US labor markets: Some signs of normalization

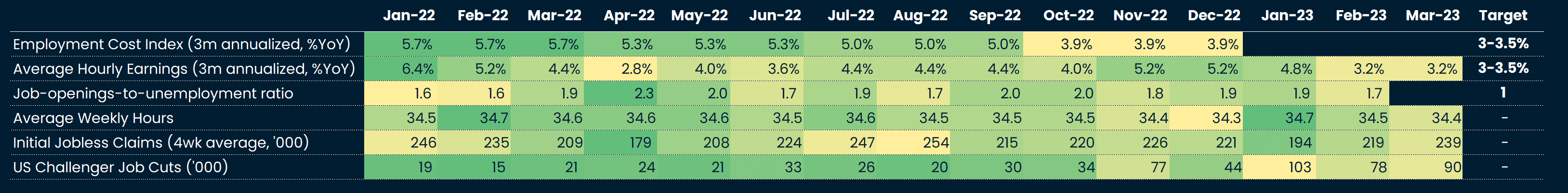

The US labor market is showing signs of normalizing, from historically tight levels. This is visible across several important data points published last week: average weekly hours, initial jobless claims, average hourly earnings. Among the unemployed, the number of permanent job losers increased by 172k to 1.6 million in March, especially in the wholesale, storage and retail trade sectors. Total nonfarm payroll employment rose by 236k in March, less than the average monthly gain of 334k over the prior six months. Average hourly earnings growth has been singled out by Fed Chair Powell in several press conferences, as a metric to assess the strength of wage growth, and, on a 3-month basis, is now within the desired range indicated by Powell.

