Foreword

So long 2023! You were yet again a year that defeated the market sybils’ predictions. You started by the consecutive bankruptcies of five banks in the US, one in Switzerland, representing a cumulated USD $1tn of assets, a record on par with the 2008 Global Financial Crisis. For crypto markets, the other major events were the US Securities and Exchange Commission investigating two of the largest crypto exchanges globally. If History rhymes, it does not often exactly repeat itself, and markets soon looked past these events, with the shiny prospects of crypto spot ETFs approvals becoming more probable. It all looked up from here, and BTC/USD is up 153% in 2023 year-to-date as we write. Solana the phoenix has risen from its FTX ashes, new blockchains have emerged at the intersection of public networks and centralized apps, the reign of Scaling and Optimistic Rollups has so far remained unchallenged though, despite promising advances in ZK rollup technology, and of course, 2023 has had a good dose of speculation.

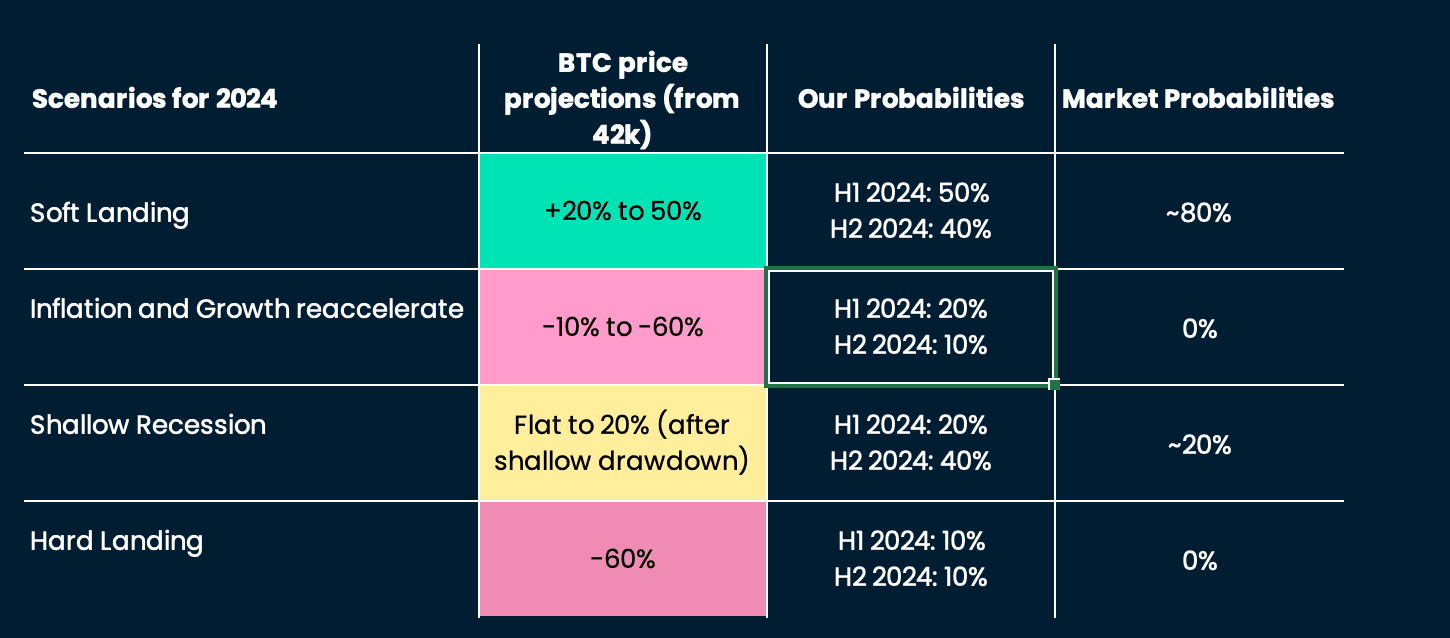

What now? To be “less wrong” on the perilous exercise of forecasting markets, we give you a deeply thought-through scenario analysis (part A). Aurelie’s higher-probability scenarios are positive crypto prices in 2024. She is more cautious than consensus, though, and sees markets as too comfortable with the soft landing scenario and not pricing any probability of inflation reaccelerating. Markets are also too relax about the slightly higher odds of a recession in H2 2024. The projections take into account the statistical boost around the Bitcoin halving, which has had BTC deliver superior returns since 2014.

