US - Europe growth gap

In our prior publication, we highlighted the gap between European and US data, with the former surprising to the downside compared to the latter. This difference in growth has increased in favor of the US. Most eye-catching last week has been the weakness in German manufacturing and services data. The German Purchasing Manager Index (PMI) is now 11.2 points in contraction territory. According to the PMI press release, “The sharp decrease in demand for goods and services reflected a range of factors, including customer hesitancy, destocking, high inflation and rising interest rates” and “there is an increased probability that the economy will be in recession in the second half of the year.”

Growth weakness in Germany is occurring in a context of “sticky” inflation: it was noted that inflation had gathered pace in July. This is the definition of “stagflation”, and the next step is probably going to be reflected in a higher unemployment rate: “The uptick in the unemployment rate, which we have seen over the last few months, is likely to continue.”

Why the weakness in Germany, while the historically vulnerable economic regions, Spain and Italy, appear to be faring better? The energy supply shock triggered by the Ukraine war appears to have had long-lasting negative effects on German companies, and has been followed by a tightening of lending conditions as the European Central Bank (ECB) normalized its policy. The German Economy minister is revisiting the option of electricity caps financed by public subsidies.

In the US, growth seems to have gained positive momentum in June: an important leading indicator, the Conference Board Consumer Confidence Expectations index, rose above 80, the level consistent with a recession. The underlying drivers of this growth bonanza are: a still very strong labor market, and desinflation, which is cushioning disposable income growth for the US households (disposable income up 4.7% YoY in June 2023).

The growing delta in US vs Eurozone growth, is, as signaled in past publications, challenging for the EUR vs the USD. We also note that net future speculative positions are historically high for both the EUR and the GBP, in contrast with the JPY (which will be touched upon in our Bank of Japan section further on).

Fed and ECB meetings’s implications

Last week, the US Federal Reserve and the European Central Bank (ECB) met and both hiked their respective policy rates by 25bps, to 5.5% and 4.25%, respectively. The ECB also cut the rate paid on bank required reserves to 0% from 3.75% (effective in September) which should translate into an income loss for banks, and potentially push banks to increase their lending rates (= more tightening in lending conditions).

There were commonalities in Fed Chair Powell’s and President Lagarde’s messages: Both the Fed and ECB estimate that they are close to the level of peak rates. « Do we have more ground to cover? At this point I would not say so » commented Lagarde.

Both the Fed and the ECB are “fine tuning” the final rate level by choosing, meeting by meeting, between a hike or a pause. Powell: «we have not made any decisions about any meeting. [...]it is possible that we will rise at the September meeting, it is possible that will hold steady"» ; Lagarde: « what I can assure you of if we are not going to cut but on the other side could be a hike could be a pause ».

The pure reliance on data was highlighted. These will be the relevant data prints for both central banks before their September meetings, and we expect high volatility around these data prints:

We will comment on July CPI vs consensus closer to the publication date, but, so far, we are wary of the base effects for energy, which will make YoY energy CPI less negative in July than in June and prior months. The same should happen for food YoY inflation from August on.

As for the labor market, the “leading” indicator, US jobless claims, shows no significant sign of market deterioration yet. Wage growth is slowing but is above 4% YoY in the US, Eurozone and UK, still too high.

When comparing Fed Chair Powell’s and President Largarde’s press conferences, the latter was slightly more dovish, supposedly because of the recent weakness in Eurozone growth data. The ECB is nevertheless “behind” the Fed in terms of how restrictive its policy rate is (policy rate - inflation expectations).

But ultimately, the risk is still asymmetric, especially for the Fed: taking the Fed’s perspective, it is safer to endure a small recession and “break the neck” of inflation rather than running the risk of letting inflation rekindle. Powell: « We would want core inflation to be coming down. Core inflation is still pretty elevated. We need to hold monetary policy at a tight level for some time ».

We are now at the “top of the mountain” and the question evolved from “how much higher is the top in rates?” to “when should we safely start our descent?” It could be a long observation and deliberation time, because of the asymmetric risk of letting inflation “escape” again.

The BoJ relaxed the yield curve control, now what?

“This is not a step toward policy normalization” said Bank of Japan (BoJ) Governor Ueda after announcing that the 10yr Japanese Government Bond yield would be allowed to fluctuate above the prior 50bps ceiling, with a hard ceiling of 1%.

The BoJ is very reluctantly normalizing its policy, without calling it normalization. But Japanese inflation is now higher than US inflation for the first time since 2015, which puts pressure on the BoJ to exit extra-accommodative policy.

Currency and bond markets reacted to the decision (leaked before the central bank meeting to the Nikkei), but, at the end of the week, there was some retracement in markets. Week-on-week, Japanese 10yr yields were up 15bps to 0.56%, US 10yr yields also rose 10bps.

What is next? More normalization that does not say its name, in our view. How to explain markets’ muted reaction? We think that investors might have already been preparing for and priced some announcement last week.

