Introduction

Murad Mahmudov’s “memecoin supercycle” centers around community, identity, and a shared, spirited belief in wealth creation through unconventional means. Beyond financial returns, it’s a digital movement driven by humor, a desire for belonging, and defiance of traditional finance. Memecoins thrive in this space, where platforms like X and Reddit amplify stories of wealth and “financial FOMO,” turning them into symbols of identity and belonging. For many, they represent a cultural shift prioritizing community and participation over conventional financial norms, fueled by the thrill of collective success.

Does the thesis hold up? Analyzing a portion of Murad’s highlighted memecoins on X suggests that, at the very least, it appears valid in the short term.

Both classic and newer memes continue to outperform Bitcoin, and as Murad recently highlighted, some memecoins boast a significant number of traders holding over $1,000 worth of these tokens. Traders can use Nansen to monitor memecoins for participation stickiness (are smart money holding?) and price action, while traders should explore X or other social platforms to assess the community-driven "cult" dynamics of these tokens.

Murad has come on YouTube interviews mentioning he goes for old established memes with an existing cult rather than jumping the next shiny thing. With that said, can we find what has performed well in the past month, sits above 10 million market cap, has at least 10,000 current holders an has a strong social following which may carry through to the next cycle, like Doge and Pepe?

Some of these tokens have already secured listings on major centralized exchanges (CEXs), aiding in sustaining their communities. A notable recent example is $PNUT, listed on Binance and supported by fan pages on X with 44,000 followers. $PNUT has exhibited price behavior reminiscent of early $DOGE, suggesting the possibility of a downturn once the current cycle ends. However, its community could persist beyond the cycle’s conclusion. Traders might leverage this framework to prepare for future trends or to identify overlooked underdog tokens that have yet to gain significant attention despite their longevity.

Do Top-Performing Tokens from the Latter Half of Cycles Excel Near the End?

Murad's thesis suggests that tokens performing well in the first half of a cycle are likely to continue performing well in the last half of the cycle. For instance, tokens that saw gains in early 2024 may also do well in the next altcoin season, which some predict for late 2024 or early 2025. This outlook holds true even as many anticipate a full bull market, noting significant price appreciation across various tokens.

As we discussed in our previous article, the hypothesis that newer tokens tend to outperform older ones has proven accurate. Of course, investors are assuming higher risks, as many tokens launched over the years gradually lose traction and fade away thus leaving the winners far and few in between.

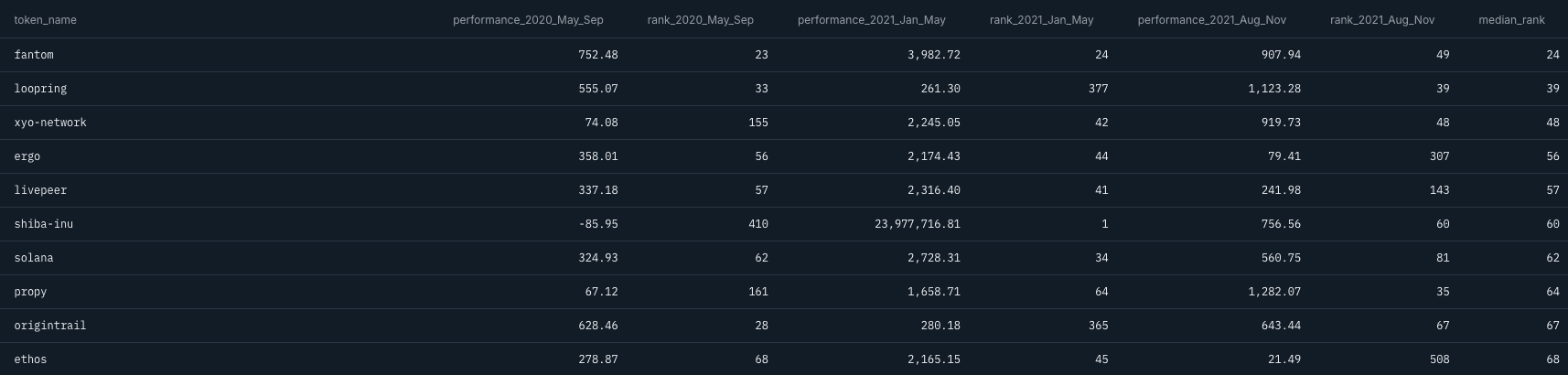

Between 2020 and 2022, during bullish periods when altcoins outperformed Bitcoin, we see some support for Murad's thesis. Examining tokens that appreciated in at least two out of the three selected timeframes (May-Sep 2020, Jan-May 2021, Aug-Nov 2021), many of these tokens performed well in the final stages of the cycle, though with varying degrees of consistency. Tokens meeting these criteria demonstrate that early success often correlates with continued performance later in the cycle. The three timeframes are roughly based on the timeframes showcased by Murad and the altcoin season index by the Blockchain Center.

Examples include tokens like Fantom, which saw strong price growth in 2020 (752% increase) and continued to perform well into 2021 with another substantial gain of over 3,900% from January to May. Shiba Inu is another standout, with a remarkable 23,977,716% surge from January to May 2021, although its performance was more volatile in the later stages. Arweave also followed this pattern, achieving significant appreciation across timeframes, reaching 851% in 2020 and 1,024% later in 2021.