We move on from educated market guesses to high convictions for crypto. Sandra foresees a world where AI agents become primary users on the blockchain (part B). She also dives into intent-centric apps (part C) as the solution to address UX and user pain points when interacting with Crypto apps.

For Jake, 2024 will be the year where DEXs gain market share from CEXs (part D) as protocol monetary incentives continue to grow, while UX and scalability features are improving fast.

Nik wraps-up (part E) with a challenge of Ethereum's rollup dominance by Bitcoin: Why would the biggest and most trusted cryptocurrency not be used to secure other use cases than simple transactions?

A special thanks to Osgur Murphy O Kane for his critical help on this note.

A. Crypto Market Scenarios

Let’s start with some scenario analysis. We envision four scenarios for the US (and the global) economy and assign probabilities and respective projections for crypto prices.

These subjective probabilities are built bottom-up from “causal drivers”, are informed by historical statistics where sufficient data samples exist, and also aim to differentiate from “what is already priced by markets”.

We also include the structural drivers that we think are likely to influence crypto markets in 2024 and beyond.

1. Scenarios and implications for Crypto in 2024

Soft Landing

In a “soft landing”, inflation decelerates towards a comfortable level for central banks (around 2%) without a significant surge in the unemployment rate in the US or mature markets. In that configuration, the US Fed would cut rates (let’s take the December median FOMC projection of 4.6% or 75bps cuts, which would keep the real rate, or the policy rate - forward inflation, around 2%).

In this environment, we expect crypto prices to grind higher without any sustainable sell-off, with the high of the range for BTC/USD being prior cycle highs or a 20% to 50% upside.

The main data points in favor of “camp soft landing” are the historically elevated excess savings held by households. In the US, the regional Feds have quantified those in a range of $300bn to $2tn (!). Even with conservative assumptions (households save more than in the past, saving rate of up to 10%), we estimate that this excess cash can be consumed in 3 to 15 months. The soft landing probability seems therefore much higher in the first half of 2024 than in the second half.

Another argument in favor of growth “holding up” is the outlook for fiscal spending globally. In the US, economists predict a fiscal deficit of ~5% in 2024, very close to 2023. Europe has to get back on track with the Stability and Growth pact, but we suspect that the tolerance for excess debts and deficits will extend to the post-covid era, given the trend for higher political support of fiscal largesses in times of relative prosperity post-2008. Japan and China are also pushing more generous fiscal packages, the latter to cushion the deleveraging occurring in its domestic real estate.

Finally, the US equity risk premium (ERP), at ~1.9%, is close to historical lows but has been associated with forward single-digit returns for the S&P500 historically, which argues against a recession in H1 2024, at least until the ERP compresses further (see Shiller model).

The main argument against the soft landing is its unfavorable odds: policy markers and investors believe in it so traditional and crypto prices are already reflecting this scenario. This is why we chose a lower probability of 50% in H1, and then 40% in H2 2024.

What will be the early signals that this scenario is materializing? No rebound in energy prices, nor surveyed inflation (PMI input and output prices).

Growth and Inflation Reaccelerate

As we write, the Fed has communicated that it is thinking about cutting rates in 2024. Core inflation still tracks 2 percentage-points above 2% YoY, and wage growth and inflation expectations in mature markets are above 3% YoY and sticky. Historically, there has been high uncertainty around the path forward for inflation even after months of disinflation. 2023 was a record year in terms of the number of and employee mobilization for strikes in the US, and, if the labor market remains tight because of looser financing conditions (the Fed cuts), wage growth could fail to slow down.