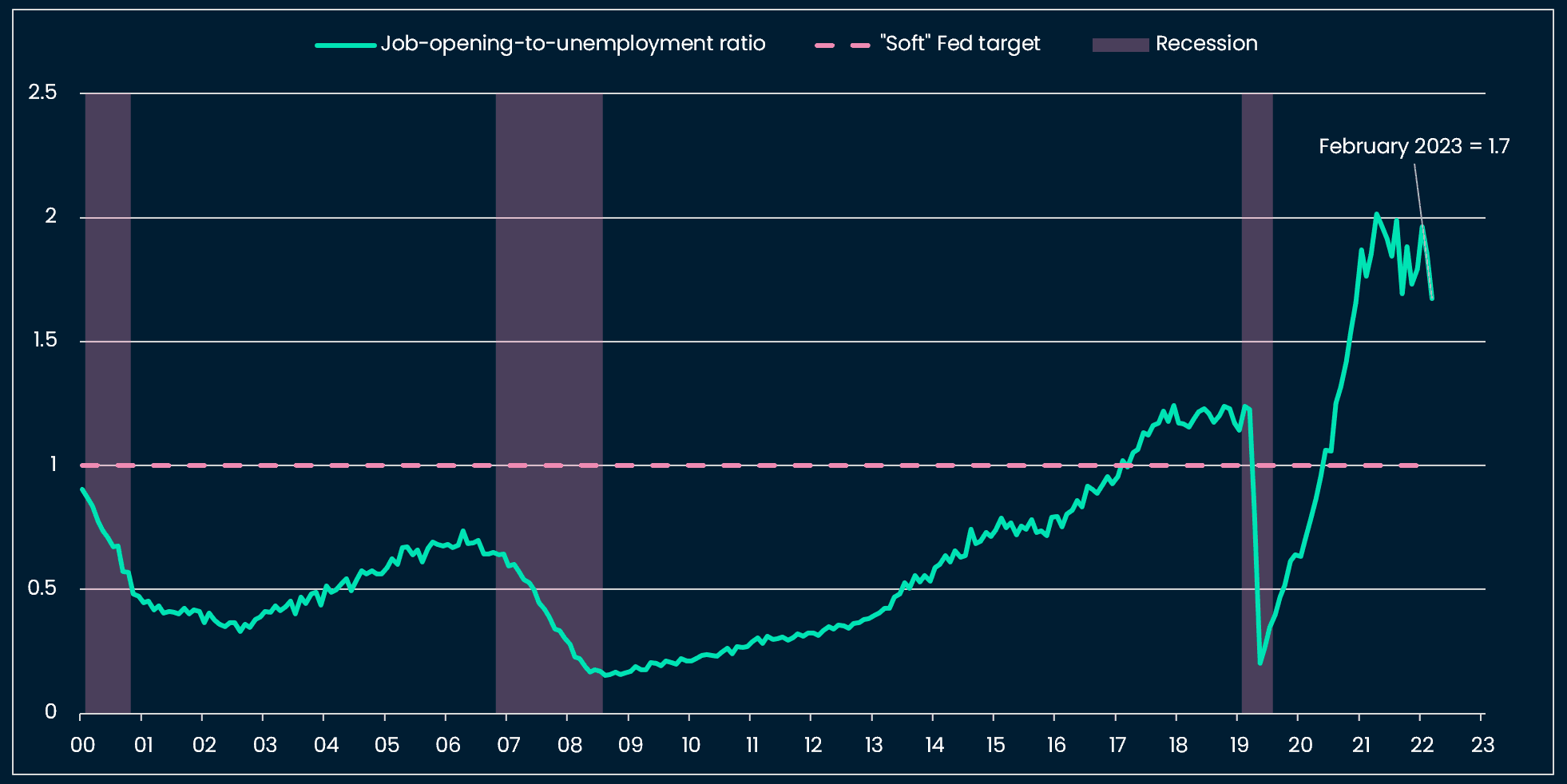

Glancing at the overall levels of labor market indicators, the conclusion is that the US labor market remains in a historically strong shape. As of February 2023, there were still ~1.7 jobs available for every unemployed person. Fed Chair Powell has indicated a soft target of ~1 in past speeches.

Before March, the state of the labor market would have probably led the Fed to acknowledge the progress towards cooling wage growth, but would not have prevented further rate hikes given the strong levels of the various labor indicators. We think that, after March’s banking developments, the decision to hike or pause in May might be more ambiguous. In his last press conference, Fed Chair Powell highlighted that tighter bank lending conditions would act as the equivalent of further rate hikes. It is likely that the Fed will need other data points (CPI this week) to decide on hiking vs pausing at the May meeting (more on this further down).

