional risk while being capital efficient.

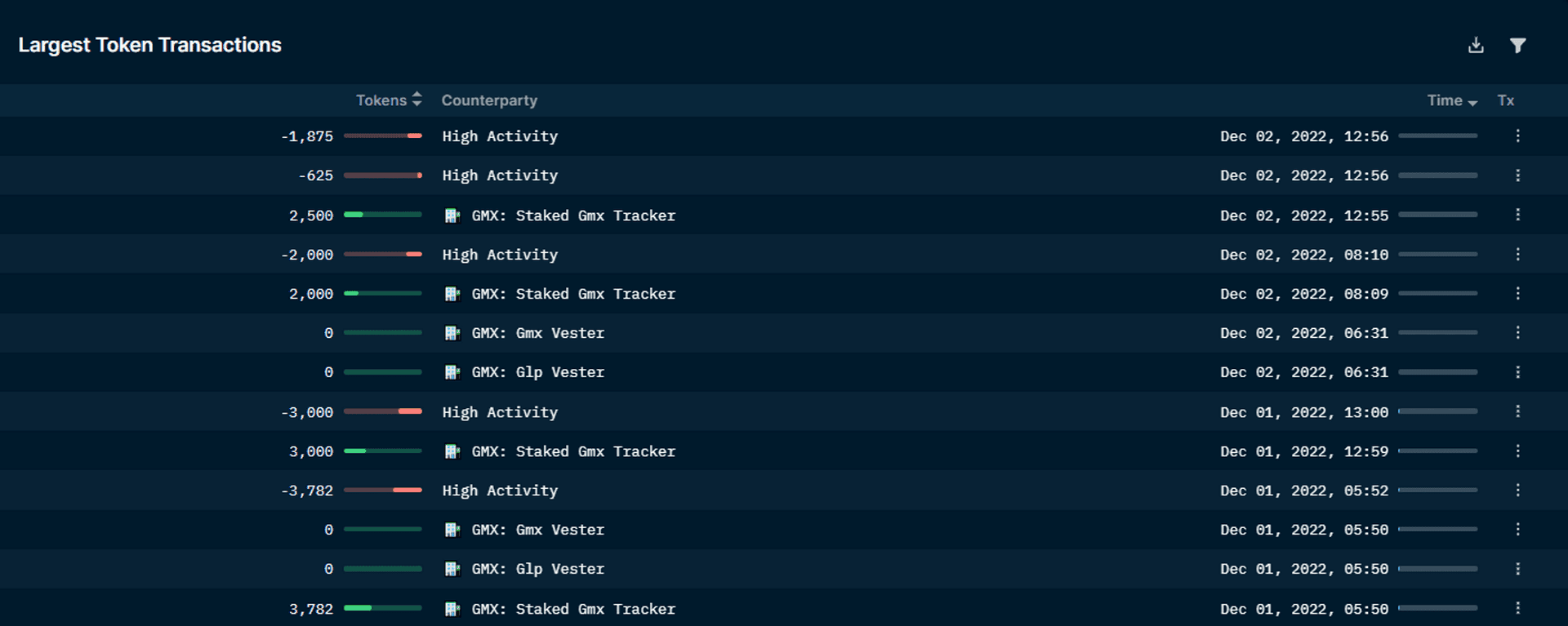

The wallet currently holds $1.5m of GMX but has been consistently unstaking it and selling it for ETH via Uniswap since 1 Dec 2022.

Upon FTX pausing withdrawals on 8 Nov 2022 and the decentralized perpetual protocol narrative catching a bid, this wallet has been routinely unstaking its GNS and selling into the price pumps.

0x6b6310bd7fb278c7d6a12f888a0360b44d209e33 (Token Millionaire)