A re-acceleration of inflation is not expected by markets and would be among the worst setups for crypto prices. We believe that BTC could revisit 2021-2022 lows in that case (~- 60% drawdown). Our probabilities for this scenario are 20% in H1 and 10% in H2 2024. Early signs to watch: energy and cyclical equities start to outperform, and bond volatility picks up.

Shallow Recession or Hard Landing

Since 1967, the US has been in recessions “only” 17% of the time, so why focus on this outcome?

A few historical statistical patterns (measured since 1967) are pushing the probability of recession higher. As a proxy of growth, we use the US ISM Manufacturing survey, it currently hovers around 46-47 which has been historically associated with ~38% recession odds (above 17%). The infamous US Treasury yield curve (US 10yr yield - US 2yr yield) when inverted and from the time of the US 2yr yield peak (December 2023 this time) has preceded recessions by 0 to 7 months.

What could be the trigger of a recession? There are many candidates. Intuitively, we keep an eye on the Bank of Japan’s policy normalization and the potential “tantrum” it could create in bond markets.

Will it be a hard (2008 and 2020 style with over 10% unemployment rate in the US) or a shallow recession (1950s-1970s with a max of 7.5% unemployment rate)? Because of the drivers detailed in the “soft landing” section, we tend towards a shallow one.

Shallow recession (20% in H1, 40% probability in H2 2024): BTC sells off briefly and then recovers to the December 2023 levels (42k). Hard landing (10% probability): BTC revisits the 2021-22 lows (-60%) and hovers around these lows for a few months at least.

We are watching credit spreads for an early sign of “trouble”: US high-yield credit spreads have only been tighter in 2020-2022, and in 1954-1956 before (!).

2. Structural drivers

We include these drivers in our estimates for BTC upside and downside ranges (see above).

The positive drivers in favor of crypto are statistical and fundamental. Statistically, the year 2024 is situated between Day - 115 and Day + 250 of the next Bitcoin Halving. Since 2014, yearly returns in this time range have been 4.8x superior to the “rest of the time”, and all major crypto bear markets have occurred outside of this Halving -115-day to + 250-day time range.

Structurally, 2023 has seen major traditional players in asset management and payments, as well as central banks forming alliances with public blockchains (Avalanche, Ethereum, Solana, Polygon, etc.), to pilot new semi-permission models. We expect some of these pilots to be validated in 2024 and therefore increase the likelihood of a wider adoption of blockchain. This should go hand in hand with further regulatory clarity. The approval of BTC spot ETF instruments is already a consensus, but further announcements around ETH and other lower-market-cap crypto coin underlyings could maintain a positive momentum in markets.

Now for the negative drivers: the trend of larger fiscal deficits and public debt in mature market governments is clear ($8.5tn or 33% of US debt will mature in 2024). Adding geopolitical fragmentation and a move towards “near-shoring” makes us believe that global rates will remain overall higher than in the 2000-2019 regime. This represents a higher economic hurdle rate for crypto projects going forward.

3. Known Unknowns

Many known unknowns could impact the probabilities above: Will China experience a hard landing, a continuation of its long slowdown in growth, or even a recovery? Will the Ukrainian conflict be resolved in 2024? As for 2024 being the year preceding the US presidential election, it is statistically non-significant for risk assets looking at past election cycles. The outcome of the election matters of course and the Senate and the House falling under the same “color” would probably catalyze the brisker passing of crypto regulations, and favor more fiscal leniency.

B. High-conviction #1: Artificial Intelligence & Crypto

Moving away from the cyclicality of markets, technology is at a pivotal moment, with AI playing a central role in defining future possibilities. The potential of AI makes this arguably the most exciting time in scientific and human history. While the full potential of AI and blockchain integration remains uncertain, several promising use cases are emerging.