These tokens, among others, each achieved a market cap of at least $100 million at some point, showing that strong performance in early bullish periods can be a sign of sustained interest and growth potential as a cycle progresses. This data highlights that while not every token will maintain its momentum, a notable subset of early-performing tokens does continue to do well later in the cycle. It's important to recognize that by focusing on specific timeframes, tokens may show different levels of price action compared to analyzing the full year for instance, examining the entirety of 2021 from start to finish.

Are Memecoins Poised for Success?

Memecoins have dominated performance over the past year, with three of the largest tokens by market cap DOGE, SHIB, and PEPE falling into this category. This trend is further reinforced by price performance data from the beginning of the year through November 18th, where nearly every top-performing token is a memecoin.

Given these performances and the mindshare across socials, it may very well be the sector that continues to outperform in the coming weeks as traders anticipate the beginning of the next altcoin season.

Generation Z, raised during periods of economic instability, faced with rising living costs, and immersed in a digital-first environment, many Gen Zers are adopting a mindset some describe as financial nihilism—a skepticism toward traditional financial systems and a focus on immediate outcomes over long-term planning. This shift is evident in their embrace of high-risk assets like memecoins and in how they consume financial information. Now of course Gen Zs is not the only segment set to decide where "retail" money goes, millennials are also there, but it cannot be disputed that Gen Zs is the next growing generation.

Financial nihilism stems from a sense of disillusionment. For many in Gen Z, conventional milestones like homeownership or retirement savings feel increasingly out of reach. A study by ConsumerAffairs highlights that their purchasing power is significantly weaker than that of previous generations, 86% worse than that of Baby Boomers when they were the same age, to be exact. With economic barriers mounting, the appeal of traditional financial goals diminishes, making alternative, high-risk approaches seem not only viable but necessary. In this context, speculative assets like memecoins gain traction as a quick, albeit volatile, path to financial gain. Combined with increasing levels of reported loneliness, this may be a recipe for growth in the memecoin category and likely also spillover into alts as a whole.

The CFA Institute notes that Gen Z relies heavily on platforms like TikTok, YouTube, Reddit, and X for financial information, a trend that is reshaping how investments are understood and pursued. This approach aligns naturally with the appeal of cryptocurrencies and memecoins, which thrive on online trends and digital community dynamics. However, the reliance on these platforms also means that young investors are highly influenced by social media figures, key opinion leaders (KOLs), and trending narratives. While this dynamic drives enthusiasm and engagement, it underscores the importance of critical evaluation and diverse perspectives in shaping sustainable investment decisions

The interplay between financial nihilism, the rise of memecoins, and Gen Z’s digital habits underscores their evolving relationship with risk and money. Their disillusionment with traditional systems fosters a higher tolerance for speculative investments. The social dynamics of memecoins, reinforced by online communities, often lead to herd behavior, while gaps in financial literacy and unregulated advice amplify vulnerabilities.

Will the Past Repeat?

With thousands of new tokens emerging daily, picking the right one has become increasingly challenging. Many altcoins now launch with a high fully diluted valuation (FDV), meaning only a portion of the total supply is initially available. This often gives early investors and venture capitalists an advantage over retail investors when the tokens finally hit public markets.

Having a token listed on a centralized exchange in most cases mainly benefits early traders, as research shows that the majority of tokens that are listed on centralized exchanges see negative price action.

Given that the general altcoin market generally is not favorable to later stage traders, can we trust in the thesis that earlier cycle winners will perform positively again? While it is growing ever less likely that we all will make it, we can check numerous factors to give us an idea of what to do. For the purpose of this article, we will focus on a breadth indicator.

A breadth indicator offers a simple way to gauge market trends by showing the percentage of tokens trading above or below key moving averages, such as the 50-day or 200-day averages. A higher percentage above these levels suggests bullish momentum, while more tokens below indicates potential market weakness.

This method also highlights whether market strength is widespread or concentrated. For example, even during a rally, a low percentage of smaller tokens above their moving averages could signal narrow market participation. Breadth indicators provide a clear snapshot of overall trends, helping traders track shifts across crypto sectors.

Nansen’s breadth indicator has recently seen that the 30 day moving average crossed the 90 day, but that the general market for altcoins, also indicated by altcoin indicators is still in the early days for the general crypto market.

Conclusion

The rise of memecoins reflects a broader shift in how digital communities engage with risk, value, and identity. These tokens function not just as speculative assets but as cultural phenomena, blending financial ambition with a sense of belonging. While historical patterns in altcoin cycles suggest potential clues for future performance, the increasing complexity and volatility of the market call for a more measured perspective.

The continued momentum of memecoins and altcoins will likely depend on the intersection of social sentiment, generational behavior, and market conditions. Gen Z’s embrace of financial nihilism and digital-first communities positions them as a driving force, yet their reliance on trends and herd dynamics introduces both potential and risk. Whether this cultural and financial movement evolves into something sustainable or remains rooted in speculative cycles is uncertain. As the landscape unfolds, a key question emerges: can these assets transcend their speculative origins, or will the volatility inherent to the market ultimately reshape expectations once again?