After a two-week refreshing break from markets, what strikes us most, when returning to the screens, is not the dismal macro data in China followed by further central bank intervention (see our prior newsletter on that), nor the repricing of US and global interest rates higher, but rather the effect of these developments on equity and crypto markets.

So far, there has been a certain “resilience” in risk assets, even as US short-term rates have been repricing higher (Fed rate cuts now pushed to after June 2024 by rate future markets).

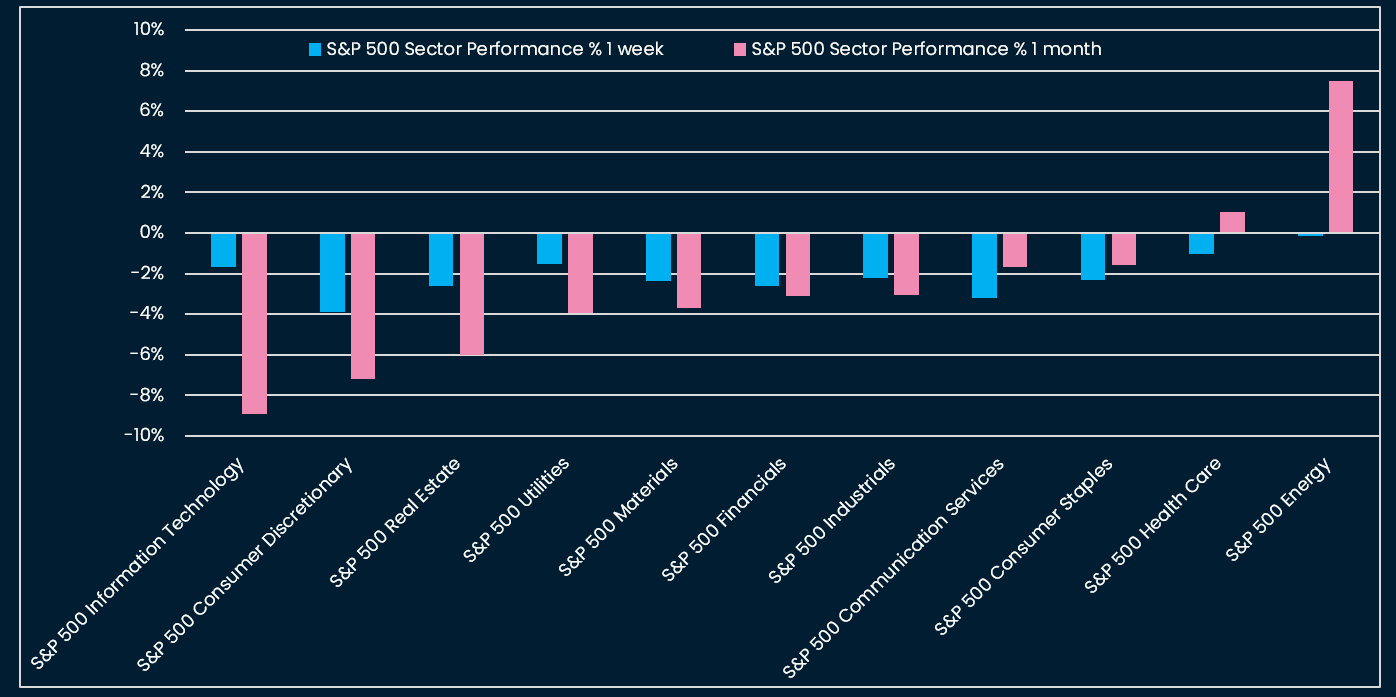

In the past month however, the Nasdaq is down -5.2%, the Russell 2000 -6.2%, the S&P 500 -4.0%, and BTC -13.2%. Is the narrative changing on higher rates and their impact on risk assets? Is the correction in risk assets done or likely to persist?