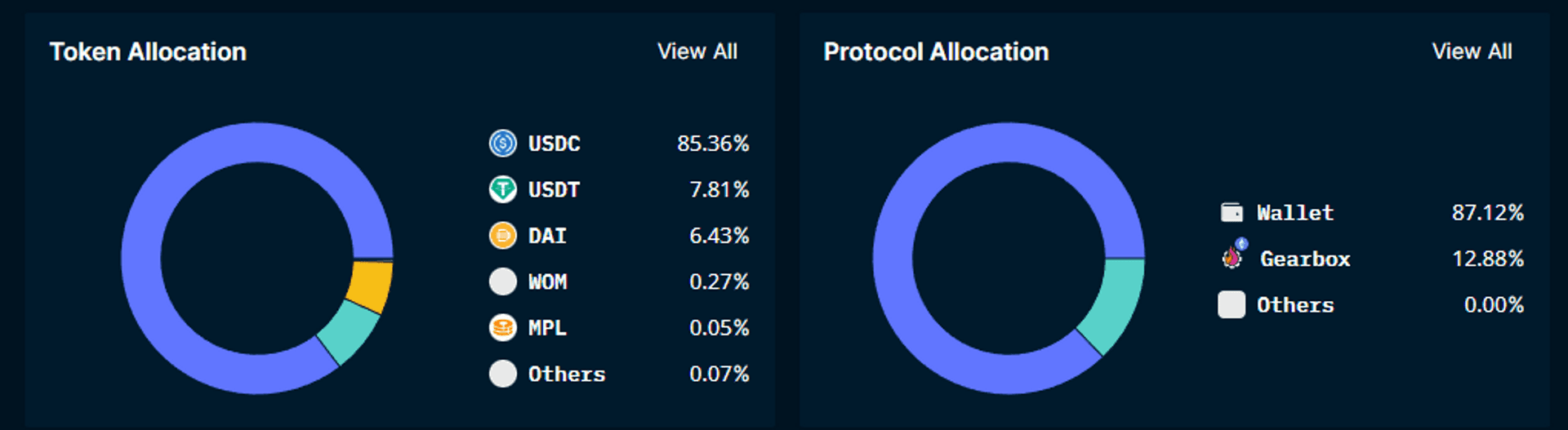

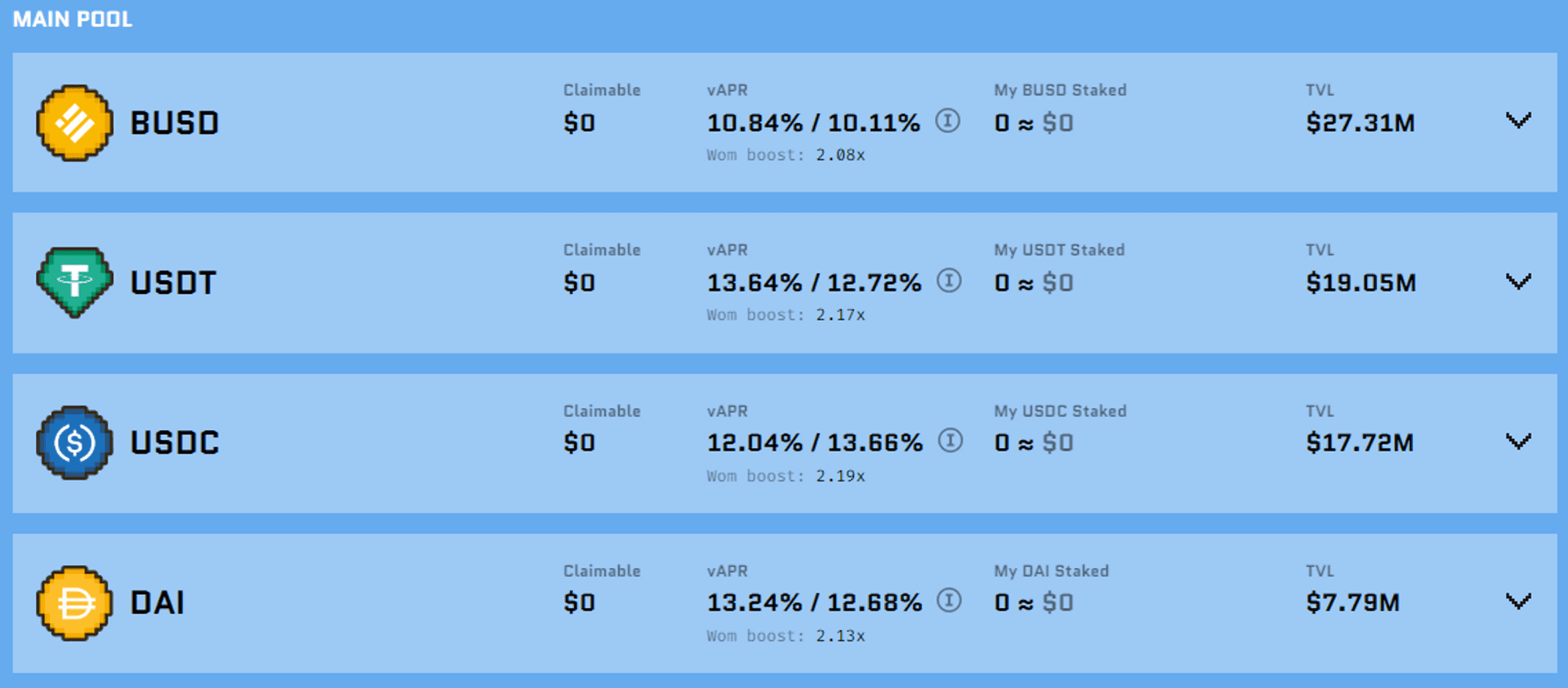

This wallet is entirely risk-off and primarily holds its funds in USDC. Additionally, the user is also very conservative when allocating into protocols and risks less than 15% of funds per farm. $1.83m of USDC and DAI was deposited into Gearbox earning 6.35%-9.62% APY while another $1.8m of USDC, USDT, BUSD, and DAI was deposited into Wombex Finance earning 10.11%-13.66% APY. Currently, a majority of the USDC (87.1%) is simply sitting idle in the wallet

0x07b23ec6aedf011114d3ab6027d69b561a2f635e (Token Millionaire)

