In this quick note, we review our three macro and BTC/ risk asset scenarios, discuss this week's FOMC meeting, and market technicals.

Scenario Update with latest data

See our last note detailing the scenario analysis.

- 55% subjective probability: wall of worry climbing, BTC climbs slowly to all-time highs again, Alts recover,

- 30%: trade negotiations drag on in May, higher inflation + lower private spending shave some points off growth, BTC range-bound, and Alts down

- 15%: full trade war, recession, and double-digit losses in crypto

On the one hand, the data and developments of the past few days suggest scenarios 1 and 2 are the most probable: in the US, consumption is slowing but remains at decent levels, layoffs are not surging yet, but the low- and middle-income households are spending less on dining out, traveling, and discretionary items, while some business sectors are faring better than others.

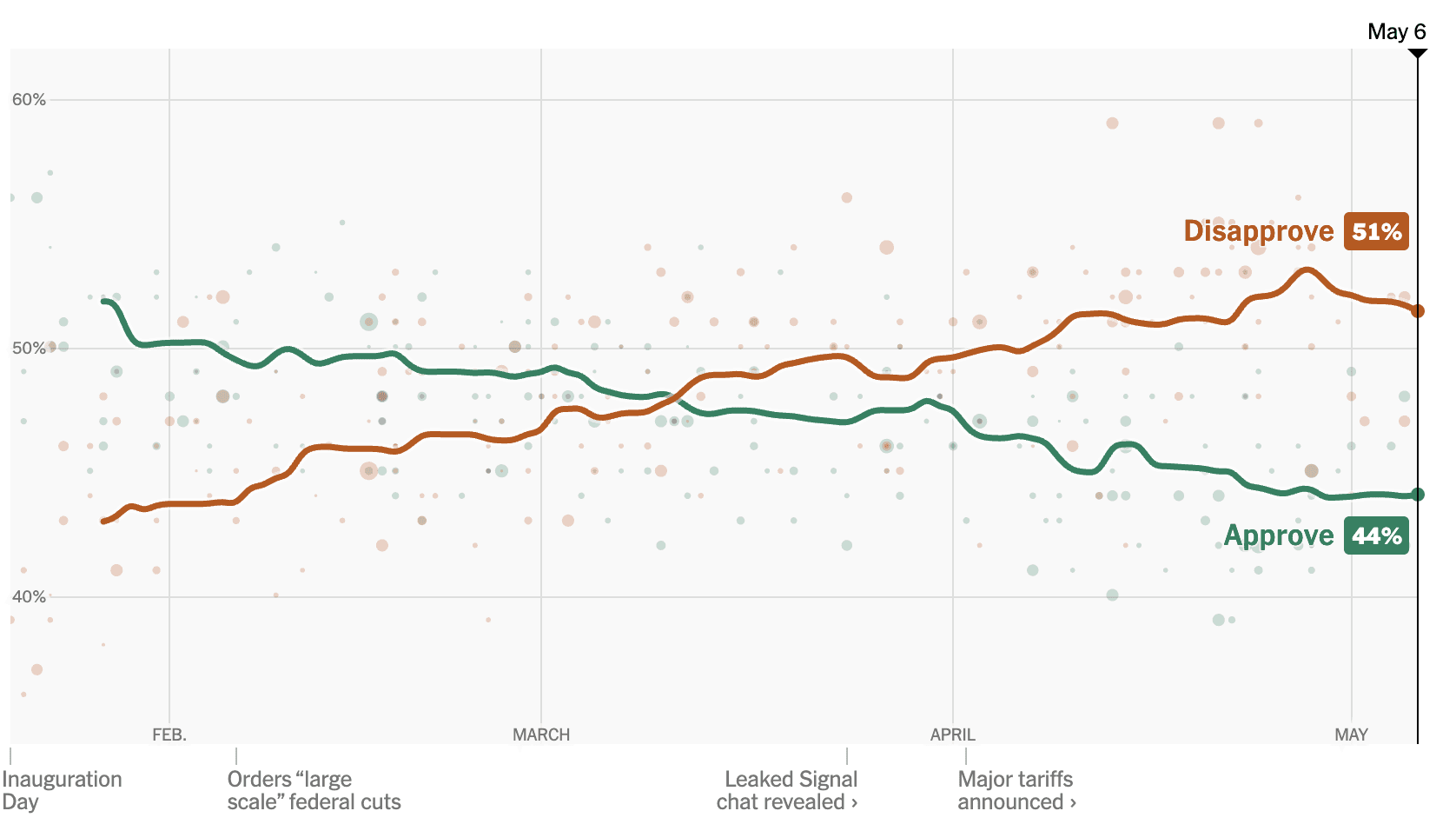

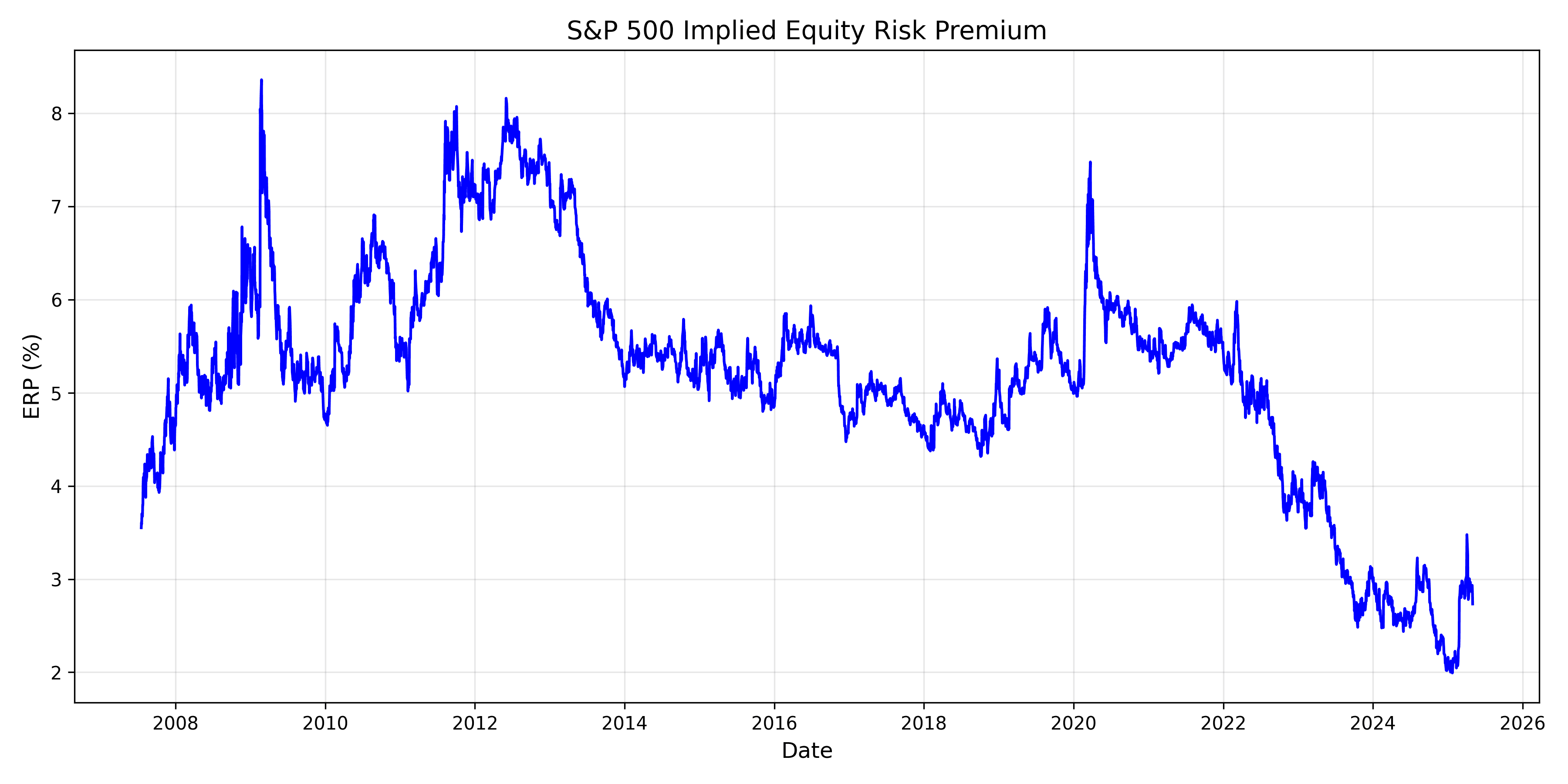

On the other hand, markets have already priced that scenario re-distribution as we write (lower pricing of recession risk and higher pricing for more benign macro outcomes). One Fed cut has been taken out by rate markets (closer to three cuts vs four before last week for FY 2025), the S&P 500 is “only” down -3% year-to-date, the equity risk premium has fallen below 3%, and BTC is testing the 90k highs. Markets have turned less pessimistic, which is making our bullish scenario 1 less asymmetric. This means cautiousness and looking for more upside catalysts: we are getting better newsflow on more generous US fiscal proposals (income tax cuts, factory investment tax deductions, etc.), but we need more good news on trade negotiation progress to validate scenario 1.

