A month ago, we wrote about the two conditions or tailwinds for the resumption of a crypto bull market: 1) Regulatory clarity in the US, 2) Proofs that core inflation is moving lower. Last week and the conclusion of the legal action of the SEC (Securities and Exchanges Commission) against Ripple, plus the disclosure of a US core CPI below economists’ consensus delivered data points in the direction of these two conditions.

In this newsletter, we review the evidence on US disinflation, what markets are pricing, and the potential macro and market scenarios from here. We also summarize the implications of the Ripple case on other crypto assets.

Disinflation is real

The striking observation from the US June CPI report was how broad-based across different items the inflation slowdown was, leading to a US core CPI growth of 4.8% YoY and 0.2% MoM, below economists’ respective expectations of 5.0% YoY and 0.3% MoM.

We highlight the slowdown in goods ex-energy-and-food MoM inflation, led by a negative print on used cars and trucks. The “Powell” metric, services inflation ex-shelter, made of medical and transportation services saw close to flat inflation MoM. Very eye-catching was the decline in airline fares (-8.1% MoM).

Even if explicitly discounted by Fed Chair Powell, the disinflation in the Shelter component is helping a lot because it accounts for ~35% of the CPI basket and ~44% of the core CPI basket. Our Case-Schiller leading indicator, which has been correctly predicting the disinflation of Shelter from April 2024 on, points towards this trend continuing into 2024.