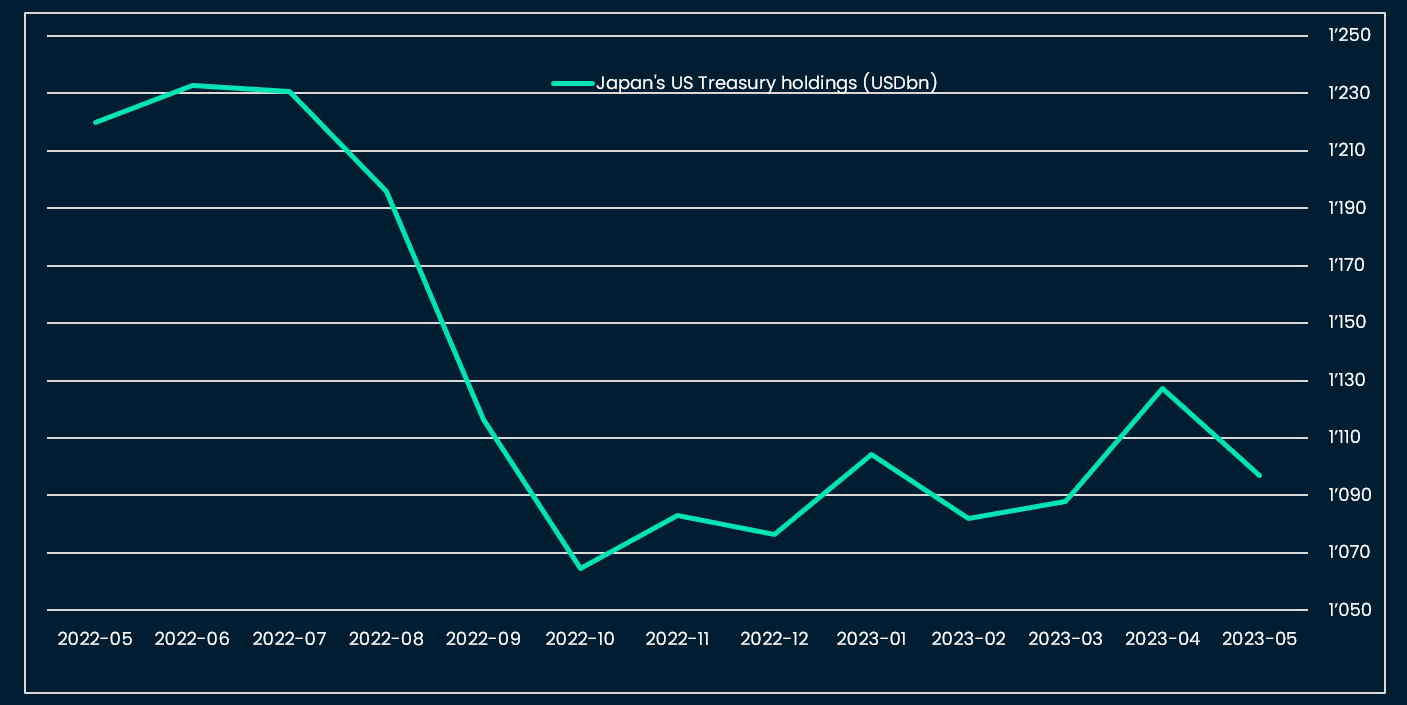

Going forward, we expect the BoJ to continue the process of yield curve control relaxation and eventually, to hike its policy rate out of negative territory. The long-term impacts are probably linked to the lower incentive for Japanese investors to buy foreign bonds, e.g. US Treasury bonds, which would put upward pressure on yields in the US, Australia and all countries where Japanese ownership is high.

Crypto in relation to equities

The correlation between the S&P 500 and BTC/USD peaked in October last year, and has been declining since. This makes sense as the perception of economic and interest rate risk has been receding since the first downside surprise in US CPI in October last year. Interestingly, this is at that same period that both equities and crypto started to recover.

If we sail into desinflation, macro will matter little for crypto. But, if rates stay high long enough to generate a significant economic shock in the US and other markets, we expect equity-crypto correlations to pick up and both assets to sell-off at the same time.

Indeed, by reviewing the the 10%+ sell-offs in the S&P 500 since Bitcoin exists, we find that in five out of seven occurrences, BTC also sells-off. In four out of seven occurrences, BTC drawdowns are more than two times larger than S&P 500 sell-offs.

We see two scenarios, depending on the intensity of a potential equity sell-off and the reactivity of the Fed:

- Shallow recession / sell-off and the Fed preempts growth weakness by easing: Crypto has a very muted and short sell-off and the bull market starts

- Very severe recession and general market sell-off e.g. liquidation of gold, long-term treasuries. Fed reacts but not fast enough: Crypto would experience a larger drawdown than equities

In the short-term, we observe that crypto markets are taking negative newsflow around hacks and regulatory developments in their stride (e.g. price weakness but no severe sell-off outside of a few tokens). We are monitoring the BTC price momentum, which is nearing zero again for the first time since last May:

This week: US job openings and employment report

Tuesday 1

- The Reserve Bank of Australia meets and is likely to hike its policy rate by 25bps to 4.35% (core inflation is just below ~6% YoY and still too high)

- German employment July report (consensus 5.7% unemployment rate)

- Eurozone employment June report (consensus 6.5%)

- US June JOLTS job openings (consensus 9.63m, according to Indeed, job postings are cooling but at a very slow pace)

- US July ISM Manufacturing PMI (consensus 46.5)

Wednesday 2

- The first rate cut by the Brazilian Central Bank is expected! (13.50% from 13.75%)

Thursday 3

- Bank of England: hike expected (+25bps to 5.25%)

- US July ISM Non-Manufacturing PMI (consensus 53.0)

Friday 4

- US July Non-farm payroll (consensus 200k) and employment report (consensus participation rate 62.6% and unemployment rate 3.6% and average hourly earnings 4.2% YoY)