Nansen's take: Smoother macro waters entering 2023, but don’t underestimate central bankers’ hawkish determination

Global growth is trumping consensus and experiencing a revival, especially in the US and Europe. European consumers have been sheltered by energy subsidies (note: in January 2023 some subsidies expire in the UK and Continental Europe, the impact on consumption has to be followed closely). The European winter has been mild so far and wholesale gas prices are back to their yearly lows. But the US, notably the US consumer, is also more optimistic and still benefits from abundant job opportunities, even as US jobless claims remain close to their historical floor.

This combination of lower inflationary pressures and improving growth has been priced by a bear-steepening of the US Treasury curve: the US 3m - US 10yr yield differential rose from its low of -90bps on December 15, to -54bps on December 30. Meanwhile, silver gained 4% in December while natural gas cratered 28%, also reflecting this changing macro backdrop.

This environment, should, theoretically, translate to more favorable conditions for risk assets, including crypto. Indeed, markets are pricing lower US Fed Fund rates after June 2023 and the US dollar keeps weakening. We remain cautious for two reasons: the clear hawkishness adopted first by Fed Chair Powell and later by ECB President Lagarde, which signifies that both central banks will want to see lagging CPI rates much lower; and the remarkable resilience of the European and American labor markets. Recall that Fed Chair Powell’s main goal is now to achieve a softening of employment (see prior newsletters). This means that better growth (even in association with lower inflation) is unlikely to satisfy central bankers and lead to the priced “Fed policy pivot” in H2 2023, unless growth conditions deteriorate significantly and risk assets reprice lower.

Turning to crypto, both on-chain metrics (transactions, number of active addresses) and price volatility (realized and implied) have signaled less activity and lower volatility. In our recent research piece, we reviewed crypto implied volatility in relation to price predictions and found that lower implied volatility tended to predict subsequent lower prices and vice versa (contrary to what can be observed in equity spot and volatility markets). Meanwhile, BTC and ETH price momentum indicators have stopped deteriorating, but remain negative. Finally, the respective market caps of the two main stable coins, USDT and USDC, have stabilized after falling significantly in May 2022 and July 2022, which can be interpreted as value having been transferred from crypto to fiat in these periods and now levelling off. Overall, we read these market and on-chain indicators’ developments as signaling quieter crypto markets, after the volatile and eventful 2021 and 2022. We could see a slow grind lower of crypto prices, and then a last crypto leg down as equities and traditional risk assets correct (see our note on analysis of crypto vs equity valuations and implied volatility). Once this capitulation has occurred, a crypto bottoming will be more likely in our view.

Switching gears, let’s touch upon two major macro developments outside of the US and Europe. First, in China, the social contract between the authorities and the people seems to have resumed. The latest December PMIs showed that the Chinese economic situation remained precarious, which risks fueling social discontent. This is likely to pressure the Chinese authorities to prioritize growth by exiting pandemic extraordinary measures but also stimulating the economy via a more favorable fiscal / monetary mix, which is a likely tailwind for Chinese risk assets.

Second, in Japan, the post-Kuroda BoJ transition has started early, at least for market participants. Unscheduled JGB buying was unable to stop the JPY from strengthening as market participants rightly look to price policy normalization e.g. an ongoing increase of the US 10yr JGB yield trading band before an eventual drop of the yield curve control altogether, and a hike of the short-term policy rate (currently still negative at -0.1%). Here are a few quotes from Hirohide Yamaguchi, the main candidate to replace Governor Kuroda in April 2023:

- "There's a chance core consumer inflation may stay around 3-4% for a fairly long period"

- "Once inflation expectations become entrenched, it's very hard for central banks to control them. That's a risk the BOJ should be mindful of."

- "The BOJ will find it too risky to abandon YCC in a single blow. If so, the natural answer would be to adjust YCC in small steps"

- "The BOJ must get rid of commitments that bind its policy, so it can respond flexibly and nimbly to changes in the economy as needed"

Market-moving data and events

Eurozone: improving sentiment, normalizing inflation Dec. German Ifo Business Climate index surprised to the upside (88.6 vs 87.4 expected, up from 86.4 prior). / The total natural gas storage remained elevated in Continental Europe amid a warm winter (89% storage rate in Germany). / German PPI printed a second consecutive negative growth rate, -3.9% MoM in December, following a -4.2% MoM contraction in November.

