Macro thread

The growth divergence between regions remains a relevant narrative for markets. In China, the bull market of local equities, copper and AUD/USD remains fundamentally supported by much better than expected activity data: in December, retail sales came in at -1.8% YoY vs -8.6% expected and -5.9% in November. At Davos, China's Vice-Premier Liu He confirmed that China was re-opening to the world: “Foreign investments are welcome in China, and the door to China will only open up further”.

In Japan, the BoJ was on hold, as we and the consensus expected.The Bank communicated that it would defend 50bps as the top of the 10yr JGB yield trading range. This caught market speculators on the wrong side as the 10yr JGB yield was down ~7bps, to 0.46%, and the USD/JPY appreciated. It seems now likely that a new central bank governor (Governor Kuroda’s last meeting is next March) will have to take over the task of normalizing monetary policy. Indeed, Japan is one of the few DM markets where inflation keeps accelerating and surprising to the upside. Japan’s PPI has now outpaced the US’s PPI by 40bps at 10.2% YoY.

“Nach den Tränen, dem Lachen”: German businesses’ mood is up, to say the least. The German ZEW Economic Sentiment jumped more than 40pts to reach +16.9. The magnitude of this recovery was last seen after the 2020 covid sell-off. Meanwhile, natural gas prices remain well-behaved, German gas storage stands above 80% of capacity. This augurs well for European flash PMIs this week and remains supportive of EUR vs USD, notably as US activity data have continued to underwhelm.

There were some points scored for the “soft landing” scenario this week (US Dec. PPI 6.2% YoY vs 6.8% expected and 7.3% prior, and initial jobless claims reaching a new at 190k). The US consumer seemed less willing to spend (US Dec. core retail sales -1.1% MoM vs -0.4% expected). Coupled with increased reliance on credit card credit and a low saving rate as highlighted in earlier publications, this keeps us cautious on the prospect for US growth in 2023.

The UK mirrors the US to a certain extent: a historically tight labor market and high wage growth (+6.4% YoY), which should keep the Bank of England vigilant, combined with very pessimistic surveys (GfK January Consumer Confidence at -45 close to all-time lows) and weak retail sales (Dec. core retail sales -6.1% YoY vs -4.4% expected).

Market thread

This brings us to market pricing of smooth desinflation: US Fed rates peak at 4.9% in June 2023 and then drop by 210bps in 18 months, according to future markets. Central banks also sounded more dovish: the Fed regional speakers pointed towards a step-down from 75bps-rate hikes and, outside of the US, some central banks stayed on hold despite inflation being above target (Norges Bank).

We do concur that disinflationary forces are still in place: in the US the next driver will be shelter inflation, which should drive core inflation lower in Q2 2023. The issue is that neither credit spreads nor equity valuations are pricing a sharp slow down in growth or any accident in financial markets (see ongoing newsflow of private debt funds unable to meet redemption' demand).

We therefore continue to assess the current rally as a bear market movement, with investors turning less negative: see how the stable coin balance in smart money wallets has been decreasing on-chain (peaked on Nov. 9, 2022 at 39% to reach 25% as of Jan. 23, 2023) and how the risk premium asked for equity has equally collapsed.