Mind the base effect, and the recency bias

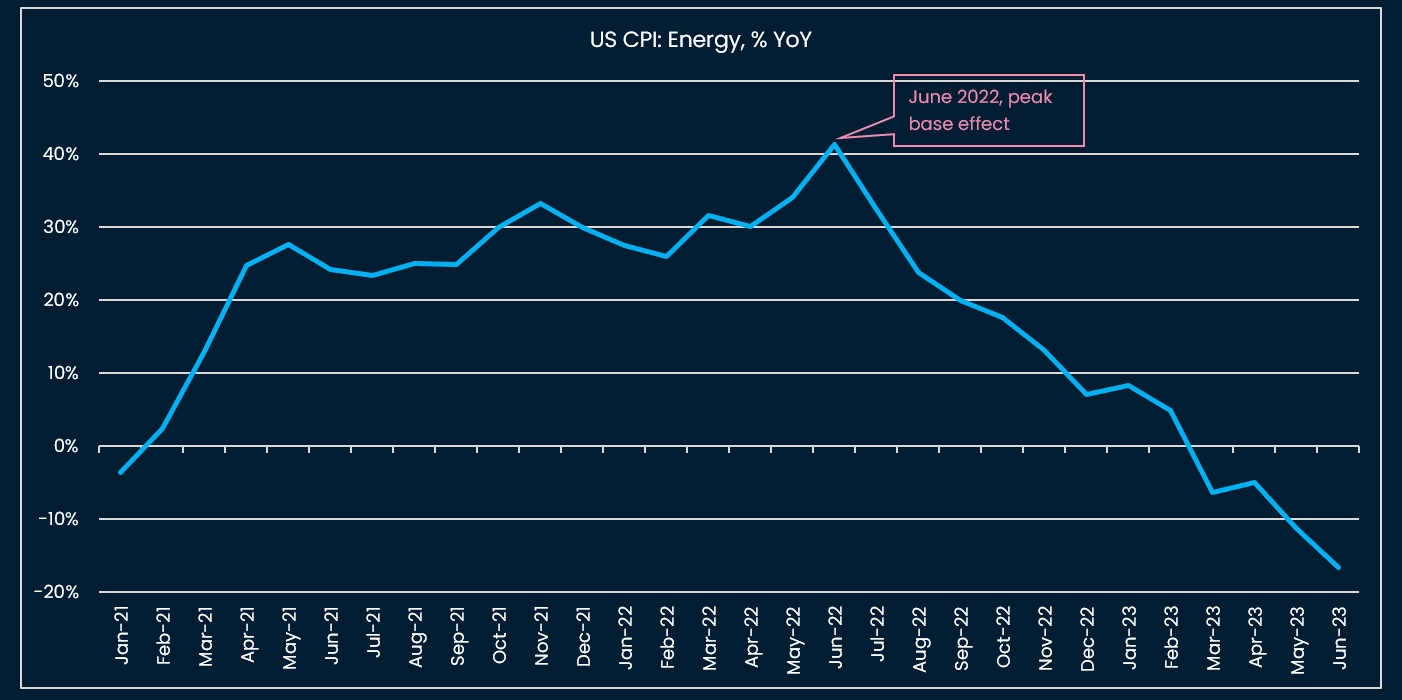

There are two caveats in the disinflation narrative. First, headline inflation, which has been slowing YoY to settle at 3.0% in June, had a lot of help from a higher base effect from Energy and Food inflation. The two charts below tell us that this base effect has peaked in June for the Energy YoY inflation rate and will peak in a couple of months for Food.

The other ground for caution is the uncertainty around the direction of wage growth (in the US but also in other mature markets).

The US Beige Book, which is a State by State survey of companies and other economic stakeholders confirmed that wage growth was decelerating: “Wages continued to rise, but more moderately. Contacts in multiple Districts reported that wage increases were returning to or nearing pre-pandemic levels.”

The website Indeed’s average posted wage growth seemed to confirm the slow down in US wage growth, but the pace of normalization indicated a return to pre-pandemic wage dynamics earliest around Spring 2024.

This is a very slow “return to normal”. Additionally, the newsflow around strikes and wage negotiations, from air pilots (United pilots are negotiating up to 40% YoY pay rise), to, more surprisingly, Hollywood actors, points towards a rising negotiation power for employees post-pandemic.

Finally, we caution against the recency bias: the past three years have repeatedly shown that markets have tended to be overconfident around disinflation, especially in the aftermath of an encouraging CPI print. The Fed is unlikely to share this overconfidence.

US Fed’s policy scenarios

Although the now former St. Louis Fed President Bullard, one of the most hawkish FOMC members in the past two years, announced he was stepping down, this does not signal a change of stance for the overall Committee.

Overall, the Fed is likely to remain concerned about the inflation part of its mandate, over growth and employment, as the latter stay resilient. According to the Beige Book, most sectors of the US economy were entering a slow growth regime at worst, with only the Office segment of the Commercial Real Estate (CRE) sector deemed in trouble. The CEOs of JP Morgan, Wells Fargo and Citi expressed the same confidence in the economic outlook for the US during their banks’ respective earnings releases, despite higher provisions for projected CRE loan defaults.

Governor Waller, referencing the June CPI report declared “This is welcome news, but one data point does not make a trend. Inflation briefly slowed in the summer of 2021 before getting much worse, so I am going to need to see this improvement sustained before I am confident that inflation has decelerated.”

On the economy and subsequent policy actions he added: “I am more confident that the banking turmoil is not going to result in a significant problem for the economy, and I see no reason why the first of those two hikes should not occur at our meeting later this month.”

What are the scenarios going forward for the US economy?

- a. More of the same: Slowing but resilient real growth + disinflation

- b. Inflation re-accelerates and at the minimum stays way above 2% YoY, either led by wage growth or an external supply shock (see renegotiation of grain export deal in Ukraine)

- c. Growth slows sharply as the lagged effects of tighter lending and funding conditions impact markets and the economy in one blow

Scenario c. was prevalent at the beginning of 2023, especially after the bank turmoil in March, but progressively got replaced by scenario b., and US short-term rates started to rise to above 5% again. Now, markets have moved to scenario a., soft landing and benign disinflation. Bond future markets have moved after last Wednesday’s CPI print to price a high likelihood of the Fed cutting rates from January 2024 on (it was June 2024 last week).