US: more weakness from housing building permits, consumer confidence improving, labor market still (too) tight US building permits plunged 11.2% MoM in November to 1.342m, below consensus and below housing starts (1.427m). In contrast, new home sales ticked up by 5.8% to 640k in November. / US core PCE printed at 4.7% YoY in November, down from a rate of 5% YoY in October. Energy and good spending led to the lower print, while services spending inflation increased. / Regional business surveys flagged improved confidence: Michigan +0.6pts to 59.7, Richmond Manufacturing up 10pts to 1, Chicago PMI up 7.7pts to 44.9, improved. In contrast, KC fell -3pts to -9 and Dallas (Fed Manufacturing) was down 4.4 points to -18.8. / US Conference Board confidence bounced back in December from 107.4 to 108.3, its highest level since April 2022. The assessment of jobs “easy” vs “hard to get” also improved. / US initial jobless claims continued to track at historical lows (225k).

Bank of Japan: Government bond purchase not enough to stop market speculations of policy normalization after 10yr yield trading band is widened

- On Dec. 20, The Bank of Japan (BoJ) widened the trading band around the Japanese Government Bond (JGB) 10yr yield from +/- 25bp to +/- 50bp around zero.

- Governor Kuroda then denied near term exit from accommodative policy

- From Dec. 27 to 30, the BoJ conducted unscheduled JGB purchases to the amount of ~ ¥17tn ($128bn)

- Former former deputy governor Hirohide Yamaguchi is seen as strong candidate for Kuroda’s replacement in April

China: bumpy normalization, but normalization nevertheless China PMIs weakened further in December (official Manufacturing PMI down 1pt to 47 and Non-manufacturing down 5.1pts to 41.6). Meanwhile, post-covid normalization continued: China canceled inbound traveler quarantine. The US and several European countries introduced negative covid tests for travelers from China. As for Hong Kong, it announced an end to gathering limits and testing requirements.

Crypto: Low price vol, no clear pick-up of on-chain activity outside of Optimism MetaMask Swaps has added support for Arbitrum and Optimism networks. / Transaction activity on-chain was stable to lower in December except on Optimism where the number of transactions has been steadily increasing since October (+104%, vs -9% on Ethereum during the same period). / Ethereum entities: Uniswap and Centre maintained their activity share (incoming transactions and number of addresses interacting with the entity). Tether increased its share of activity in December (see chart).

This week: Global PMIs and important US employment data

Tuesday 3 January: German Dec. unemployment change (consensus +15k). / German Dec. CPI (consensus 9.1% YoY)

Wednesday 4 January: US Dec. ISM Manufacturing PMI (consensus 48.5) / US Nov. JOLT job openings (consensus 10m) / FOMC meeting minutes: we expect the minutes to show divisions between Fed Chair Powell plus the hawkish FOMC members vs the more dovish participants.

Friday 5 January: US Dec. Nonfarm Payrolls (consensus 200k), US employment survey (consensus for unemployment rate unchanged at 3.7%) and US average hourly earnings (consensus 5.0% YoY). / US ISM Non-manufacturing expected at 55.

Charts that matter

US Conference Board Consumer Confidence flags improved job opportunities

US Treasury yield curve bear steepens thanks to better macro recently

Silver up, natural gas down correlating with lower inflation and marginally better growth

Tether increasing its share of incoming transactions on Ethereum in December 2022

Tether increasing its share of interacting addresses on Ethereum in December 2022