The pressure is on: President Trump is fighting to regain some approval.

The US consumer is spending less, but 1.8% is still solid.

Keep an eye on jobless claims. There was a small uptick last week, but it looks more like noise than a signal.

Earnings guidance: Tech and Healthcare are doing ok, Energy and Consumer sectors not so much.

The S&P 500 is historically expensive, again.

What about the Fed tomorrow?

Rate markets have priced out one rate cut last week, and now expect the Fed to cut by 25bps in July, September, and December.

The political pressure on Fed Chair Powell has gone up and down again, and will likely not influence the Committee’s decision.

Inflation is still too high (services inflation has been climbing again in Q1, even if energy inflation is well-behaved). There is still the upside risk of tariff transmissions to consumers (surveys show that most companies want to pass on tariff costs to the end-consumer), even if tariffs settle down lower (our base case is 40% for China and 10% for the RoW). The labor market is cooling but not cracking. The Fed will therefore remain on hold, indicating that it is waiting for more clarity on the impact of policies on the inflation/ growth mix. We expect no significant effect from tomorrow’s FOMC meeting on crypto.

Market Technicals

BTC's technicals remain better (fast-moving averages crossing above slow-moving averages) than for US equities: the S&P 500 has rejected its 200-day moving average resistance. Still, it is difficult to venture into Alts as long as we have no further confirmation that we are in Scenario 1 vs. Scenario 2 (see above).

BTC: Upward trend confirmed

BTC: Nansen Risk Barometer risk-on since April 19, 2025

S&P 500: 200-day moving average resistance rejected for now

BTC ETF: Triple-digit daily net inflows are back