Growing consensus on US economic “resilience”

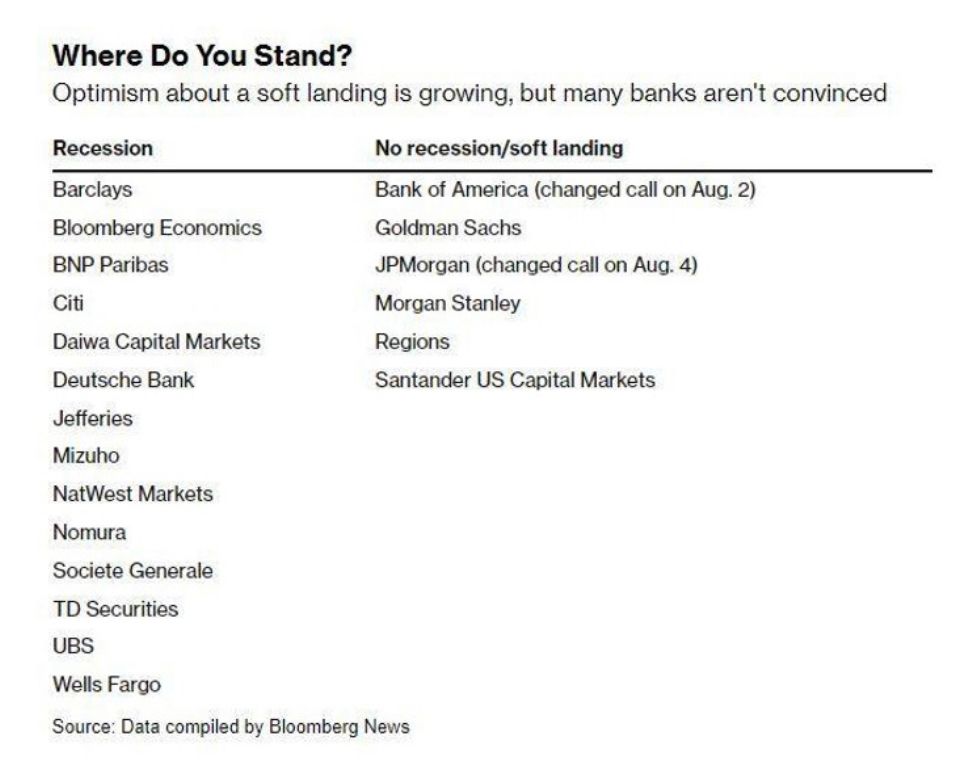

Central bankers, market observers, and investors are increasingly pushing back on the scenario of a US recession in the face of resilient economic data.

Patrick Hacker, President of the Philadelphia Fed and FOMC voting committee member, declared: “In sum, I expect only a modest slowdown in economic activity to go along with a slow but sure disinflation. In other words, I do see us on the flight path to the soft landing we all hope for and that has proved quite elusive in the past.”.

Investment research houses are also progressively moving to the “soft landing” camp:

Finally, Wall Street Journal journalist and Fed observer Nick Timiraos published an article a few hours ago “Why the Era of Historically Low Interest Rates Could be Over”. This article could foreshadow Fed Chair Powell’s speech at the 2023 Jackson Hole Symposium. The official theme of the conference is "Structural Shifts in the Global Economy."

Data backing this consensus

US economic data have been improving in the past few weeks. The NFIB Small Business survey, published last week, contains a few key messages on the US economy.

- Namely, pessimism on the economic outlook is diminishing, owners expecting better business conditions over the next six months improved 10 points from June to a net negative 30%.

- The labor market remains historically tight: 42% of owners reported job openings that were hard to fill, unchanged from June but remaining historically very high.

- Desinflation: “The net percent of owners raising average selling prices decreased four points to a net 25% seasonally adjusted, still a very inflationary level but trending down. This is the lowest reading since January 2021.”

- Low demand for loans: “Twenty-five percent reported all credit needs were met and 62% said they were not interested in a loan.”

The survey paints the picture of an economy which is slowing, but remains robust, with inflation trending lower, but wage growth and the power of the negotiation of employees in a tight labor market likely creating a floor for inflation.

Interestingly, even with lending conditions tightening for commercial and industrial loans, because demand for lending is low, the impact of this tightening is not fully visible in economic activity yet.

