ECB’s dovishness

The only hawkish surprise delivered by the European Central Bank’s (ECB) meeting last week was the central bank’s decision to hike the main policy interest rate by 25bps to 4.50%, which, itself seems to have been more contentious than in prior meetings: “Some members would have preferred to pause” (ECB press conference). The tone, guidance and press conference were all on the dovish side compared to this summer.

The key sentences of the meeting were: “Based on our current assessment, we consider that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to our target. Our future decisions will ensure that the key ECB interest rates will be set at sufficiently restrictive levels for as long as necessary.” This translates into: “based on the data we see today, we are reasonably confident that we have reached the terminal rate for this cycle, but we remain data-dependent”.

The ECB staff revised inflation projections up and growth projections down for 2023-25. President Lagarde conveyed a greater concern around growth weakness and the “slower momentum” in employment growth than around persistent inflation. Gone is the overheated discussion on the possibility of a “wage-price” growth spiral in the Eurozone (it was barely a few months ago, but in a “data-dependent” world, narratives move fast).

The rate market enigma

Markets took the hint as the EUR/USD lost -0.90% in the few hours after the beginning of the press conference. This reaction of the EUR to a relatively dovish meeting is not surprising. What intrigues us is the move higher in European rates: the German 2 yr rate was up 1+3bps and the 10 yr +6bps week-on-week. Interestingly, US rates were up too, less so on the shorter durations but by +6bps on the 10 yr.

Below we show a “split” of US nominal 10 yr rates between the inflation pricing and the “real rate”. The former roughly reflects markets’ projection on inflation plus the uncertainty around this projection, while the latter is the projection of the real rate associated with how restrictive policy is. As the chart below shows, the real rate tends to come down prior to recessions (expectations of the Fed cutting from 2007 and 2019 on). This has not been the case in the past few months though: real rates are up by 83 bps while the pricing of inflation (breakeven) is up by a mere 10 bps.

We are tempted to interpret the combination of less hawkish central banks (outside of the Bank of Japan) and rising real rates as the market beginning to be more convinced that central banks will actually hold policy rates higher for longer, even as inflation comes down.

For the US, this may be the result of macro data beating expectations. The Eurozone is in a different position: with real rates still somewhat negative, policy does not appear restrictive enough yet, given the small progress on core inflation and wage growth tracking above 4.5% YoY. The UK is in a difficult position too, with wage growth having accelerated to just below 8% YoY but unemployment starting to rise.

If we put everything together, our intuition is that the Bank of England (BoE) and the ECB could be forced to tighten more than what they are comfortable with. For the Fed, we see one more rate hike likely in 2023 (November or December) and then a long period of holding rates steady. The Summary of Economic Projections to be published on Wednesday by the FOMC Committee will probably show an additional rate hike, and a revision to “shave off” some rate cuts in 2024.

From rates to risk assets

The first “instability” that strikes us is rates moving higher in mature economies despite relatively less hawkish central banks.

Another intriguing price pattern to us is the underperformance of Information Technology US stocks in the last month, and especially week, with some signs of price consolidation (price at or below the 50-day moving average) for the best year-to-date performers such as Nvidia and Apple. We cannot help but associate our observations on real rates with what is happening with these stocks. Have real rates reached such a level that some of these tech stocks valuations become less attractive?

It is difficult to become outrightly bearish on equities because, on the other hand, we can observe a “healthy” rotation to Consumer Discretionary stocks (who would not do well into recessions).

Nevertheless we keep an eye on the dynamic real rates - tech stocks - and crypto.. So far crypto markets have traded uncorrelated to these macro dynamics, but, if instability is the sign of a trend change, it is worth keeping an eye on these relationships.

The third observed “instability” is the strong rally in energy commodities, in the context of central banks becoming more confident that “we have experienced the worst of inflation”. So far gasoline and oil prices have rallied further in September and will add again to the headline CPI in the US and globally for September (as energy prices declined in September 2022). Central banks are focused on core inflation, but if energy rallies too much it could become a worry.

Crypto markets

We dive into traditional financial markets because, even as price moves are relatively subtle now, they could impact crypto markets if and when “instability” becomes a trend. The worst cases would be a re-acceleration of inflation or a sharp fall of growth to which central banks are slow to react.

For now, crypto is trading uncorrelated to other assets and on low volumes. Looking at pure crypto metrics, we note that one of our top-performing risk management indicators, the BTC price momentum, has come above zero two days ago, which means it turned from risk-off to risk-on.

What strikes us is the low volume and the muted price reactions to “bad” (FTX asset tokens’ liquidation) and “good” news (Deutsche Bank has partnered with Taurus to “provide custody services for institutional clients' cryptocurrencies and tokenized assets”, this continues the strike of bullish news on crypto institutional adoption, see our last note) affecting crypto.

