China’s stimulus not working, yet

The People's Bank of China (PBOC) took its most decisive step towards monetary easing on June 19, 2023, by shaving its main policy rate, the one-year loan prime rate, by 10bps to 3.55% for the first time in one year. Since then, the Shanghai Shenzhen CSI 300 and the Hang Seng are down respectively by 2.2% and 6.6% and copper, the barometer for the health of global manufacturing, has lost 3.2%.

What is the reason behind this negative reaction by equity and commodity markets? This time, the monetary and fiscal stimulus architected by the Chinese authorities is a bit different from prior exercises, the first major one having occurred post global financial crisis with significant positive effects on infrastructure investment and real estate construction.

This time there is evidence that Chinese total social financing, an aggregate measure of domestic credit, has failed to react significantly to monetary and fiscal easing (see chart below).

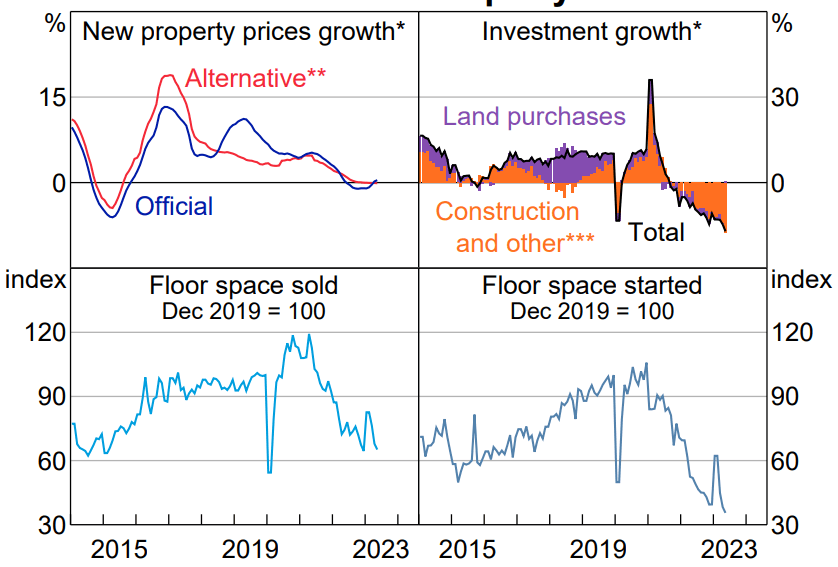

The weakness in total social financing might be a product of lags before stimulus reaches the economy. There are also signs that the policy transmission mechanism to domestic demand is not as smooth as in past occurences. The main reason appears to be the existing debt overhang among local governments and publicly-supported entities and companies. Because of the slump in land and real estate sales, local governments also appear to be missing a major source of fiscal revenues.

A note by Goldman Sachs estimated total public borrowing to have ballooned to ~USD 23tn or ~1.2x Chinese GDP. There are also reports that local governments are having trouble financing their fiscal expenses because of the share of their respective debt burdens. It seems that the first step of the latest policy stimulus has indeed been to reduce the debt burden of local governments: the South China Morning Post reported that the State banks Industrial and Commercial Bank of China and China Construction Bank have increased the tenor of loans granted through local government financing vehicles (LGFV) by as much as ten years, and granted relief measures on interest payment.

What are the implications for the economy and markets, locally and globally?

The State banks are backed by the central bank, the PBoC, and can receive support in the shape of recapitalization, as has been the case in the past. The latest round of policy “stimulus” could aim at backstopping profitability issues from State banks, especially if non-performing loans start to surge.

This is a form of monetary + fiscal combination programme, which, logically, would weaken the Chinese Yuan further, especially if the PBOC cuts rates further, and is forced to use its FX reserves to support State banks. So the obvious consequence would be a higher USD/CNY, which we have already written about at the beginning of the year and has already reached its second highest level since 2007 last June, at ~7.23. It will be interesting to see if this level breaks. We assume it could be the case, especially if the US economy can sustain high local policy rates for longer (rates high in the US but going lower in China).

If the Chinese authorities are determined to prop up domestic demand, we assume that further stimulative measures will likely be announced, and, at some point, be reflected in local risk assets.

Hong Kong and the crypto “renaissance”?

In the wake of the business-friendly measures that followed Greater China’s zero covid policy abandon, Hong Kong switched to more crypto-friendly regulations. Notably, regulatory licensing for retail and institutional crypto trading has been relaxed.