AI agents

AI agents exemplify the practical blending of AI and blockchain technology, enhancing blockchain performance and use cases. Evolving from deterministic task bots, these agents now operate with greater autonomy. AI agents can help process transactions, hold things of value, and exchange value, on behalf of users. We could foresee a world where AI agents become a primary category of users on the blockchain.

Verification/Risk Management through Cryptography

While AI can enable certain use cases within blockchains, cryptography-based identification verification will be crucial, in our view, to distinguish between humans and AI. Blockchains can help verify agents’ authenticity by enabling:

- Cryptographic proof using digital signatures: signatures can be created using a private key which is known to the creator and verified using public keys that are available openly.

- IPFS & Merkle Trees: Utilizing IPFS & Merkle Trees can help verify the integrity of data sets and AI models. This approach guarantees the preservation of content integrity, as any alteration to the data triggers an update in the Merkle Trees, serving as a verification mechanism (i.e: a new hash will be updated on Merkle Trees if there is a change in content).

- zkML (zero-knowledge machine learning): zkML can cryptographically prove certain AI models without revealing the model’s details. zkML can be used in financial services, smart contracts, legal, etc.

- Limitations: Some of these cryptographic models will be trained and optimized (off-chain) using AI. If AI cryptographic models become performant enough in the future, will AI be able to manipulate ZK or other proofs?

Rewards through token-based incentives

For AI models to function autonomously, token-based incentives can be used to reward these AI agents/models when they perform as desired.

On the crypto-native front, likely, tokens and projects like Bittensor (TAO), Autonolas (OLAS), and other projects associated with AI will continue to catch a bid. The strong outperformance of AI project tokens during the bear market (as early as the beginning of 2023) has shown that there is enough belief and momentum in the early innings of AI and blockchain. Other OG plays like FET, AGIX, are among the leading tokens for higher-cap AI coins.

While there is currently an emphasis on expanding the foundation of AI infrastructure, we anticipate a shift towards prioritizing consumer-oriented applications that make the most of the existing technology framework. It becomes evident that the challenge lies not only in the infrastructure itself but also in identifying the intended beneficiaries and end-users of these applications.

C. High-conviction #2: Improved UX in crypto applications

The existing cryptocurrency applications pose a significant entry hurdle for investors who are not already familiar with the crypto space, as the consumer interfaces of these apps are often regarded as cumbersome and challenging to navigate. Throughout the past year, we have observed many efforts aimed at streamlining the current user experience, enhancing the underlying infrastructure for payments, and improving various functionalities. All of these endeavors are vital steps in making the crypto apps more user-friendly and accessible.

Intent-centric applications for DeFi applications, and focus on generalized models

With “intents”, users can express a desired outcome while outsourcing the task of best achieving the outcome to third parties. The process of executing something from 0 to 1 does not need to be known by the user and will be completed in the most capital-efficient manner. Teams like Anoma and Flashbots are working towards general-purpose solutions by adhering to the permissionless nature of blockchains. “General” signifies that deploying new applications will not require setting up new parameters (i.e. mempools). While general-purpose intents are likely the “end-game” for intent-centric architectures, we will likely not see a fully generalized system being adopted in the near term.

Account abstraction + better wallet infrastructure

Account abstraction (AA) allows users to delegate their actions on-chain to smart contracts, without losing wallet custody. It will likely greatly enhance the UX of interacting with blockchains. ERC-4337 as a standard for relaying smart account-initiated transactions will further catalyze the evolution of wallet infrastructure to accommodate AA, giving rise to new market structures, dApp developments, etc.

There will be a focus on chain-specific native AA that can enable specific use cases to abstract the complexities of interacting with blockchain applications.

- Starknet = Starknet has full native account abstraction. Watch out for session keys (preventing the need to sign individual transactions every time a user interacts with the blockchain)

- ZkSync = smart accounts and paymasters. Despite native AA, EOAs are primarily used on the network so far.