Our intuition based on ongoing data and market positioning is that scenario a. is “in the price”, especially of risk assets. A lot of good news on the inflation / growth mix has been reflected in equity and credit prices. Of course the positive momentum in risk assets’ prices can continue, and probably will for a little more as disinflation progresses in the US, helped by Shelter and other drivers. However, the level of equity risk premium indicates a lot of optimism and not a lot of room for scenario c. (which is still a very likely outcome if the Fed sticks to rates above 5% and if inflation only slowly decelerates).

Ripple vs SEC: Regulatory implications for the rest of crypto

The goal of this section is not to detail the outcomes of the SEC - Ripple litigation but to analyze the likely repercussions on other crypto assets and whether those are already “in the price”.

In last week’s verdict, XRP met the notorious Howey test and was deemed a security for its “institutional sales”, but not for its “programmatic sales” e.g. the trading of XRP on exchanges.

As a reminder, the Howey test has three criteria: “(1) “a contract between a promoter and an investor that establishe[s] the investor’s rights as to an investment,” which contract (2) “impose[s] post-sale obligations on the promoter to take specific actions for the investor’s benefit” and (3) “grant[s] the investor a right to share in profits from the promoter’s efforts to generate a return on the use of investor funds.”

Criteria 3 failed to be validated in XRP’s “programmatic” or exchange-based sales under three arguments:

- Ripple’s promotional material, which linked the health of the ecosystem with capital received by investors, was not circulated to the general public of traders.

- The level of sophistication of institutional investors is higher than the level of “programmatic buyers”.

- The relative size of the sales in relation to trading volume: “Ripple’s Programmatic Sales represented less than 1% of the global XRP trading volume”

The implications for crypto projects and protocols are:

- Those having relied less on institutional sales are less likely to be have their token qualify as a security

- The size of the “investment” received compared to the trading volume of the token matters too

- The marketing communication and its level of centralization counts

For exchanges who decide to list a token, the same clemency might not be applied. Indeed, exchanges are the intermediary between the project and the “unsophisticated programmatic buyer” and it can be argued that exchanges are sophisticated enough and informed enough to assess whether the asset being listed meets the three criteria of the Howey test.

What crypto is pricing

Unsurprisingly XRP rallied +64% and COIN +50% last week, but the positive contagion to the rest of the crypto market was not as strong. BTC came close to 32k before retracing lower on Friday: this is an important resistance level to break.

Also, the rally in altcoins had already started in June. Looking at our sector indices’ performance, we note that, until June, the two sectors with strong positive performance year-to-date had been Artificial Intelligence and Liquid Staking. The outperformance has broadened to other sectors MoM, with “Forked Layer 1” and “Gaming” the top performers.

Like traditional risk assets, crypto is surfing a positive price momentum, and it seems unwise to go against it. However, crypto is also dependent on the macro scenarios sketched above, and especially vulnerable to scenario c. (sharp growth slow-down while rates are high). This has to be considered when allocating risk to the asset class.

This week: More CPI prints

The whole week

- S&P 500’s Q2 earnings season

Tuesday 18

- US June retail sales (consensus 0.5% MoM)

- Canada June CPI report (consensus headline CPI 3.0% YoY and core CPI 3.4% YoY)

Wednesday 19

- UK June CPI report (consensus 8.2% YoY for headline and 7.1% YoY for core). Food price disinflation likely to help headline come down

- Eurozone June CPI (consensus 5.5% YoY for headline and 5.4% for core)

- PBoC Loan Prime Rate decision (current 3.55%, activity data have been deteriorating and provide an impetus for the central bank to do more on the easing front)

Thursday 20

- Philadelphia Fed Manufacturing Index for July (consensus for July -10.4)

- Central bank meetings in EM: Turkey, South Africa

- Japan National CPI for June (consensus 3.4% YoY for headline and 3.3% for core)