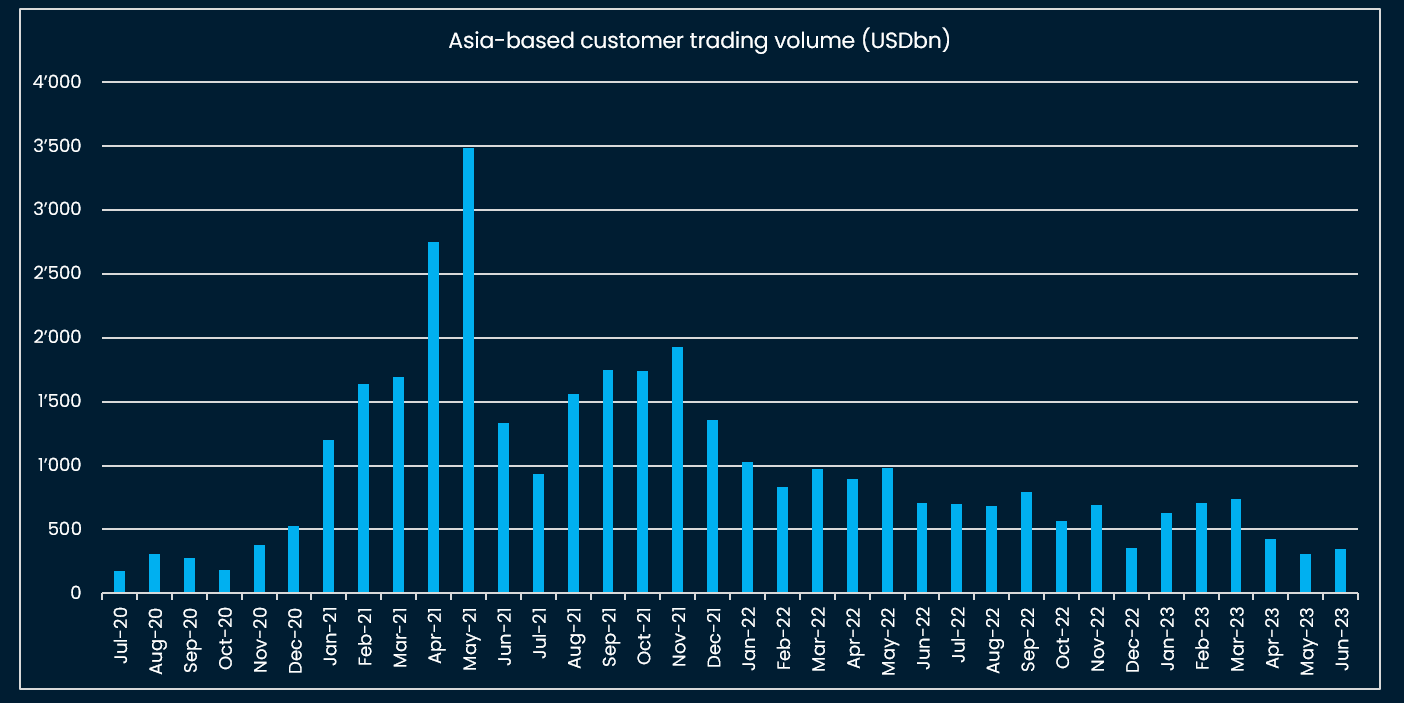

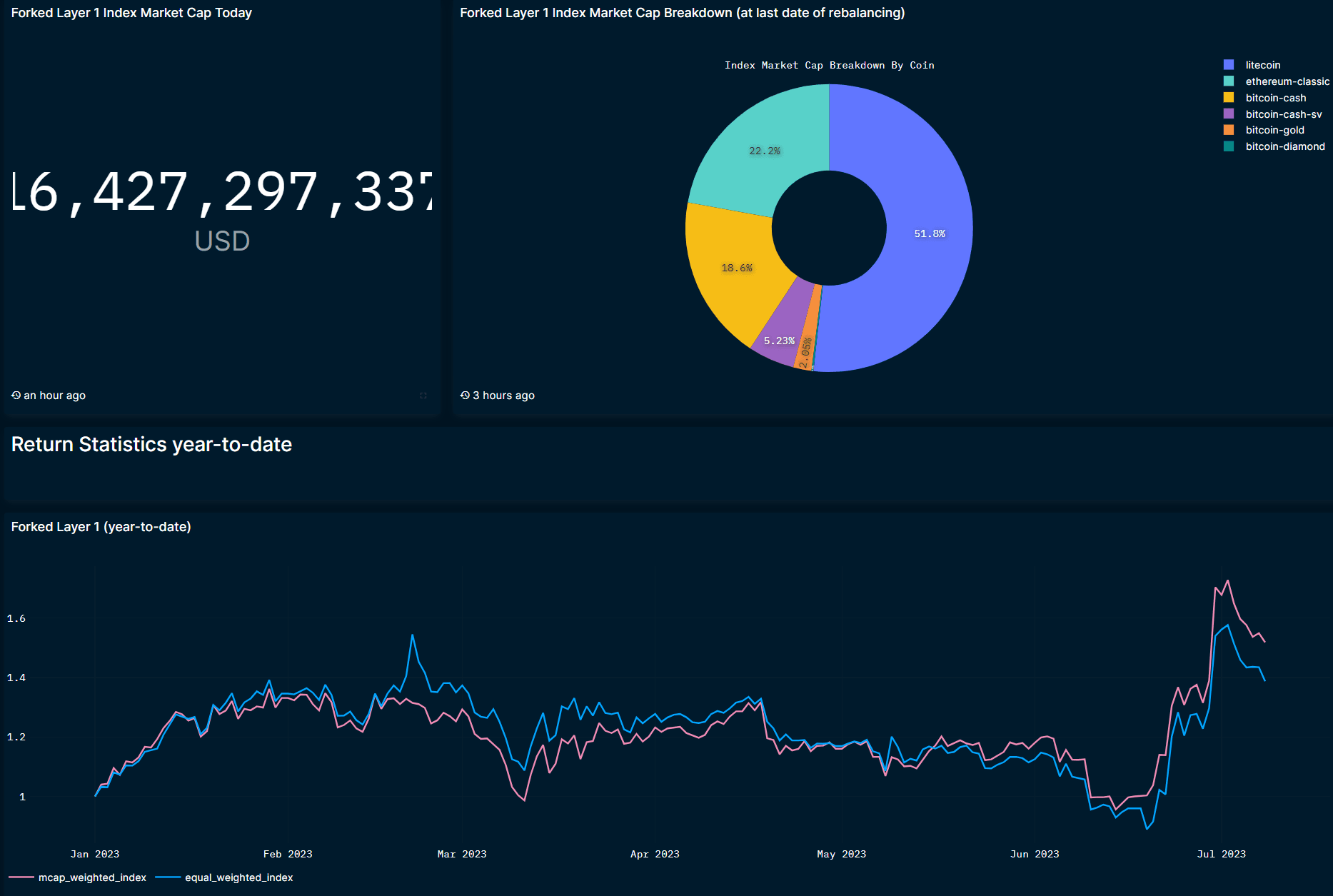

So far, the effect of the new regulations has not been reflected in trading volume (see below) but it could be early days.

