Macro and market thread

Last week the three major central banks, the European Central Bank (ECB), the US Federal Reserve (Fed), and the Bank of England (BoE) hiked their respective interest rates by 50bps to 3.00%, by 25bps to 4.50-4.75%, and by 50bps to 4.00%. These actions were well telegraphed and markets were rather focused on press conferences, forward guidance (or lack thereof), and the intricacies of rhetoric and tone nuances.

The ECB sounded, as we had expected (see last newsletter) the more hawkish of the three, with President Lagarde guiding for an additional 50bps hike at the March meeting. However, the commonalities between the three were striking with all governors highlighting the encouraging process of “disinflation” and less worse than expected growth (the BoE upgraded its forecast from recession to “shallow” recession).

The scenario of “soft landing” (or its less optimistic UK version of “shallow recession”) that markets have been pricing since October 2022 has now gained a higher probability of occurrence for central bankers and economists. If there would be one word to describe the tone of all three central banks, it would be “uncertainty”: uncertainty around possible macro outcomes and therefore data-dependency.

“Uncertainty has increased [...] we are in uncharted territory” BoE Governor Bailey

“the Governing Council’s future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.” ECB President Lagarde

”I don’t feel a lot of certainty about where that will be. It could certainly be higher than what we are writing down right now [interest rate projections compared to December]. If we come to the view that we need to move rates up beyond what we said in December we would certainly do that , at the same time if data come in any other direction, we will make data-depend decision” Fed Chair Powell

Summarizing:

- Central banks have caught up with markets, as narratives follow prices

- Equity prices have priced out the probability of a recession (US Tech and German Dax index best performing equity markets last week) and US bond futures are discounting one more rate hike and then none in 2023

- Central banks will react to the ongoing stream of data. On the radar of the Fed wage growth is prominent (average hourly earnings and employment cost index)

This sums up to more uncertainty in market outcomes. What is priced in e.g. a lower rate path is therefore likely to change, which, in turn, introduces downside risk for risk assets.

How to determine the path forward for macro scenarios (and risk assets)? As we have described in our prior publication, there are two possible scenarios from here:

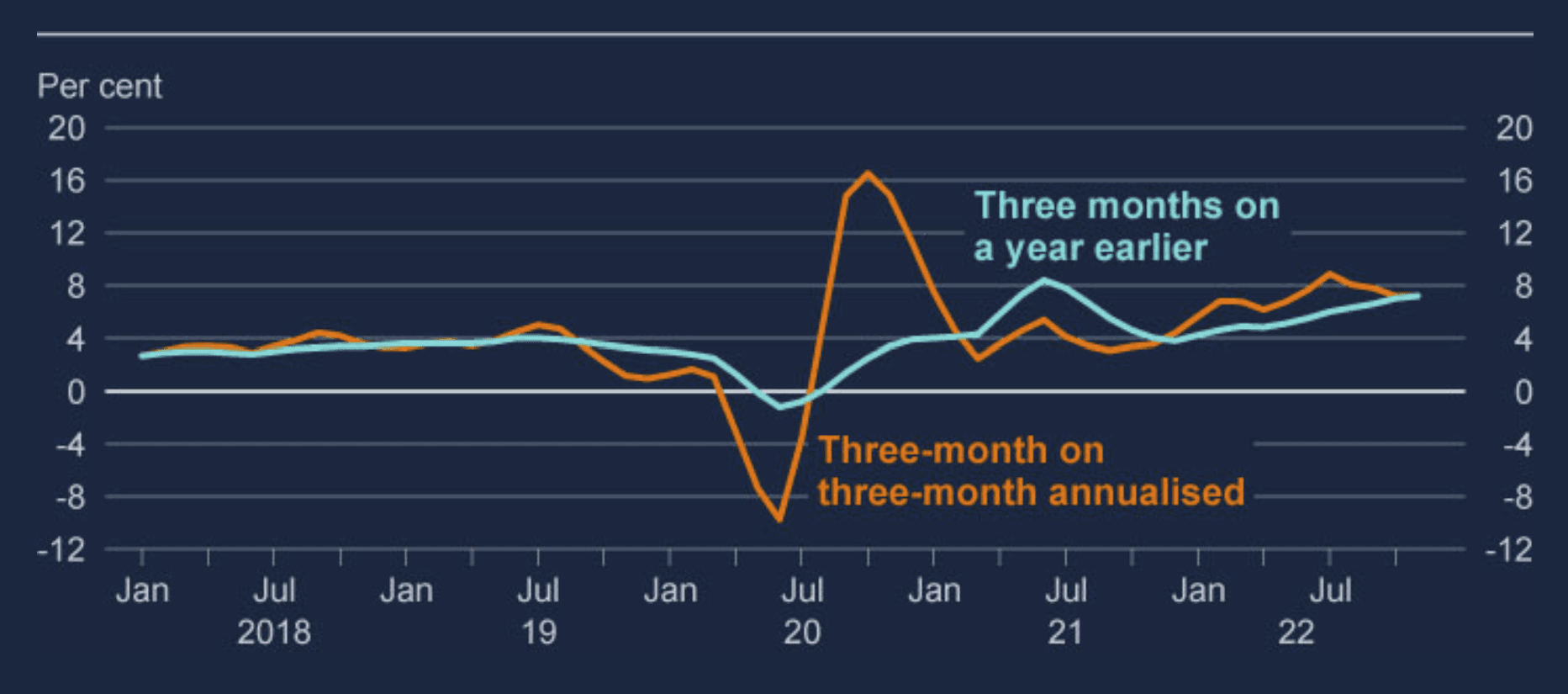

- A sharp deterioration in growth or a recession: this is what the momentum in housing data is pointing to, at least in the UK (see chart below). This is also the message from US banks’ record credit provisions and the historical tightening in Eurozone bank lending standards (26% of surveyed European banks tightened, the highest ratio since the European sovereign debt crisis). If bank credit becomes sparse, this should indeed affect business investment and growth at some point.

