Dealing With Uncertainty

The most acute phase of the banking equity and bond turmoil appears to have passed, seemingly thanks to the willingness, communicated by the US Treasury Secretary, to guarantee all banking customers’ deposits (not just the insured deposits under $250k), if needed. Europe led equity markets higher last week, with Deutsche Bank regaining +9.56%. In the US, Silicon Valley Bank appreciated +13.19%. Overall, credit spreads also retraced lower, and our measure of equity risk premium calculated from option prices fell to 5.6% just above the long-term average (the lower the perceived uncertainty around future equity returns, the lower the premium, and vice versa).

After the storm, the weather rarely reverts to a clear blue sky straight away: This macro and market environment is very difficult to read, especially in the short-term. Case in point, BTC and the most net-sold tech stocks of 2022 have delivered double-digit returns year-to-date, wrong-footing hedge funds’ short positions.

To attempt to navigate this uncertain environment, we can 1) stick to scenario analysis, like the one outlayed in our prior newsletter, 2) review the key data points and assets to watch as they provide us with ongoing clues about the path forward.

On 1), the projection that appears the least subject to uncertainty is that a recession is the next logical phase in the US (and DM) economic cycle. Let’s leave aside the inverted yield curve analysis, and consider that labor markets are tight, inflation is coming down but is still too high, and that the US Fed Chair Powell is determined to emulate Paul Volcker, not Arthur Burns. Former Fed Chair Arthur Burns hiked rates significantly in 1972 - 1974 but then proceeded to cut them during the economic recession that followed. As a result, inflation settled at high levels and took many more years to “tackle”.

How about the probability of a “soft landing” e.g. desinflation and some softness in growth, but no severe macro recession (the best case scenario for crypto)? The March banking events have shown us that the fast policy switch to quantitative tightening and higher rates, following 15 years of quantitative easing, will very likely trigger volatile “readjustments” in markets.

Scenario analysis can be helpful for an investor, but remains secondary to the principle of staying alert to the “unknowns”. We attempt to chart the different parameters of these unknowns by reviewing ongoing and likely future developments in macro, traditional markets and crypto markets, and the clues they give us.

Macro clues: Desinflation yet sticky core inflation; Slowing but not collapsing growth

Recent data shows that while desinflation persists due to energy and goods, core inflation remains sticky in both the US (with core PCE at 4.6% YoY in Feb.) and the Eurozone (with core CPI at 5.7% YoY in March).

As for growth, spending data for Europe showed ongoing weakness. In the US, before the banking woes, consumer’s spending was already moderating and restricting itself more and more to essential goods and services such as housing, utilities, and gasoline. Timelier data from Citi disclosed that card spending has contracted by close to 9% in the first two weeks of March, the sharpest fall since April 2022.

So far, the slowdown of consumption growth in the US and Europe does not clearly point to a “hard” vs “soft” landing. Although, the stickiness of core inflation, supported by robust wage growth and a tight labor market, is the main data point that suggests that the Fed is unlikely to cut rates as fast as markets are expecting.

Questioning the Consensus

The US Treasury 3-month yield peaked at 5.07% on March 8th, bottomed at 4.46% on March 17th, following the Credit Suisse’s acquisition announcement by UBS, and stands at 4.97% as we write. The contrarian view to market consensus is that the rate can rise a bit further and stay high for most of 2023.

The Nasdaq and crypto prices have benefitted from rates repricing lower in the past weeks, and from the belief that central banks and governments were at the stage of concern about “breaking” something in markets and therefore close to cutting rates. This is this underlying assumption, which is consensually priced by equity, crypto, and rate markets. We question that assumption, based on the macro observations above (growth coming down faster than inflation) and also on the following known unknowns.

The Known unknowns

What is the equilibrium point for banks?