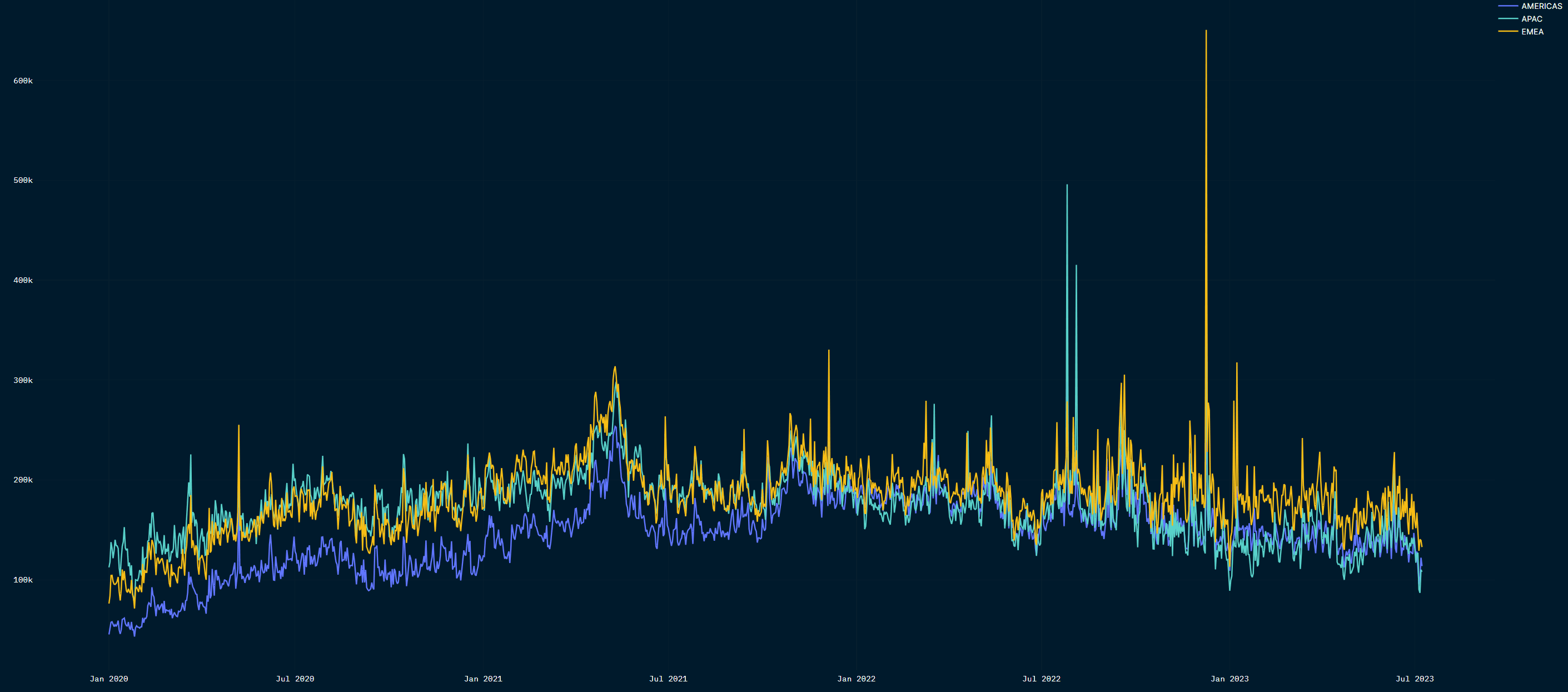

Looking at active on-chain addresses on Ethereum identified by Nansen as being located in Asia, it is not clear that activity has picked up yet. Asian activity seems to follow global activity and has not really increased year-to-date.

China - US geopolitical escalation…

“We believe that the world is big enough for both of our countries to thrive.” said US Treasury Secretary Yellen in the wake of her Beijing visit.

In parallel to their own domestic cycles, China and the US are going through a geopolitical struggle for power. That struggle is not visible in reassuring diplomatic statements, but rather in concrete economic and political actions.

The latest escalation is China restricting exports of metals used as inputs to semiconductor manufacturing. This follows the US limiting the exports of some advanced chip making machinery to China, including advanced lithography tools, and reaching agreements with its trade partners (Japan and the Netherlands recently) to enforce the ban.

Economic protectionism is now reaching economic and social areas outside of semiconductor manufacturing, as the anti-espionage law comes into effect this July. The law covers “intelligence and other documents, data, materials, and items related to national security and interests” beyond the existing “state secrets.” It opens some ambiguity around any cross-border collaboration between foreign companies or foreign individuals and China’s economic counterparts: hiring, cross-border collaboration, market research and even academic exchanges. The law grants stronger powers to national security agencies. Entities or individuals found guilty of endangering “national security and interests” can incur punishment ranging from simple fines to prison or even death penalty.

The USA's next “tit for tat” is a legislation in the making called “RESTRICT” which targets China and another restricted list of countries susceptible to “pose an undue or unacceptable risk to the national security of the United States or the safety of United States persons.”