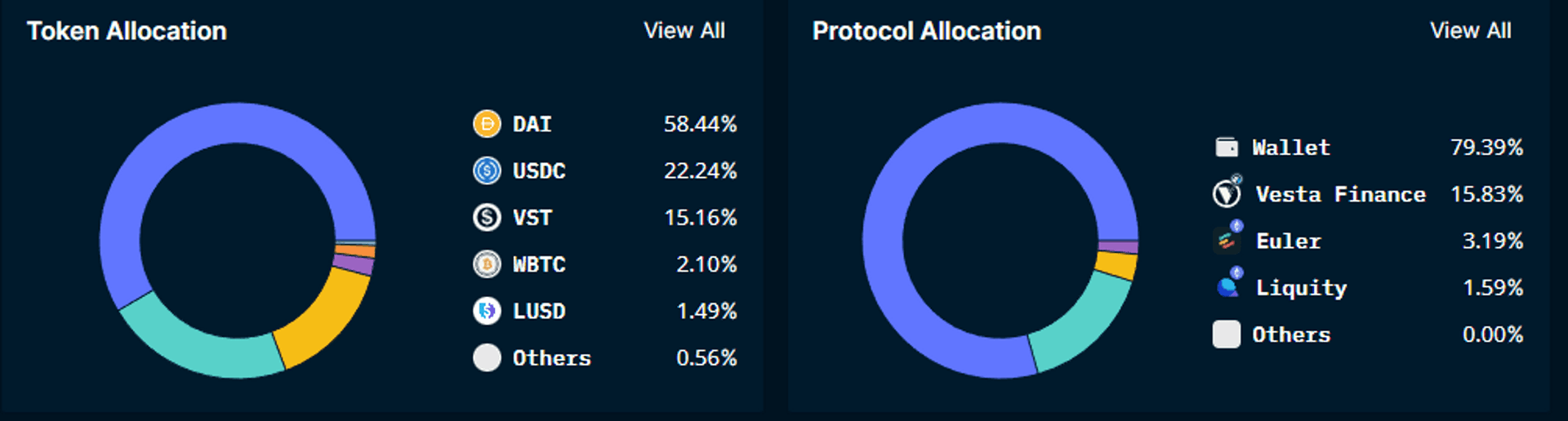

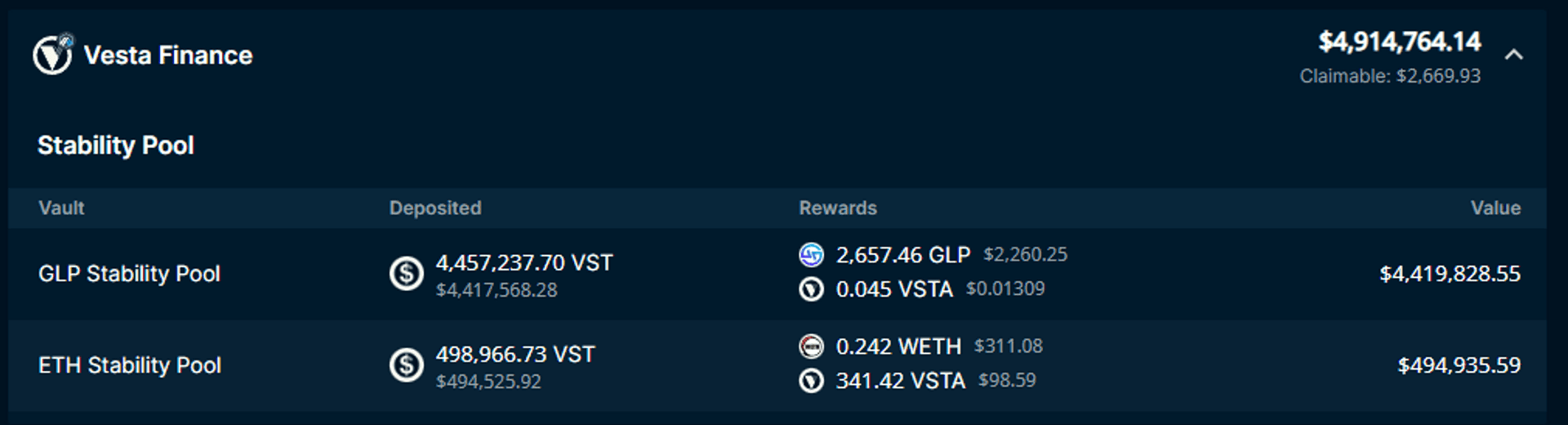

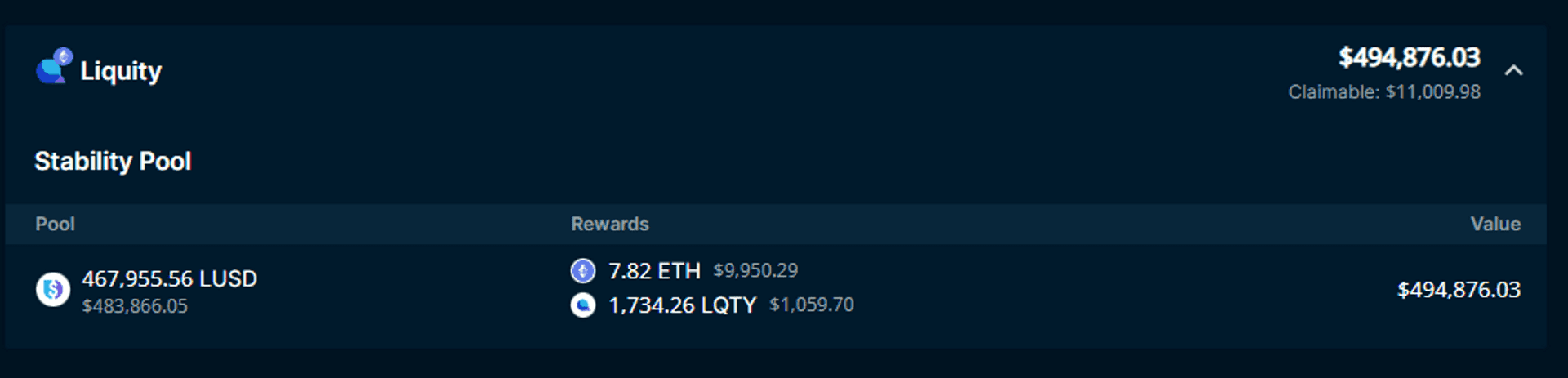

This wallet is entirely risk-off and holds various stable-coins like DAI, USDC, VST, LUSD along with a nominal WBTC position.

The wallet has also strategically allocated a portion of funds into VST and LUSD and staked it into the GLP and ETH stability pools to buy the liquidations of positions in addition to earning yield. This was a strategy utilized by Tetranode who famously bought the ETH dip with LUSD on Liquity during the May 2022 crash.

0xe52f5349153b8eb3b89675af45ac7502c4997e6a (Token Millionaire)

This wallet is currently in 100% stable-coins (USDC) and has opened a few short positions by depositing USDC into Aave and borrowing WBTC, YFI, and MATIC.

0x5e12fc70b97902ac19b9cb87f2ac5a8593769779 (Found on Avalanche)

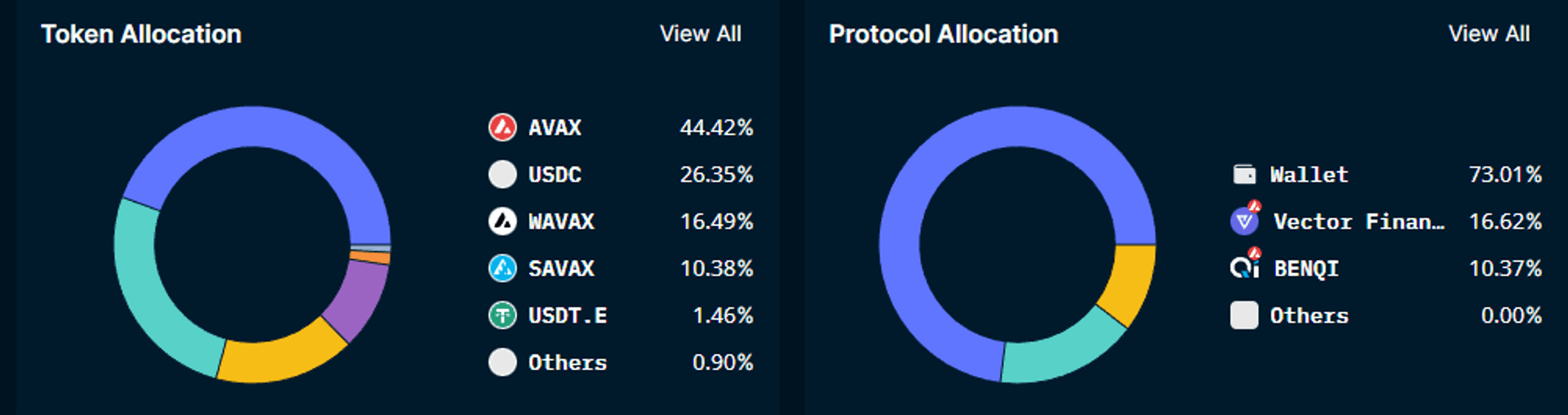

This wallet is a massive AVAX bull and holds 71.3% ($24.2m) of his portfolio in AVAX, WAVAX, and SAVAX. While a majority of the funds sit idle in the wallet, a portion of the AVAX is deposited into Vector Finance and BENQI earning yield. The remainder of the funds are sitting in USDC.

