zkSync Era has seen exponential growth in terms of new users and TVL since its launch. Since covering zkSync in April 2023, the number of unique depositors has surpassed 1 million addresses and exceeded $650m in TVL. Unique depositors to zkSync have been experiencing substantial growth, with a strong upward trend from May onwards. All of the data shown in the report is as of June 28th, 2023. However, readers can access the most up-to-date data using our free dashboard tracking zkSync Era.

There are many depositors, but who exactly are these users?

zkSync Users in a Nutshell

Of the nearly 1,050,000 unique depositors, here is a brief snapshot of them from a high level:

- Average Age of Wallets

- Over 84% of addresses are less than 1 year old

- Distribution of Deposits (USD)

- Nearly 50% of addresses have deposited less than $100

- The Depositor Types based on actions on Ethereum

- 15.9% are DEX traders

- 12.7% are OpenSea users

- 8.18% are Contract deployers

- 3.58% are Liquidity Providers

- Smart Money

- 391 smart money wallets have bridged to zkSync Era

Other Bridges Used

Looking at zkSync depositors, we analyze the other bridges these users are using below. There is a clear trend: Layer 2s are very popular amongst zkSync depositors. This is no surprise, but it is interesting to see that over 28% of zkSync users have also bridged to StarkNet, another layer 2 that has seen a lot of speculation of an airdrop. Below is the full view of the top bridges used by zkSync depositors:

Real User vs Airdrop Farmer?

This article does not intend to define what is an airdrop farmer vs a real user. However, let's run through some high-level data to help us define what “stands out” against the sea of depositors. We do not account for activity on zkSync itself, but only for their activity on Ethereum such as the following:

- USD deposited

- Age of wallet

- Previous actions on Ethereum mainnet

USD Deposited

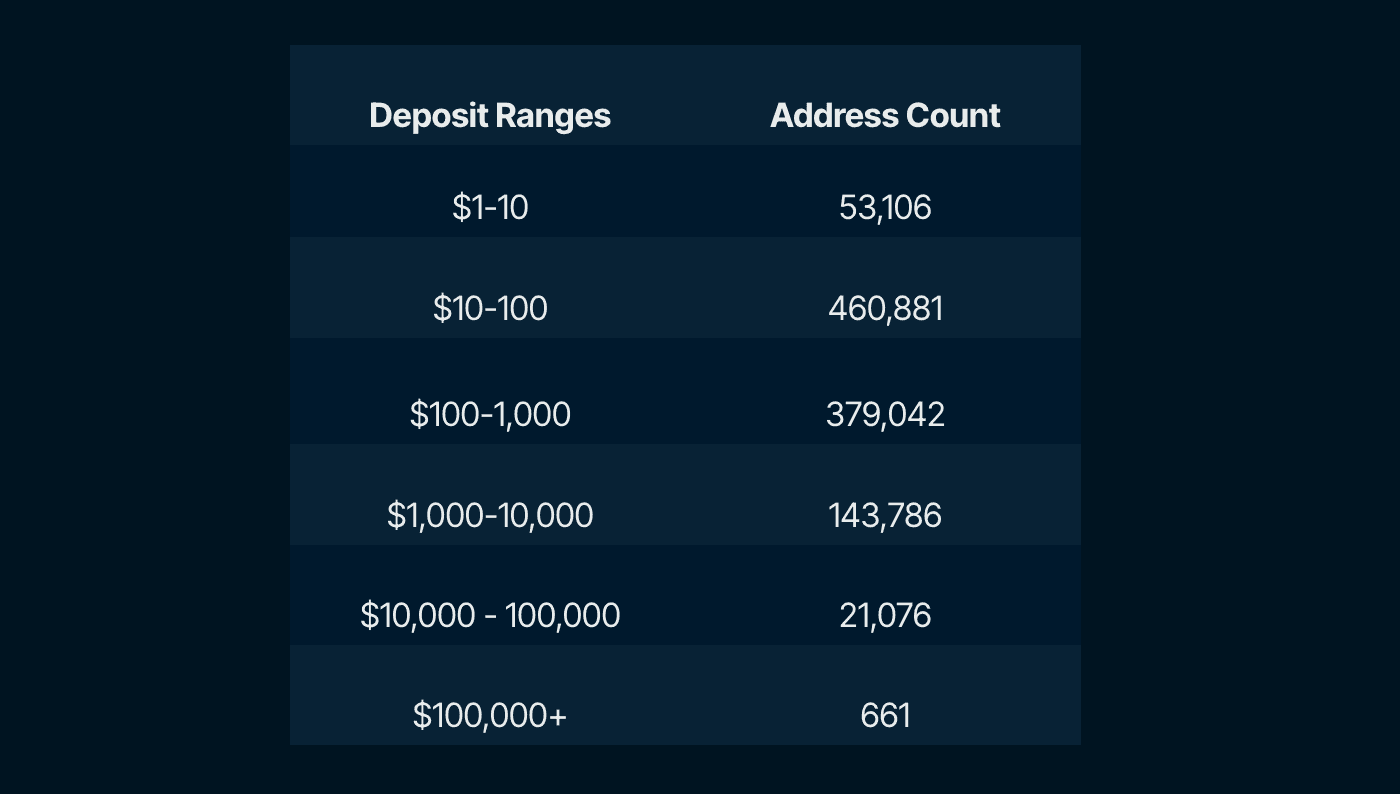

The amount deposited skews heavily toward small deposits in the range of $10-100. Of course, we do not expect all addresses to be whales but bridging $10-100 may not leave too much room to play around on zkSync Era given gas costs, which have at times been close to mainnet fees. Therefore - we can reasonably expect a few of these to be sybil wallets.

We looked at how much users deposit in USD terms and then determined various groups based on USD deposits to help profile deposit volumes. The following ranges were created that go up by a factor of 10 for simplicity. We included their respective wallet counts and the overall percentage of addresses.

Depositing more than $1,000 will put you ahead of 84% of addresses. Of course, this only looks at one metric and does not provide a full picture. These deposit volume ranges give a good sense of zkSync’s user base, most of which are depositing less than $100. It's clear that there's a wide range of user engagement, from small-scale depositors to 'whales’. Using the above groupings can help users stand out from the crowd of potential sybil addresses.

Age of Wallet

Nearly all addresses were created within the past year. Only 15% of addresses are over a year old that have bridged to zkSync Era. The key takeaway is that many addresses are fresh wallets, given over 65% of wallets were made in the last 3 months alone.

Actions on Ethereum mainnet

We used a few categories to dictate what is likely an EOA with their previous activity on Ethereum. We get the following results:

The chart indicates that only a few zkSync depositors are doing things on-chain on Ethereum. From the chart above, we look at all zkSync depositors - 1 million and counting and only 15.7% of users have made DEX trades, 12% are OpenSea users, 8% are contract deployers and 3.54% are liquidity providers. These are common actions from wallets so we wanted to highlight them in a granular way for zkSync users. There are likely many reasons why these user behaviors only make up such a small portion of overall zkSync depositors but the two major ones are likely:

- Gas fees are very high, pricing out most retail

- People may be sybiling with fresh wallets

In short, having some activity on Ethereum can help consider a wallet as an active EOA that isn't just sybilling. DEX trades are costly so be mindful of gas. If mainnet is too costly to use, users can surely diversify by using other layer 2s. This is happening as shown by the chart below that shows the top other bridges used by zkSync depositors.

Given we covered the zkSync user base extensively, let's briefly highlight the top apps by TVL increase over the past week [June 21 - 28th].

Top Apps on zkSync

| Rank | Protocol Name | Category | TVL | 7-Day Change | 7-Day TVL Increase | zkSync Native Protocol? |

|---|---|---|---|---|---|---|

| 1 | SyncSwap | DEX | $69,878,760 | 7.64% | $4,959,808 | Yes |

| 2 | Mute. io | DEX | $23,403,023 | 5.34% | $1,186,369 | Yes |

| 3 | Kannagi Finance | Yield | $667,224 | 420.42% | $539,015 | Yes |

| 4 | eZKalibur | DEX | $4,457,763 | 11.37% | $455,102 | Yes |

| 5 | Rollup Finance | Derivatives | $720,664 | 135.2% | $414,259 | Yes |

| 6 | veSync | DEX | $4,043,518 | 10.5% | $384,226 | Yes |

Source: Defillama

DEXs dominate the space, with SyncSwap, Mute. io, and iZiSwap taking the lead. Notably, Kannagi Finance and Rollup Finance, both in the yield category, have experienced significant growth, with Kannagi Finance's TVL skyrocketing 420.42% over the past week [June 21 - 28th]. The above protocols are all native to zkSync and the high TVL in DEXs and yield protocols indicate an interest in trading and yield farming. In terms of bridged capital, the top 5 tokens bridged to zkSync are the following:

- ETH

- USDC

- MUTE

- USDT

- WBTC

These are mostly large-cap tokens or stablecoins which can often be used to LP on DEXs and yield protocols.