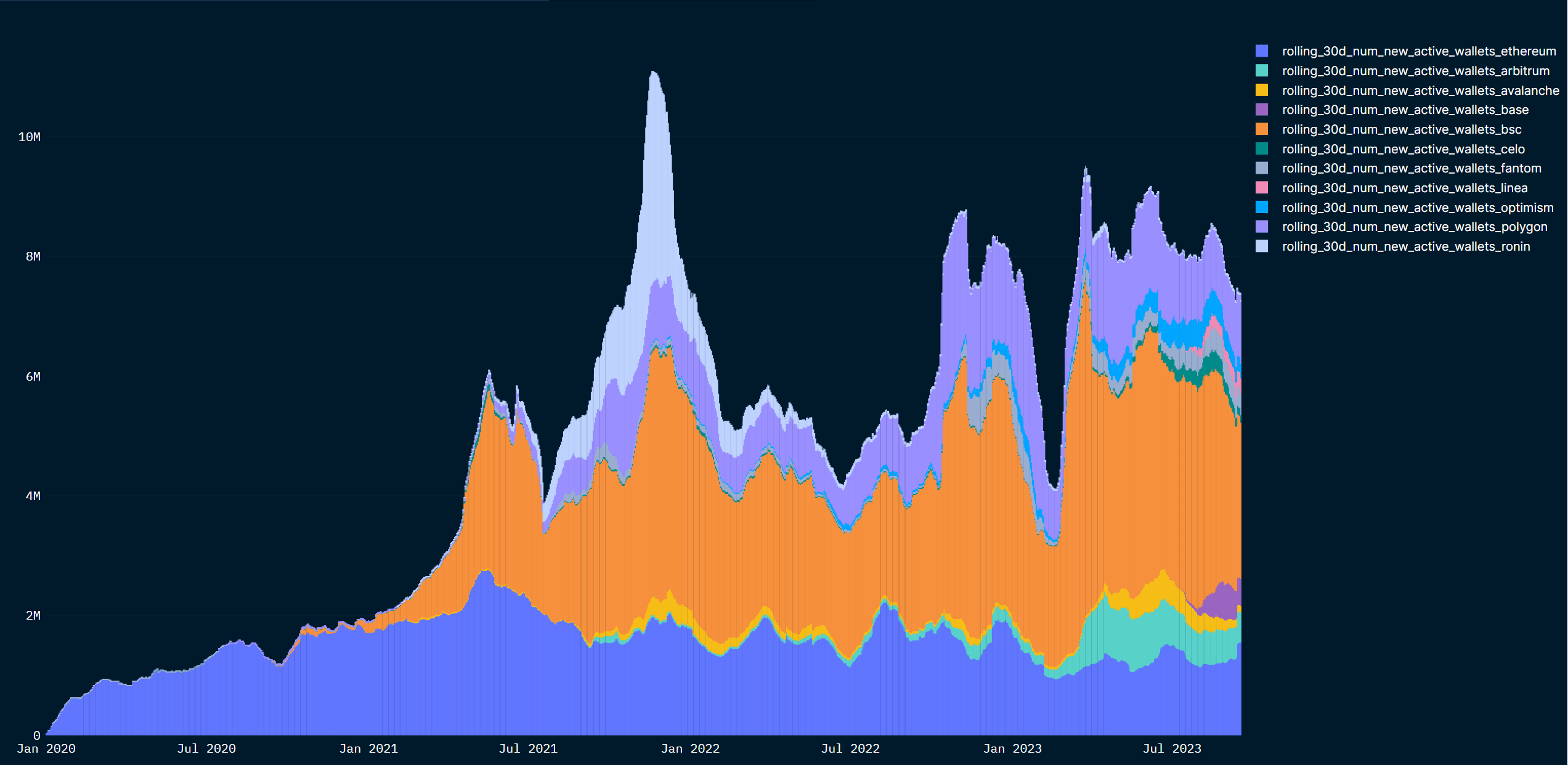

Barred the situation on the macro front (e.g. the headwinds of higher real rates and wobbly tech stocks), we are seeing 1) Ongoing institutional use cases for crypto, 2) An increase in new addresses on-chain, which are two major tailwinds for the asset class. We will finish this note with the brief impressions from our Nansen research colleagues on the past TOKEN2049 event in Singapore: they observed an overall significantly larger space rented and higher number of participants compared to the past edition. Anecdotally, quite a few VCs were looking for attractively-valued projects, with projects more reluctant to raise at lower valuations.

This week: Central-bank-heavy

Tuesday 19

- Eurozone Aug. CPI and core CPI (consensus is for both to come at 5.3% YoY)

- US Aug. Building Permits (consensus 1.440m)

Wednesday 20

- UK Aug. CPI (consensus 7.1% YoY)

- FOMC Meeting: We expect the Fed to be on hold (as consensus does) at 5.50%. The Summary of Economic Projections will be interesting. We see the interest rate projection displaying one more rate hike by year-end 2023 and a slower pace of rate cuts for 2024.

- The Brazilian Central Bank meets (consensus for 50 bps cut to 12.75%)

Thursday 21

- The Swiss National Bank meets (consensus for 25 bps hike to 2.00%)

- The Bank of England meets (consensus for 25 bps hike to 5.50%). The BoE is facing high inflation, high wage growth, and increasing unemployment. It will be a tricky press conference and if Governor Bailey is as dovish as President Lagarde was last week, the GBP/USD will probably move lower

- US Philadelphia Fed Manufacturing Index (consensus -1)

- Japan Aug. National Core CPI (consensus 3.0% YoY)

- The Bank of Japan meets (consensus -0.10% on policy rate). Governor Ueda will be quizzed after alluding to a possible normalization of policy by the end of this year. We are a bit apprehensive about that meeting given the rate / tech stocks dynamics described in this note.

Friday 22

- Flash PMIs for the US, UK, Eurozone, Australia, Japan