- Fuel Network = WebAuth P-256 (enabling native transaction signing using AA, biometrics also enabled)

D. High-conviction #3: 2024, the Decentralized Exchange year

1. Base Assumptions and Catalysts

Perpetual swaps have proven to have great product-market fit in the crypto market and have seen very innovative designs emerge lately. Some major design categories are LP-based AMMs (Automatic Market Makers) like GMX vs CLOBs (Central Limit Order Books) such as dYdX, or a hybrid version such as Vertex. Furthermore, this segment has a very lucrative business model that has proven it can generate significant revenues for different stakeholders of the protocols. We believe the perp DEX space will grow considerably in 2024 based on the following catalysts and base assumptions:

Base Assumptions

- A more active market leads to higher trading volumes

- Liquidity will follow the incentives

- Protocols’ monetary incentives continue to grow via trading rewards and point systems

- Scalability, fees, and UX will get better across DEXs

- App-chains, app-specific rollups, and other approaches scale DEXs and provide better fees and UX

Catalysts

- The addressable market for assets is bigger for DEXs:

- DEXs can offer markets for the long tail of assets (niche, lower liquidity)

- DEXs can expand easily into other asset classes - equity derivatives, FX, commodities, and prediction markets

- The design space is growing and can offer fundamentally unique features:

- Combatting MEV in protocol (app-chains and app-rollups)

- Frequent batch auctions, threshold encryption, etc.

- Value Capture

- Perp tokens are very reflexive with clear value accrual

- Revenue distribution can be shared with stakers and LPs

From these assumptions and catalysts, we predict the following for 2024/2025:

- Binance and other top centralized exchanges will likely lose some market share to Perp DEXs, while more strictly regulated CEXs such as Coinbase will continue to gain market share

- Perp DEX volumes account for around 2-10% market share today (according to range of estimates) but at some point we expect this to climb above 10% and up to 20% by the end of 2024/2025. This would represent a 2-10x increase in derivative volume market share for perp DEXs

In short, we expect liquidity to follow the incentives and trading volumes to continue to increase with a likely bull market in H1 2024 (see scenario analysis section above). Perpetual swaps have historically been an optimal way for market participants to get leverage and we expect the underlying platforms to perform well into 2024.

2. Setting the Scene: The Current Landscape

Why do users prefer CEXs over DEXs? We believe there are three main reasons for this:

- Fiat onramps

- Web2-like experience with straightforward onboarding (no private key, gas, chain usage, etc.)

- Fees (cheaper, no gas nor approval fees)

Onboarding to CEXs is just like using every other Web 2 app that millions of users are already used to - users can log in via email, 2FA, and other methods. We believe that combining scalable perp DEXs and account abstraction will tackle these blockers head-on and provide an even superior onboarding experience for users.

So far, we have laid out a few of our assumptions, catalysts, and predictions along with what we perceive as current bottlenecks. Let us now dive into the data for 2023 and speculate on who is likely to lead the perp DEX universe into 2024.

Where are we today?

Perp DEX volumes are very nascent, making up 2 to 10% of CEX volumes according the The Block, Kaiko, and DefiLlama estimates. This ratio has shown signs of an improvement with DEXs gaining market share over CEXs, with a particular uptick in Q3 of 2023. We expect this trend to persist well into 2024 and aggregate perp volumes to continue to rise.

Monthly Volumes

Over 2023, perps have seen consistent usage across exchanges. Below, is a view of the monthly DEX volumes over 2023. The cutoff day is December 15th, so there will be missing data for December 2023.

Perp DEX volumes have rallied considerably from September 2023 onward. December was cut in half, but has already accounted for $56.2b. If these volumes continue, we can expect over $110b in monthly volumes by perp DEXs for December 2023. The last time we saw these types of volumes was back in October 2021 ($108b monthly volume), which shows a considerable market upturn.

We have looked at perp DEX volumes, but what about the DEX to CEX volume ratio?