...and its macro impact

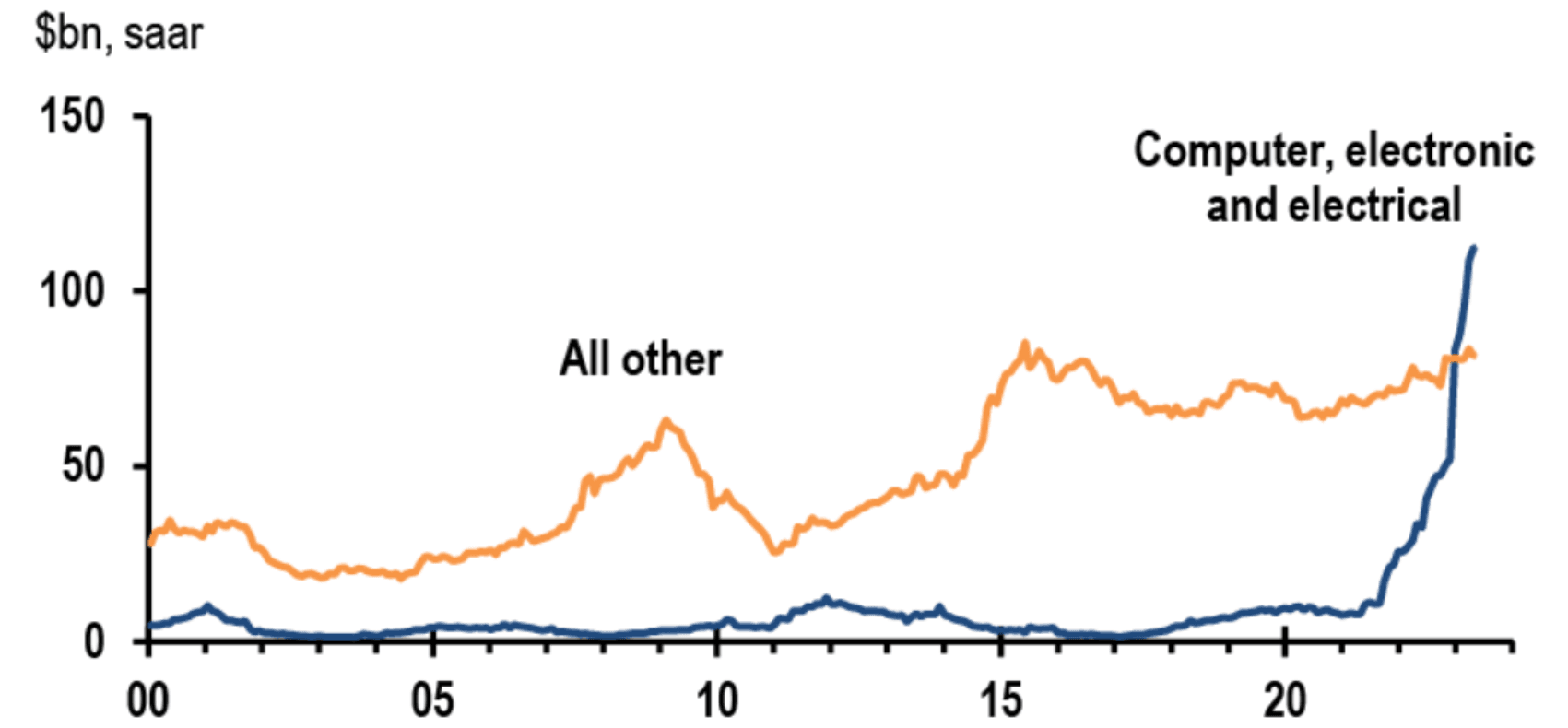

What are the implications of economic protectionism and geopolitical escalation? The first stage has been arguably growth-positive for the US in the sense that it has unlocked fiscal spending to boost local supply in competitive industries such as chip-making (the famous “relocalization” trend). In the chart (by JP Morgan) below, the impact of the ongoing Infrastructure and CHIPS Act on US investment is visible.

On the China side, it is likely that the focus will also be to develop independent local high-value supply chains, which points once more towards more fiscal spending being the likely route for policy in the coming years.

However, a severe escalation that would go with strictly enforced export bans on key manufacturing inputs would, at some point, have a detrimental effect on global growth and on productivity, we speculate.

Geopolitics, blockchain and crypto

The narrative of Bitcoin valued as a safe haven to geopolitical uncertainty is yet to clearly materialize. So far, the Chinese PBoC has diversified its foreign assets by buying more gold.

A promising area where blockchain technology and some crypto asset models like stablecoins could play a key geopolitical role would be facilitating cross-border transactions, though.

Indeed, the retail use case of the most advanced Central Bank Digital Currency (CBDC), the Digital Yuan, has so far struggled to compete with established domestic mobile and online payment methods. According to the PBOC, 261 million people had set up a digital yuan wallet in 2022, this is less than 29% of the number of users of mobile payments. If we look at payment volume, this ratio is even smaller. But what about the use cases for wholesale CBDCs and cross-border transactions and payments between certain public and private entities?

