Financial markets are feeling good

Risk assets, from crypto to equities, via their strong performance, appear to reflect more investor bullishness and a lower risk premium.

In the US, “cyclical” stocks such as Caterpillar and Chevron have taken over the US equity performance leadership from big-tech stocks in the past week. This would tend to suggest less pessimism from investors on global growth prospects.

We also note that spreads on US high-yield credit have been tightening recently (see chart below).

We will comment on crypto prices in the last section of this newsletter, but, excluding the price action of NFTs, prices have recovered from the SEC-induced sell-off a few weeks ago. This manifests a higher sensitivity of crypto prices to “good news” and a lesser one to “bad news”.

Drivers of market optimism

It is easy to retroactively fit narratives to price action, so we will not dwell on the exercise. As we wrote two weeks ago, market participants are pricing a lower probability of recession in the next few months, based on encouraging economic data points, in the US especially, on solid consumption (of services mainly) and on resilient labor market conditions in mature markets. In the latest US Conference Board Survey, US consumers reported better financial conditions, still plentiful job opportunities, and revised down their recessionary expectations (see below).

Wage income has so far been supporting consumption in the US, even if consumption has been mainly focused on services, less so on goods.

Other drivers

Other drivers of positive equity market performance might be linked to a higher pricing of the near-end of the Ukrainian conflict, given the latest newsflow and speculation following the so-called Wagner mutiny. It is true that European stocks were among the best performers last week, and the region would probably benefit economically from the war ending. However, we did not observe any significant further sell-off in natural gas prices, which would be a logical consequence of such an outcome. We note the acceleration of the USD / RUB rally since last weekend, though. This move could reflect the pricing of a negative geopolitical scenario for Russia.

Fundamentals not great everywhere

We are currently observing a divergence between some macro fundamentals and the price action described above.

Global manufacturing activity has weakened further, as indicated by the JPM global manufacturing PMI (Purchasing Manager’s Index), which plunged to 48.8, its lowest level since the COVID collapse in 2019. It is a fair assessment that services are now the main and only positive driver of global growth.

Cyclically-sensitive Germany has become the laggard economy in the Eurozone and globally, as confirmed by a PMI of 40.6, 9.4 points in contraction, and by the IFO survey. Interestingly, unemployment has also started to come up from very tight levels.

How to reconcile bullish price action and record low readings in manufacturing surveys? If we dive into the details of the PMI surveys, we observe that lower demand has been cushioned by companies drawing down on their inventories. Firms have not yet moved to significant workforce reduction plans either. This brings us back to tight labor markets as the base for resilient growth in mature economies.

Central banks’ reaction function

Central bankers have come to the same observations on the labor market (resilient) but are still worried about being able to curb core services inflation (ex-housing), and its main input factor, wage growth.

At last week’s European Central Bank Forum (ECB) in Sintra, we learned that:

- The main perceived risk is around containing core or underlying inflation

- Fed Chair Powell, Bank of England (BOE) Governor Bailey and ECB President Lagarde did not see inflation getting back to target before 2025

- Fed Chair Powell expected at least two more 25bps-rate hikes

Bond futures markets have slowly been repricing central bank hawkish rhetoric. Since we last wrote around this “chasing” dynamics, Fed rate cut market projections have been pushed from January 2024 to May 2024.

We expect this repricing dynamic to persist (markets are “only” projecting one more Fed rate hike, one less than signaled by Powell and expect rate cuts in 2024, not 2025).

Equity and crypto assets have so far ignored higher rates, however. Why does monetary policy tightening seem to be shrugged off by equity and crypto markets? Intuitively, we would have to infer this is a combination of markets anticipating central banks being “close” to peak rates, of other macro factors that work against high rates (excess savings and still stimulative fiscal policy), and an improvement in investor sentiment (the risk premium concept we discussed above).