The same can be observed for mortgage loan rates, which rose to their highest level since the early 2000s. However, house owners have locked lower mortgage rates and are holding off from selling their houses.

Rates repricing

Rates have risen to their highest levels since the global financial crisis. The longer-end of the curve has retraced higher in the past month (duration > 2 years). This indicates that markets are reading the economic data described above and are predicting “high for long” rates.

Interestingly, real rates are rising, which tends to signify a repricing higher of real growth, not inflation.

Equity markets

The counterparty of rising rates has been falling equity prices since one month. Is the correction just a breather in a new bull market?

We find the following patterns interesting:

The Tech and Consumer Discretionary sectors, which led the year-to-date rally, underperformed month-on-month. This could suggest that higher rates are starting to become an issue for rate-sensitive equities again.

We also note some technical divergence in trends for certain indices and stocks. Below is the example of Apple, where the MACD is posting a negative divergence.

Finally, our measure of the US equity risk premium based on option implied volatility is low and rising. This could be flagging the beginning of a larger equity market correction:

Crypto markets

In the BTC/USD technical chart, we also observe that the MACD is rolling over:

On August 17th, the BTC price momentum turned negative:

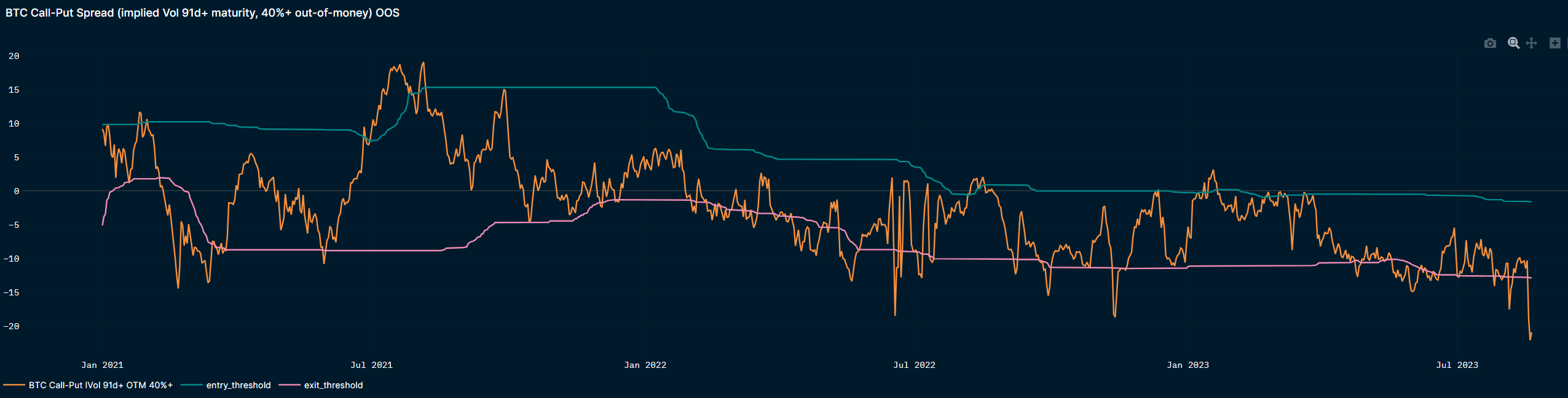

The BTC call-put spread indicator has remained below the risk-off threshold since April:

The combination of a change in market narrative, namely equities and crypto more vulnerable to high rates for longer, and deteriorating price trends plus low but rising implied volatility keep us on the cautious side prior to the Jackson Hole central bank symposium this week.

This week: Jackson Hole Symposium

Tuesday 22

- BRICS summit

- US July existing home sales (consensus 4.15m)

Wednesday 23

- Eurozone, UK, US August Flash PMIs (consensus for respective flash PMIs: Eurozone 48.5, UK 50.3, US 52)

- US July new home sales (consensus 706k)

Thursday 24 to Saturday 26

- Jackson Hole Symposium on the theme "Structural Shifts in the Global Economy." Fed Chair Powell and ECB President Lagarde will speak on Friday 25.