The Bank of International Settlements (BIS) is pioneering several proof-of-concept projects on wholesale CBDCs, involving separate clusters of central banks. Encouragingly, research and testing have persisted through the latest bear market. One of these projects, “Tourbillon”, has spelled out the desirable features of a wholesale CBDC: “cyber-resiliency, scalability and privacy” while at the same time, enabling “countering of illegal activities”.

If the world becomes even more fragmented into “blocks” of economic and political alliances, a cross-border technology that allows a certain control over value flows with “allies” and resilience to cyber-attacks by “adversaries” would be perceived as valuable.

The BIS projects remain at the proof-of-concept stage but many seem to use the technology and architecture available on permissionless blockchains such as Ethereum, and transpose those to permissioned blockchains. Retaining the control and sovereignty of a currency is key to central banks’ mandates so the solution of permissioned blockchains makes sense for CBDCs. We suspect that, if and when blockchain adoption for cross-border payments matures, it could mostly be run through these permissioned and / or semi-permissioned models.

See below the high-level architecture of “Project Mariana”’s CBDC. The interim report of the project was published last June. The concept borrows the architectural elements of automatic market makers and bridges from Decentralized Finance. Meanwhile, domestic platforms are permissioned versions of Ethereum and the international network is an Ethereum testnet.

Crypto institutional adoption, other silver linings

Stepping aside from geopolitics, we look at other drivers of crypto institutional adoption. Recently, indeed, institutional adoption, notably through various announcements of BTC ETF applications, has been the main narrative underlying the June - July rally.

We argue that regulatory clarity, around token asset class categorization, custody requirements and other will facilitate institutional adoption, even if only a select number of projects and / or tokens pass the regulatory test and survive.

Following the announcements of the SEC’s lawsuits against Coinbase and Binance, investors have favored tokens that would unambiguously be disqualified as US securities. Hence the rally in Bitcoin and equivalent “payment” tokens, which have held their price gains year-to-date:

Interestingly, investors have also speculated that tokens with a certain level of decentralization would likely escape the security categorization. We suspect that this is partly the reason why net deposits to stake ETH 2 have continually increased through the regulatory newsflows, even if the asset effectively delivers the equivalent of an investment “yield” to stakers (investors). We note that stakers’ “centralized” intermediaries, such as Coinbase, are being investigated for their yield programmes.

In the last two sections, we run through the macro and market data that caught our attention last week.

Macro nuggets worth following

This section will deal with the latest wage data from Japan, and the US.

In Japan, earnings growth YoY (including overtime) has surpassed the soft target that the Bank of Japan flagged as a mark to reach to say that underlying inflation was settling at 2% YoY. We suspect that the Governor will want to see wage growth stay above 2% YoY for several months, as the next step before policy normalization. Nevertheless, the BoJ could meet its “target” sooner than expected.

In the US, much has been written about the relative weakness of the latest labor market report. Yes, our heatmap below displays a bit more yellow in June 2023 than in prior months. And the number of persons employed part time for economic reasons did increase, and the divergence between sectors that continue to employ, and those that are reducing employee working hours (manufacturing) has increased. But, labor participation of the 25-54-year-old is back to all-time highs, and still job vacancies significantly outpace the number of unemployed (~1.6 ratio), and, interestingly, average earnings growth has accelerated to 4.8% YoY on a three-month basis.

This tells us that, even with some components of inflation growth slowing sharply (energy base effects will turn more negative for the June CPI number, and shelter inflation will likely cool too), wage growth shows no sign of moving back to 2% yet.

Market nuggets

We are sharing three market observations to conclude this newsletter.

First, global stocks’ ascent has taken a break last week and we flag especially a pause in French luxury stocks’ performance (linked to global consumption growth and China reopening), which has to be monitored:

Second, the US yield curve has begun to re-steepen, as rate cuts in the next two to five-years are being priced out. We assume that this follows the relative strength of the latest US macro data vs markets’ recessionary expectations (see our last newsletter examining the increasing bullishness from risk asset investors visible in price and positioning).