Crypto more reactive to good news

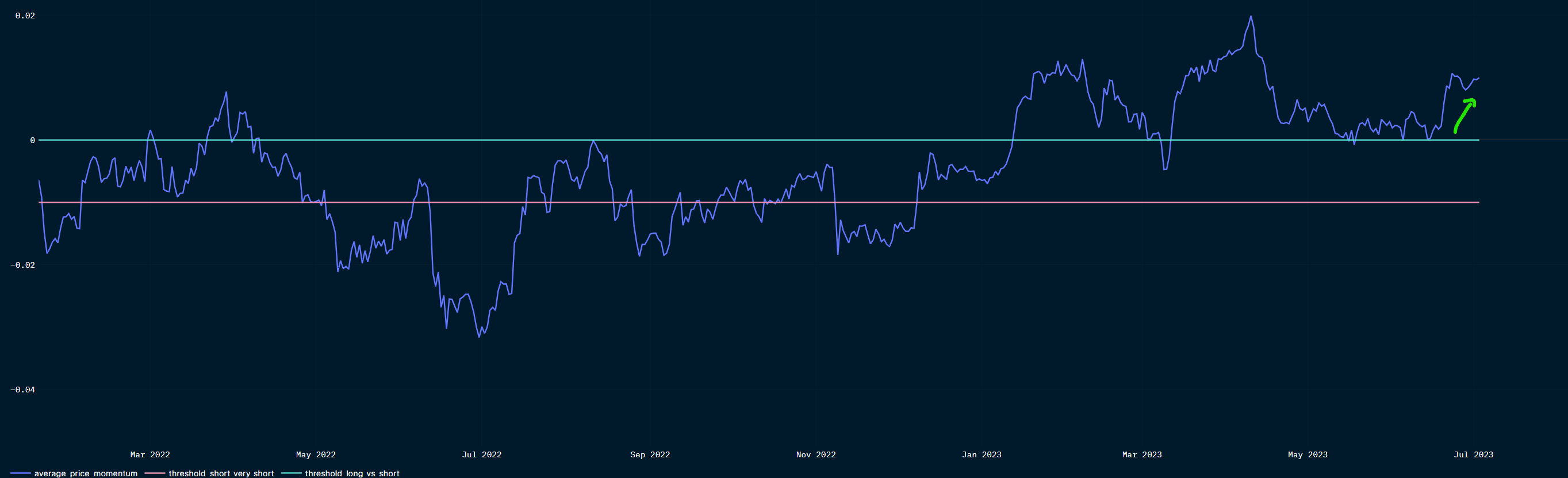

Crypto prices, at least for fungible tokens, seem to be literally on a positive momentum. Some of our tactical indicators are still bearish (call-put spread) but the BTC momentum has cleared the ambiguity and moved more clearly above zero.

Many have commented around the series of “good news” around new ETF applications for BTC spot, the announcement of a crypto exchange backed by traditional institutions, and more regulatory clarity in non-US jurisdictions, this time in the UK. Among the larger cap top performing tokens, we find Litecoin and Bitcoin Cash, two of the four tokens said to be traded on the newly launched EDX markets (with Bitcoin and ETH).

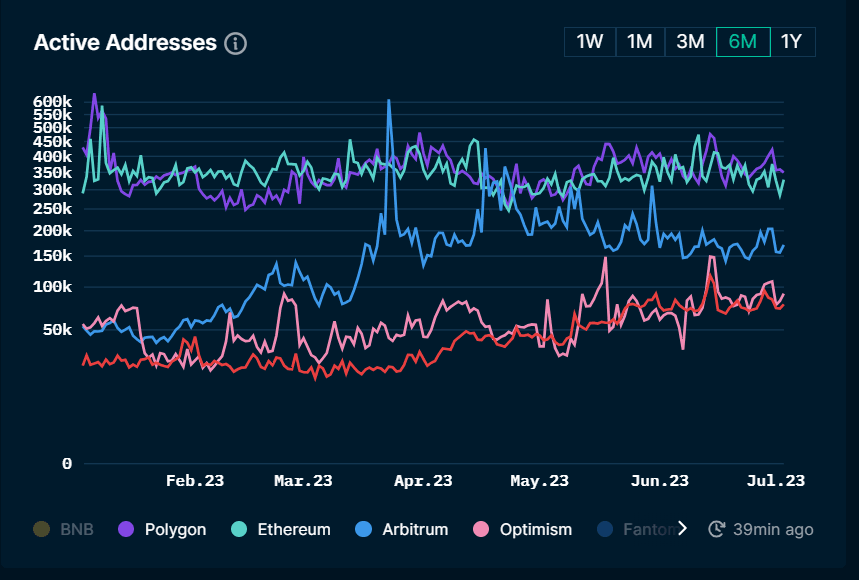

What is more remarkable to us is the asymmetric reaction of crypto prices, with good news generating more upside than “bad news” generating downside which tells us that the positive momentum encountered in equities is also driving crypto prices. This is despite tepid growth in on-chain activity on Ethereum (with other chains such as Optimism and Avalanche getting some traction recently).

An important question is, how long will positive sentiment last? We get back to the paradox of higher policy rates and their lack of effect on risk assets. Our intuition is that, if central banks are truly concerned about inflation and appropriately increase policy rates for longer, the effect should be reflected on risk assets at some point. In the meantime, crypto and risk assets are surfing the “feel good” momentum.

This week: US employment and Japanese wage data

Thursday 6

- US ISM June non-manufacturing PMI (consensus 51)

- US JOLTS job openings for May (consensus 9.9m)

- Japan average cash earnings for June (consensus 0.7% YoY). Governor Ueda has signaled that 1) wage growth above 2% was a necessary condition to normalize policy, 2) more assurance was needed that inflation would accelerate in 2024 (the Bank of Japan expects a slow down in H2 2023 due to energy base effects).

Friday 7

US June labor data:

- US average hourly earnings (consensus 4.2% YoY)

- US non-farm payrolls (consensus 225k)

- US unemployment rate (consensus 3.7% with a participation rate stable at 62.6%)