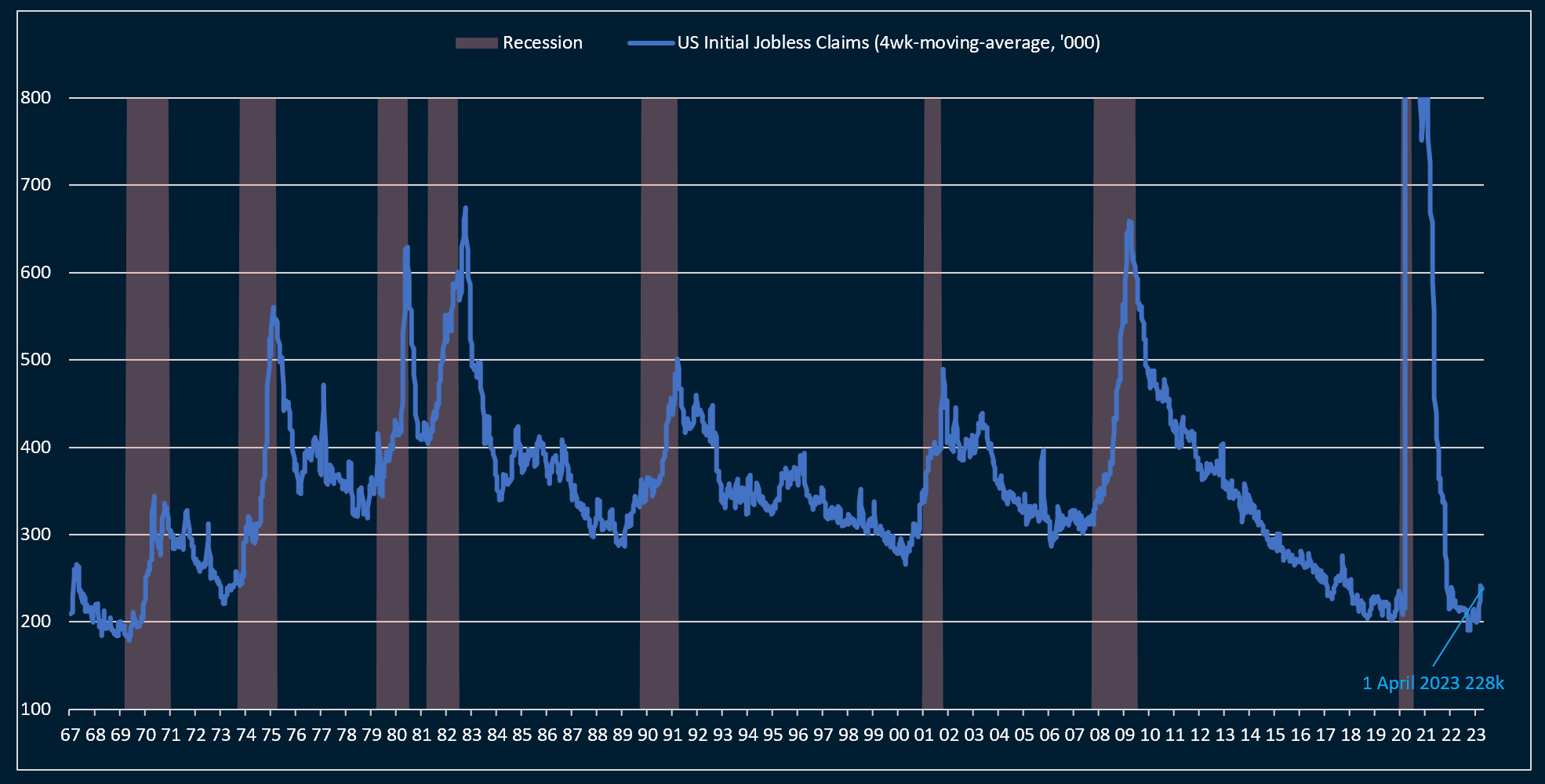

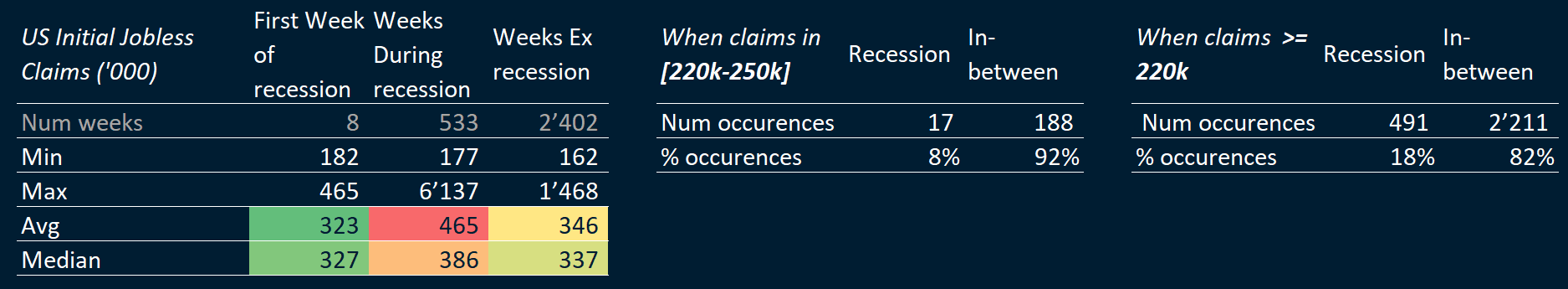

We note that the state of the labor market, although an input to Fed’s decision making, is usually lagging in the economic cycle. Looking at the patterns for US initial jobless claims, since 1967, we note a lot of variability in the level of claims at the beginning, during or outside recessions. Claims above 220k (where we currently stand) are not necessarily associated with recessions.