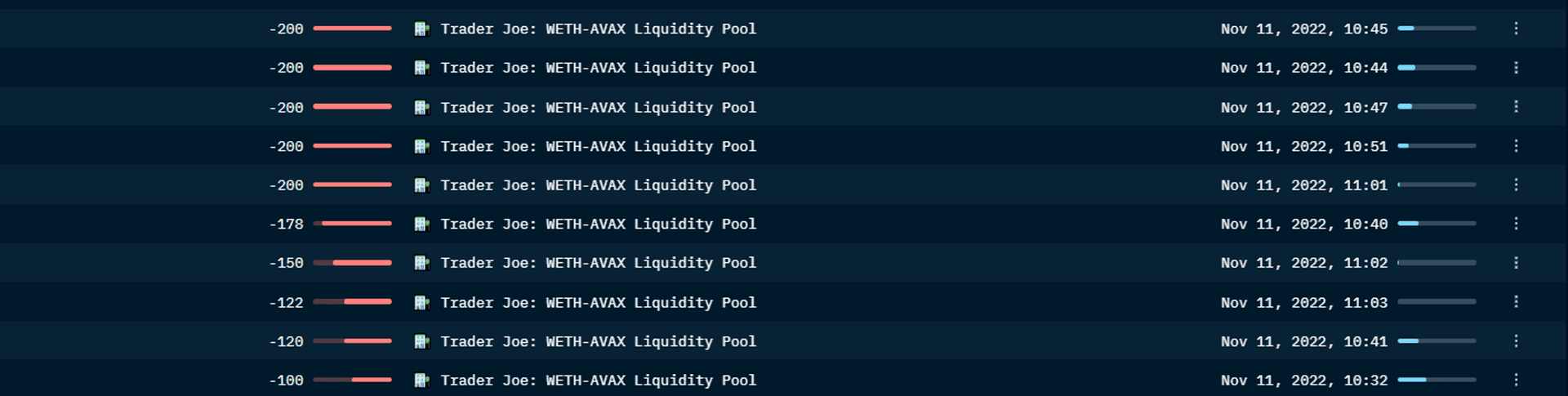

On 11 Nov 2022, the wallet TWAPED 145k AVAX (~$2m) by swapping 1670 ETH on Trader Joe.

0x9681319f4e60dd165ca2432f30d91bb4dcfdfaa2 (Token Millionaire)