Historically, the DEX volumes only account for ~2-5% of CEX volumes according to Kaiko and Coingecko. Keeping in mind that the space is nascent and continually growing, who are some of the top perp DEXs today?

As of December 15th, the top 10 Perp DEXs sorted by last 24-hour volumes are (in $):

- dYdX (1.18b)

- RabbitX (508m)

- Vertex Protocol (442m)

- Hyperliquid (432m)

- MUX Protocol (403m)

- ApeX Protocol (289m)

- GMX (219m)

- Bluefin (126m)

- Synthetix (107m)

- Gains Network (101m)

Source: DefiLlama

We believe strongly in the continued growth of perp DEXs. This is because DEXs have been achieving product market fit for many years now, while the design space is just beginning to take shape with many exciting new protocols tackling a large addressable market (more than $1 trillion of monthly CEX and DEX volume so far).

E. High-conviction #4: Projects built on Bitcoin will be among the winners of the next rally

1. Bitcoin is the most trusted crypto asset

BTC is undoubtedly the leader of the current price action, with ETH taking a back seat for now. The ETH/BTC chart has been in steady decline since the beginning of 2023 and shows no sign of slowing down, despite news of an upcoming ETH spot ETF.

This momentum not only directs all eyes on Bitcoin but also gives a sense of security and strengthens the long-term belief in the grandparent of cryptocurrencies. On top of that, the network itself is as steady as ever in terms of technological continuity and on-chain activity. Although BTC is the first and largest cryptocurrency, the Bitcoin blockchain has never “stopped”, never successfully been 51% attacked or shut down. Combined with a religion-like following and a leading market cap, this makes it arguably the safest crypto asset for many.

What if this unparalleled trust and security of the Bitcoin network were used beyond “BTC hodling” and the occasional transaction? We believe Bitcoin has the prime position to become one of the primary components of the future infrastructure of finance.

2. “This trust is made for building”

The idea of Bitcoin securing on-chain activity is not new: indeed, Bitcoin layers to increase throughput (e.g. Lightning or Liquid) or even enable smart contracts (e.g. Rootstock or Stacks) already exist but have so far failed to gain significant traction - so what has been holding up building on Bitcoin?

Well, there are several hurdles such as a bad UX or inheriting the scaling challenges of the base layer at some point (transacting on Bitcoin is expensive). Also, parts of the Bitcoin community have voiced concerns over using Bitcoin for any other activity than transactions, as this might lead to centralization issues, network congestion, or warrant more updates than necessary, which inevitably introduces additional risks.

Nevertheless, the most recent attempt to add more functionality to Bitcoin, Ordinals, has gained lots of hype and attention. Through inscribing Satoshis, the smallest units of Bitcoin (similar to a WEI on Ethereum), and making them “unique” in the process, the Ordinals protocol effectively enables NFT creation on the Bitcoin blockchain. The “BRC-20” standard also uses Ordinals to create fungible tokens.

Although neither NFTs nor BRC-20s carry as much functionality or usability as their Ethereum counterparts for now, markets’ price increases have signaled clear readiness and hunger for Bitcoin as infrastructure (see ~$84b in trading volume on BRC-20s). And the innovative efforts to quench that hunger and expand on the idea are evident (e.g. through BRC-20 infrastructure projects like TRAC or MUBI which have performed exceptionally well in recent weeks).

So what will be the endgame for Bitcoin as infrastructure? As well as the Ordinals protocol, we will likely see the emergence of Layer-2s on Bitcoin, and perhaps the increasingly popular modular architecture (e.g. powered by Celestia or the OP Stack). Or perhaps something entirely different.

The answer to this question still appears up for debate, but using the biggest and most trusted cryptocurrency to secure other use cases than simple transactions seems inevitable to us, in the mid to long term. So being on the lookout for just about anything Bitcoin beyond actual BTC will probably be worth your time in 2024.