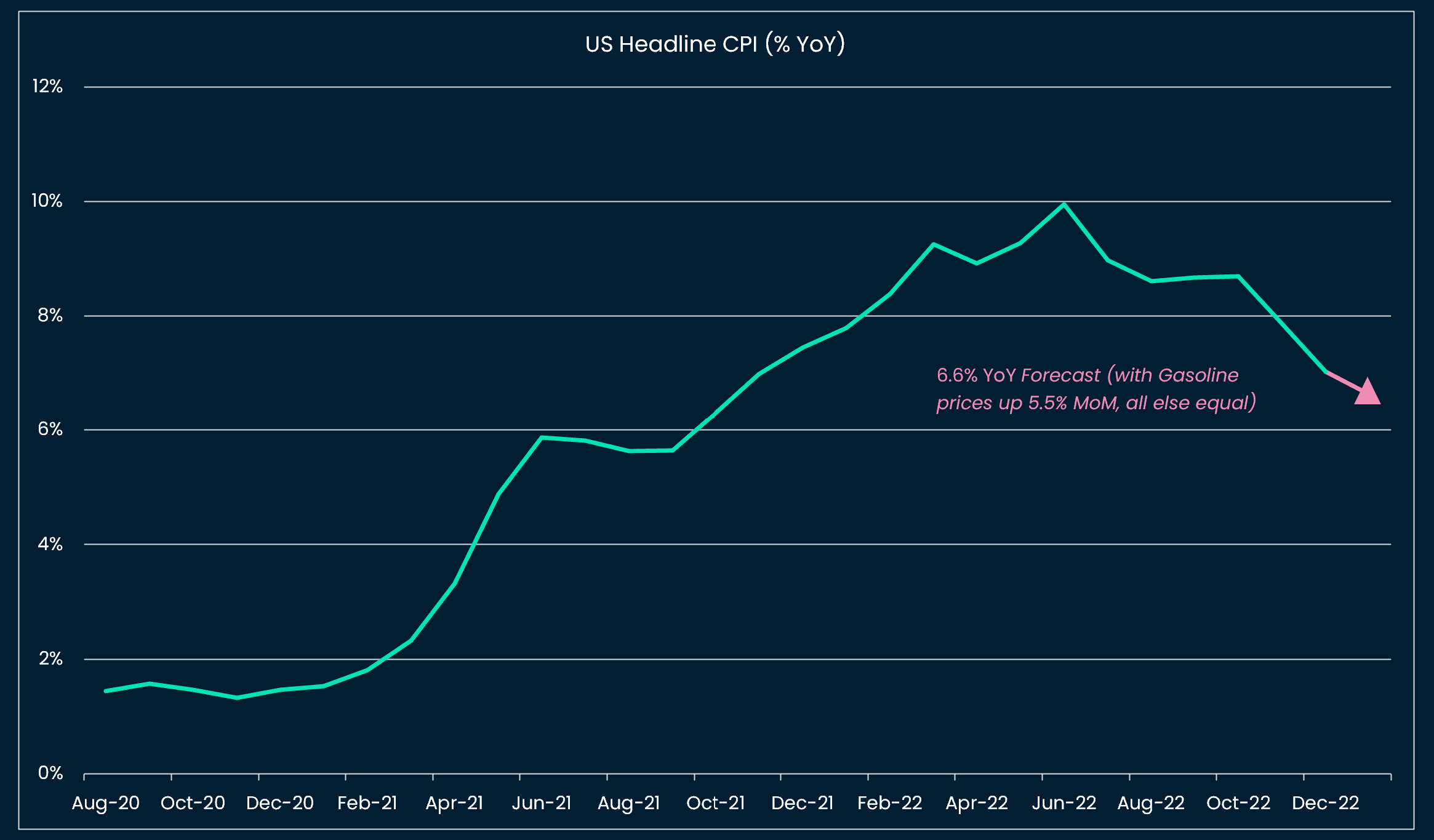

- A re-acceleration of growth and inflation on the base of the so-called “goldilock” conditions: the labor markets in both US and Europe / the UK are tight and the negotiating power has remained with the employees, even if wage growth has been settling at a slower 4% YoY rate recently (US). We note, in favor of this scenario: the increase in US retail gasoline prices by 5.5% MoM which should sustain the January CPI (released on 14 February, all things equal the gasoline price increase would deliver a 6.6%YoY US headline CPI).

What to monitor:

- Energy prices (lead inflation): are they recovering? So far not really, except for the recent stabilization in gasoline prices

- Supply / demand balance in labor markets (higher frequency wage growth and job posting like the ones reported by the website Indeed, and also the US jobless claims)

- Asset price momentum (as economic data tend to lag, unfortunately)

On the last point, it is striking that, despite US Tech equities outperforming last week:

- The US 1yr Treasury yield lost 10bps following the FOMC but regained 14bps later in the week

- Gold, and the US dollar FX crosses behaved similarly. The AUD/USD rose post-Fed and then retraced lower especially on payroll day (last Friday)

- Chinese equities and copper underperformed last week

The US dollar, gold, rates are all linked to the pricing of US monetary policy: last week’s moves could hint at markets slowly moving away from “soft landing” to “higher rates for longer”. This needs to be monitored.

We also wonder whether the China reopening trade, which has fed animal spirits cross-asset YTD, might have run its course? China macro data continue to describe a very sharp rebound but, as we have established before, prices lead and narratives follow.

For a crypto investor, it is important to stick to risk management and price the YTD rally as a likely bear market rally. As we wrote at the beginning of the year: “Enjoy the party but stay close to the door”. Macro scenarios are possibly more uncertain than they have been during the last 15 years of Quantitative Easing.

On-chain observations and market indicators

This week we highlight the surge in on-chain NFT activity: the volume of mints has moved up, and interestingly the nascent market of NFT-backed lending is also thriving, marked by historically high volume.

Our crypto indicators continue to describe a bear market rally and animal spirits pushed our equity risk premium close to long-term averages.

Next week: Jay Powell speaks again

- Monday 6: The Reserve Bank of Australia is likely to hike by 25bps to 3.35%. DM central banks have sounded less hawkish recently, but, in Australia, the bar to contain inflation appears higher as data have come up above expectations.

- Tuesday 7: Fed Chair Powell speaks: Will he take the opportunity to dampen markets' enthusiasm?

- Thursday 9: January German CPI release (consensus 9.2% YoY)