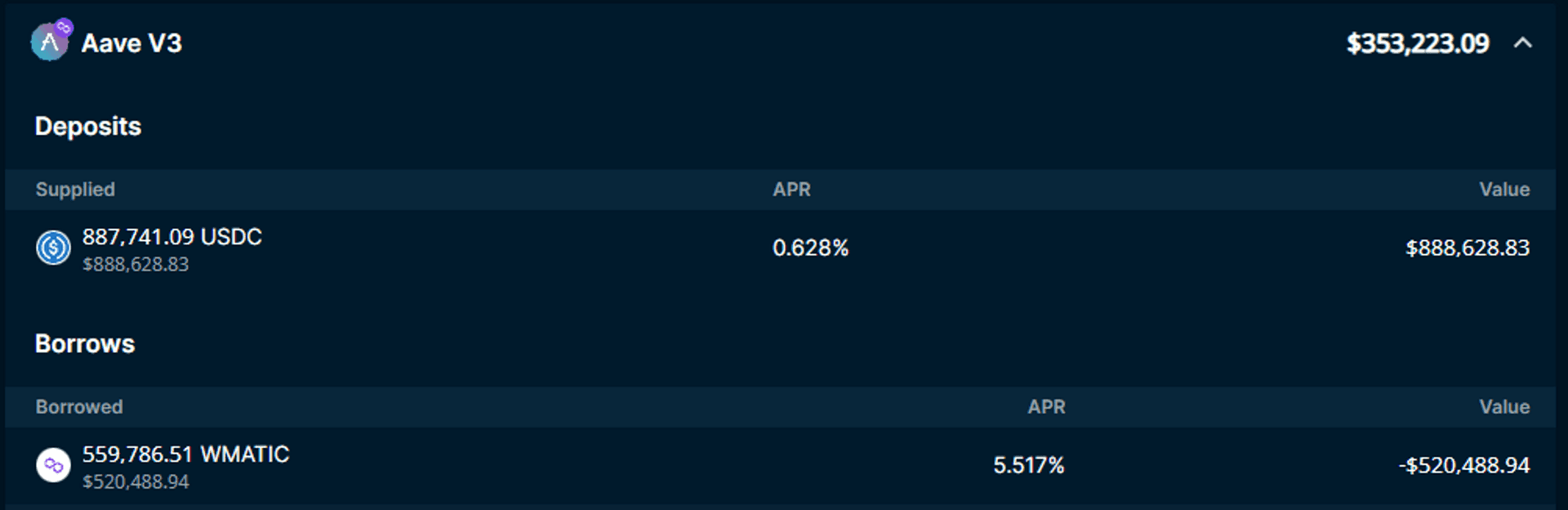

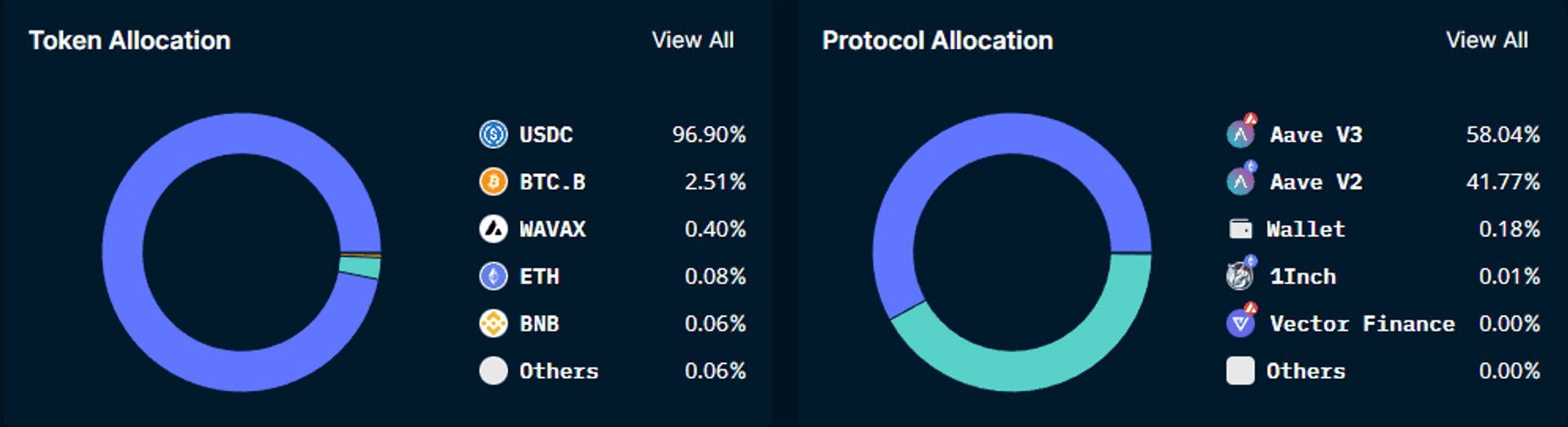

While this wallet is largely risk-off and in 96.9% USDC, all the funds are being put to work and collecting yield in blue-chip protocols like Aave across both Ethereum and Avalanche. $2m USDC is supplied on Aave (Avalanche) earning 1.96% APY and $1.5m USDC is supplied on Aave (Ethereum) earning 1.18% APY.

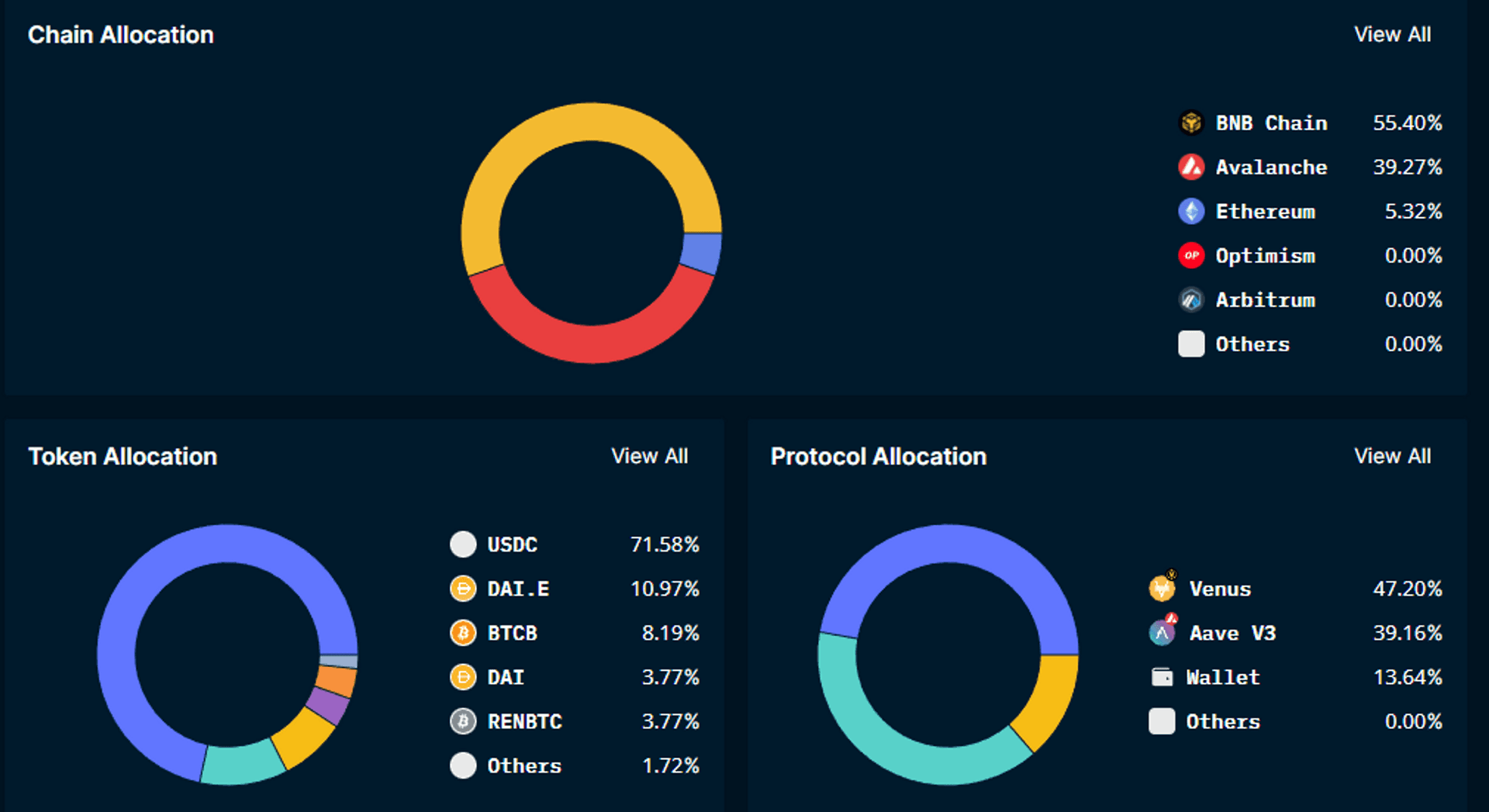

0x3c8d1abf82599f54519e477e194199720b06541f (jackgao.eth)

This wallet primarily consists of stable-coins like USDC and DAI alongside a small BTCB/RENBTC (12%) position. Over half of the wallet’s USDC is deployed onto a protocol called Venus Finance earning 2.52% APY. This comes off as quite surprising given how the yield is only marginally higher than battle-tested protocols like Aave but with arguably much greater smart contract risk. The top 2 chains used are BNB Chain (47.2%) and Avalanche (39.2%)