PMIs: Manufacturing says recession, Services survey is ok, Momentum is negative for both

We turn to the PMIs, which hold a somewhat superior predictive power for economic recessions.

There are three main messages delivered by global PMIs (Purchasing Managers’ Indices): global manufacturing is exhibiting “concerning trends”, the service sector is slowing but still robust, and desinflation continues outside of labor costs.

On manufacturing, Korea’s PMI fell 9-ticks, to 47.6. Korea usually stands as a leading economy (meaning it weakens and recovers first in a global growth cycle) given its exposure to global tech exports. China, whose service sector is rebounding sharply thanks to the lifting of zero-covid restrictions, is also flagging weak external demand for its manufacturing production. In the US, the manufacturing ISM PMI survey fell to 46.3 in March, which was the lowest print since May 2020.

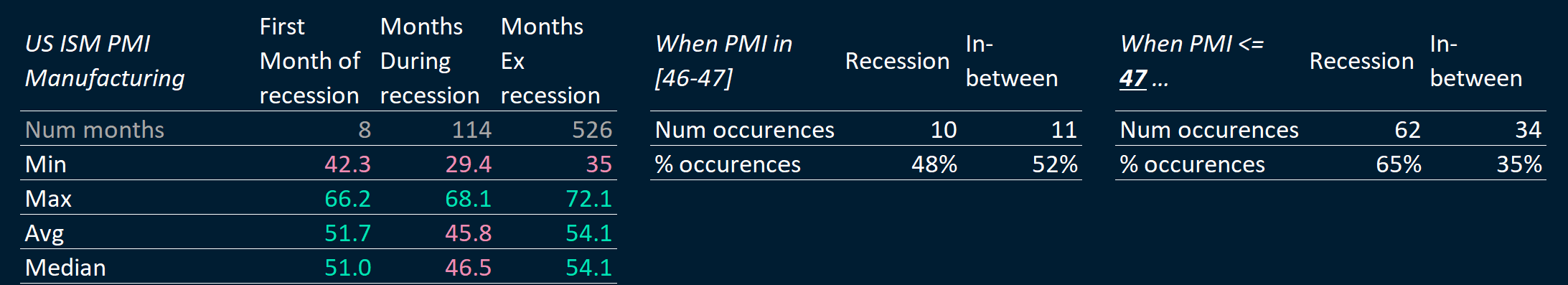

Looking at the history of the ISM Manufacturing PMI since 1970, we find that an ISM between 46 and 47 has coincided with a US recession in 48% of the occurrences. An ISM equal to or below 47 has been associated with recessions in 65% of cases.

Bank lending activity: the new focus point for the Fed

The logical consequences of the liquidity issues encountered by the banking sector in March would be a slow down in the pace at which banks grant loans to the real economy. We find that lending growth has indeed started to slow, already from December 2022 on, and that the banking sector’s turmoil has accelerated this trend. The YoY growth peaked at 12.5% YoY in early December 2022, cooled to 11.7% YoY in early February 2023, and decreased at a steeper pace after that, to reach 9.7% YoY at the end of March 2023.

This slow down in lending will probably be mirrored by the US economy (investment and consumption), especially as household savings are slowly normalizing. However, the lending data does not suffice at this stage to distinguish a slowdown from a recession. In the chart below, we can identify periods when lending had reached similar levels and was slowing as sharply. In 1985 and 1995, lending slowed without leading to an immediate recession (recessions occurred five years later in both those instances).