Last week, net borrowing by banks across the various Fed liquidity and lending facilities decreased by $15bn. This is the first week of net decrease since the banking woes started and seems to suggest that banks’ needs for fast liquidity have become less acute. Nevertheless, a residual of ~ $343bn in total loans remains. Record inflows to more attractive US money market funds, which yield a higher return than bank deposits, have also persisted. Therefore, uncertainty around the end point of these liquidity dynamics remains. One conjecture that bears a high level of probability, in our view, is that banks will have to tighten their criteria for lending to the “real economy” (asset side), which is growth negative, especially in a less benign fiscal environment.

What will be the impact of H2 2023 fiscal bite?

The end of 2023 will bring an interesting confluence of factors: tighter bank lending standards, running off of some fiscal spending programmes implemented from President Biden’s Build Back Better programme, and the recurring issue of lifting the debt ceiling (will resurface around next summer). Analysts have also estimated that US households will have returned to normal level of cash savings by the end of 2023, after the boost of pandemic programmes.

What about market seasonality?

With hindsight, this excellent paper from Jeremy Grantham highlighted the prevalence of powerful equity (and crypto) rallies during bear markets. Those rallies are almost impossible to time, but positioning, flow and seasonality tools can help a little. Jeremy highlighted that January was usually a “reversal” month for assets that had performed badly the past previous year, partly for tax reasons (incentive to materialize losses at the end of the year to generate tax rebates). In January, investors start with a “clean slate”. The paper also studied the “US Presidential cycle” over the past decades: the period that starts in January of the year prior to US presidential elections and finishes three months later in April tends to be favorable to risk assets, as a result of pro-cyclical policies by the incumbent administration.

Crypto Indicator Review: Tactically risk-on; Cyclically Still a Bear Market

Finally, we review what crypto risk-on and risk-off indicators are signaling. We have two categories of indicators: cyclical (aim to capture bull and bear cycles for crypto) and tactical (aim at flagging short-term risk and positioning shifts).

Tactical indicators:

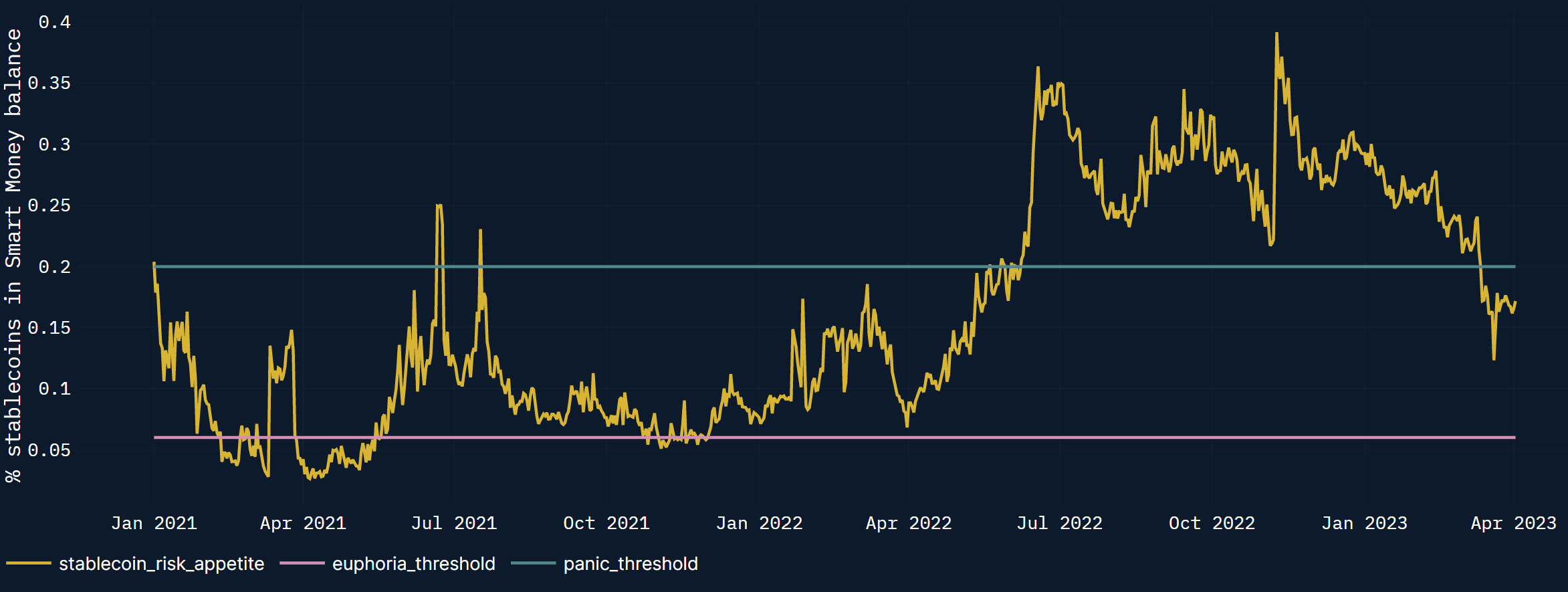

- Smart Money Stablecoin indicator: Risk-on since May 2022, no new signal since

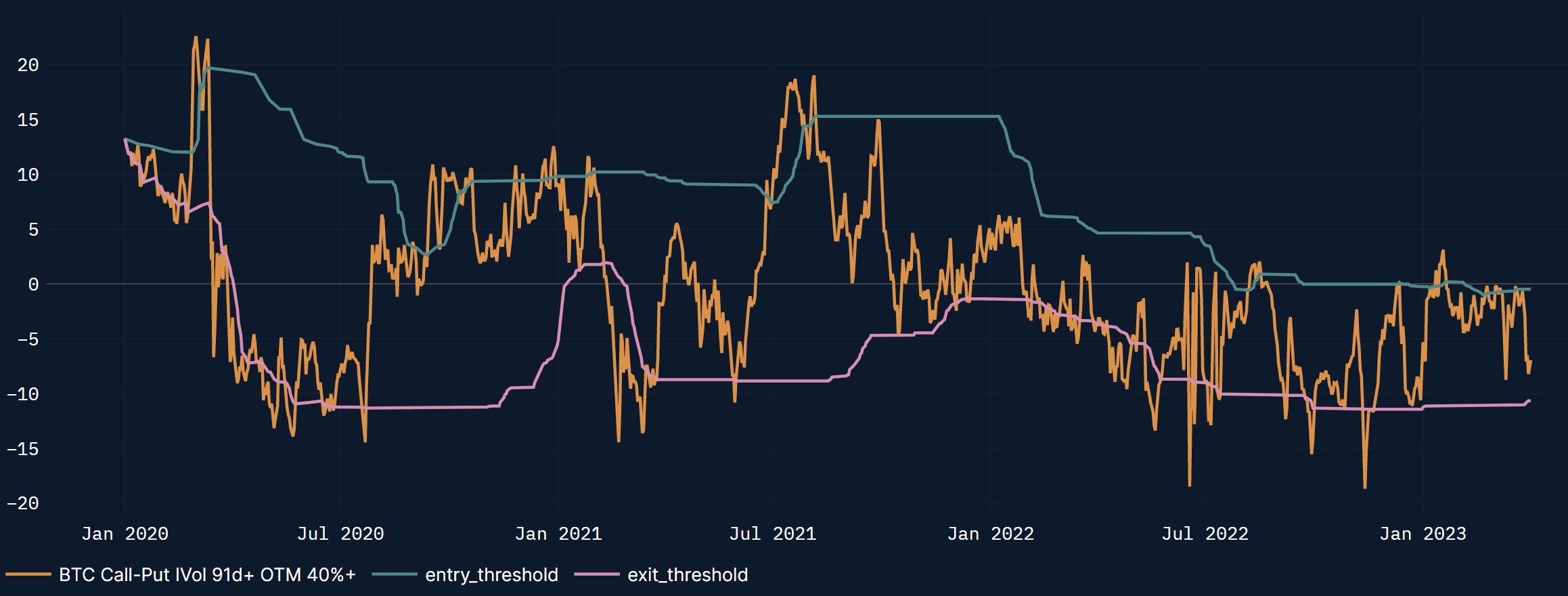

- BTC call-put spread: Risk-on since December 2022, getting closer to risk-off

Cyclical indicators:

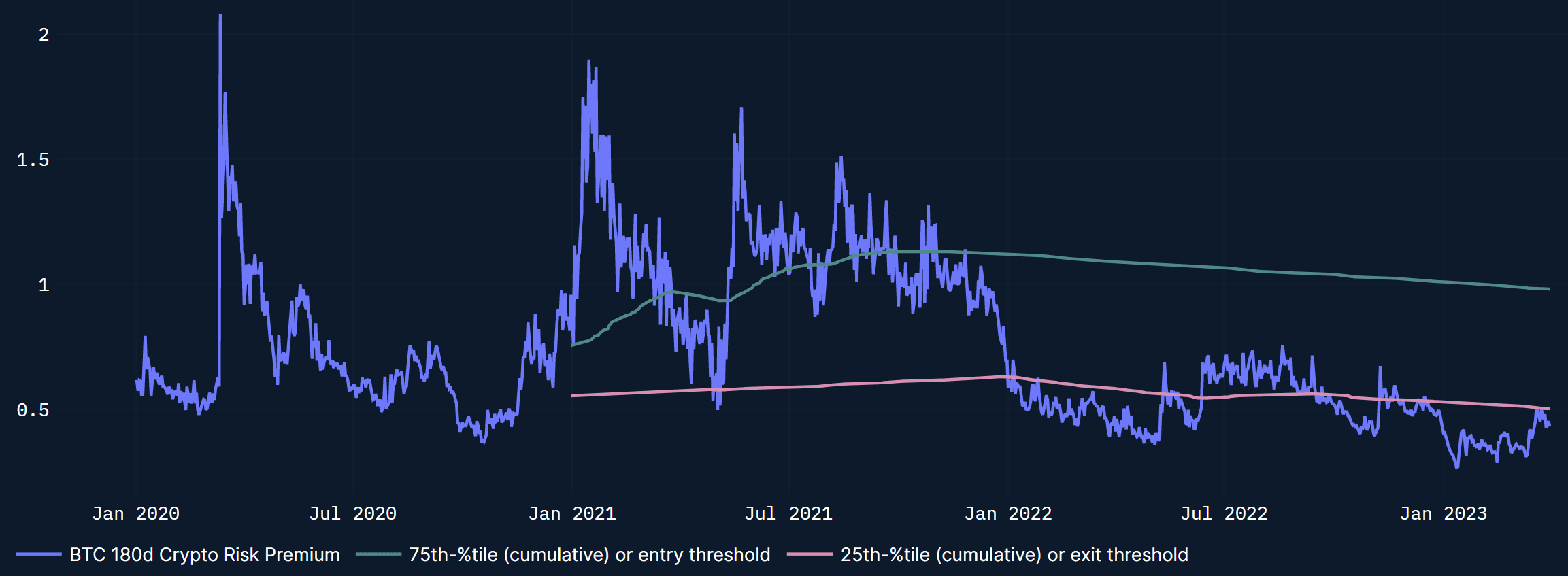

- BTC risk premium: Bear market signal since January 2022

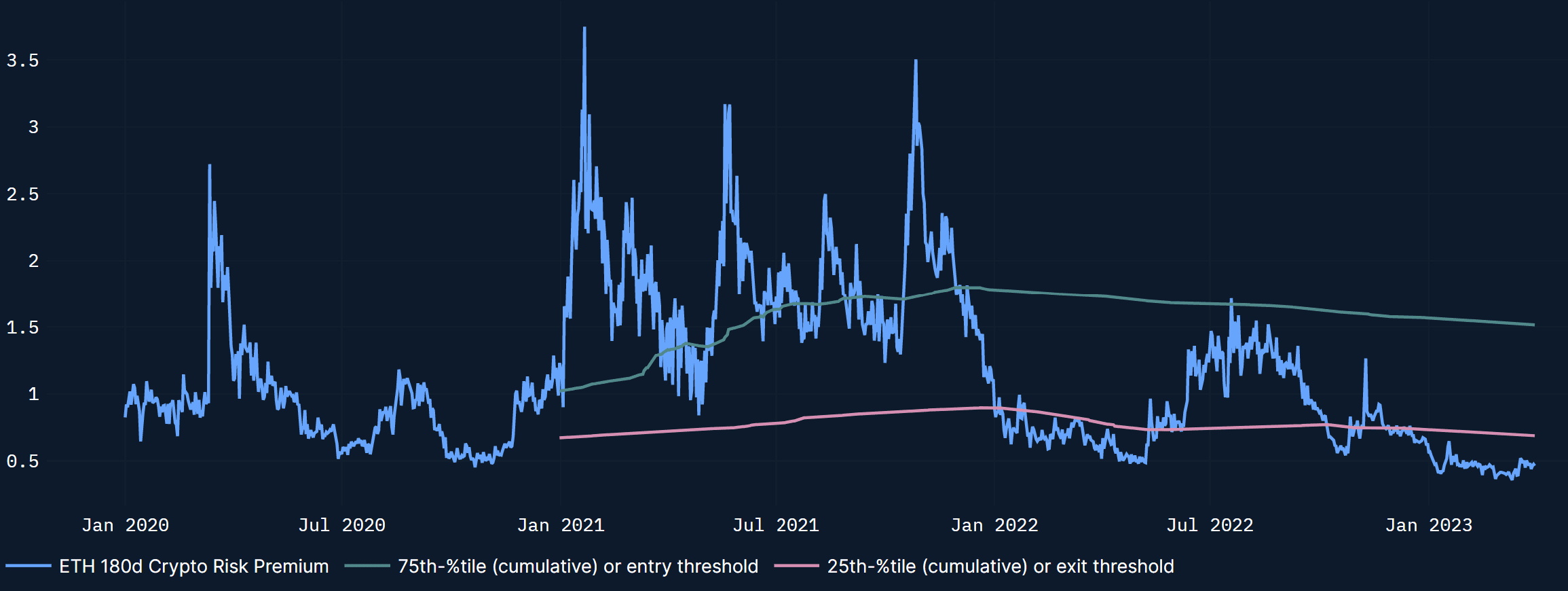

- ETH risk premium: Bear market signal reiterated on October 2022

This Week: PMIs and US Labor Market Data

Tuesday 4 April

- The Reserve Bank of Australia is expected to hike by 25bps (vs consensus expecting no change in the 3.60% policy rate)

- US Feb. JOLTs job openings (consensus 10.4m)

Wednesday 5 April

- US March ISM Non-Manufacturing PMI (consensus 54.5)

- China Caixin Manufacturing PMI (consensus 51.7, the official PMI, already published, has been on the weak side)

Friday 7 April

- US March non-farm payrolls (consensus 240k) and unemployment rate (consensus 3.6%)

2023 has proven a difficult year for market analysts so far, with asset prices evolving independently from fundamentals, based on market participants’ perception that we are nearing the “peak of policy rates”, and helped by seasonality and investor positioning.

Taking a step back, and studying historical patterns, it appears that the next phase in the cycle will probably be a recession. This makes timing and benefiting from bear market rallies very difficult: we attempt to reduce this difficulty by capturing extreme sentiment and positioning turning points in our risk-on / risk off indicators. We also highlight the importance of market seasonality, which tends to stay favorable until April, and then reverse in May.

Finally, forecasting the very long-term appears at present less difficult a task than charting the next few months, given the accelerating dynamics around de-globalization and fragmentation of various geopolitical blocks involving China, Russia, the Middle East on one side, and the US, Western Europe, Japan, and Australia on the other. These dynamics have clear long-term inflationary implications, in our view, as they accelerate the reshoring of production (countries move production locally such as the US pushing for local semiconductor manufacturing), and boosting defense and energy infrastructure spending.