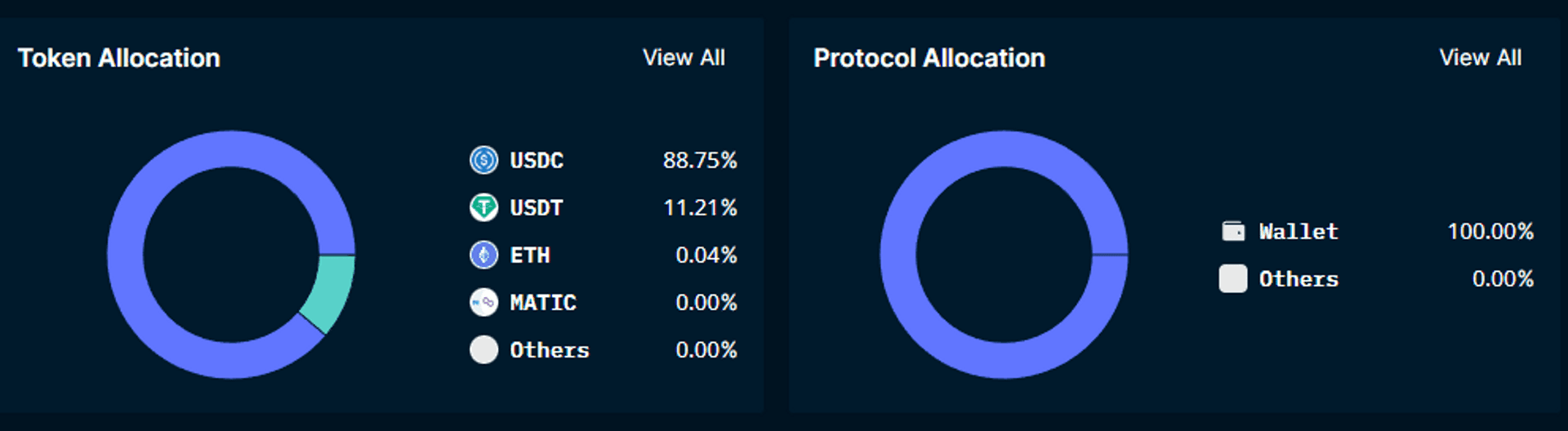

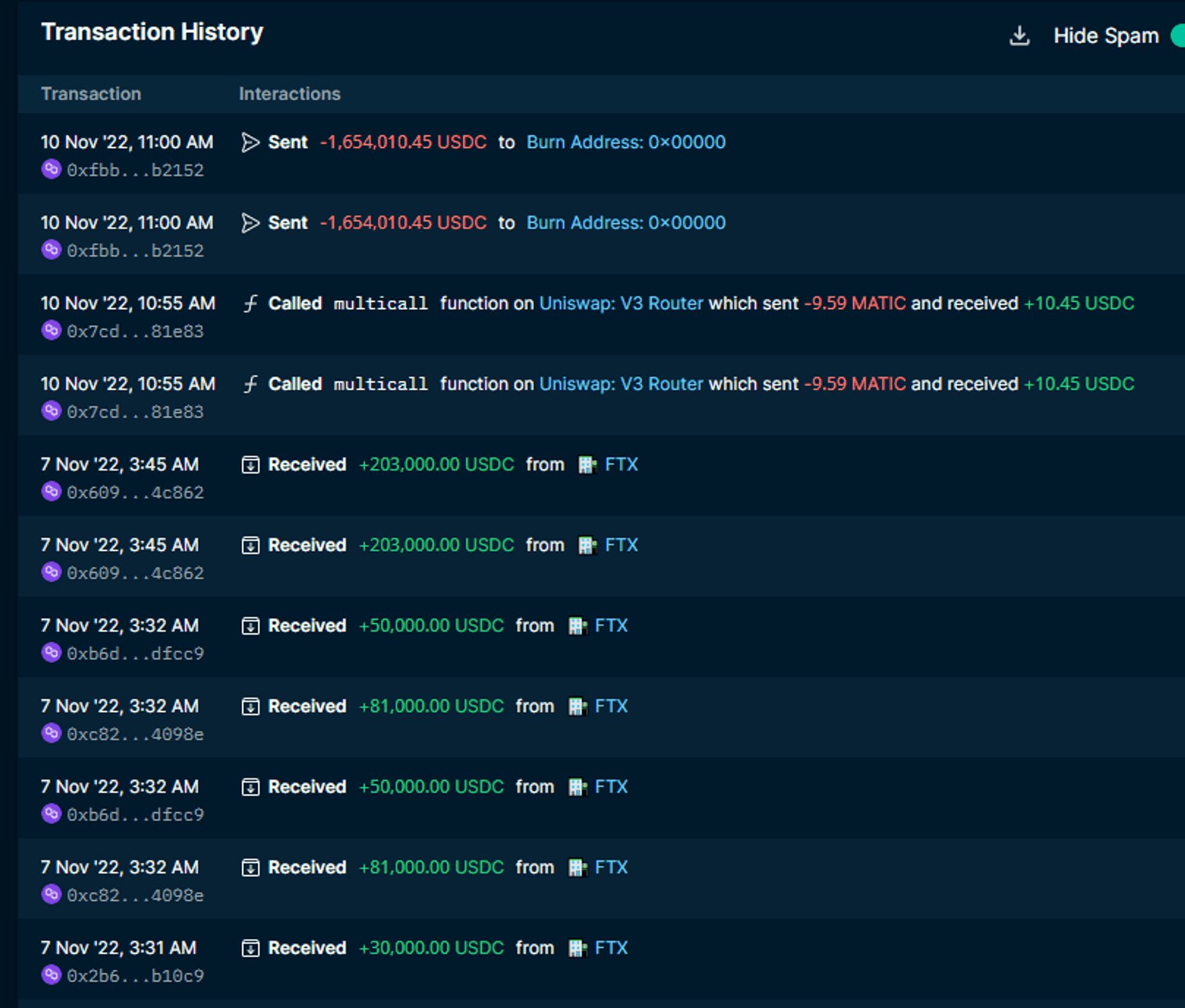

0x9611d4093f3430ea059877ff232584693f80f9e8 (Token Millionaire)

This wallet withdrew a total of $1.65m via Polygon across 18 transactions on 7 Nov and bridged it all back onto mainnet a few days later. The user most likely split up the withdrawals to increase the likelihood of it getting processed quicker in addition to using a less congested chain like Polygon. It currently holds its entire portfolio in a split between USDC and USDT.

0x857f876490b63bdc7605165e0df568ae54f72d8e (Medium Uniswap V3 LP)

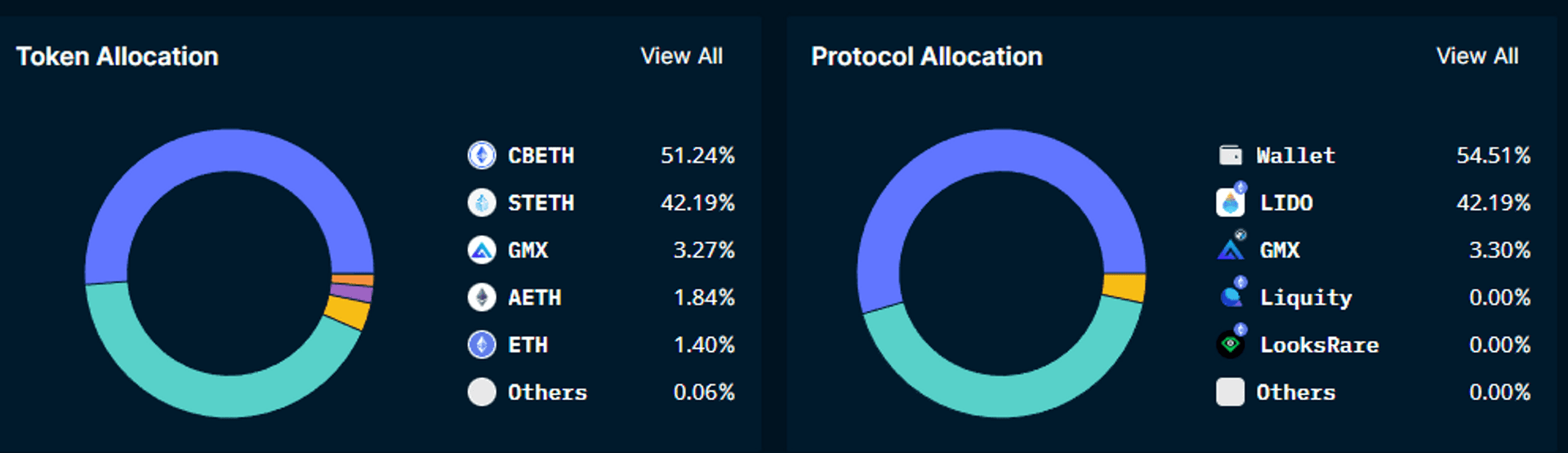

This wallet is entirely risk-on with cbETH and stETH making up a majority of its token allocation (93.4%). Roughly half of the ETH is staked on Lido while the remaining sits idle within the wallet. They also hold a small nominal position of GMX (3.3%) that is currently staked.

Closing Thoughts

From our analysis of looking into the on-chain activity of ‘FTX Withdrawers’, it is evident that most whale wallets are exhibiting risk-off behavior. In addition to holding a large majority of their assets in stable-coins like USDC and USDT, most wallets are wary of smart contract risk and are depositing very minimal funds if any into more established protocols like Aave, GMX, Uniswap, and Stargate. By looking at the existing active wallets, we also see that Ethereum is by far the preferred chain where they are parking funds. That being said, setting smart alerts on these wallets will allow us to be notified in real-time on when they start becoming risk-on again.

Appendix

FTX Hot Wallets

Ethereum

- 0x2faf487a4414fe77e2327f0bf4ae2a264a776ad2

- 0xc098b2a3aa256d2140208c3de6543aaef5cd3a94

- 0x7abe0ce388281d2acf297cb089caef3819b13448 (FTX US)

Avalanche

- 0x279f8940ca2a44c35ca3edf7d28945254d0f0ae6

Polygon

- 0x6e685a45db4d97ba160fa067cb81b40dfed47245