The Fed’s reaction function

Currently, mature markets’ central banks (outside of the idiosyncratic Bank of Japan) seem to have adopted two types of strategies. “Wait and see”: waiting for economic data points over several months before altering the policy rate. These central banks, which include the Bank of England, the Reserve Bank of Australia (RBA), the Bank of Canada are growing implicitly more concerned about the impact of monetary tightening on their respective domestic economies. The RBA “took the decision to hold interest rates steady this month to provide additional time to assess the impact of the increase in interest rates to date and the economic outlook”, despite inflation and wage growth tracking way above its policy rate. The second strategy, “data dependency”, leads central banks to react to the latest data. The implicit assumption for these central banks, which comprise the US Fed, the European Central Bank, the Swiss National Bank, is that the priority is to act fast enough so that inflation does not become entrenched.

The Fed has so far pioneered the “data dependency” strategy. However, since the March FOMC meeting, Fed Chair Powell has slightly amended his message, indicating that the Committee would pay attention to bank lending data as an equivalent to policy rate hikes.

Putting it all together, the Fed’s primary concern remains inflation, but the Committee seems more flexible on the level of the terminal rate (either 4.75% or 5.00%) as it waits and assesses the impact of bank lending contraction. We see this week’s CPI data as key for the FOMC May meeting: if CPI and core CPI come in below consensus (5.2% YoY for headline CPI) the Fed could pause, and vice versa hike another 25bps if CPI comes in hotter. As we write, bond investors expect a 25bps hike in May followed by rate cuts at the following meetings, which is a bit contradictory.

Leaving the FOMC May meeting aside, we still see the Fed in the camp of “high for long” rates, even as growth starts to deteriorate. This means that the rate cuts priced by bond investors from June 2023 on are in contradiction with what the Fed is signaling.

Financial markets’ jitters

Concerns about the banking sector have flared up again last week: the US High Yield CDS spread, a barometer of stress in credit markets, rose by 30bps.

The KRE index of regional banks fell further, with SVB down 12%. The sector rotation was also interesting, with Utilities (Johnson & Johnson +8.9%) outperforming and Industrial Cyclical names underperforming (Caterpillar - 8.6%).

If equity markets start to price “bad news” as bad for equity prices (vs “bad news” as “good news” for stocks because of the anticipated Fed pivot), then we are starting to witness a move to more recessionary trades, contrary to the beginning of the year, see the “The cure before the disease” newsletter.

Crypto indicators: no change since last week, watching BTC call-put spread

There were no major changes in our crypto indicators compared to last week: tactical indicators remain risk-on (short-term) and cyclical indicators signal that the bear market is not over (long-term).

We are closely monitoring the BTC call - put spread (the difference between the implied volatility of calls vs puts, this is a short-term tactical signal). It is getting closer to risk-off (price of put > price of spread) but has not crossed yet.

For an overview of our indicators please see our dashboards: here for the signal, here for the backtest.

This week: US CPI to provide guidance on the FOMC May meeting

The newsletter will not be published next week and will be back on 24 April. Thank you!

Wed. 12

US March CPI (consensus 5.2% YoY; just considering gasoline price YoY, we get ~5.0% YoY) and core CPI (consensus 5.6% YoY)

Thurs. 13

US March PPI (consensus 3.0% YoY); German March CPI (consensus 7.4% YoY)

Fri. 14

US March core retail sales (consensus -0.3% MoM)

US macro data tell us that the odds of a recession are increasing. The reaction of the Fed to slower growth data will be key. We think that the Committee will keep rates high for longer than what is being priced by markets. So far equity markets have benefited from the Fed pivot hope, but there are signs that this narrative is weakening as markets start to price bad macro news as not so good news for asset prices. Crypto has remained resilient and outperformed other assets YTD, but could re-correlate to equity markets this year if growth slows sharply and the Fed does not pivot as fast as expected by investors.