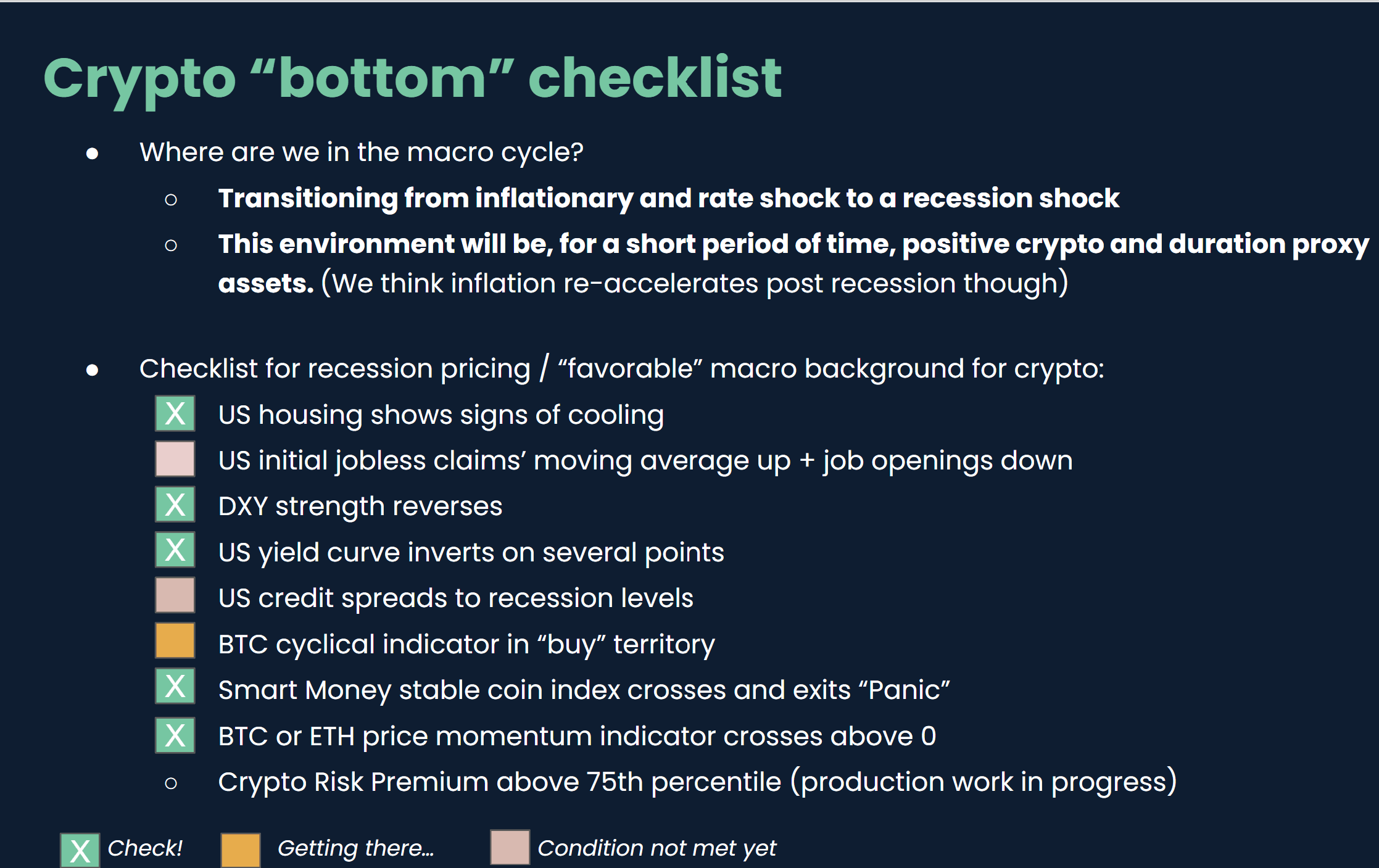

We keep an eye on our heat map to spot the crypto bottom. As described earlier, traditional risk assets are too expensive relative to possible macro scenarios:

We are transitioning from “weaker inflation, ok growth” to “weaker inflation, weaker growth”:

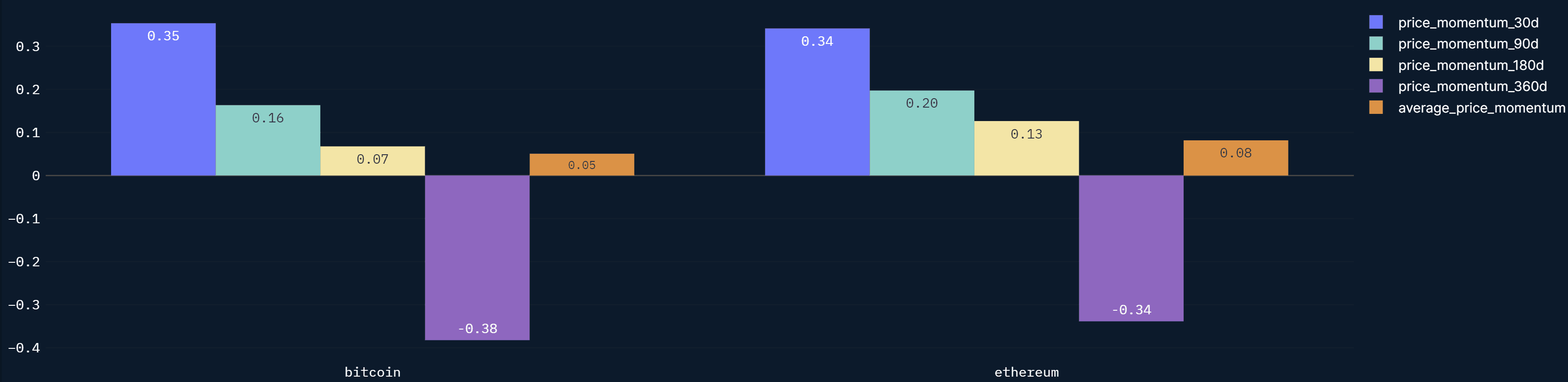

Momentum indicators continue to favor crypto in the short-term, with a flavor of 2019 before 2020 re-visit of the bottom:

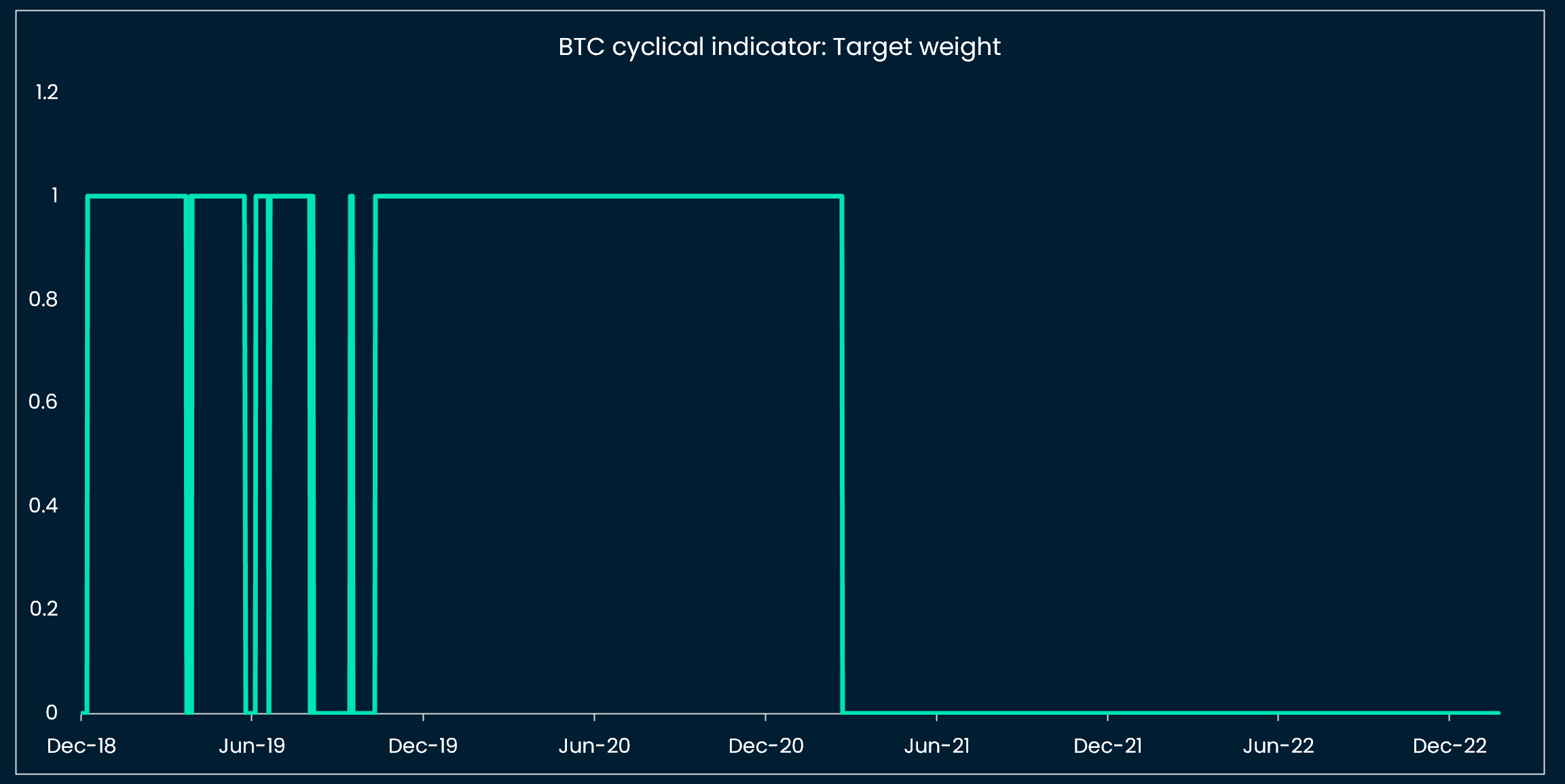

Our BTC cyclical indicator needs the US yield curve to re-steepen (Fed pivot) and / or lower BTC prices to turn positive:

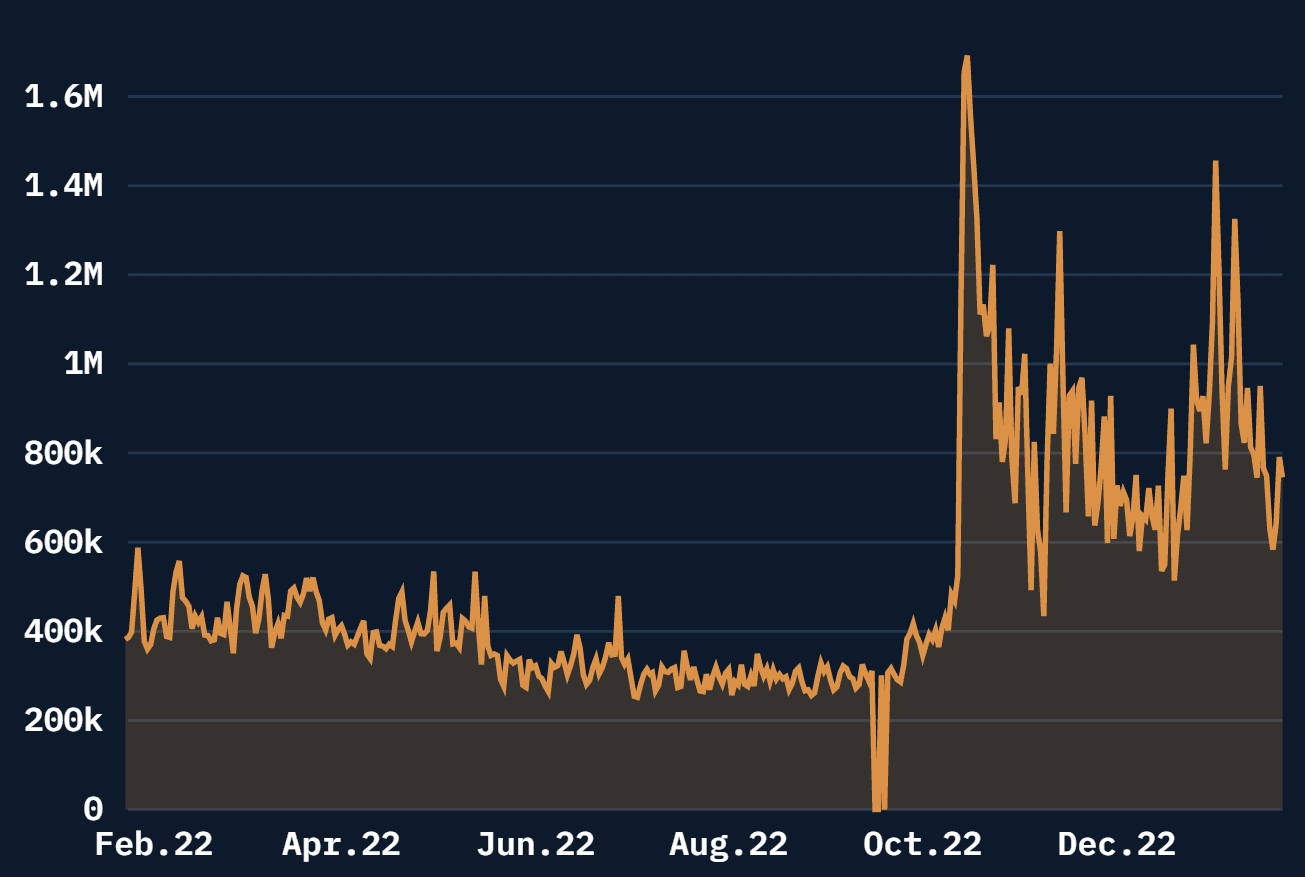

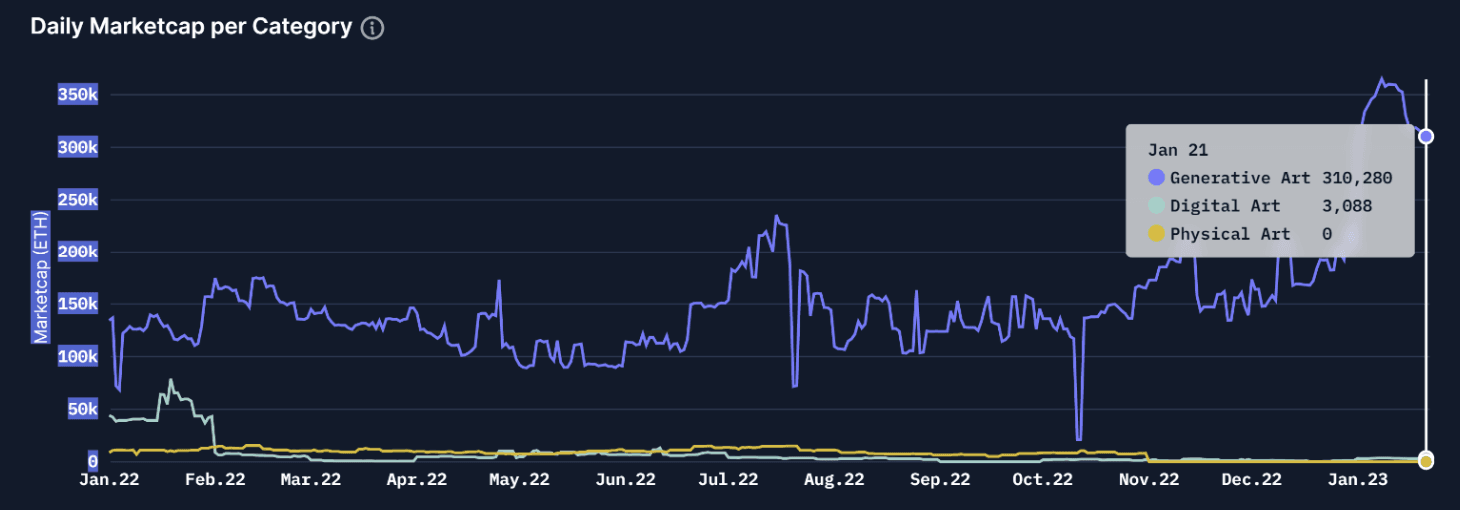

Higher prices bring activity in DeFi and for NFTs. On-chain, layer 2 blockchains, such as Polygon, are gaining some traction (we highlighted Optimism in the past weeks). There are equally signs of life in NFT markets as Opensea volume tentatively picks up and NFT floor prices of PFP + generative art lead higher.

What matters this week

Wed. 25

- The Bank of Canada meets and is likely to hike by 25bps to 4.50%. Likely to renew its rather dovish statement “Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further”

Thurs. 26

- US Q4 GDP (2.5% QoQ consensus)

Friday 27

- US Dec. core PCE (consensus 4.4% YoY, prior 4.7%)