Number of transactions on Optimism up 104% since October 2022

USDT and USDC market caps stabilized after decreasing in Q2-Q3 2022

BTC and ETH average price momentum indicators stable but still negative

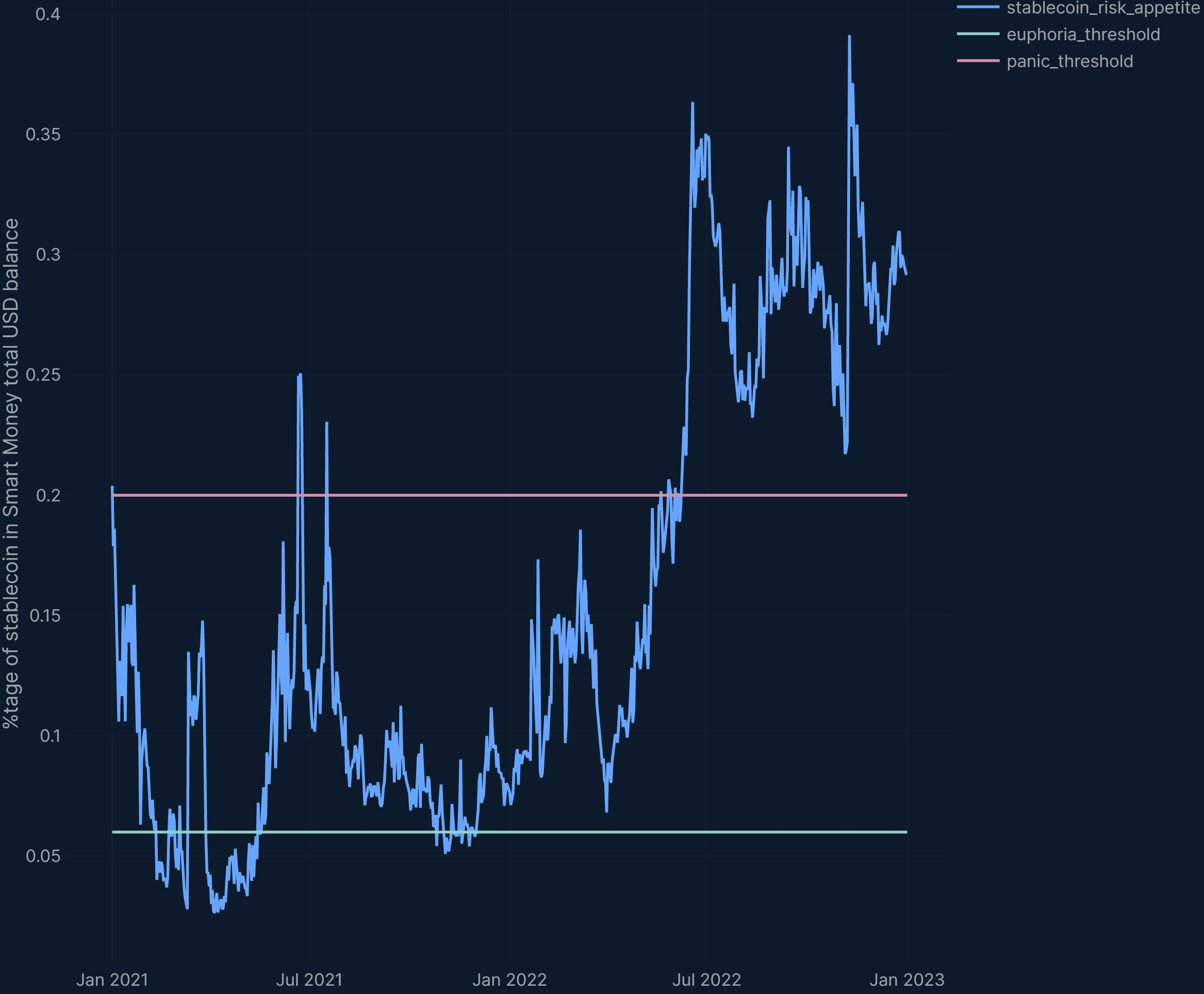

Nansen stablecoin risk appetite indicator at 29%, still in "panic"

Long-term BTC indicator close but not yet at buy

Equity risk premium at 7.4%, the low of a rising trend

Stronger JPY or BoJ policy normalization being priced in