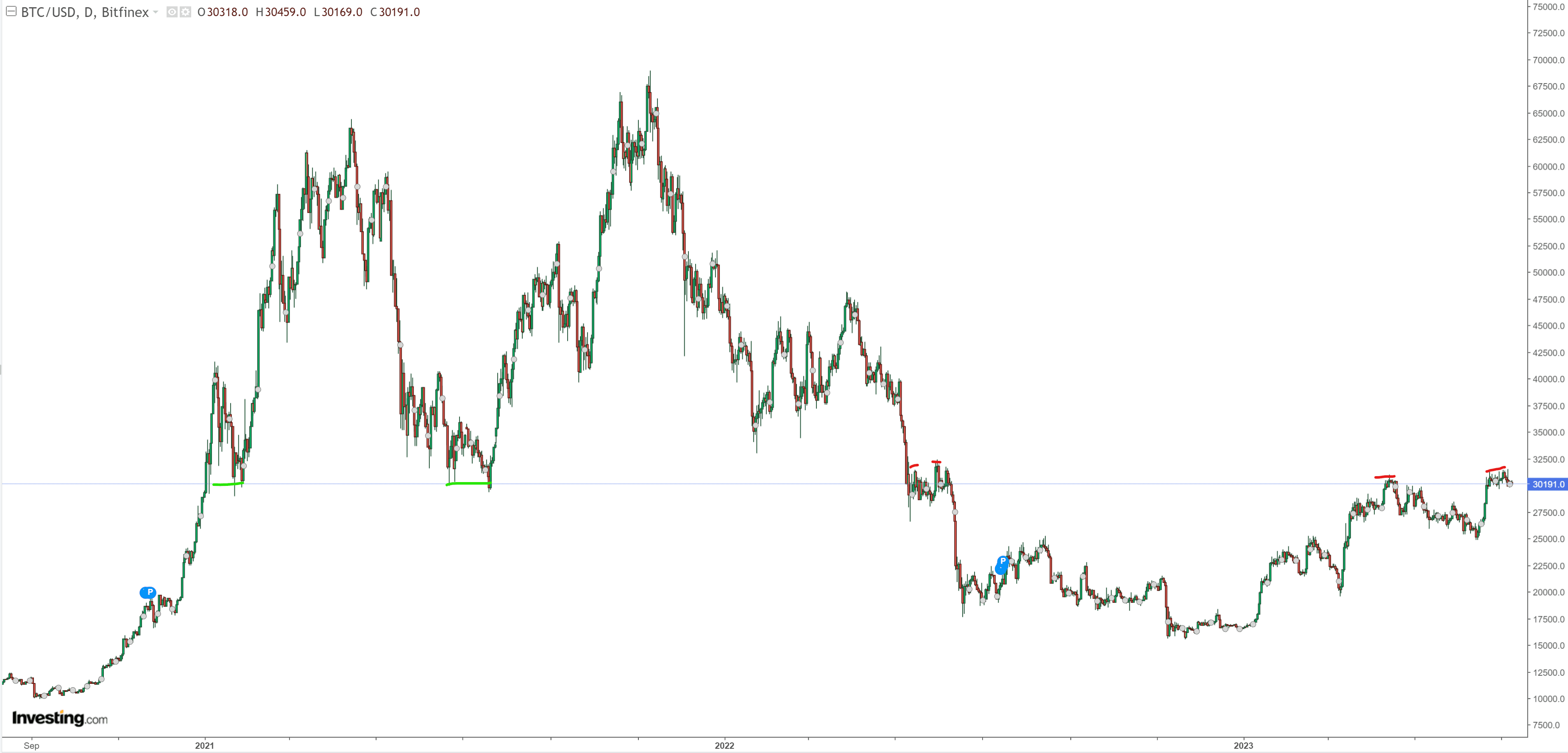

Finally, BTC strength has surprised us so far and BTC is currently testing an important resistance area between 30k and 31k, which has been tested repeatedly in the prior years:

This week: US CPI, SEC's first legal response to Coinbase

Tuesday 11

- May UK average earnings + bonus (consensus 6.8% YoY)

- June Germany CPI (consensus 6.4% YoY)

Wednesday 12

- US June CPI (consensus 3.1% YoY) and core CPI (5.0% YoY)

- Bank of Canada’s interest rate decision (consensus for a 25bps rate hike to 5.00%)

- China June Exports and Imports (consensus resp. 0.5% and -6.1% YoY)

Thursday 13

- The US Securities and Exchange Commission (SEC) responds to Coinbase's first legal defense.

- US June PPI (consensus 0.4% YoY)